Change your life by

managing your money better.

Subscribe to our free weekly newsletter by entering your email address below.

Subscribe to our free weekly newsletter by entering your email address below.

New data shows that Americans are struggling when it comes to credit card debt and savings rates. In this Q&A, we discuss the new shocking data and give you tips on how to avoid this huge financial mistake.

Subscribe on these platforms or wherever you listen to podcasts! Turn on notifications to keep up with our new content, including:

The US economy has set an all-time high record in personal finance destruction, according to a shocking data trend that shows a significant increase in the country’s debt and consumption problem.

Credit card debt is a problem that Americans have been warned against for years. Although they were making headway before the pandemic, the crisis that ensued exposed the fragility of the country’s savings rate. Before the pandemic, the US had never hit $900 billion in credit card debt. But during the pandemic, as the government stimulus checks were rolled out, credit card debt dropped to $750 billion. Companies were getting stimulus from the government, and individuals were getting stimulus checks, which they used to pay off debts. This positive trend, however, didn’t last long.

The US’s savings rate, which is between 7-8%, spiked way up during the pandemic, thanks to the government stimulus checks. People were locked down in their houses and had nothing to do, so they saved money. However, the savings rate did start to come down when people were getting used to all the money coming in. But here’s the real kicker: the credit card debt is ballooning to $939 billion, and the savings rate has dropped to 3.4%, the lowest it’s ever been.

The power of compounding interest has always been a popular topic among investors. However, it works both ways: if it’s working for you, it can make you money, but if it’s working against you, it can destroy you. Unfortunately, the compounding interest is working against those who have fallen into credit card debt, which is now at an all-time high. With the average APR for a credit card standing at over 20%, credit card debt is a no-go. This is a lesson that many Americans have yet to learn.

In conclusion, the US has set an all-time high record in personal finance destruction. While some people are paying off their debts, others are accumulating more debts, which is not a sustainable way to live. People need to learn to manage their finances better, and the government needs to do more to help the country’s economy. It’s time for America to address its debt and consumption problem before it’s too late.

For more information, check out our Wealth Multiplier resource here.

Free Resources

Here are the 9 steps you’ve been waiting for Building wealth is simple when you know what to do and the order in which to...

Free Resources

If you want to set yourself up for future success, find out how much you need to save every month to become a millionaire.

Free Resources

Here’s how you can buy a dependable car that won’t break the bank. Our free checklist walks you through the 20/3/8 rule and strategies to...

Articles

Health insurance premiums may make up a significant portion of your budget. How can you find more affordable health insurance? Is it ever worth going...

Articles

There is no need to wait until an arbitrary date on a calendar to make positive changes in your financial life, but if you are...

Articles

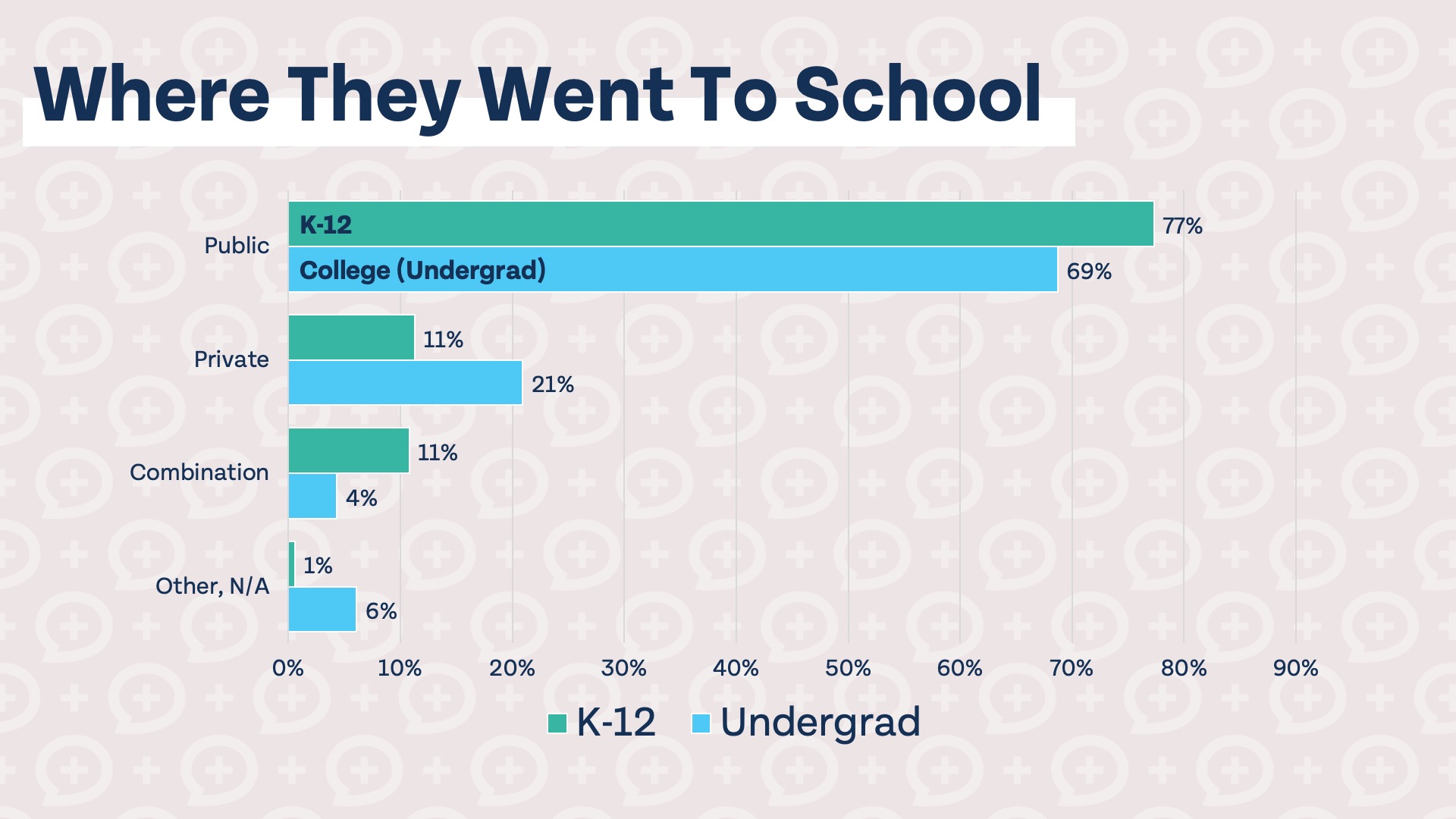

Each year we conduct an annual survey of our millionaire clients. Some of the data is not too surprising. Yes, they have much higher than...

How about more sense and more money?

Check for blindspots and shift into the financial fast-lane. Join a community of like minded Financial Mutants as we accelerate our wealth building process and have fun while doing it.

Free Resources

Here are the 9 steps you’ve been waiting for Building wealth is simple when you know what to do and the order in which to...

Free Resources

If you want to set yourself up for future success, find out how much you need to save every month to become a millionaire.

Free Resources

Here’s how you can buy a dependable car that won’t break the bank. Our free checklist walks you through the 20/3/8 rule and strategies to...

It's like finding some change in the couch cushions.

Watch or listen every week to learn and apply financial strategies to grow your wealth and live your best life.

Episodes

Think your rental barely breaks even? We reveal the shocking math when this couple asks if they should sell their duplex to reclaim their time...

Episodes

Big changes are coming to 401(k)s! And, 595K hit 401(k) millionaire status in Q2 2025, but 41% cash out when changing jobs. Watch now to...

Episodes

If you're between 27 and 43 with six figures invested, you're in the often-overlooked "messy middle" between reaching your first $100,000 and retirement. Bo breaks...

Subscribe to our free weekly newsletter by entering your email address below.