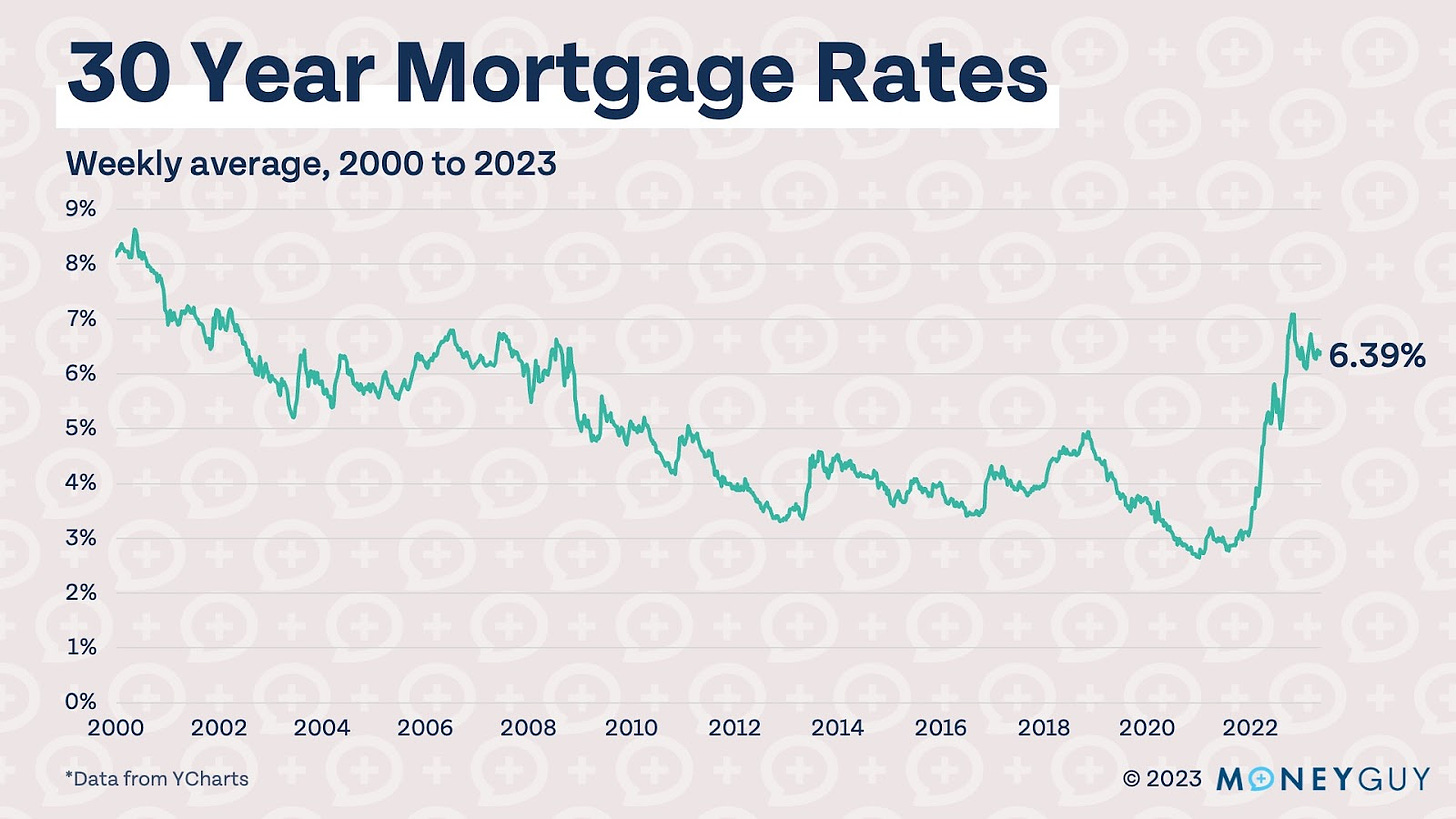

We’ve long been proponents of thinking twice before paying your mortgage off early. With long-term mortgage rates at 3% or less, the decision to invest instead of pre-paying that debt seemed clear for younger investors. Interest rates are now holding steady above 6%, and the decision isn’t so clear anymore. With mortgage rates at levels not seen since the early 2000s, does it make sense to prioritize mortgage debt before investing? Here’s what you need to consider before paying off your mortgage early.

1. What step of the Financial Order of Operations are you on?

The biggest factor in deciding whether or not to pay off your mortgage early is where you are at in your financial life. If you are under 45, it’s difficult to argue that your dollars would be better served paying off your mortgage unless you are on Step 9, pre-pay low-interest debt. You should aim to be completely debt-free by retirement, and after age 45 you can begin thinking more seriously about pre-paying your mortgage.

The opportunity cost of paying off your mortgage before investing for retirement is very high when you are young. As we like to say on the show, the only thing cooler than having a paid off house is having the ability to pay off your house and a seven-figure investment portfolio. Prioritizing paying off your mortgage also means you may not have enough liquidity to get through emergencies, like if you lost your job.

2. What is your mortgage rate?

Although current interest rates are higher, 99% of borrowers have a mortgage interest rate under 6%. Chances are you locked in a low interest rate sometime in the last few years, in which case the decision to not pre-pay your mortgage is a little easier.

Even for borrowers in the 6% range, it may not be financially optimal to prioritize your mortgage as high-interest debt. Unlike consumer debt, car loans, and student loans, mortgage debt is on an asset that typically appreciates in value – your home. This means if you look at the long-term, 5-7 years or longer, you don’t have to worry as much about becoming underwater on your home if you are not paying extra on your mortgage.

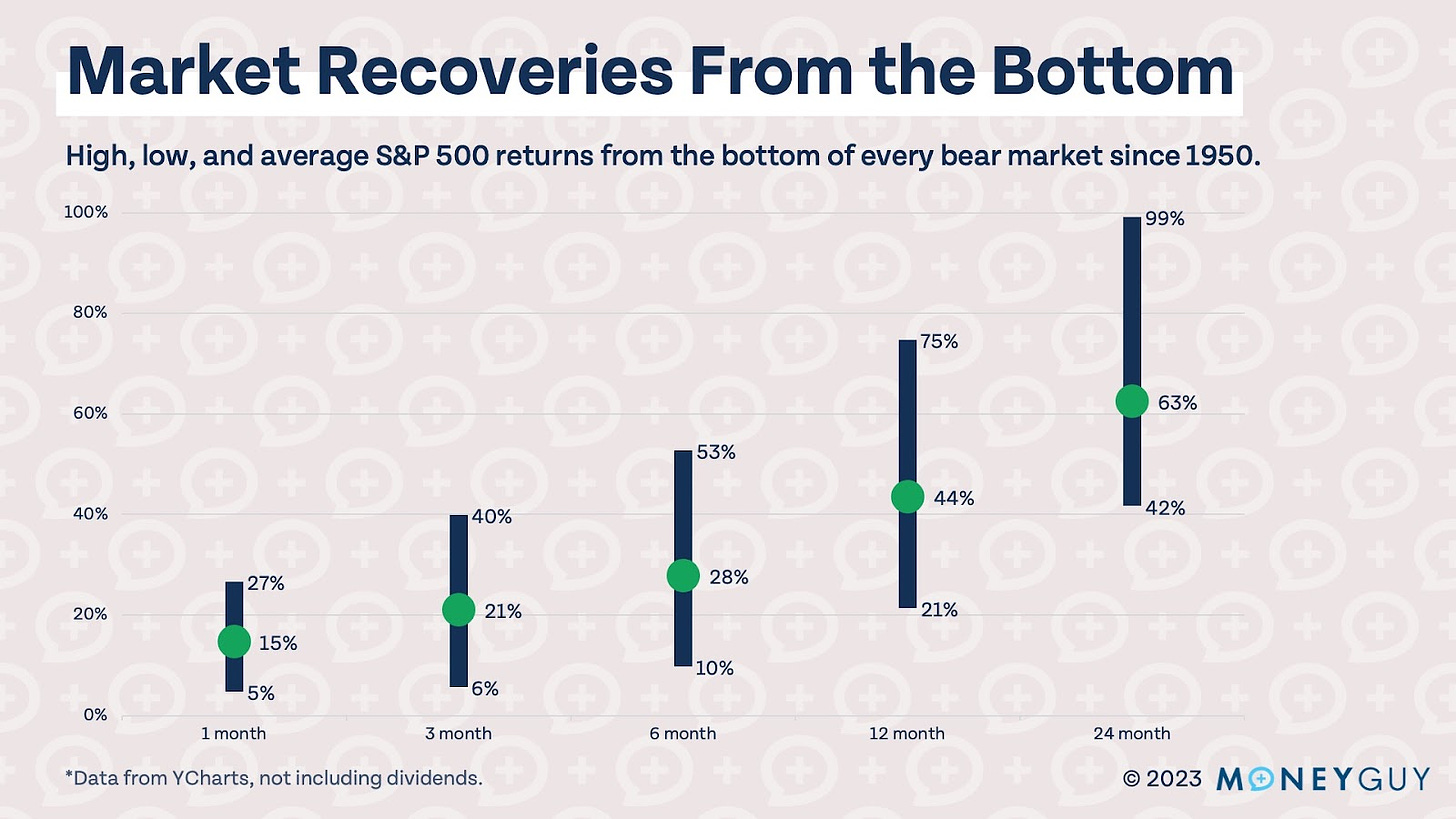

The interest rate you can earn on cash by taking little risk has also increased significantly over the last year. When mortgage rates were in the 2% – 3% range, interest rates on cash were near 0%. Now, with mortgage rates over 6%, many banks and financial institutions are offering rates over 4%. Current mortgage rates still don’t compare to the long-term average return of the S&P 500. Since 1980, the index has annualized 11.56%. This is not to mention we are currently in a down market, after which we typically experience very strong returns.

If mortgage rates were to rise significantly from here, they may be considered high-interest debt. With current rates, investing for retirement still looks very attractive if you are under 45 and not yet on Step 9 of the Financial Order of Operations.

3. Do you itemize your deductions?

Mortgage interest is an itemized deduction that may allow you to subtract some or all mortgage interest from your taxable income. If you do have a higher income or itemize, the mortgage interest deduction can effectively “lower” your mortgage rate by allowing you to pay less in taxes. It’s important to consider any mortgage interest deduction you claim before you pay off your house early.

4. Will you have an opportunity to refinance?

This is a question no one knows the answer to, but it’s still one you should consider. If you locked in a 30 year mortgage rate over 6%, you may not be locked into that rate for the next 30 years. Those who locked in rates over 6% in the early to mid 2000s had plenty of opportunities to refinance in the 2010s and 2020s. Don’t count on rates dropping considerably anytime soon, but there is a possibility you will eventually be able to refinance at a lower rate.

Deciding whether or not to pay extra on your mortgage isn’t an easy decision, especially if you are buying a home right now with rates above 6%. Even with higher rates, we believe that investing for retirement still comes before pre-paying low-interest debt in the Financial Order of Operations. If you are already investing 25% and are itching to pay extra on your mortgage, you could always round your payments up or make one extra payment per year.