High-interest debt is very harmful to your financial life, and the magic of compounding interest can work against you just as much as it can work for you. It can feel like an uphill battle that you have no chance of winning, and high-interest debt takes both a financial and psychological toll. However, there is a light at the tunnel and you can work towards building your more beautiful tomorrow regardless of your debts. We want to help you develop a plan of attack for getting rid of extremely harmful debt.

Do you have high-interest debt?

That may seem like a silly question. Shouldn’t you already know whether or not you have high-interest debt? In some cases you absolutely know whether or not you have high-interest debt, but in other situations it isn’t as clear-cut. What if you are a college student and just graduated with student loans at 6.8% interest? Or what if you just bought your first home and closed at a 6.75% interest rate?

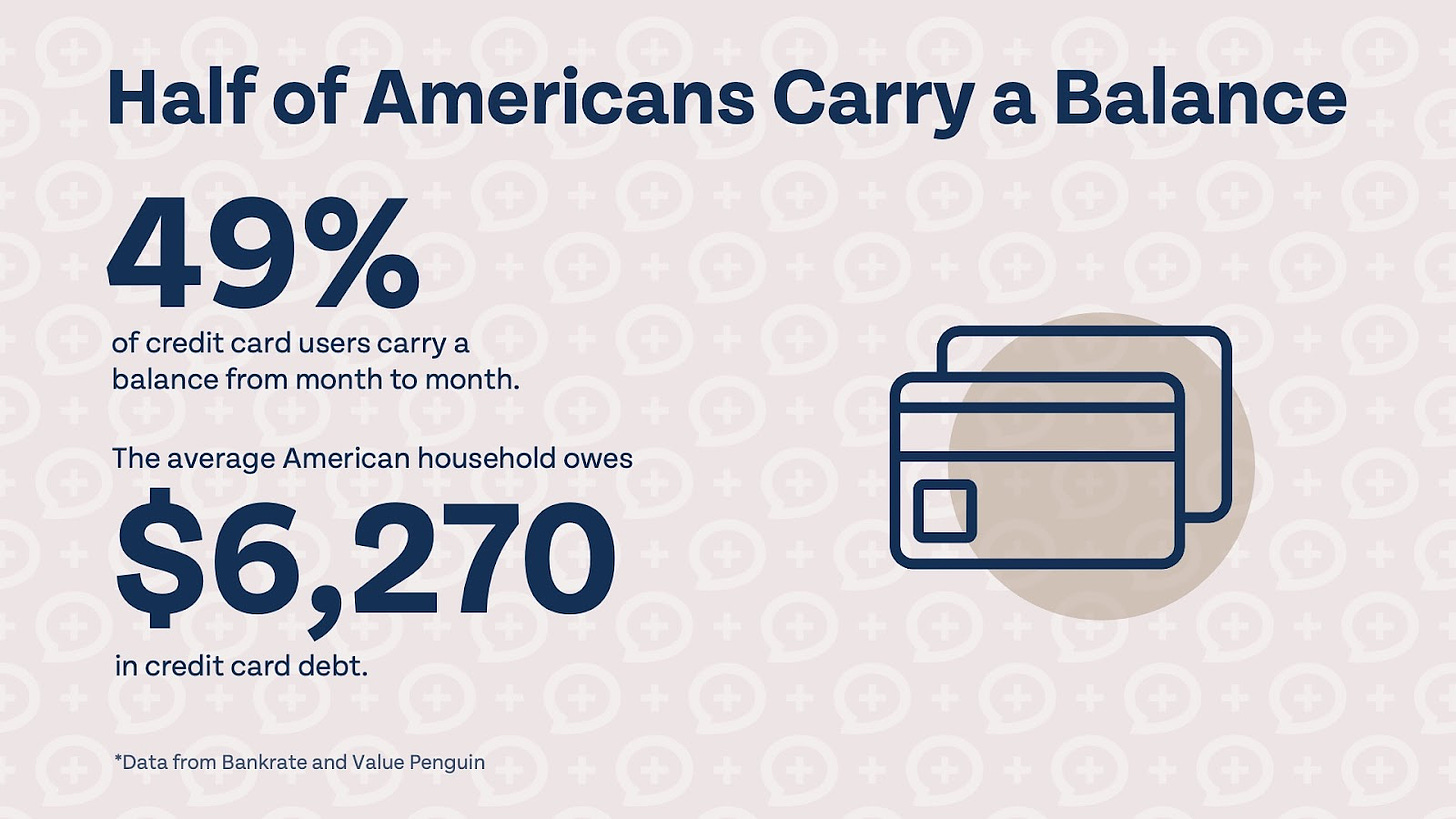

Before we discuss more nuanced situations, let’s define what counts as high-interest debt for everyone. Any unsecured consumer debt that you do not pay off in full every month counts as high-interest debt. This is commonly a credit card balance, as almost half of all credit card users carry a balance on at least one of their cards. Unsecured consumer debt isn’t just credit cards. Lines of credit at stores, loans to purchase electronics, furniture, and other home goods, personal loans, and more all count as unsecured debt that should be prioritized as high-interest debt.

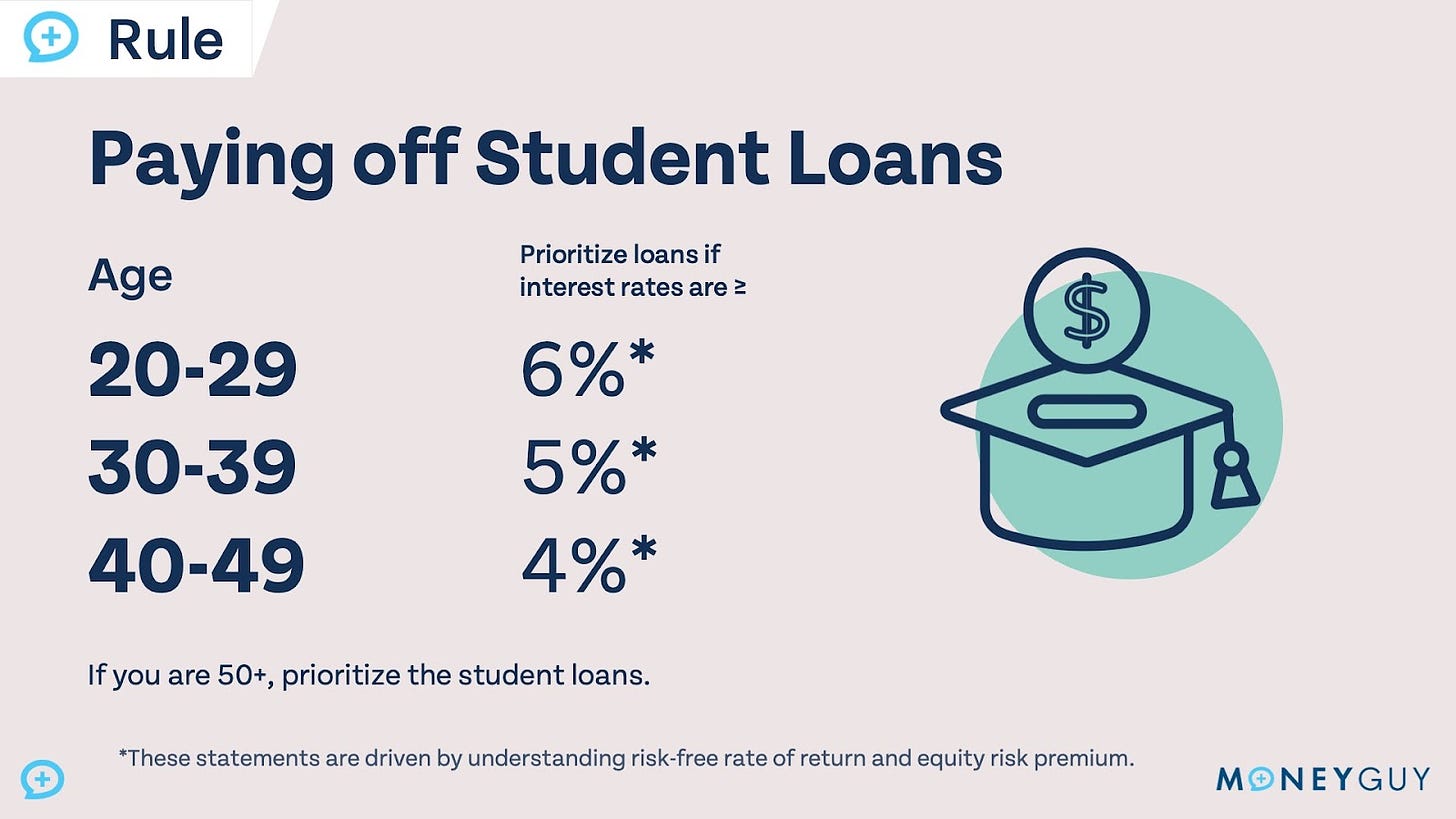

A few types of debt work a little differently and may or may not count as high-interest debt for you. Student loans are often a necessary evil to obtain a college degree, and whether or not you count them as high-interest debt depends on your age and interest rate of your student loans. In your 20s, student loans with interest rates greater than 6% can be considered high-interest, and in your 30s anything over 5%, in your 40s over 4%, and all student loans should be prioritized after 50.

It’s important to note that the stated interest rate on your student loans may not be your effective interest rate. If you are on a SAVE income-driven repayment plan, any interest in excess of your monthly loan payment is not charged as long as you make the required monthly payment. This means some of the interest you owe may be forgiven each month and thus lower your effective interest rate (and possibly the priority of paying off your student loans).

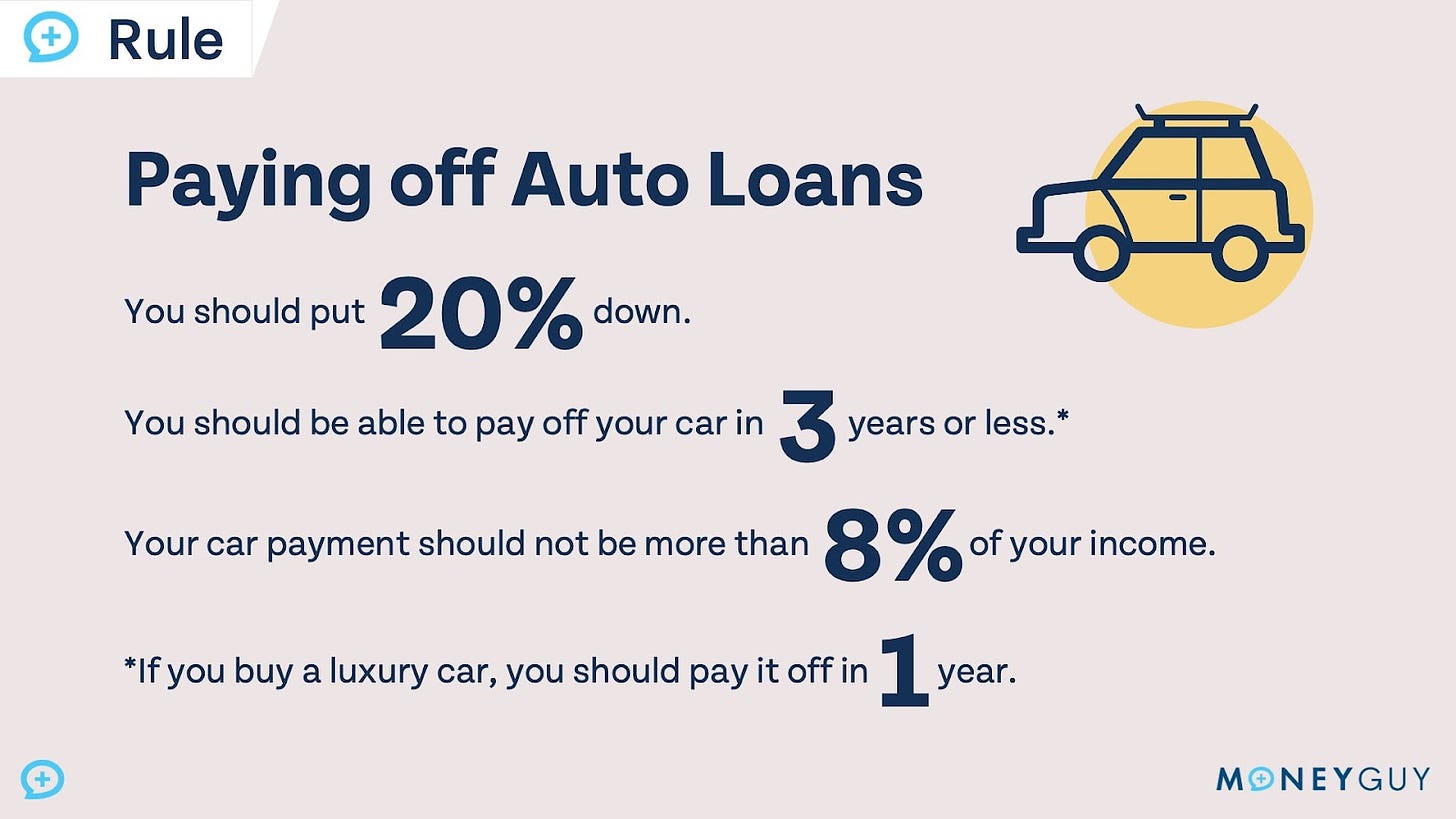

Auto loans are unique and don’t fit neatly into high-interest debt or low-interest debt. Unlike mortgage debt, which we will get to next, auto loans are on assets that typically depreciate (or go down in value over time). This makes car loans more of a liability, which is why we recommend avoiding taking out a vehicle loan if possible and paying for a car in cash if you have the ability. We recognize reliable transportation is usually a need and not a want, which is why it does make sense to take out a loan to get a reliable car if necessary.

If you are taking out an auto loan, you should put at least 20% down, pay off your car in 3 years or less, and keep the monthly payment (or payments, if you have more than one car loan in your household) to 8% or less of your gross income. If your car loan falls outside of these guidelines, you should consider it a higher priority or high-interest debt (Step 3 of the Financial Order of Operations). We created an interactive tool to help you determine how much car you can buy, which you can use here.

Mortgage debt is another unique type of debt. Unlike every other type of debt we’ve mentioned so far, this debt is on an asset that typically appreciates in value. Not only that, if you itemize on your taxes, you may be able to claim a mortgage interest deduction that could be thought of as lowering your effective mortgage rate. For most individuals and families, mortgage debt does not count as high-interest debt, even at 2024 interest rates. However, you should still make sure you follow our rules for buying a home to ensure you are living within your means and buying a home you can afford.

How do you pay off high-interest debt?

Now that you know exactly what counts as high-interest debt, how do you pay it all off? There are two main schools of thought when it comes to the best way to pay down your high-interest debt. We don’t believe that either is right or wrong, but depending on how you are wired, one may make more sense than the other.

Debt Avalanche vs. Debt Snowball: Which Is Better?

If you are mathematically minded and have the discipline and desire to pay off your debt as quickly as possible, the debt avalanche method may be for you. With the avalanche method, you prioritize debts based on the interest rate without regard to the balance of the debts. This ensures you pay off the most harmful debts first and minimize the amount of interest paid on your debt. This method will save you the most money in the long run if you have the discipline to pay as much as you can towards your high-interest debt.

The debt snowball method may be better if you are more affected by the emotional and mental burden of being in debt and need small “wins” to give you motivation to get out of debt. With the debt snowball method, you pay off the debt with the lowest balance first without regard to the interest rate. This means when you start paying off your high-interest debt you will get the “wins” of eliminating balances, but overall you might pay more interest and be in debt longer than if you had used the debt avalanche method.

No matter what types of high-interest debt you have or what your balances look like, it is possible for you to get rid of all of your most harmful debt and build a brighter and more beautiful tomorrow for you and your family. The steps you must take to get rid of your debt may be as simple as reducing frivolous spending and building more financial discipline. If you have a larger amount of debt, it may be smart to look for different ways to increase your income. It’s normal for high-interest debt to make you feel anxious, financially insecure, and afraid of the future. Instead of focusing on those negative emotions, try to imagine how you will feel once you eliminate high-interest debt for good and never look back – and use that as motivation to work towards paying off high-interest debt.