Here’s the great thing about financial success: the keys to achieving it for yourself are based on some pretty simple, easy-to-understand concepts.

Spend less than you earn. Save (and wisely invest) as much as you can.

Save and invest what you can, consistently and over time, and you will achive financial independence. Sound too good to be true? Check out this post from early retirement expert Mr. Money Mustache. It’s appropriately titled, “The Shockingly Simple Math Behind Early Retirement.”

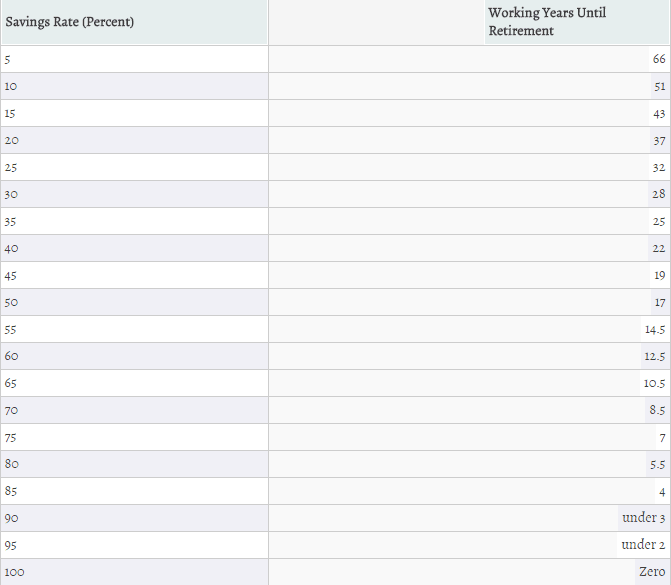

Note the savings chart he shares with readers there – or check out a copy below:

The point is that the math behind the idea of becoming financially independent is really simple. So why aren’t more people kicking back on the beach with a fruity umbrella drink at the age of 35 or 40?

Because taking that consistent action and saving 20%, 30%, or more of your income for more than a few years takes good planning and serious dedication. It’s hard work, in other words. You’ve got to be highly motivated and driven to your goal of financial success.

And we can help you with the planning part. Get started on the path to financial independence with these three steps to take action on now:

Take Full Advantage of Employer-Sponsored Retirement Plans

If your employer offers you a 401(k) plan with a company match, take advantage. Any employer-sponsored retirement plan is going to provide one of the easiest ways for you to reach your goal of financial independence. That employer match is free money on the table.

Not enrolled? Get yourself signed up immediately. Then contribute at least enough to your account to secure that match. If your employer offers to match up to 3% of your contributions, you need to contribute at least 3% of your earnings to that account. If they offer a partial match beyond 3%, take advantage of that as well.

Every time you earn a raise, make sure you bump up your contributions. Or make a plan to increase your contributions by 1% every 6 months or every year.

Remember, securing the match should be the minimium. Work toward putting away at least 15% to 20% of your gross, before-tax income. Ideally, you should work towards maxing out your 401(k) each year.

Don’t have this type of plan? If you work a public service job, you may have access to a 403(b) plan instead. If you’re at a small company, your option may be a Simple IRA (which functions in a similar way to a 401(k)). Ask the individual in charge of human resources about your options for employer-sponsored retirement plans, and then get signed up.

Self-employed? While you may not have access to an employer-sponsored plan, you can still take care of your own retirement with a variety of accounts for people who work for themselves. You can choose from a Solo 401(k), SEP IRA, or Simple IRA. Speak with a financial professional to determine which account makes the most sense for your situation.

Balance Your Invested Accounts

Why all the focus on 401(k) plans (and similar retirement accounts for those who don’t have access to 401(k)s)? These accounts are advantageous and should be the centerpiece of your retirement planning because they’re tax-deferred.

This means that you don’t pay taxes on your contibutions in the year you contributed – you will owe when you withdraw your funds, but you get a tax break today. This is huge, because if you owe less in taxes today you can save more today, too.

And financial independence is all about what you can save today. The sooner the start, the more time you’ll provide your investments to compound. The magic of compound interest is why someone who’s saving 50% of their income will reach financial independence in just 17 years – rather than working for 40 years or more.

So tax-deferred retirement accounts offer a big benefit: they give you the opportunity to reduce your tax burden in the present in order to contribute more money to your nest egg. But there are other tax-advantaged accounts you should utitilze, too.

While 401(k)s are tax-deferred, a Roth IRA is funded with after tax dollars but the earnings in the account grow tax-free. The second step to financial independence is to balance your tax-advantaged retirement accounts and utilize both types.

Roth IRAs are extremely beneficial in saving for retirement because all of the earnings in your account accumulate completely tax free. And what that means is that when you retire, you can pull money out of the account and thumb your nose at the IRS because you owe them nothing.

Take that money you didn’t have to pay in taxes thanks to the deductions your 401(k) allowed you for this year, and fund your Roth IRA with your savings! For 2014, those under 50 can contribute $5,500 for the year. Those over 50 can contribute $6,500.

Aim to max out your Roth. That means contributing about $450 per month to this account.

Save, Save, Save

The final step toward financial independence? Save as much as possible. In fact, aim to be a “hyper saver,” or someone who saves at least 20% of their gross income.

Embrace your inner tightwad and make sure you’re not spending money on frivolous things that don’t get you any closer to your goals — or aren’t really in line with your values. Value experiences and people over things (and then stop spending so much money on things just to impress other people).

Oh, and remember: invest wisely!