When enrolling at college and choosing your major, it’s not always apparent which careers will offer the highest earning potential, job satisfaction, and career opportunities. Often it seems like appealing degrees offer less earning potential and career satisfaction than more difficult, less appealing programs. In-state tuition and fees at public universities has risen 175% over the last 20 years and total student debt has ballooned to $1.75 trillion, which means choosing the right college degree is more important than ever.

Beyond the ability to boast about the job prospects of their graduates, colleges don’t necessarily have a financial interest in ensuring graduates become successful after leaving school. No matter whether you choose a major with a poor success rate after graduation or a very high success rate, the college will make the same in tuition and fees.

Graduates of degree programs looking for jobs are able to offer a more unbiased perspective into the actual value of their major. Any rose-tinted glasses have likely worn off by the time graduates are deep into their job search after earning their degree. Which degrees do they end up regretting the most?

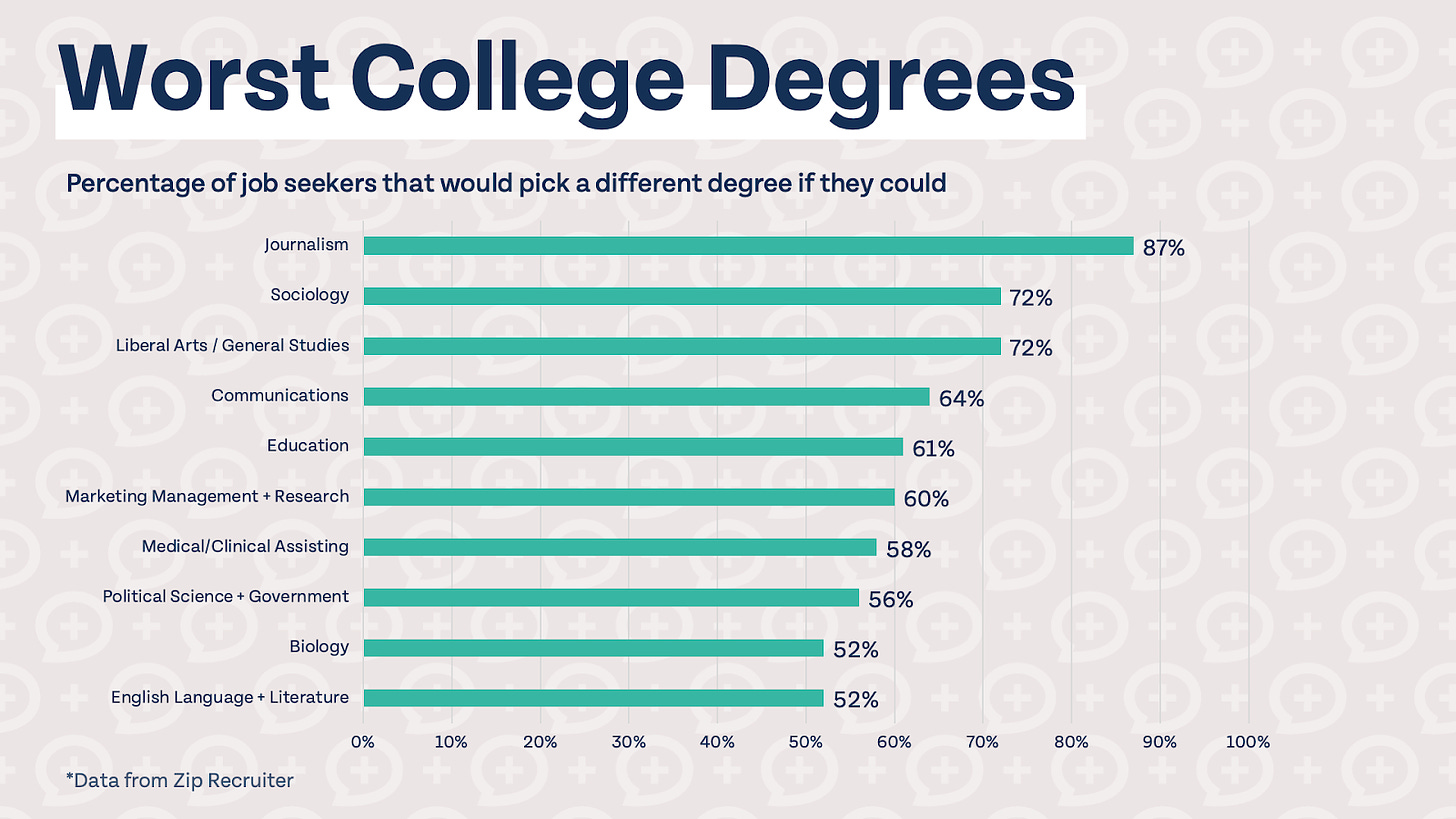

Worst College Degrees

A survey of recent graduates seeking a job asked them how many would pick a different major if they could, and the following chart shows the most regretted college majors.

As someone with a degree in one of, sorry, the most-regretted college majors, I feel like my decision to stay in school to complete a financial planning degree (spoiler alert, finance made the list of best college degrees) was absolutely the right decision. Still, I wonder if my college experience would have differed if I knew this statistic before deciding on a major. I chose the field of journalism because I had a strong interest in writing and wanted to develop my skills and eventually make a living writing. I was generally aware of the competitiveness of jobs and lower starting salaries, but it didn’t become a reality for me until I was close to graduating.

The focus in many degree programs, or mine at least, was making students the best possible _______ they can be, whether that blank is doctor, lawyer, journalist, artist, philosopher, or engineer. College is a place where you should be able to explore your interests and find a career path that makes you happy, but an emphasis should also be placed on choosing a degree program that is in demand and pays well (and “pays well” may be defined differently from person-to-person; you need to consider not only starting pay, but long-term career trajectory and the potential for growth). Unfortunately, the high percentage of graduates saying they would choose a different major if they could do it all over again indicates they are not happy with their career opportunities and/or salary potential.

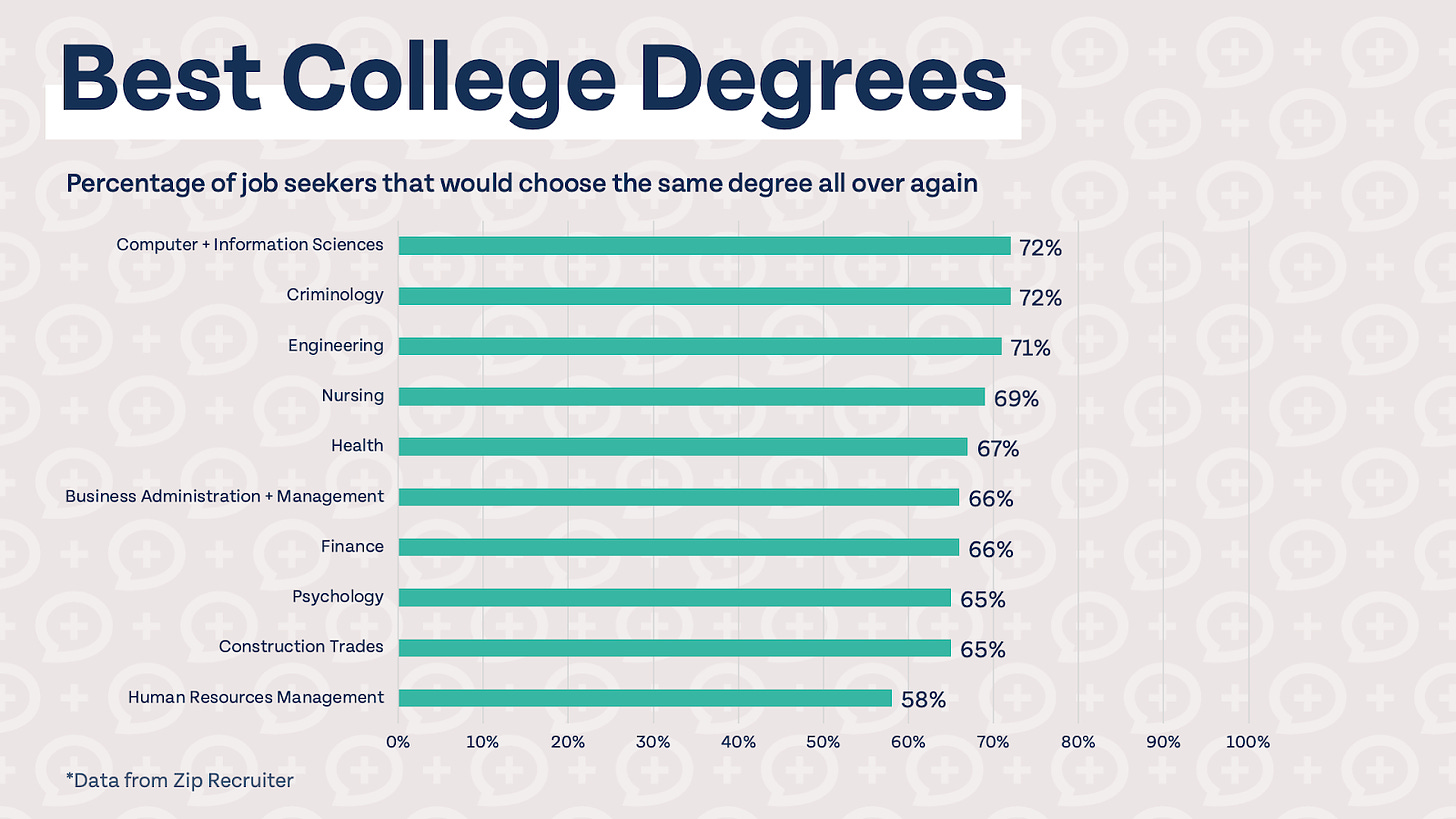

Best College Degrees

The best college degrees, based on the percentage of job seekers that said they would choose the same program again, isn’t too surprising.

Degrees in computer science, engineering, nursing, and finance are among the highest-paying, so it makes sense that graduates with degrees in those fields of study would do it all over again if they had the option.

The reality of what a degree choice really means may not hit students until after graduation, when they begin to rely on their choice of degree to support themselves. It’s easy to overlook a bad decision when your choice of major doesn’t yet have any noticeable financial impacts on your life. If you have yet to choose a major, or decide if you are even going to attend college, make sure you weigh the earning potential and career satisfaction of any potential degrees.

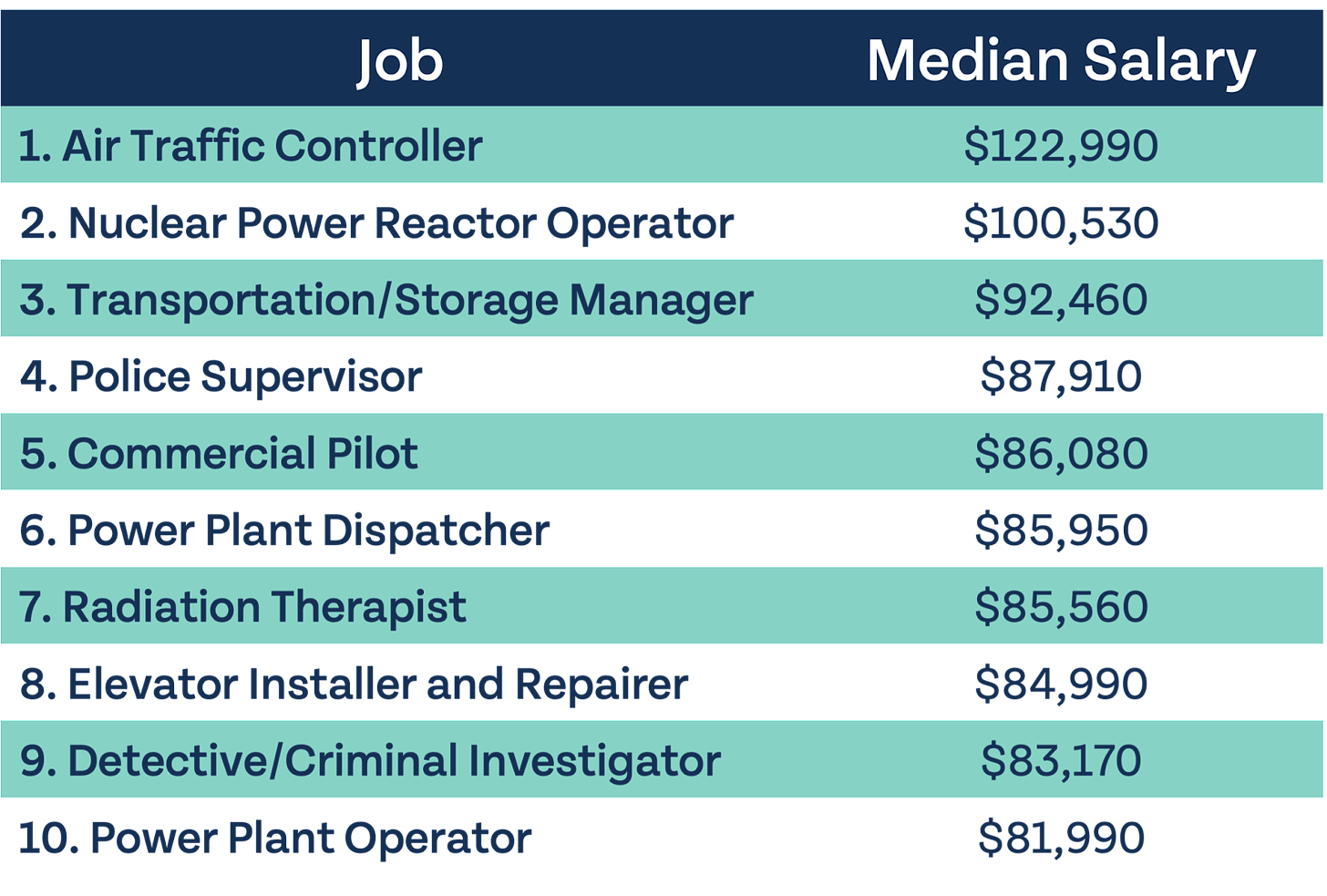

If you graduated with a degree you now regret, making a career change is always possible and doesn’t have to be extremely costly. The table below shows some of the highest-paying jobs that require no college degree; all but two require just a high school diploma (air traffic controllers and radiation therapists must obtain an associate’s degree).

Trade schools or community college costs a fraction of the price of traditional college, and can be an option for both high school graduates or those further into their careers that are looking for a change.

Choosing a degree program can be overwhelming, but knowing what the earning potential and career satisfaction is of potential choices can help you narrow down your options. Begin with the end in mind: before you are even close to choosing a major, have an idea of what’s important to you when it comes to your future career. Even if you’ve graduated with a major you regret, it is never too late to change careers.