The largest relief package in American history was recently signed into law by President Trump. The stimulus bill will provide much needed aid to Americans and businesses suffering economic loss as a result of the coronavirus. Millions of Americans have lost their jobs over the past few weeks, and businesses across the country have been forced to shut down, temporarily or permanently, due to the coronavirus. Whether you’re recently unemployed, just retired, or are only wondering about the stimulus checks, here’s what you need to know about the coronavirus stimulus bill.

Eligibility for recovery rebates

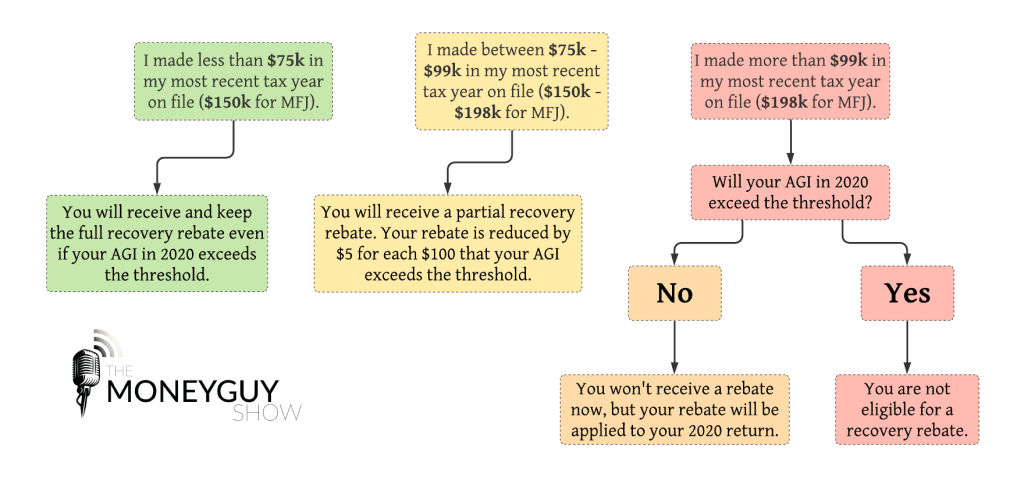

Most Americans will be eligible for a full or partial recovery rebate. For an individual, the maximum rebate is $1,200 and for a married couple it is $2,400. For every qualifying child age 16 or under, you may receive an additional $500. Not everyone will qualify for a rebate, and income is not the only excluding factor. These groups may also be ineligible for a rebate:

- Adults who can be claimed as dependents.

- Children age 17 or 18.

- Many college students age 19-23.

- Taxpayers who file using an Individual Taxpayer Identification Number (ITIN) instead of a Social Security number.

- People who haven’t filed 2018 or 2019 tax returns.

- Estates.

- Individuals with an AGI greater than $99,000 or married filing jointly taxpayers with an income greater than $198,000.

We aren’t exactly sure when the stimulus rebates will arrive, but Treasury Secretary Steve Mnuchin says the money should start going out in the next few weeks. If you still aren’t sure if you’re getting a rebate (or how much you’re getting), you can use our flowchart below to see if you may be eligible for a recovery rebate.

RMDs may be deferred

The stimulus bill will allow many Americans with required minimum distributions (RMDs) to defer those RMDs if they so wish. This is great news for retirees who don’t need to take RMDs but would otherwise be required to. The broad stock market is down over 20% this year, and withdrawing money from a retirement account when the market is down can be especially harmful to the portfolios of retirees.

To qualify for deferring RMDs, you, your spouse, or a dependent must be diagnosed with COVID-19 or suffer adverse financial consequences from conditions related to coronavirus. This includes being quarantined, furloughed, laid off, reduced business hours, or being unable to work for other reasons. This list is not all-inclusive, so many Americans should be able to qualify to defer RMDs if they wish.

Relaxed withdrawal rules

If you are eligible to defer RMDs, you may also be eligible to take an aggregate distribution of up to $100,000 from all retirement accounts without the normal 10% early withdrawal penalty. This is only applicable to distributions taken in 2020. The income tax on distributions may also be spread evenly over three years or it may be repaid to an eligible retirement plan within three years. Rules for loans from retirement plans have also been modified for 2020, and loan repayments may now be delayed for one year.

Charitable deductions

The new stimulus bill has great news for charitable organizations and taxpayers who take the standard deduction: a new above-the-line charitable contribution deduction of up to $300. Taxpayers will be able to claim up to $300 in cash contributions without itemizing on their 2020 tax return. Cash contributions for those itemizing deductions can now be up to 100% of AGI for 2020 instead of the previous limit of 60%.

Unemployment compensation

The new bill significantly expands unemployment compensation to provide relief to millions of Americans that recently lost their jobs. Self-employed and part-time workers may now qualify for benefits under the expanded program. Gig workers, freelancers, and independent contractors are included as self-employed workers. Eligible workers will receive an additional $600 per week from the federal government in addition to any state benefits they are eligible to receive.

Unemployment benefits will also last longer than usual; the bill provides workers with an additional 13 weeks of compensation, and many states offer 26 weeks of unemployment compensation, which means eligible workers may be covered for up to 39 weeks. For more information on benefits and to file a claim, you will need to contact your state unemployment office.

Student loan relief

Americans with federal student loans may be eligible to defer payments until September 30, 2020. No interest will accrue during this period, either. (Note: this does not apply to private student loans, only federal loans.) Many borrowers have recently lost their job, and this student loan relief will help free-up additional money in their monthly budget at a time when it is needed the most. Borrowers who are able to continue making payments may want to consider doing so to get their debt paid off earlier.

Healthcare benefits

If you have an HSA or an FSA, you may benefit from an expanded definition of medical expenses. Funds may now be used for feminine products and over-the-counter medications like Tylenol. Insurance policies that offer coverage for tele-health services must now waive deductible requirements. The deadline for 2019 contributions to an HSA or FSA has been extended as well, until July 15th, the same date as the deadline for 2019 contributions to IRAs and as the tax-filing deadline.

Our most recent show, “Stimulus Checks: How to Maximize Your Money (Important Information),” covers benefits available to businesses as well as benefits and planning opportunities for individuals. Watch it now on YouTube below.