“Should I pay off my mortgage early?” is probably a question you’ve asked yourself at some point if you have extra cash flow. This question, like almost every question in the personal finance world, isn’t a simple “yes” or “no” and is highly dependent on your personal situation. For the first time in over two decades, though, external factors may be having a big impact on whether or not you should pay off your mortgage early.

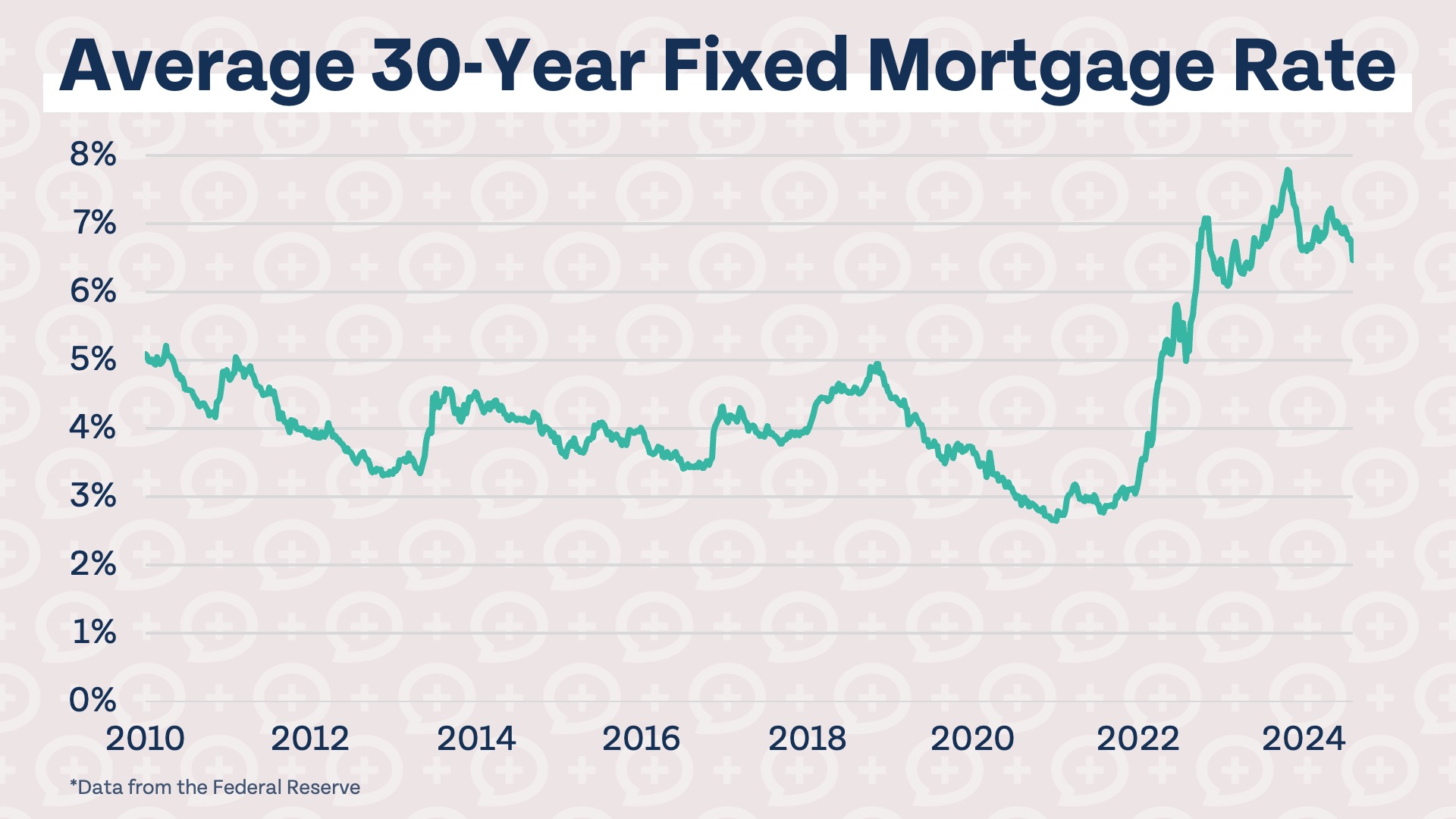

The average 30-year fixed mortgage rate reached a high last year that hasn’t been seen in over 20 years. Rates have moderated a bit and are now in the 6.5% range, but still remain much higher than what we’ve grown accustomed to since 2010.

If you locked in a mortgage rate of 7.5% last year, you’re probably feeling a lot more pressure to get that debt paid off early than someone who locked in a rate under 3% in 2021. While the rate of your mortgage is a big factor in whether or not you should prioritize it, it is not the only factor, and may not even be the deciding factor. Here’s what you should consider before deciding whether or not to prioritize paying off your mortgage.

Is your mortgage high-interest debt?

A rate of 6% or 7% on your home mortgage may feel high after experiencing over a decade of rates under 5%, but it isn’t out of the ordinary historically. During a period of high inflation in the 1980s, average mortgage rates peaked over 18%. Now that is high-interest mortgage debt. Current rates can’t really be considered high-interest debt, but they aren’t really low-interest debt, either. So where do they fit in the Financial Order of Operations?

Mortgage debt is unique because the underlying asset, your home, typically appreciates in value. This makes it less dangerous than auto debt or consumer debt. If your home has gone up in value, you can sell your home to pay off your mortgage. You can’t say the same thing about a car loan or credit card debt.

There may also be opportunities to lower, or effectively lower, your mortgage interest rate. Refinancing is the most straightforward way. If rates drop in the future, you can refinance your mortgage debt to a lower rate. If you don’t have the opportunity to refinance currently, it may make sense, depending on your tax situation, to itemize deductions and use the mortgage interest you paid throughout the year to save on taxes, lowering your effective rate.

We believe paying off mortgage debt fits into Step 9 of our Financial Order of Operations. Although rates have risen over the last several years, they have not yet reached the point where the debt should be treated like credit card debt or other high-interest debt. If a mortgage isn’t typically high-interest debt, and should be prioritized at Step 9 of the Financial Order of Operations, the next question you find yourself asking may be…

When should I pay off my mortgage?

Paying off your mortgage might not seem important at first glance since it is the last step in the Financial Order of Operations. There is a window in your life, though, when paying off your mortgage should be a priority. That window starts around age 45 or 50 and lasts until retirement. Why this particular time period? For younger folks, time is on your side. You have plenty of time to eventually pay off your mortgage, and having plenty of time means your wealth multiplier is extremely powerful. As you get older, you have less and less time to become debt-free before retirement and the money you invest isn’t quite as powerful as when you were younger.

This doesn’t mean the day you turn 45 you should log on to your mortgage company’s website and pay off the entire balance, but it would be a good idea to start strategizing about how you plan to become debt-free by retirement. You may already be on-track to be debt-free by retirement, which is great! If you still have work to do, it could make sense to increase your monthly payment or make extra payments to get rid of your debt by retirement.

If you are younger than 45 and happen to reach Step 9 of the Financial Order of Operations, you might be able to pay off your mortgage even earlier. For most folks, though, it should at least become something you plan for and think about around age 45 or 50 (or earlier if you plan to retire early).

Depending on how you think about debt, the benefits of paying off your mortgage could be purely financial or both financial and psychological. Some Financial Mutants aren’t bothered by the idea of carrying low-interest mortgage debt, and the benefit of paying it off is strictly financial. It’s easy to see why some think this way since it’s now common to earn more on a savings accounts than you owe in interest on your mortgage. For others, the thought of having such a significant amount of mortgage debt is anxiety-inducing and they will feel better mentally once their debt is gone, even if it is at a very low interest rate.

Both ways of thinking about debt are completely normal and there isn’t necessarily a benefit to thinking one way over the other (not that you can change the way you think, anyway). While there may not be a right or wrong way to think about mortgage debt, we believe everyone should aim to be completely debt-free by retirement and, if you are under age 45 and before Step 9 in the Financial Order of Operations, paying off that debt may be on the back burner.