How much is enough? 10%? 20%? 30%? Is it possible to save too much for retirement?

How much money should you be saving and investing for retirement? There’s no broad consensus. The general rule of thumb is to save and invest around 15% of your gross income; others, like us at The Money Guy Show, think you should work towards 25%. Academic research is also mixed. One recent paper found that you shouldn’t worry about saving for retirement until age 40 (we did a deeper dive into this study on a Q&A episode from a few months ago), while another thinks you should be saving 40% of your income.

Depending on who you listen to, you might be saving anywhere from 0% to 40% of your gross income for retirement (or more). There are many different factors that affect what you should or even can save for retirement, and not everyone needs to save the same amount. So, how much should you be saving for your financial goals? Consider the following six factors as you craft the right strategy for your specific situation.

1. Income

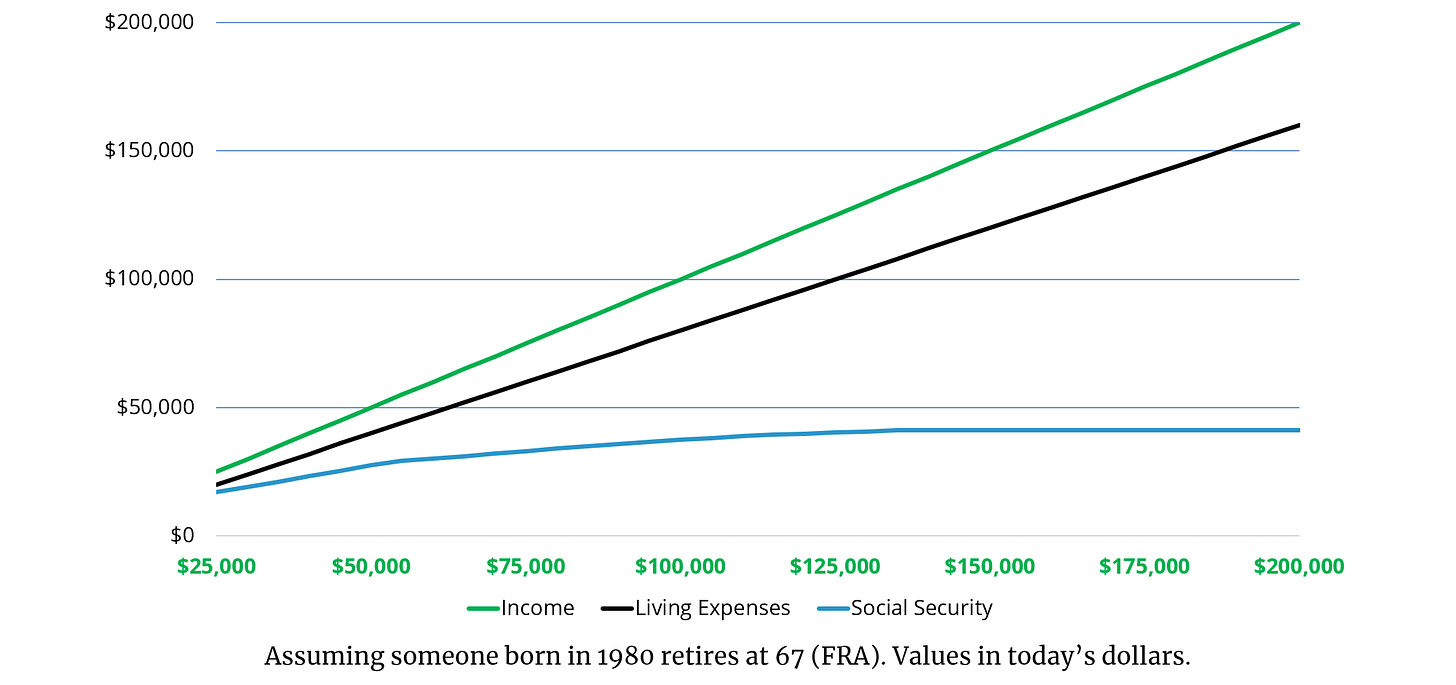

Those who make more money generally need to save and invest a higher percentage of their income; Social Security phases out for high income earners, and will cover less and less as your income increases. You can see this illustrated in the chart below.

For those making $25,000 per year, Social Security covers 85% of their living expenses in retirement (assuming living expenses in retirement are 80% of their pre-retirement income, and they were born in 1980, retiring at 67). Using the same assumptions, Social Security would only cover 26% of the living expenses in retirement for someone making $200,000 per year, continually decreasing as your income increases.

The burden of saving for your own retirement falls squarely on your shoulders if you have a high income. Maxing out your Roth IRA and 401(k) might not be enough – in 2021, the combined limit is $25,500 for those accounts, if you are under 50, and for someone making $200,000 that amounts to a savings rate of just 13%. A higher income before retirement likely means a higher income in retirement, which can also mean a higher tax burden. Medicare premiums might be higher, a portion of your Social Security could be taxed, and distributions from taxable and pre-tax accounts could be taxed at a higher rate than those with a lower income, which is why those that earn more need to save more.

Takeaway: The more money you make, the more you need to save for retirement. Middle and lower income individuals can save less, as a percentage of their gross income, because Social Security will cover a larger portion of their income and they will be taxed at a lower rate. If you have a higher income, save and invest more!

2. Retirement Age

It goes without saying, but the earlier you want to retire, the more you need to save. A normal retirement of around 30 years can handle a few bumps along the way. An extended retirement of, say, 50 years or more, needs to be able to absorb more than a few blows. If you want to be retired for longer not only will you need to save more, but you’ll need to be more flexible. This means you might need to work part-time to supplement your income, or take smaller distributions when your portfolio is down.

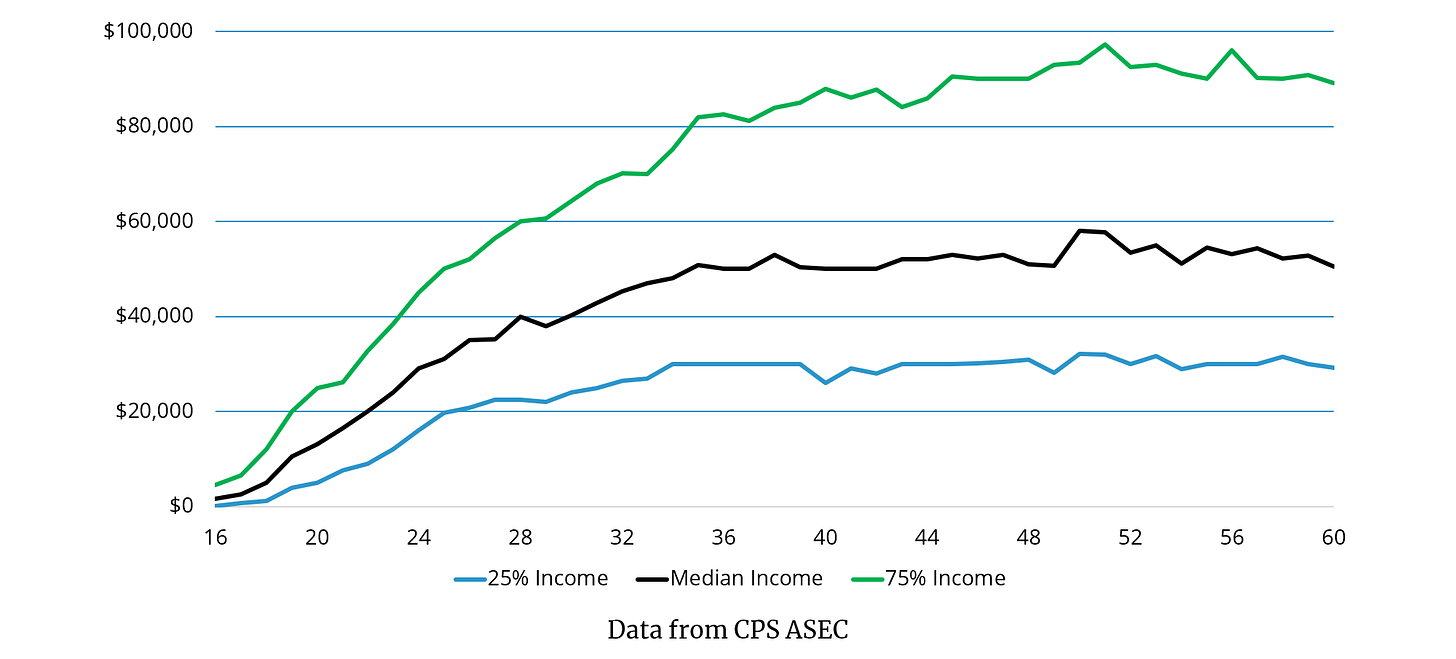

Retiring really early, like in your 20s or 30s, is unrealistic unless you come into a windfall (such as an inheritance) or earn an ultra-high income for several years (for example, the highest-paid athletes could retire in their 30s if they saved and invested well). Retiring early is more obtainable in your mid-40s to early 60s, although it won’t be easy. Aside from the amount you’ll need to save and the number of years your money will have to last (and storms it will need to weather), work provides many people with a sense of purpose. Retiring early could mean leaving some of your highest-earning years on the table; as you can see, median income doesn’t peak for high earners until your late 40s and early 50s.

If you do plan to retire early, make sure you dot every i and cross every t. You’ll need to start saving early and save more than your peers. For more content about retiring early, watch our latest FIRE (Financial Independence/Retire Early) show: “How to Retire Early By Age!”

Takeaway: If you plan to retire early, it is imperative you start saving and investing early and often.

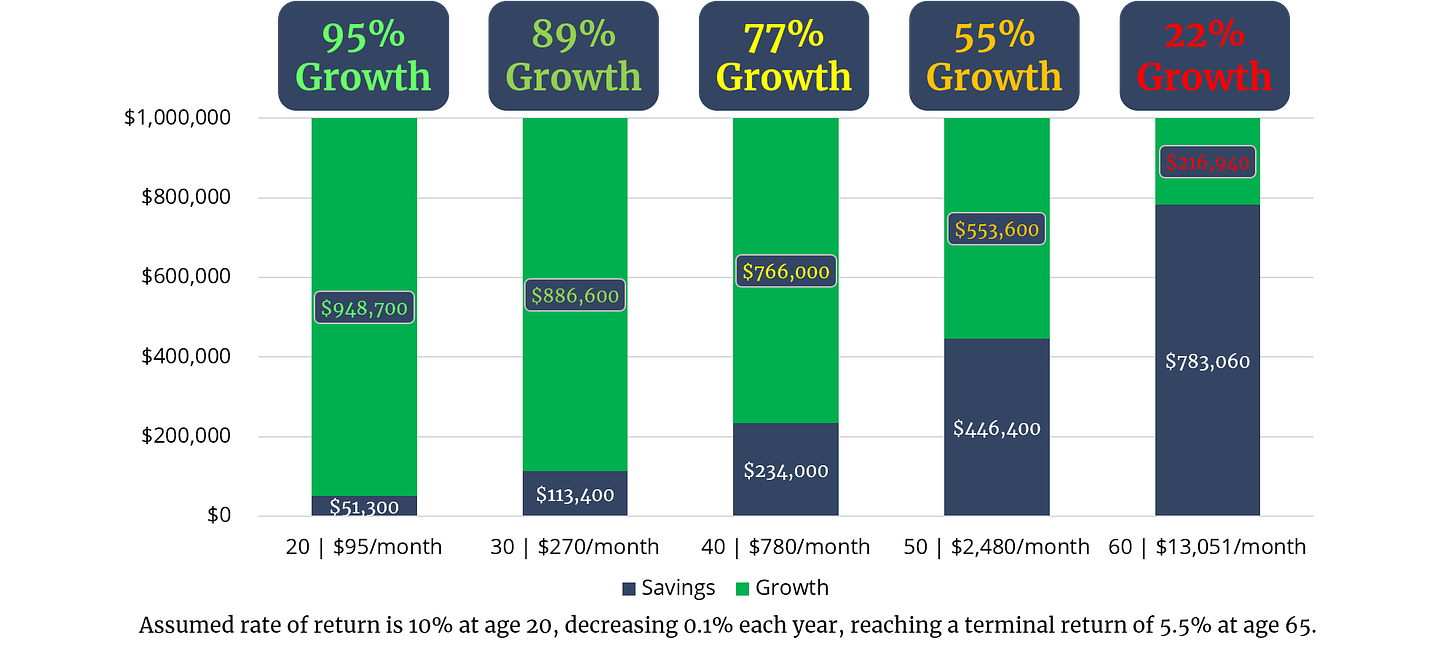

3. How early you start

The earlier you start saving, the less you need to save due to the magic of compounding interest. The chart below shows exactly how little a 20-year-old would need to save to become a millionaire: just $95 per month or $51,300 total over a 45-year working career. On the other hand, the later you start saving, the more you need to save. If you don’t start saving until your 40s, you will either have to retire later or save more than someone with a similar income that started saving in their 20s or 30s.

Takeaway: If you don’t start saving until later in life, you need to make up for lost time and save more than your peers.

4. Retirement goals

The goals you want to accomplish in retirement have a huge impact on your living expenses and how much you need to save. In retirement, you will be able to allocate your time as you wish: traveling, visiting family, learning new hobbies, and everything you never had a chance to do in your working years. All of your retirement goals will likely require money and need to be planned for.

Takeaway: Know what your dreams and goals are in retirement, and how much you will need to save to accomplish those dreams and goals.

5. Future expenses

Extra margin should be built into your retirement savings plan to account for the unexpected. The biggest variable expense in retirement for most will be medical expenses. A 65-year-old couple in good health can expect to spend almost $400,000 on medical expenses (including end-of-life care and assisted living) during their retirement, and the longer you live, the higher your expected costs. You may not know exactly how much to expect in future medical expenses, but family history can be an indicator. If your parents and grandparents all lived into their 90s, you probably need to plan for a long life and save more for preventative care and medical expenses.

In addition to medical expenses and end-of-life care, make sure to plan for funeral and burial expenses. The last thing anyone wants to do is leave their family with a large bill to pay for their funeral (check out these other common estate planning mistakes if you have the time).

Takeaway: Expect the unexpected, and start planning now for the unknowns. Your retirement portfolio should not be rigid, but built with enough flexibility to withstand a few storms.

6. Account structure

Not all dollars saved for retirement are equal. Money saved in tax-free accounts, such as a Roth IRA, allow qualified distributions to be completely tax-free. $1,000,000 in a Roth account will be $1,000,000 after taxes. This isn’t the case with other retirement savings vehicles; money saved in pre-tax accounts will be taxed at ordinary income tax rates upon distribution, so $1,000,000 in a traditional IRA could lose a third of its value and purchasing power to taxes.

Your account structure should play a role in determining how much you need to save for retirement. If you do have a substantial amount in pre-tax or taxable accounts, future tax changes and required distributions should also be accounted for. Taxes could change for you if you make more money in retirement than you were expecting, move to a different state, or if ordinary income and capital gains tax rates are changed.

Takeaway: Not all dollars saved and invested for retirement are equal. Planning around and for your account structure is critical to your retirement success.

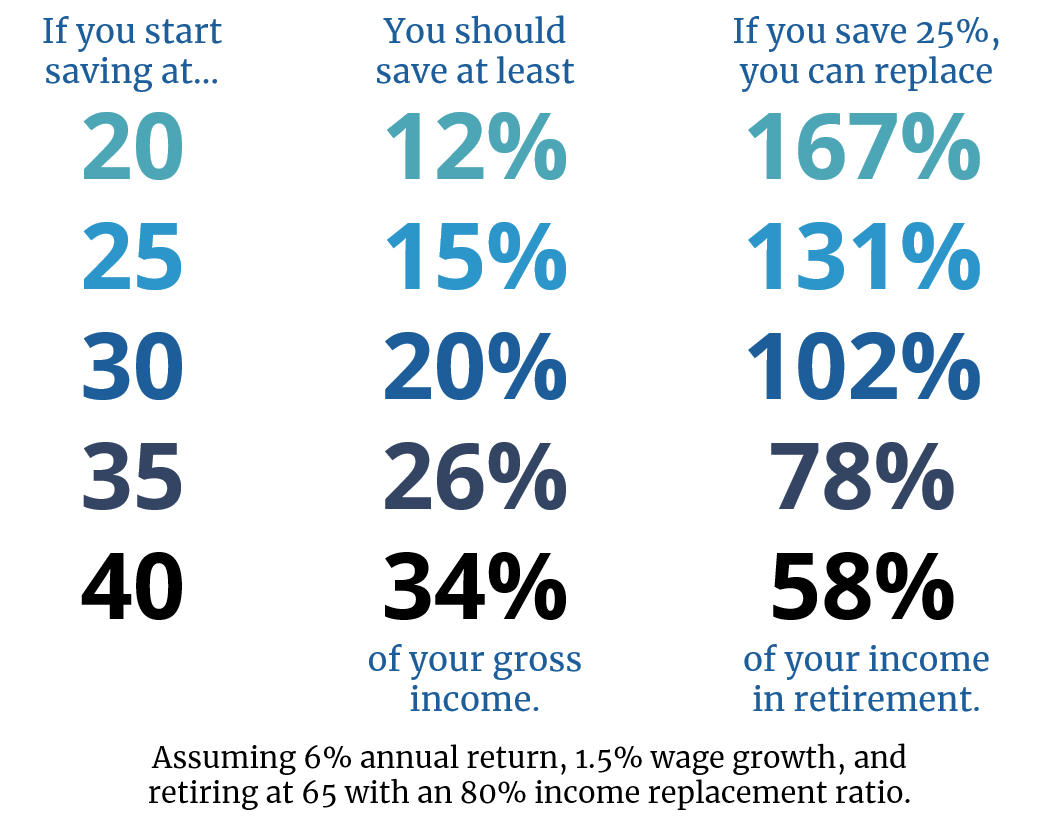

The math behind 25%

We think you should work towards saving 20% to 25% of your gross income for retirement as soon as possible. We also realize that younger savers in their 20s, who typically start out with lower incomes, may not be able to save the full 25% of their gross income. However, by age 30 you should be at the 20% to 25% mark. The chart below shows the math behind 25%, and why younger savers shouldn’t beat themselves up if they aren’t able to quite hit that 25% mark just yet.

If someone starts saving at age 25, they would need to save just 15% of their gross income to replace 80% of their income in retirement (assuming a 6% annual rate of return, 1.5% wage growth, and retiring at age 65). However, if you are able to reach the target 25% savings rate by age 25, you can replace 131% of your income in retirement. This leaves a substantial amount of margin for retirement and legacy goals, and a cushion for unexpected expenses. If you can reach a 25% savings rate by age 30, you will be on track to replace 102% of your income in retirement. Work towards saving 25% of your gross income for retirement as soon as possible, and the earlier you reach the target, the more flexibility you will have in retirement and even to potentially retire early.

How to save more

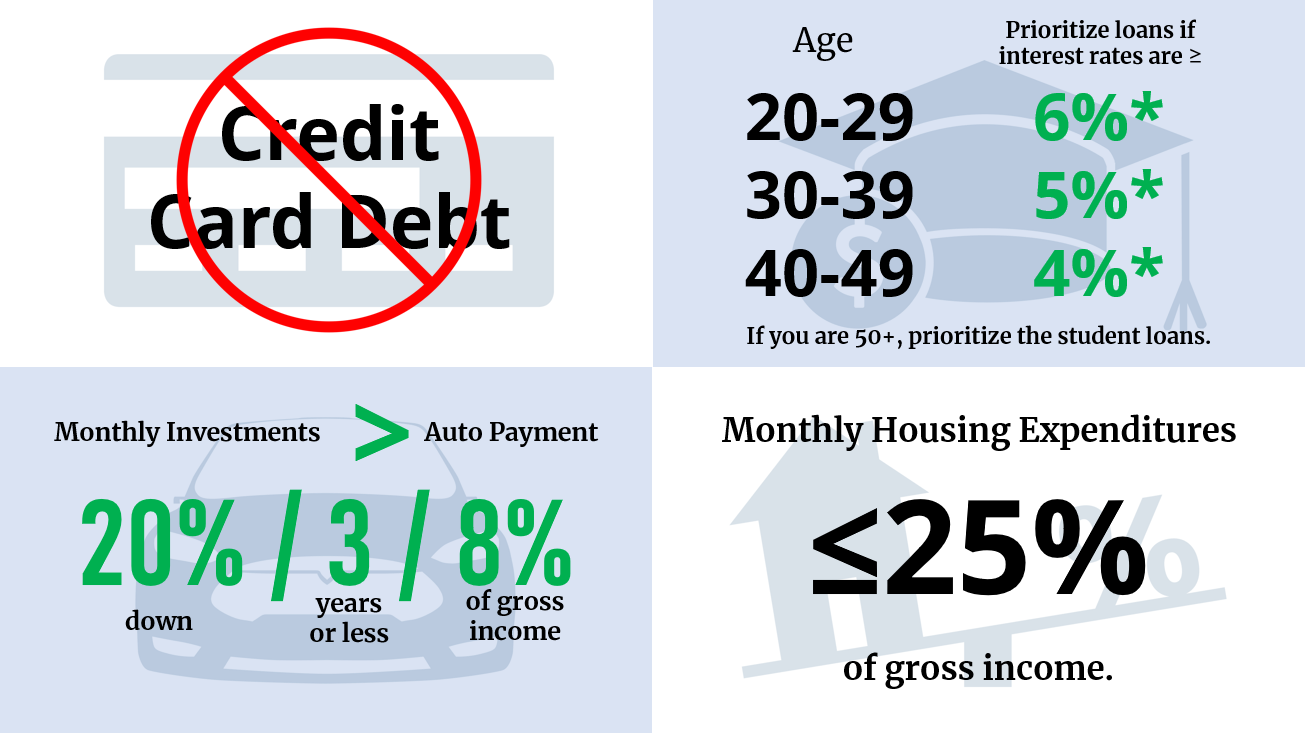

Saving for retirement is simple, but it isn’t easy – if it was easy, everyone would do it. The average American historically saves around 7% of their disposable income. That’s a far cry from 25% of gross income. Americans aren’t able to save because they have over $5,000 in credit card debt, take nearly six years to repay their car loans (not to mention that one in three are underwater on their vehicle), and spend nearly 40% of their income on housing. If you have trouble saving for retirement, make sure you are following our Money Guy guidelines below: 1) Credit card debt should not exist; 2) Know when to prioritize student loan debt; 3) Follow 20/3/8 when buying a vehicle; and 4) Keep your monthly housing expenditures, including interest, taxes, insurance, utilities, maintenance, and repairs, below 25% of your gross income.

In addition to our guidelines for debt, we have a few rules for saving money as well. Pay yourself first by saving off the top instead of just whatever is leftover every month. You can’t pay for food or housing or any other expenses with whatever amount of money you have left at the end of the month, and saving for retirement should be no different. Prioritize retirement account contributions like you would any other expense. Practice forced scarcity by increasing your savings rate every time you get a pay raise at work; not only will this improve your savings rate, practicing forced scarcity also helps keep lifestyle creep at bay. Implementing the Money Guy rules for debt and saving will get you closer and closer to saving 25% of your income and to a long, happy, successful retirement.