For retirees, the withdrawal rate is the amount of money taken out of their portfolio each year for living expenses. Withdrawals may be required, in the case of required minimum distributions (RMDs), or they may be dynamic (if the market is down, it may make sense to withdraw less from your portfolio). A safe withdrawal rate is the amount of money that can be safely withdrawn each year in retirement without putting yourself in danger of running out of money.

Retirement is a fairly new concept; a generation ago, Americans were expected to work just about as long as they were alive. Workers began retiring earlier starting in the 1950s and the average life expectancy has also significantly increased over the past 70 years. Defined benefit pension plans initially provided much of a retiree’s income, but with the rise in popularity of 401(k)s, and subsequent decline in pensions, most Americans are now responsible for their own retirement.

The FIRE movement is especially unique because participants are leaving the workforce even earlier. Instead of paying for a 20-year or 30-year retirement, which many Americans struggle to do, they must have enough saved to cover 40 or even 50 years of retirement.

Safe withdrawal rates for an ordinary retirement

Traditionally, 4% is thought to be the baseline safe withdrawal rate. This number comes from the Trinity Study, published in 1998. There are several large economic events that have happened since 1998 (the dot-com bubble, housing crisis, and a global pandemic, to name a few), and the Trinity Study only tested simulations for up to 30 years of retirement. Fortunately, the Trinity Study has been updated for 2020 with recent data and longer retirement simulations. What does this new study tell us about safe withdrawal rates for a normal retirement, and for an abnormally long retirement?

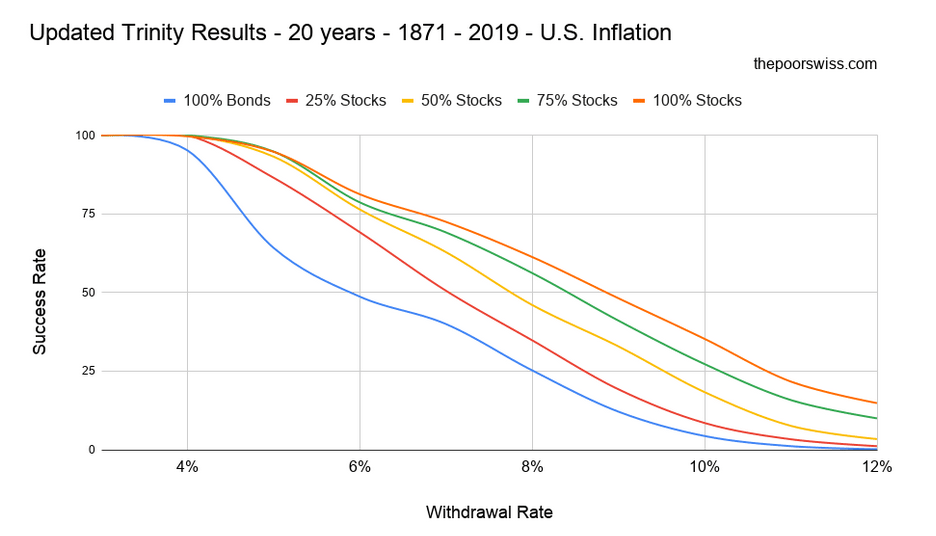

Looking at the graph above (all charts come from The Poor Swiss blog, and their updated Trinity Study), we can see that a 4% withdrawal rate holds up pretty well over a 20-year retirement as long as you have some allocation of stocks in your portfolio (the 100% bond portfolio, unsurprisingly, did not do that well). This is good news for Americans that aren’t retiring early and might not plan to live that long in retirement, but what about those who will live longer or retire earlier?

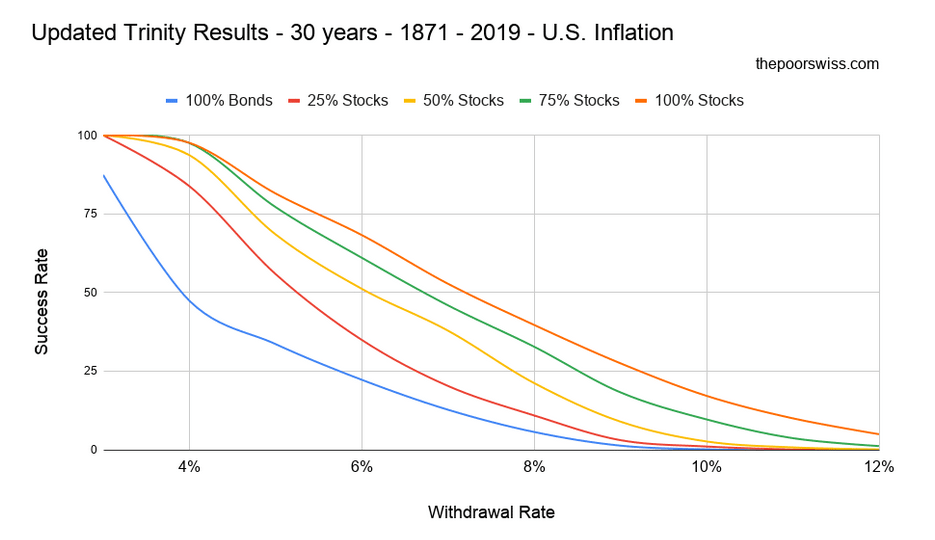

A 30-year retirement, pictured above, might be more appropriate for the average American. This would mean retiring at 65 and passing away at 95, or retiring early at 60 and living until age 90. Over a 30-year retirement, a 4% withdrawal rate still holds up pretty well, with the exception being if you have a portfolio consisting entirely of bonds. A 5% withdrawal rate is also possible, but the chance of running out of money goes up significantly. For those planning to be retired for about 30 years, a 4% withdrawal rate seems to work out pretty well, but what about FIRE folks that want to retire at 40 or 50?

Safe withdrawal rates for FIRE

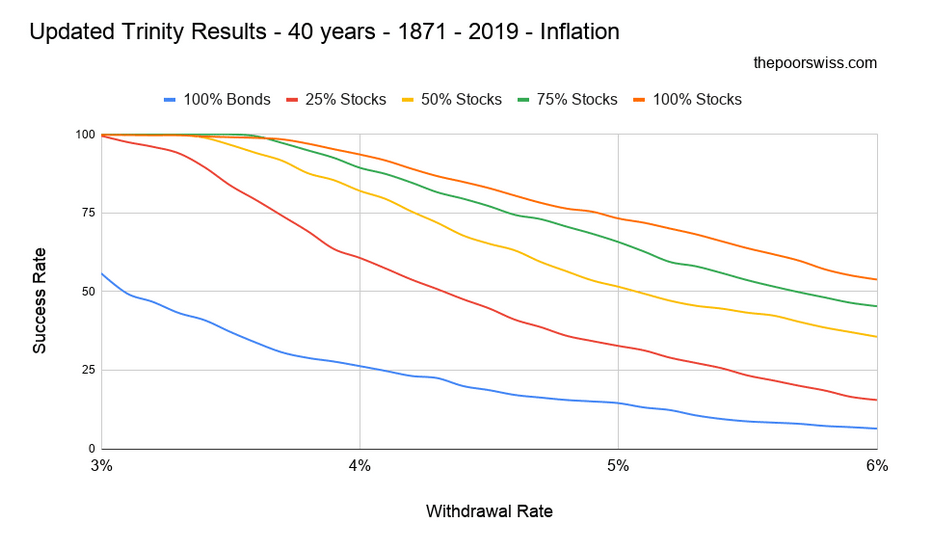

Being retired for 40 years is certainly a possibility, and might even be likely for someone in the FIRE movement who retires early. As you can see in the chart above, the rate of success for a 40-year retirement is decent if you withdraw 4% per year, although there is a not insignificant chance of running out of money. If you plan to be retired for 40 years, a withdrawal rate of under 4% may be more appropriate and has a greater chance of success.

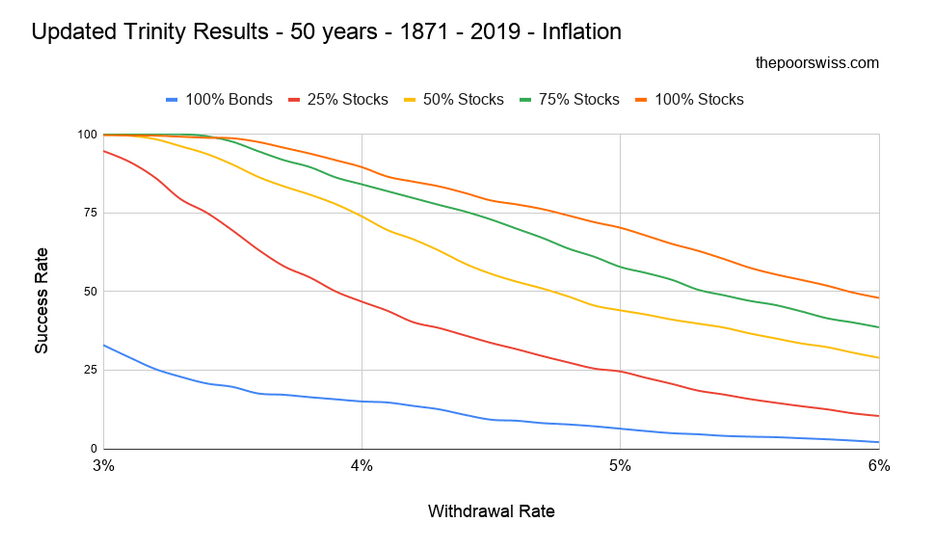

Some in the FIRE movement would prefer to leave the workforce as early as possible, and could even spend the majority of their life retired. Over a 50-year retirement, a 4% withdrawal rate could be successful (and you may even have a better chance of success than of failure), but a prudent retiree may want to decrease their withdrawal rate to 3.5% or even a touch less. The longer you’re retired, the longer your money will need to last, and the greater the chance of a few once-in-a-lifetime events occurring that could throw your retirement off track.

There are other tools FIRE participants have at their disposal to combat unfavorable economic conditions; many are young enough to go back to work, or may continue working part-time in retirement to supplement their lifestyle. Some may choose to adjust their spending up or down based on how well their portfolio is doing. Over an extra long retirement, many unforeseen events will likely occur, and keeping your options open and withdrawal rate in a safe range will greatly increase your chance of success.

Our latest show, “Did 2020 Destroy the FIRE Movement?” takes a closer look at what type of lifestyle and savings rate is required for a successful retirement. One thing the updated Trinity Study doesn’t include is market data from 2020; has anything changed, or is FIRE still as possible today as it was in 2019? Watch our latest episode on YouTube below to find out.