Nobody enjoys thinking about life insurance, for the same reason no one enjoys planning their own funeral or shopping for coffins. It’s normal to not want to think about what happens after you or your spouse are no longer here. Avoiding or delaying the purchase of life insurance, though, can have an enormous cost. Life insurance offers valuable protection from unforeseen events and can help ensure your family is taken care of after you are gone. How do you know whether or not you need life insurance, what kind do you get, and how much do you need?

Who needs life insurance?

While life insurance offers an extremely valuable and necessary protection for many people, purchasing an unnecessary product can cost you thousands (or potentially millions, when you account for the compounding growth opportunity cost). If there are others depending on your income or labor, whether it is a spouse or children or other family members, you may need life insurance. If others are dependent on your income to pay bills (like a mortgage) and would struggle financially if you passed away, you should consider your need for life insurance.

If others are dependent on your labor, for example if you are responsible for childcare and other household tasks, you should also consider your need for life insurance. In relationships where one spouse works a traditional job and the other is a stay-at-home parent, they may make the mistake of assuming only the working spouse should be covered. However, the labor of caring for children will need to be replaced in the event that a stay-at-home parent passes away and this should be considered when determining your family’s life insurance need.

Not everyone has a need for life insurance. If you are younger and don’t have anyone dependent on your income, you may not need life insurance. If you are older and debt-free with a large enough portfolio to self-insure, you may no longer have a need for life insurance.

Once you determine whether or not you need life insurance, how do you decide what kind of policy to choose?

How to choose the right life insurance

41% of Americans don’t have any life insurance, and not always because they think they don’t need it. 52% say that life insurance is too expensive, 17% believe they don’t need it, 15% don’t know what kind of policy to get, and 11% say the process is too confusing. Some life insurance policies are purposely designed to be confusing to mask high expenses, fees, and commissions, but buying life insurance doesn’t have to be confusing or expensive.

Permanent life insurance can make sense in certain situations, like if you have an extraordinarily large estate, but term life insurance is worth considering for the majority of the population with a need for life insurance. Term life insurance is pure insurance without an investment component; you are paying for a specific amount of coverage for a certain length of time, and there is no cash value. This keeps the cost of term life insurance down. A 30-year-old female in excellent health can expect to pay between $25-$30 per month for a 20-year policy with $1,000,000 of coverage. A 30-year-old male in excellent health can expect to pay $30-$35 for the same amount of coverage.

That is very affordable! For the cost of Netflix and HBO Max, you can potentially protect your family in case something unexpected were to happen to you. With how inexpensive term life insurance is, it is typically better to err on the side of caution and purchase too much insurance rather than too little.

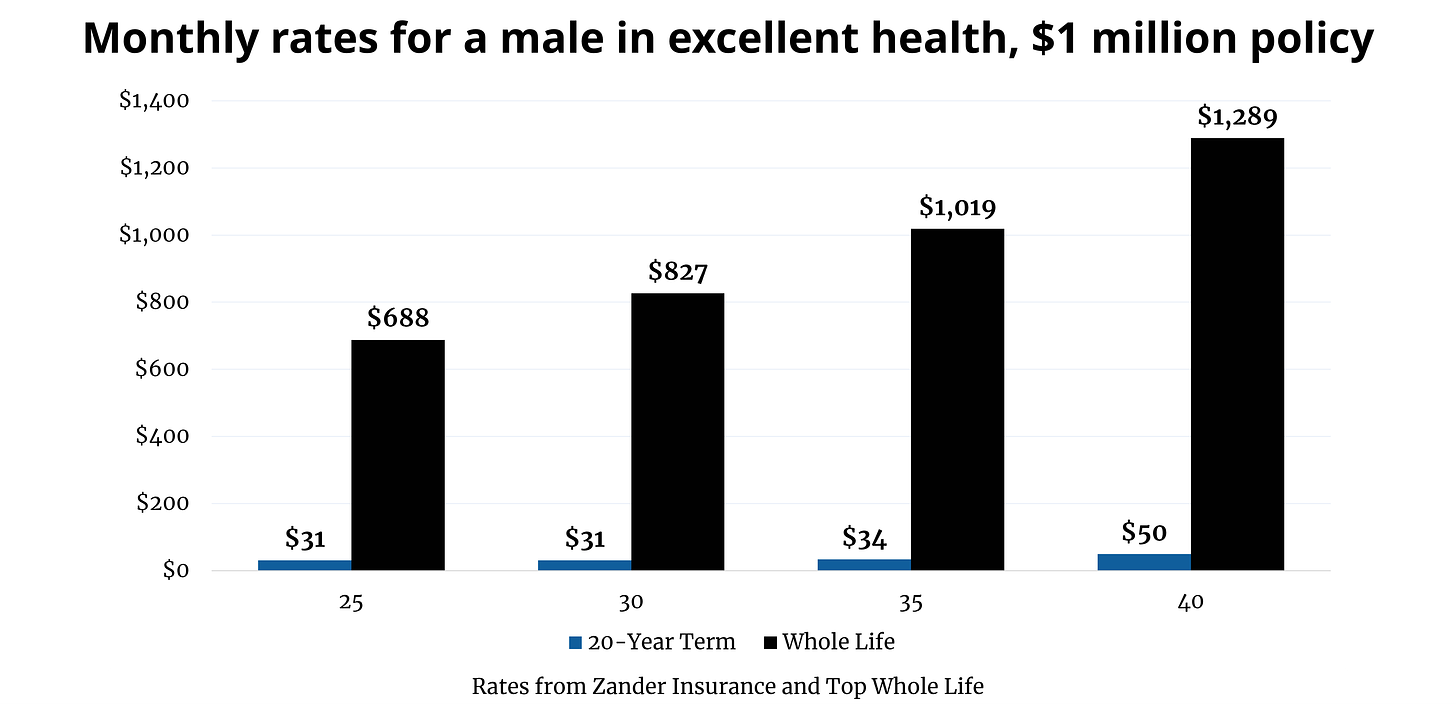

Whole life insurance is not quite as affordable. Part of what you are paying for is permanent insurance coverage, but you are also paying higher expenses, fees, commissions, and for an investment or cash value component. This drives up the cost. For a 30-year-old female in excellent health, $1,000,000 of coverage will cost around $733 per month, which is roughly 25x to 30x more expensive than 20-year term life insurance coverage. A 30-year-old male in excellent health would expect to pay around $827 per month for the same whole life insurance policy, which is about 24x to 28x more expensive than 20-year term insurance. The chart below shows a comparison of rates for different ages, and whole life insurance is consistently 20x-30x more expensive than term life insurance.

Advocates for permanent life insurance will say the higher costs are justified, but Consumer Reports found that the average annual rate of return for whole life guaranteed cash value, after fees and expenses, is just 1.5%. Whole life insurance is often pitched as an investment vehicle, a sort of forced savings account that can be used in retirement, but there are much better retirement savings vehicles available. If you aren’t familiar with all of the tax-advantaged retirement savings vehicles, like Roth IRAs, HSAs, and 401(k)s, or low-cost investment options, like target date index funds, check out these episodes of the show: “How to Legally Hide Money from the Government FOREVER in 2021” and “Are You Using Your 401(k) the WRONG Way?”

How much insurance do you need?

Let’s say you’ve already determined whether or not you need life insurance and which type of insurance is best for you. How do you determine how much insurance coverage you need? The general guidance is to carry around 10x your annual salary in life insurance, but you may need more or less coverage depending on your liabilities (and goals such as education for children) and how much you want or need to provide for your family. To more precisely estimate your life insurance need, beyond using general rules-of-thumb, you need to do a more in-depth analysis of your family’s expenses. This is also something a fee-only, fiduciary financial advisor can help with.

When estimating your life insurance need, you should consider what debts you want paid off, what your family’s living expenses will look like without you (there may be additional childcare expenses), how long you want to provide for your family, and any end-of-life expenses you don’t already have covered (funeral, attorney fees, etc.). Once you reach a level where your retirement portfolio is large enough to pay off debts, provide for your family, and cover end-of-life expenses, you may no longer have a need for life insurance. Plus, hopefully adult children will be financially independent after they leave your house, typically after 18-22 years.

How to buy life insurance

Nowadays it is extremely easy to get life insurance quotes online, so make sure to compare rates from several different providers when looking for life insurance. It is not always best to select the cheapest rate available; some companies are better off financially than others, so it is important to select a provider with good financial ratings and a long track record in the industry. You can also opt to work with an independent insurance agent to get coverage if you prefer a personal touch.

Depending on your age and the amount of coverage you are seeking, you may be able to skip the medical exam. Whether or not you can skip the exam, you will need to be in good health to get the best rates, and you can expect to answer many different questions related to your health on your application.

Not everyone needs life insurance, but if you do there is no reason to put it off (and many reasons not to put it off). Term life insurance policies are affordable and offer valuable protection. If you have dependents, whether a spouse, children, or other family members, it is extremely important to take the necessary steps to protect your family in case something unexpected were to happen. Nobody likes thinking about death, but the peace of mind and security that comes with knowing your family is adequately protected is well worth the cost.