College costs have been skyrocketing for years, and attending has placed a huge financial burden on millions of families. Are the extraordinary costs worth it?

College is in the news a lot these days. Costs have been skyrocketing for years, and to pay for school graduates have taken on more and more debt; recently, some have even called for student loan forgiveness for those saddled with student debt. The question at the heart of the issue, though, often gets ignored: is college even worth it anymore? How did something so positive end up putting the financial futures of so many Americans in jeopardy?

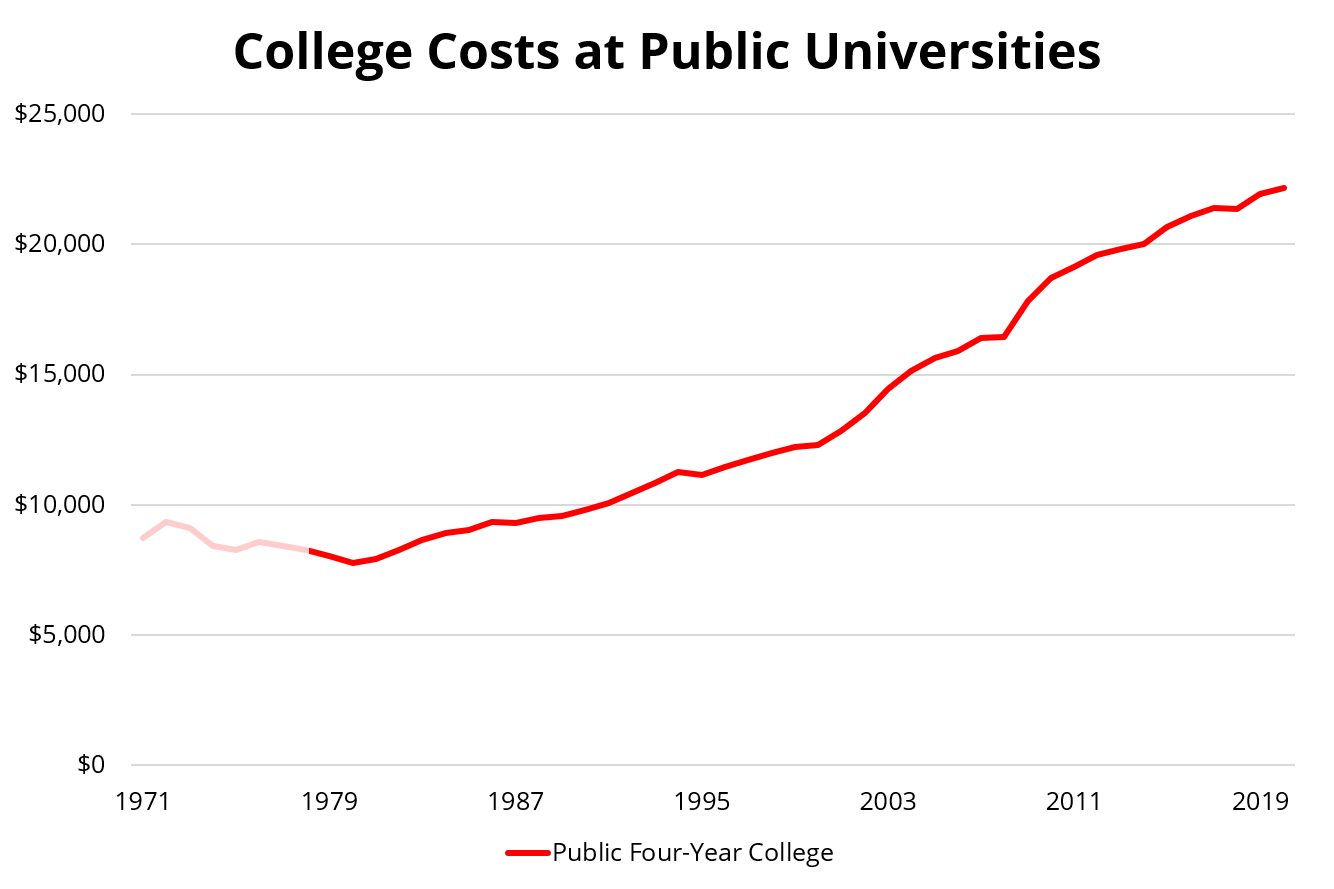

Despite the plethora of options available for high school graduates, including community college, trade school, and certifications, the vast majority still choose to go straight to a traditional four-year college. Degrees aren’t as affordable as they used to be; the cost of college for undergraduate students at public four-year universities has increased 169% since 1978, after adjusting for inflation. The average cost of attendance, inflation-adjusted to today’s dollars, was just $8,250 to attend school for the entire 1978-1979 academic year. That sum includes tuition, fees, and room and board. For the 2020-2021 academic year, the average cost of attendance was $22,180. For the typical American family, college is no longer affordable without loans or other financial aid.

Why have college costs gone up so much?

Up until the late 1970s, the cost of attending college was affordable and not increasing at a sharp rate. Someone in 1978 earning the federal minimum wage of $2.65 would need to work just 808 hours per year to pay for college (in 1978 dollars, the cost of college was $2,142 for an entire year). That is pretty doable for a student; they would need to work about 20 hours per week, and would even have money left over for food, going out, and everything else college students spend money on. In 2020, students earning the federal minimum wage of $7.25 would need to work 3,059 hours per year to pay for college, which is not doable. That equates to working about 59 hours per week if you work all 52 weeks in a year. If they are able to find a better-paying job, making $10 per hour, they would still need to work nearly 43 hours per week, every week of the year.†

Why has college gone from affordable with a part-time job to not affordable even if you work full-time or overtime while going to school? Back when college was much more affordable, financial aid programs were nearly nonexistent, and the majority of students did not receive any assistance from the federal government to pay for college. That changed with the Middle Income Student Assistance Act in 1978. More and more students became eligible for (and received) financial aid to pay for college, including Pell Grants and subsidized loans. While this legislation was well-intentioned, it came with many unintended consequences (as the old saying goes, no good deed goes unpunished).

Making financial aid available to more students did a few things. First, it increased the number of students who could afford college. This increased the demand for college, but the supply could not adjust quickly enough to meet the demand. Basic economics tells us this is the perfect recipe to create price increases, and oh how they have gone up! Students who couldn’t previously attend college weren’t the only ones affected; many students who were already planning to go to college (and could afford to pay for it out-of-pocket) suddenly became eligible for grants and subsidized loans. One of the unintended consequences of the 1978 bill was that universities started to charge more for college due to the short-term limited supply, but the long-term impact was that colleges realized that students could afford to pay more.

The resources (government grants and loans) that were to make college more affordable for middle class families actually worked against the goal and created a golden opportunity for colleges to use the legislation to charge more. Government aid does help some needy students, but it also helps students who can already afford college pay more. A report by the Federal Reserve Bank of New York found that for every new dollar of federal aid, tuition goes up by as much as 65 cents. It makes one wonder if the 1978 Middle Income Student Assistance Act wasn’t written by universities and colleges, as they benefited much more than middle income families.

As you can see below, college costs at public universities were steady in the 1970s, even decreasing slightly when adjusted for inflation. A few years after the 1978 bill passed, costs began increasing and haven’t looked back since. All values below are in today’s dollars, so if college costs were simply increasing at the same rate as inflation, the line below would be perfectly flat.

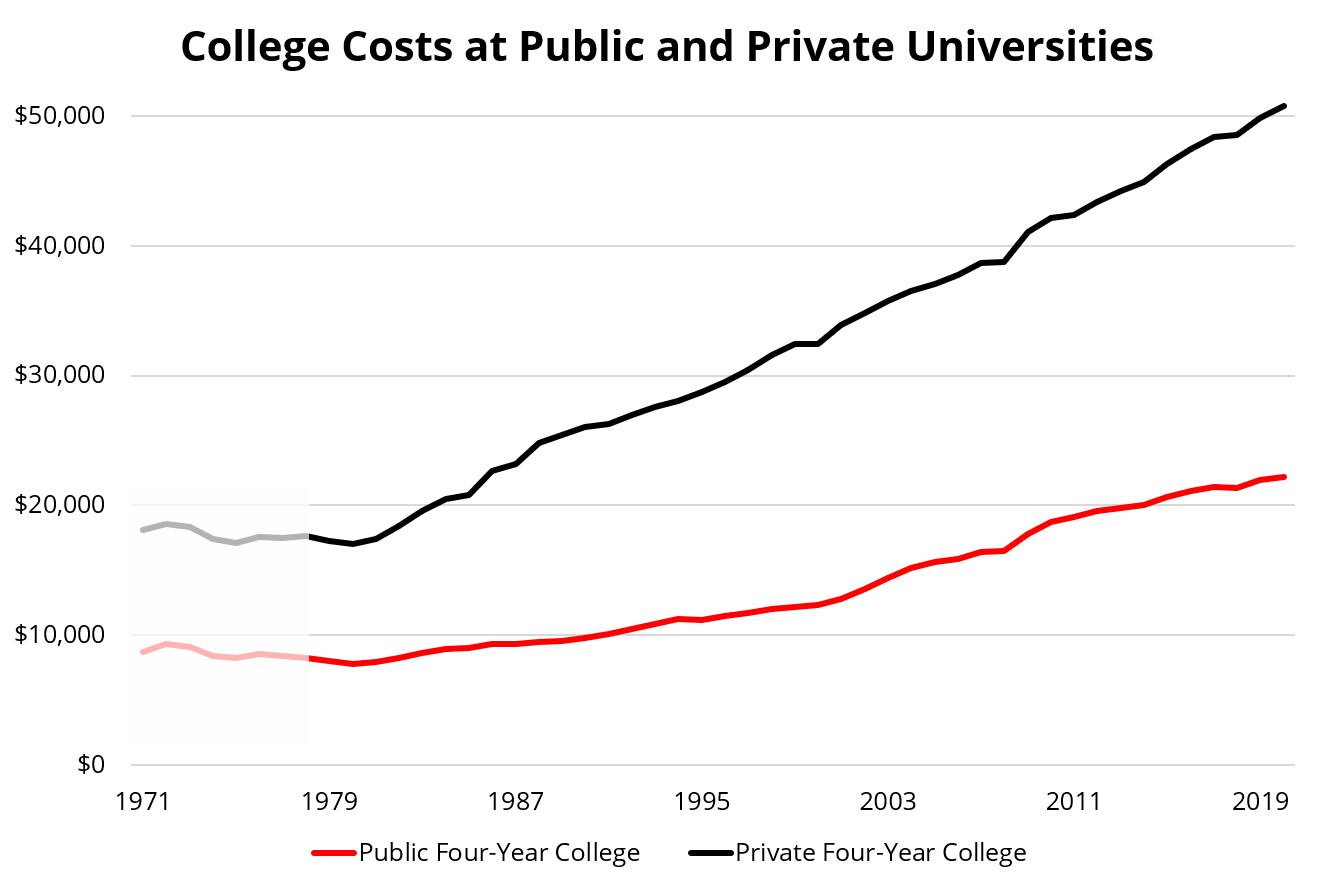

The increasing cost of college at four-year public universities seems modest only when compared to the increase seen at private schools. As shown below, private school costs have grown at an even more egregious rate. Students that attend private universities are eligible for the same federal aid (including grants and subsidized loans) as students attending public schools, and private colleges certainly seem to have taken advantage of the increased capacity of Americans to pay for college. Private colleges are more expensive partially because people believe the higher the cost, the better the education.

Is college worth it?

Although college costs have gone up exponentially over the past 40 years, it may still be “worth it” for some students, depending on what you are going to school for. Graduates with certain degrees, such as those in STEM-related fields (science, technology, engineering, and mathematics), have an easier time paying off student loans. If you want to be an engineer or accountant, yes, college is probably worth it, and your degree may not be too expensive if you attend a public school (or even better, a community college for at least the first few years). Your earning potential will be high, and you’ll likely have the capacity to pay off any student loans you may have accumulated while in school.

For many other potential college attendees, the cost of college can be difficult to justify. Some universities have started adding thousands of new majors, hoping niche degree programs will increase enrollment. Some are useful, like cybersecurity and data analytics. Someone graduating with a cybersecurity degree will likely increase their odds of getting hired into the field. Others, such as casino management and peace education, sound far less lucrative (well, less lucrative for graduates; they sound very lucrative for the colleges offering them).

If you are considering enrolling in a traditional university, the most important question that needs to be answered is if college is worth it financially. If you can estimate how much your degree will cost and how much it will increase your future earnings, you can answer this question. Let’s imagine someone must take out $50,000 in student loans to graduate, and their increased earning potential is $10,000 per year for the rest of their working life of 40 years. At 4% interest and a term of 20 years, their student loans will cost $72,718 total. If they are earning $10,000 more per year than they would have had they not gone to college, they will “break even” after 7 years in the workforce.

However, that is only part of the equation; let’s say in addition to the $50,000 in student loans over four years, you use $5,000 per year from your part-time job to cover the rest of your tuition, fees, and books. If you weren’t attending college, that money could instead be saved in a Roth IRA for retirement. Contributing $5,000 per year from ages 18 to 21, $20,000 total, would turn into $1,868,831 by age 65, growing at 10% per year. If you chose to go to college and wanted to make up for the lost $1.8 million, you would need to save $218 per month every month until age 65 (assuming the same 10% annual return). In other words, your increased earning potential would only be $7,383 per year instead of $10,000, and that’s not considering the 7 years it will take you to break even on your student loans.

College may be worth it if you are certain to make $10,000 more per year for the rest of your life, but the math isn’t normally so simple; not everyone that goes to college ends up making more money. Only 27% of college graduates are working in a field related to their major. Many of those who find work in fields unrelated to their major do not even need a college degree to do their job. In these cases, college was almost certainly not worth it. Others find themselves in jobs that require a college degree, but not a specific type. Almost everyone that attends college believes they will use their degree in their future career; if they didn’t, why bother attending college at all?

An ever increasing number of Americans waste tens of thousands, or even hundreds of thousands of dollars on an unnecessary college degree. Why? They’ve bought into the narrative that you need to go to college to be successful in life. Not only to make more money, but to appear smart and educated in the eyes of the world. College will help you become more educated and might increase your future salary, but a degree is certainly not a prerequisite for success. Some of our most successful entrepreneurs dropped out of college, including Bill Gates, Steve Jobs, and Mark Zuckerberg.

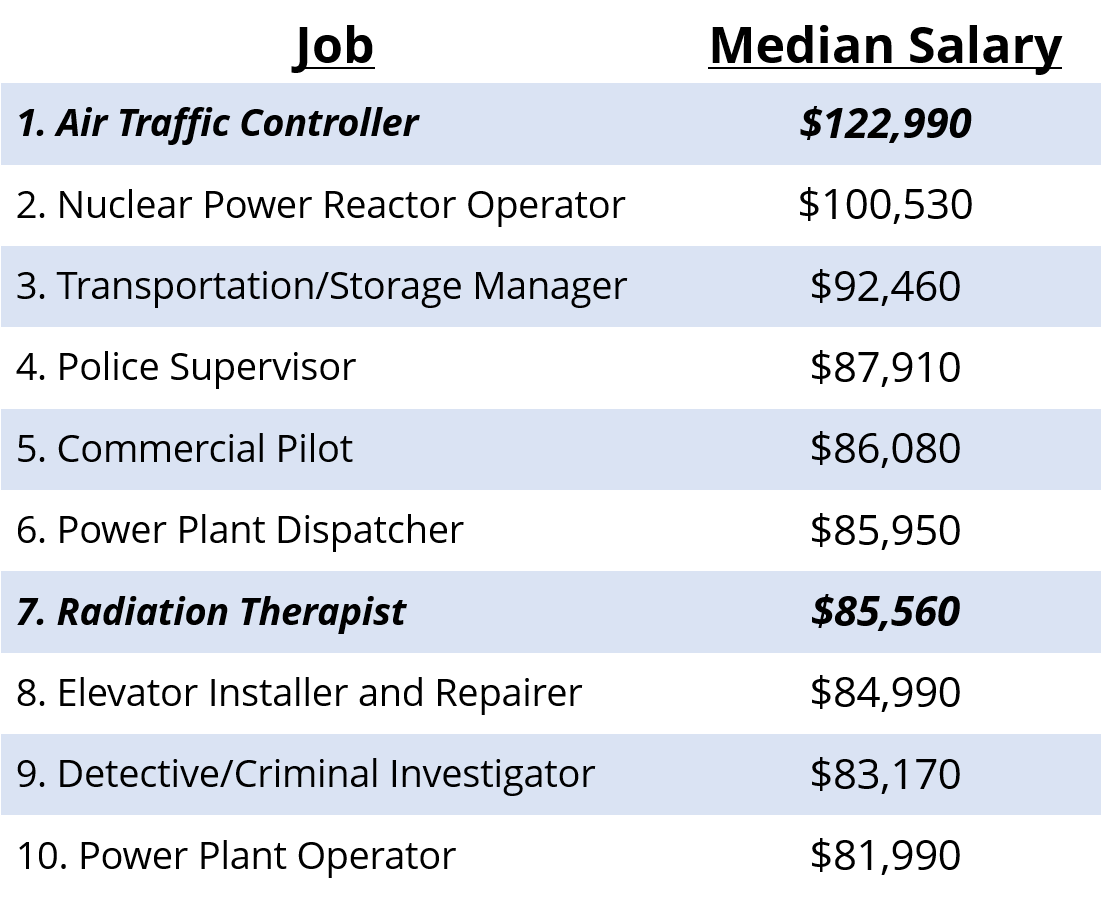

You might not be able to become the CEO of a big tech company, but you can learn a skill or trade that earns a high-paying wage. Below is a list of the top 10 highest-paying jobs that don’t require a four-year college degree, compiled from Bureau of Labor Statistics data.

In addition to the careers listed above, plumbers, electricians, mechanics, locksmiths, and software developers all earn a great income without needing a college degree. Trade school and community college costs a fraction of the price of traditional college. Google is now offering career certificates of their own, which cost just under $300 and take 6 months to complete. The company has said it will treat their career certificates as the equivalent of a four-year degree for related roles.

How do I know if college is right for me?

Attending college isn’t required to be successful, but it may still be right for you. If you plan to pursue a more traditional career, in fields such as accounting, science, or engineering, a degree from a major university may be required by potential employers. In the future, career education and training may be done more by the companies doing the hiring, like Google and other tech companies recently started doing, but for now getting a degree from a four-year college if you have your heart set on a more traditional career path. However, this doesn’t mean you need to go deep into debt to go to college.

How to do college right.

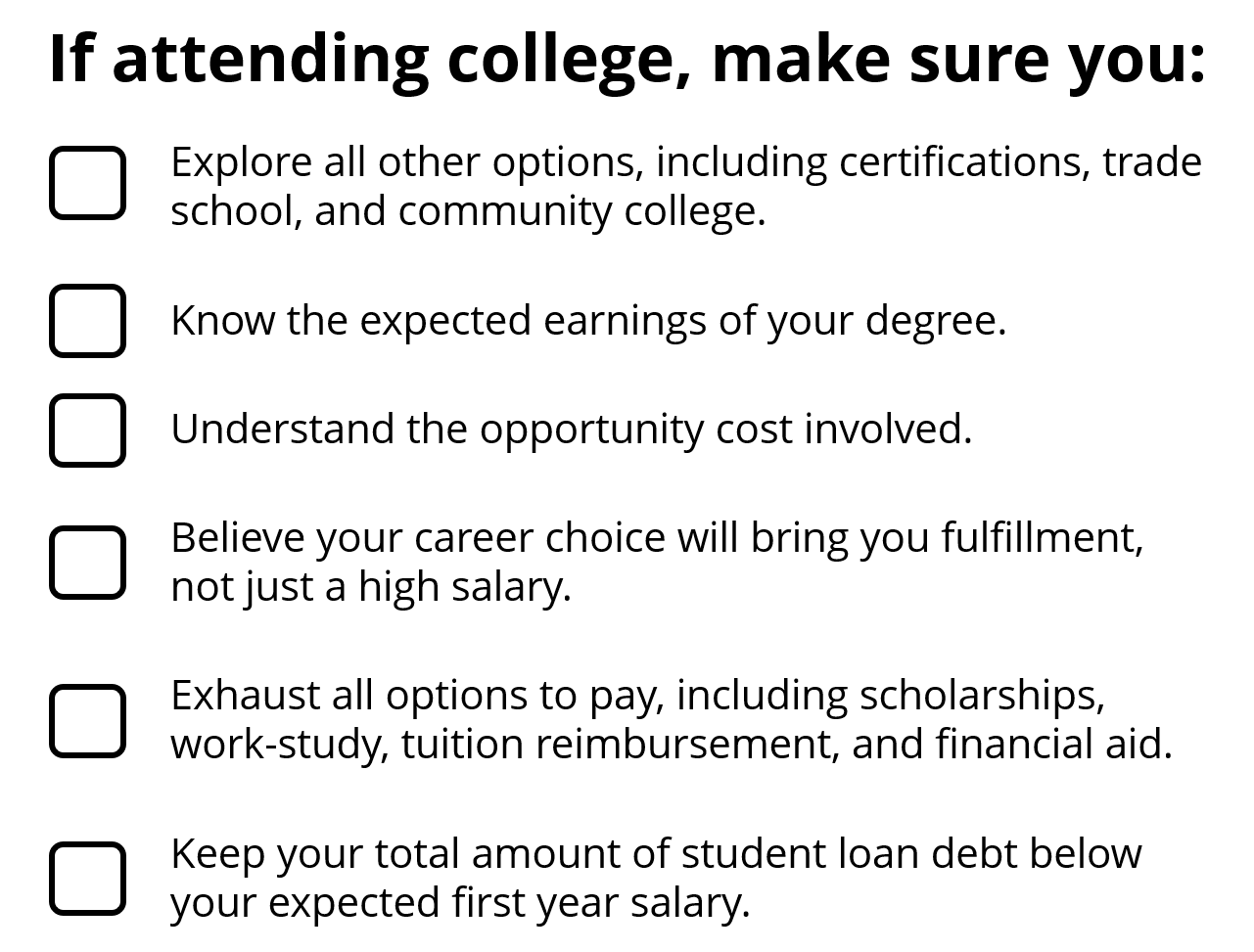

If you’ve decided you want to pursue a career that requires a college degree and it makes financial sense for you to go to college, there are a few things you can do to make your time in school cost-effective. In-state schools are much more affordable than out-of-state schools; it probably doesn’t make sense to pay out the wazoo to go to an out-of-state school when you can get an identical degree from your local college at half the price. Scholarships offered by states and colleges can help pay for the majority of the costs of attendance.

If you don’t qualify for scholarships, there are still other ways to make college affordable. Many companies offer tuition reimbursement for employees. Some of the big ones include Chipotle, Starbucks, and Home Depot, jobs which are very attainable for college students. I received tuition reimbursement through my former employer, Publix, which was and is a great place to work. (Not only for college students, but also for non-traditional career changers looking for an alternative way to pay for college.) Other jobs, typically on-campus, may qualify for federal work-study programs. If all else fails and you must resort to loans, keep your total student loan balance below your expected first year salary out of college.

Although you may only be able to obtain your preferred degree from a four-year university, that doesn’t mean you need to start there. Many students start at more affordable community colleges to get their core classes out of the way before moving on to bigger universities for their major-specific classes. I took a handful of classes online at a less expensive in-state university, although looking back I would have taken even more of my core classes at lower-cost alternatives. (Unfortunately I wasn’t listening to The Money Guy Show in high school, because if I was I may have considered starting at a two-year school instead of a major university.)

Certifications are available for a wide range of fields, probably wider than you think. The education you need to get the high-paying job of your dreams may only cost several hundred dollars instead of tens of thousands of dollars. Career selection is one of the most important decisions you will ever make. Your future earnings, job satisfaction, and overall happiness depend on picking the right career. Consider all of these factors, along with the cost of your degree, very carefully when deciding whether or not to go to college. If you decide that attending college makes sense for you, remember to keep your total amount of student loan debt below your expected first year salary. If you can’t do that, you may need to reconsider your major or decision to attend college. After all, there are plenty of brilliant, successful people with high-paying jobs that never went to college.

College is more expensive than ever, and enrollment is at record highs. Nearly 70% of high school graduates immediately enroll in college, yet only 27% of college graduates have a job related to their major. Millions of Americans are unnecessarily attending and paying for college because they believe it is a prerequisite for success. Don’t go to college for the sake of going to college; if you do choose to attend, use the checklist below to help make sure the cost (not just the financial cost, but the opportunity cost of spending 4+ years in college) is worth the reward.

†These calculations are simplified and do not account for income taxes or FICA taxes. Both students, in 1978 and present day, would have to work slightly more to pay for school to account for money lost to taxation.