Average interest rates on credit card accounts assessed interest last year rose to a record high of 22.75%. If you never carry a balance on your credit card this rate doesn’t matter, but only 35% of credit card users say they always pay their balance in full every month. Like it or not, the average credit card APR matters significantly to most credit card users. We take it for granted that credit card interest rates are extremely high, but has it always been this way? And does it have to be this way?

History of credit card interest rates

Credit card debt is unsecured debt, which means you are not required to “secure” the debt with an asset. Mortgages and car loans are two common types of secured debt, or debt backed by collateral. If you fail to pay your mortgage or car loan, the bank has collateral (your house or car) it can repossess. Interest rates on mortgages and cars are naturally lower than credit card interest rates because the debt is secured.

Comparing credit card interest rates to mortgage and car loan rates isn’t a fair comparison, but we can compare credit card interest rates today to historical rates. Credit card APRs are currently at an all-time high since the Federal Reserve began tracking data back in 1994, but the federal funds effective rate has also risen significantly over the past few years. Instead of comparing credit card rates now to credit card rates a few years ago, I want to compare credit card rates now to a time when overall interest rates were similar.

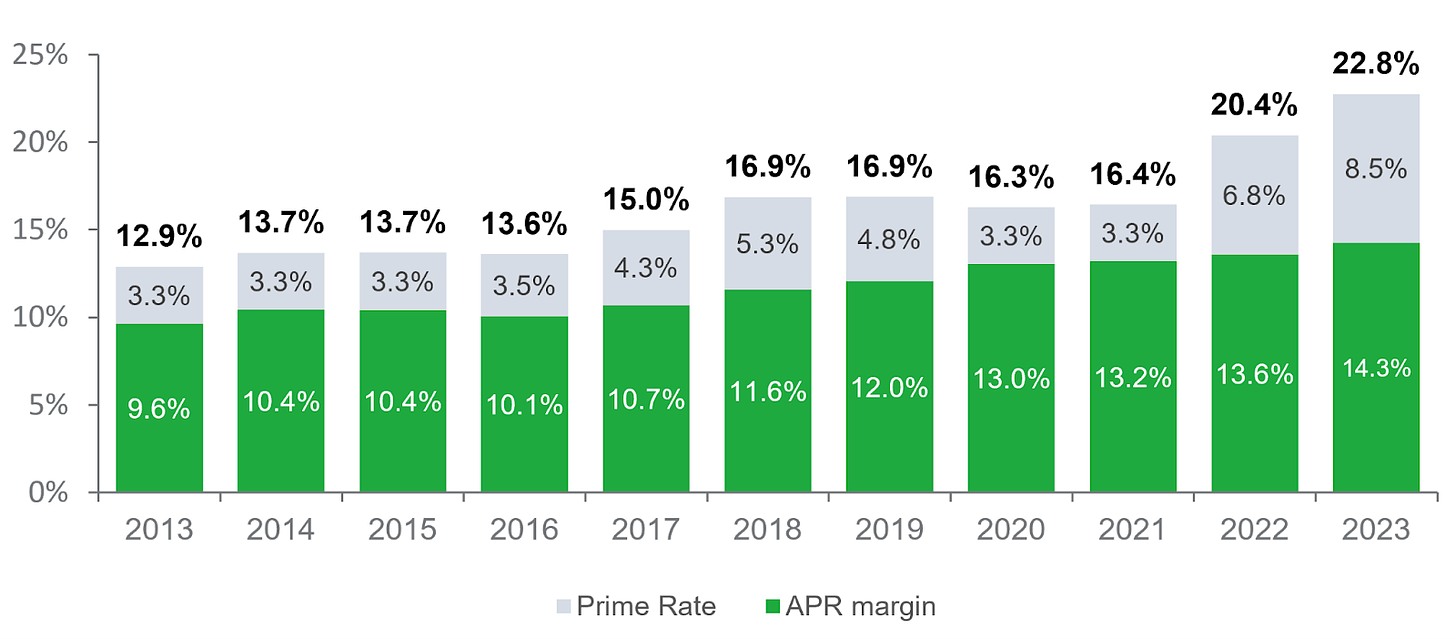

The Federal Funds effective rate is currently 5.33%. From October of 1994 through December of 2000, the average federal funds rate was 5.51%. All else being equal, I would expect credit card rates to be about the same in that period as they are today – if not a little higher back then since federal rates were higher. But that is not what we’re seeing. From the 4th quarter of 1994, when the Federal Reserve began tracking credit card APRs, to the end of 2000, the average credit card interest rate on accounts being charged interest was 15.39%. Today, the average credit card interest rate on accounts being charged interest is 22.75%. This chart from the Consumer Financial Protection Bureau shows how credit card rates have risen much faster than prime rate.

Why is there such a large discrepancy? Is it more expensive to lend now or is something else going on?

Why credit card interest rates have gone up

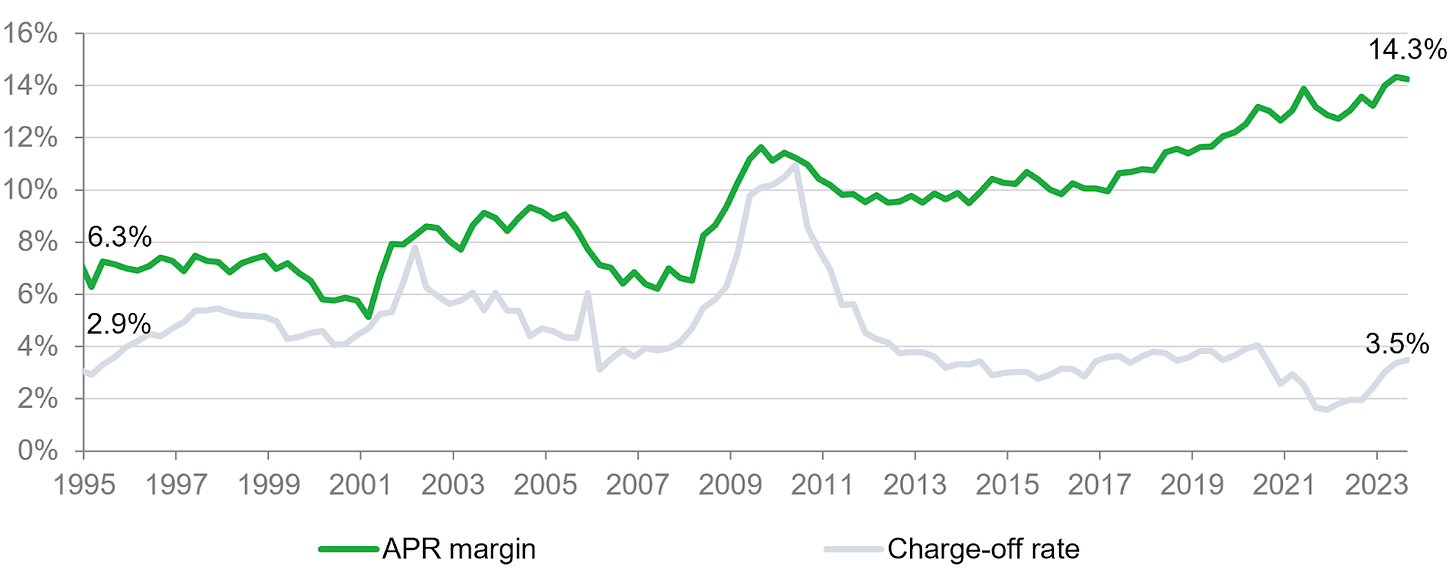

To give credit card companies the benefit of the doubt, if more Americans are not paying off their debts, raising credit card interest rates would be a natural way to maintain your profit margin and protect your company from losses. Fortunately all of this data is tracked so we can see if this is why credit card rates are so much higher these days. This chart, also from the Consumer Financial Protection Bureau, shows the APR margin of credit card companies and the charge-off rate. The charge-off rate is the percentage of defaulted balances compared to the total amount of credit outstanding.

This chart is insane to me. 1995 to 2011 are what I would expect the chart to look like, and then we see a huge divergence after 2011. The APR margin for credit card companies keeps rising while the charge-off rate remains low and steady. What does this mean? Credit card companies are making more money than ever off of Americans. But there is a way you can win and beat the credit card companies at their own game.

How to beat the credit card companies

Credit card companies will likely continue increasing their profit margins over time, which means consumers with credit card debt will pay more and more interest to credit card companies. However, you can beat the credit card companies at their own game. We believe it is possible to responsibly use credit cards and not carry a balance from month-to-month. If you are able to do this, you will receive all of the benefits of using credit cards (rewards, better protection, extended warranties, travel benefits, and more) with none of the penalties (high interest rates and fees).

Not all Americans are able to use credit cards responsibly. The data shows that only 35% of cardholders always pay their balance in full every month. If you are part of the majority of Americans that does not use credit cards responsibly, credit cards might not be for you – and that’s okay. It is much better to use debit cards and have a little less protection and fewer rewards than to rack up debt on a credit card and pay an exorbitant amount in interest and fees to credit card companies.

The interest rate on credit cards has changed significantly since the 1990s, but the trap you need to avoid has not changed. Don’t let credit card companies win and make money off of your hard-earned dollars. Put that money to work for you and start investing today. Check out our new Wealth Multiplier tool to see exactly what each dollar you save in credit card interest could turn into by retirement.