Credit card debt should be avoided at almost all costs. The average interest rate on credit cards is currently 24.20%, which means for every $1,000 you have in credit card debt you will owe, on average, $242 in interest each year the balance remains unpaid. In the Financial Order of Operations, paying off high-interest credit card debt falls in Step 3, High-Interest Debt, behind only covering your deductibles and getting your employer match.

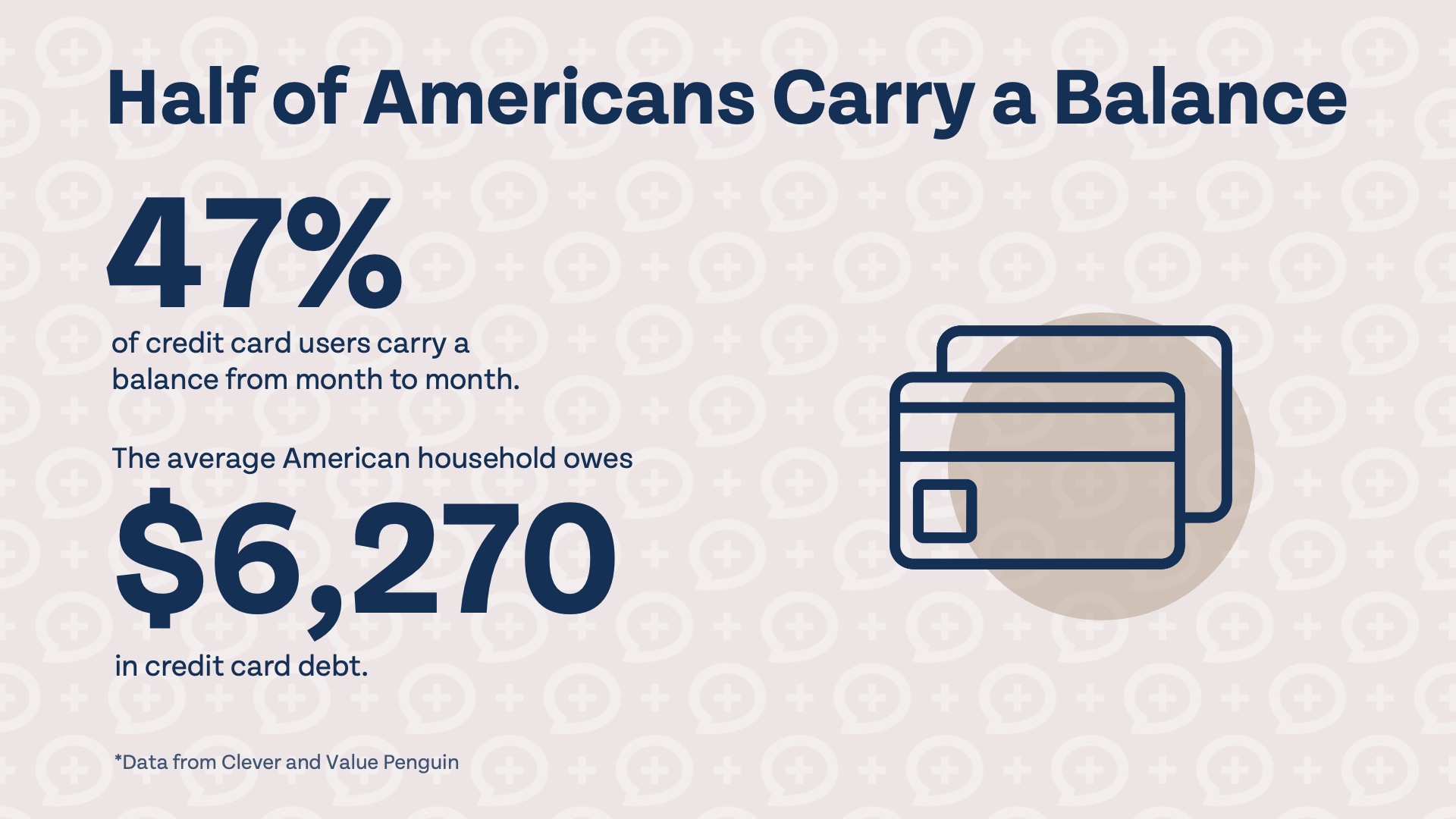

Despite how harmful credit card debt can be, it is very common. Almost half of all credit card users are in debt, and the average American household with credit card balances owes $6,270 in debt. If they are paying the average interest rate of 24.20%, that means they would be paying $1,517 per year in interest.

If you find yourself carrying credit card debt, you are not alone. Unfortunately, shame and embarrassment can hinder your ability to focus on the debt and pay it off as quickly as possible. Here’s how to get rid of credit card debt for good and relieve yourself of the stress and anxiety that always comes with high-interest debt.

1. Know how much debt you have

You may know exactly how much credit card debt you carry down to the penny, in which case figuring out how much debt you have seems like a silly suggestion. However, many Americans avoid thinking about their debt at all costs, and around 25% don’t know how much credit card debt they have. If you are part of this 25%, the first (very painful) step to getting out of debt is determining exactly how much debt you have and the interest rate on each credit card, if you carry debt on more than one card. Knowing how big the problem is makes it more difficult to ignore and helps you prioritize which credit card to pay off first.

2. Determine how much you spend each month

The next step to paying off your credit card debt is determining how much you spend each month. If you have credit card debt, chances are you may be spending more than you make (unless your debt is due to one-off spending for emergencies). Take a moment to sit down, look at all of your accounts, and categorize all of your expenses from the prior month. If you are spending more than you make, your budget is not sustainable and you will continue to accumulate more credit card debt unless you make a change. You must reduce your spending or increase your income to pay off your debt.

3. Develop a plan for paying off your debt (and stop using the card)

Once you know how much you are spending every month and have (or can make) room in your budget, next you will develop a plan for paying off your credit card debt. Make your debt a priority and a top-level budget item instead of just using whatever money is leftover at the end of the month on your debt. Dedicate as much money as possible to your credit card debt; it is in your best interest to get rid of it as quickly as possible. Financially, it is better to prioritize debts in order of interest rate and pay off the highest interest rate debts first. Some believe in paying off the smallest debts first, which may give you the motivation you need to keep going. Check out our take on the avalanche vs. snowball method if you are curious which may be right for you.

An important step of getting rid of credit card debt is making sure you don’t accumulate any additional credit card debt while you are working to pay yours off. It may make sense to only use a debit card if you are prone to overspending when using credit cards.

4. Implement your plan (and make changes as necessary)

Now that you know how much debt you have, know what you are spending each month, and have developed a plan for getting out of debt, it should be smooth sailing, right? Maybe! But maybe not. Prepare for setbacks and have a plan for when things don’t go quite as expected. What if you have an emergency vet bill of $2,000 one month? Or worse, what if you or your spouse lost their job? Everything might not go as expected when paying off your credit card debt. Your “get out of debt” plan should evolve if your financial situation changes.

If you experience unexpected expenses one month that hinder your ability to pay off debt, look for ways to make more room in your budget. Maybe it makes sense to spend a month not eating out and shopping at a discount grocer like Aldi. Hopefully your plan will go as expected or better than expected, but a willingness to make changes to your plan and make sacrifices might be necessary to ensure your success.

Nobody wants to have credit card debt, and rarely does anyone plan to take years and years to pay off their cards. Credit card debt usually starts small. It’s easy to make a purchase on your card without the money to pay for it. After all, you can just pay off your credit card when you get paid and you won’t even owe any interest. What’s the harm in that? But maybe you have a minor financial emergency right after you get paid. You have to use your paycheck to take care of the emergency, but that’s alright. You can pay off your credit card next month.

Next month comes around faster than you expected and after last month’s financial emergency, you aren’t sure you have enough money for groceries and gas this month, much less extra money to pay off your credit card. The stress from worrying about money could lead you to make more poor financial decisions. Spending money on your credit card helps you forget that you don’t actually have the money to be spending on your credit card, if only for a moment. Next month your credit card balance and stress both grow and the cycle continues.

It is all too easy to fall into credit card debt. Remember that you are not alone and this is a trap that ensnares millions of Americans. It may not feel like it right now, but it is possible to get rid of your credit card debt completely and never look back.