As the name implies, the Mega Backdoor Roth strategy is a way to build a very large amount of tax-free Roth dollars for retirement. While a traditional “Backdoor” Roth allows high-income earners to contribute to their Roth IRA, the Mega Backdoor Roth allows those with qualified employer plans, such as a 401(k), to funnel more money through their plan into a Roth IRA. In 2024, you may be able to get up to $46,000 extra into a Roth IRA, beyond your typical employee contribution limit. Sound too good to be true? Well, there are several catches, and this strategy isn’t right for everyone. Read on to find out if a Mega Backdoor Roth could work for you.

How to do a Mega Backdoor Roth

Many retirement savers only know about the standard salary deferral limit for 401(k) plans, which is $23,000 in 2024 for those under 50. Most don’t need to know how to contribute more, as only 15% of employees max out their workplace retirement plan. For some super savers, maybe Financial Mutants even, they max out their salary deferrals and look for additional places to invest. The salary deferral limit of $23,000, or $30,500 for those 50 and older, does not apply to after-tax 401(k) contributions. The annual additions limit applies to salary deferrals, employer matches, and after-tax contributions, and is $69,000 in 2024 (or $76,500 for the 50+ crowd).

What does this mean? Well, for someone under 50 that doesn’t get an employer match, it means they may be able t0 make $46,000 in after-tax contributions to their employer-sponsored plan. There is a big catch: not all employers allow after-tax contributions. Even if your employer allows after-tax contributions, they must allow in-plan Roth conversions in order for you to convert those after-tax contributions to Roth. If you have those magical ingredients, you may be able to build an enormous amount of Roth dollars for retirement.

Should I do a Mega Backdoor Roth?

I know what you’re thinking: forget about paying off high-interest debt, building an emergency fund, or contributing to a regular Roth IRA. I need to try out this Mega Backdoor Roth strategy now. Even if you do have the ability to build Roth dollars using the Mega Backdoor Roth strategy, it may not make sense to use it. For starters, there’s no reason to use this strategy if you can still contribute more money to a Roth IRA the old fashioned way or still have room left in your 401(k) salary deferral limit. There’s no advantage to building Mega Backdoor Roth dollars over Roth IRA or normal Roth 401(k) dollars, and executing the strategy is more complex. The Mega Backdoor Roth is part of Step 7 of the Financial Order of Operations for a reason. It is a maximization strategy and something to think about after your other financial ducks are in a row.

Even if you have the ability to use the Mega Backdoor Roth strategy and find yourself in Step 7 of the FOO, it still may not make sense for you. The average salary in the US is just over $60,000, which means if you max-out a Roth IRA, HSA, and 401(k), you would be contributing over half of your gross income into retirement accounts. That is a lot to ask for most Americans, to put it mildly, but also means it may not be necessary for most to maximize a 401(k), much less worry about advanced strategies like the Mega Backdoor Roth. If you have questions about how much you may need to invest for retirement, and what your retirement “number” is, check out our Know Your Number course.

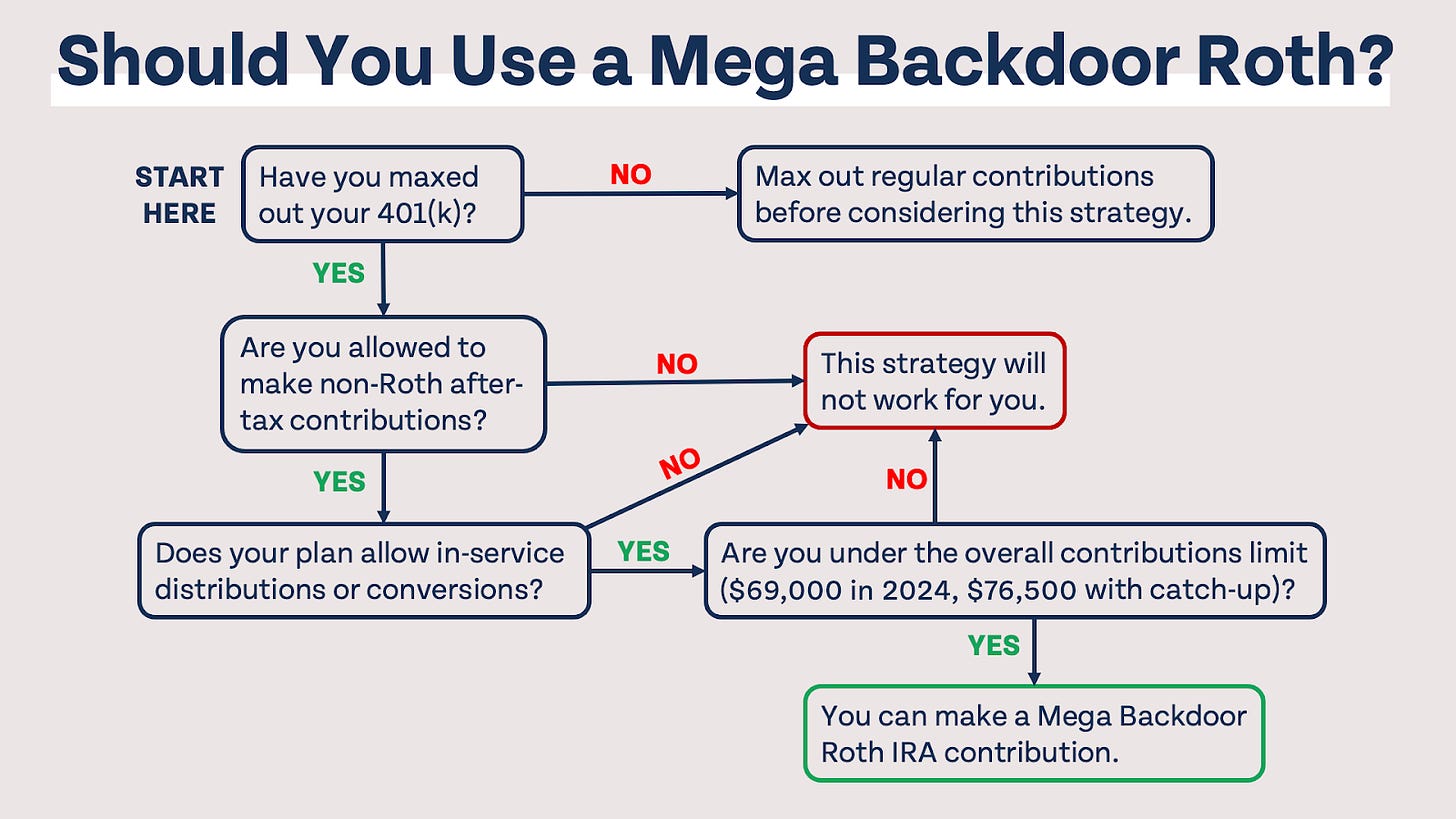

The short answer to whether or not you should use the Mega Backdoor Roth strategy is “maybe.” If you aren’t sure, use the flowchart below to help you determine whether or not this strategy is right for you.

Can I do a Mega Backdoor Roth on my own?

So you’ve decided it makes sense for you to use the Mega Backdoor Roth strategy. Is this something you should attempt on your own or does it require the help of a professional? It is possible to attempt this strategy by yourself, but that doesn’t necessarily mean it is a great idea. The Mega Backdoor Roth is a complex strategy and, like the “normal” Backdoor Roth, there is a potential for unexpected tax consequences if something is not done correctly. Common pitfalls include not making sure your employer plan is set up correctly, not rolling your rollover balance quickly, or not knowing documentation requirements. If you have any doubts about your ability to effectively implement this strategy, or would feel better getting the help of a professional who has done it many times before, it may be worth reaching out to an experienced tax professional and/or a fee-only financial advisor.

For retirement savers that have already maximized their Roth IRA, HSA, 401(k), and other tax-advantaged retirement vehicles, the Mega Backdoor Roth strategy offers an incredible avenue to build even more tax-free dollars for retirement. However, this is a strategy that is best suited for high-income earners and Financial Mutants. Most Americans will never need to think about using the Mega Backdoor Roth strategy, and that’s fine! It is complex and not for the faint of heart, but the rewards can be tremendous.

Have questions about Roth IRAs and how Backdoor Roths work? Check out our Roth IRA Guide.