Many businesses have been forced to close down during the coronavirus outbreak and some may never reopen. As a result, millions of Americans are temporarily unemployed. The largest stimulus bill in U.S. history was recently signed into law, and for some Americans relief can’t arrive soon enough. Unfortunately there are people and companies out there looking to take advantage of the desperation that many people are feeling right now. Some of these rip-offs and scams can be hard to recognize since they’re so new. Here’s what you need to look out for and avoid during the coronavirus outbreak.

Stimulus check scams

The stimulus bill that was just signed into law is sending many Americans direct relief in the form of a direct deposit or a check from the federal government. According to the IRS, no action is required for most people. However, some seniors and others who do not typically file a tax return will need to file a simple tax return to receive the stimulus payment. Money should start going out in the next few weeks, according to Treasury Secretary Steve Mnuchin.

Be very wary of anyone claiming to work for the government or IRS asking for your personal information. They may try to use the recovery rebate as leverage to get your information or steal your identity. For example, they may say something like “We just need to confirm your bank account information to ensure there are no delays in sending your stimulus check.” Never provide your personal information to anyone unless you can verify who they are and who they’re working for. If you receive a call from someone claiming to be from the IRS or your bank, you can always hang up and call them back. By calling the official number listed on their website or your bank statement you can ensure you are talking to who you think you’re talking to.

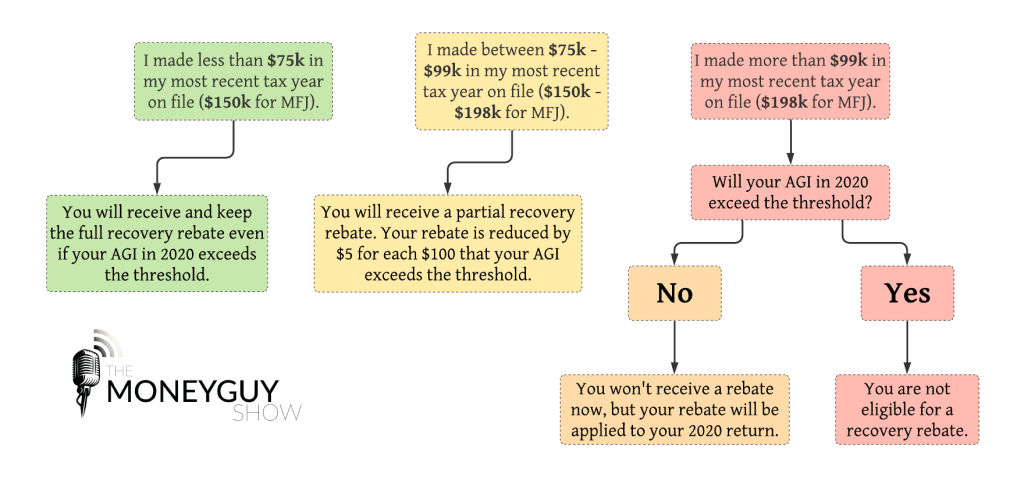

Most Americans will receive a partial or full recovery rebate. If you aren’t sure how much you’ll receive or if you’ll receive anything at all, you can use the flowchart we created below to help determine what you may be eligible to receive.

Predatory loans

Many Americans that recently became unemployed need money quickly to pay for housing, food, and other living expenses. There are some lending companies offering loans to those in need, but every other option available should be evaluated before taking out a loan.

The federal government recently expanded unemployment compensation with the stimulus bill, so many people, including self-employed, who lost their income or job will qualify for unemployment compensation. There are also now more options available for those who are forced to withdraw money from retirement accounts to pay for expenses. If you are currently making payments on a federal student loan, you may be able to temporarily stop making payments until September 30th, 2020 if you need extra money to pay for living expenses.

If you are struggling to make your mortgage payment or rent payment, it is worth talking with your bank or landlord directly to see what options are available to you. There are also resources out there if you are having trouble paying for groceries, utility bills, and other expenses. Check with your local governmental authority for information on programs that help those in need of assistance.

If you or anyone you know is considering taking out a loan to pay for expenses they can no longer afford, make sure they are aware of the terms of the loan, interest rate, and any other options that may be available to them. There are companies offering short-term loans to pay rent with interest rates as high as 99.99%, and that doesn’t include the additional fees they charge when the loan is disbursed. Taking out a temporary loan to pay for expenses may not seem like a bad idea now, but the financial consequences down the road could be very harmful.

Fear-based purchases

Anyone that has shopped at a grocery store in the last month has witnessed fear-based purchases being made. We are living in uncertain times, and some people are coping by stocking up on food and toilet paper. When we are faced with a situation we can’t control, like the coronavirus outbreak, we will do anything we can to get that feeling of control back.

There is no need to buy an excessive amount of food or toilet paper. We have an incredibly strong supply chain, and empty shelves in grocery stores are not caused by shortages but by people hoarding more goods than they need. Only purchase what you need until the next time you visit the store to make sure you’re leaving enough for your neighbors. Many fear-based purchases are both unnecessary and a waste of money.

There are some companies and people out there who will inevitably take advantage of that fear and desire to be in control by offering a solution. One televangelist is now being sued by the state of Missouri for selling a fake coronavirus cure. Beware of any purchases made out of fear, and make sure you’re buying things for the right reasons. The CDC has provided guidelines to slow the spread of the coronavirus, and your local, state, and federal health agencies will provide the best information and guidance on the outbreak.

We recently unpacked the recent coronavirus stimulus bill in our latest “Ask The Money Guy” episode and answered a bunch of questions related to the bill. Watch “Coronavirus Stimulus Bill: What You Need To Know” on YouTube below for information on the stimulus bill and how it may affect your finances.