Last Updated

December 3, 2025

Read Time

Share

There’s a reason why Albert Einstein called compounding interest the eighth wonder of the world. The magic of investing over long periods of time can be difficult to understand, but our Money Guy Wealth Multiplier breaks it down for everyone, regardless of age.

Learn exactly how much each dollar could turn into by age 65 and how much you need to invest to become a millionaire.

Your Wealth Multiplier begins as soon as you start investing money – or anyone starts investing on your behalf. The earlier you start investing, the harder your dollars can work.

Your money does not stop growing when you retire, either: you may be invested in more conservative assets, but the magic of compounding interest never stops. The Money Guy Wealth Multiplier concept is truly a lifelong financial concept.

Learn everything you need to know about investing, including how to start, what to invest in, and when to prioritize paying off debt, at our Money Guy investing guide.

Key Takeaways

Copy link to this section: Key Takeaways

Copied the URL to your clipboard!

- Learn what every invested dollar could turn into by age 65.

- Understand how much you need to invest every month to become a millionaire.

- Know why it’s so important to start investing as early as possible.

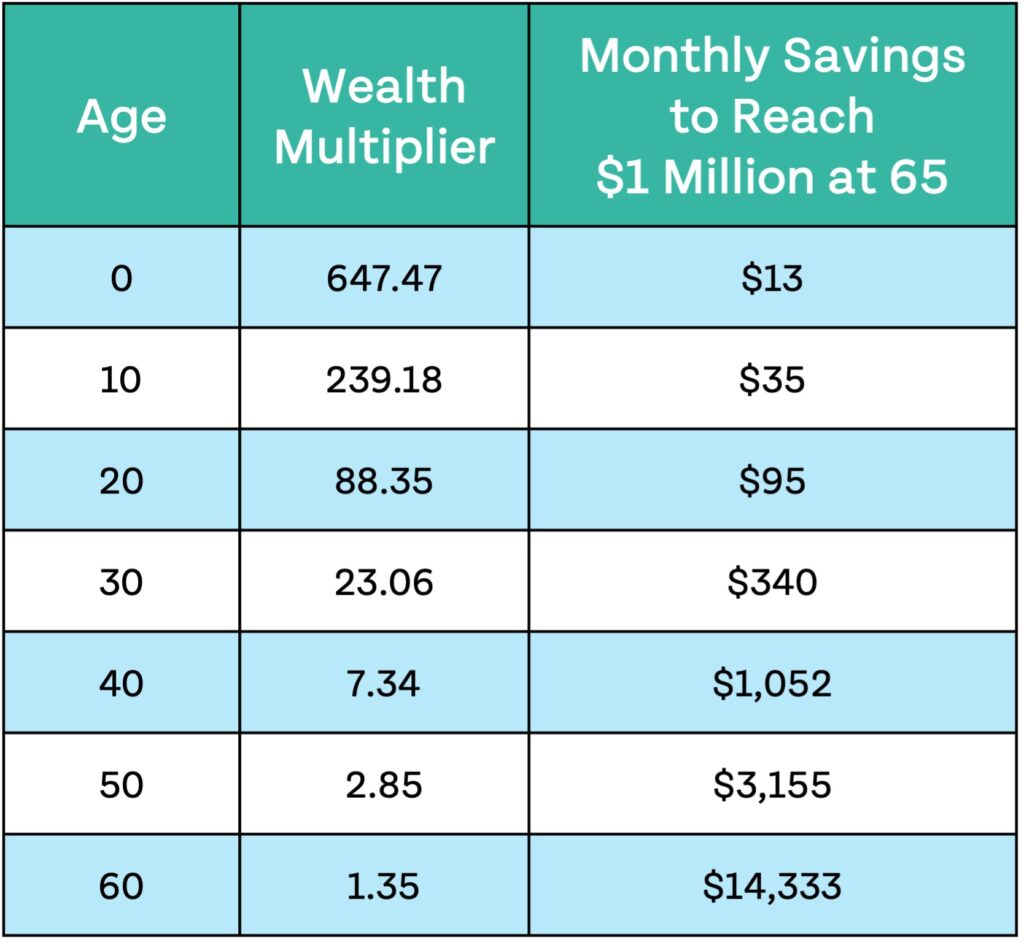

At age 20, you would need to invest just $95 per month to reach millionaire status by age 65.

How much do you need to be investing each month? Download our Money Guy Wealth Multiplier now to see exactly how powerful your dollars are at ages 0 to 65 and how much you need to invest every month to reach millionaire status.

Wealth Multiplier Background

Copy link to this section: Wealth Multiplier Background

Copied the URL to your clipboard!

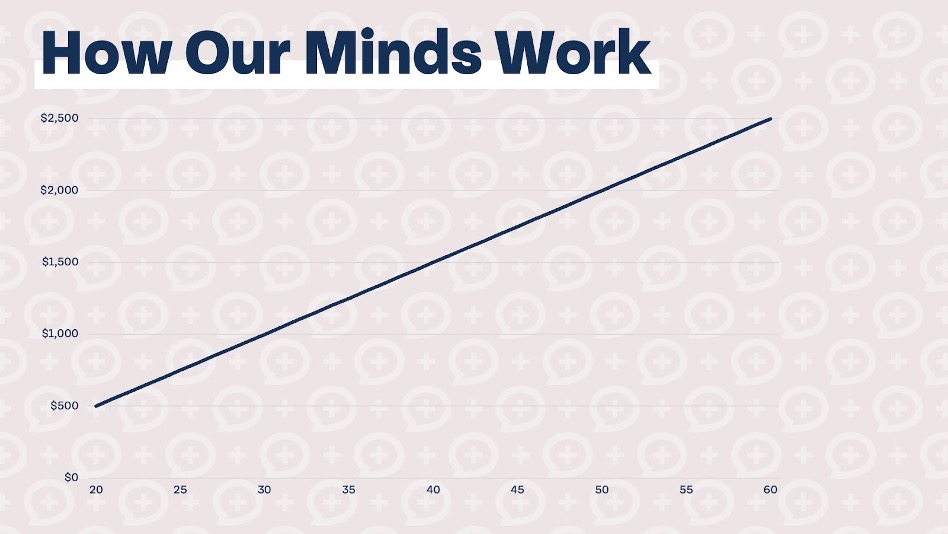

Understanding the magic of compounding interest isn’t easy. The chart below shows how we think about our money growing over time.

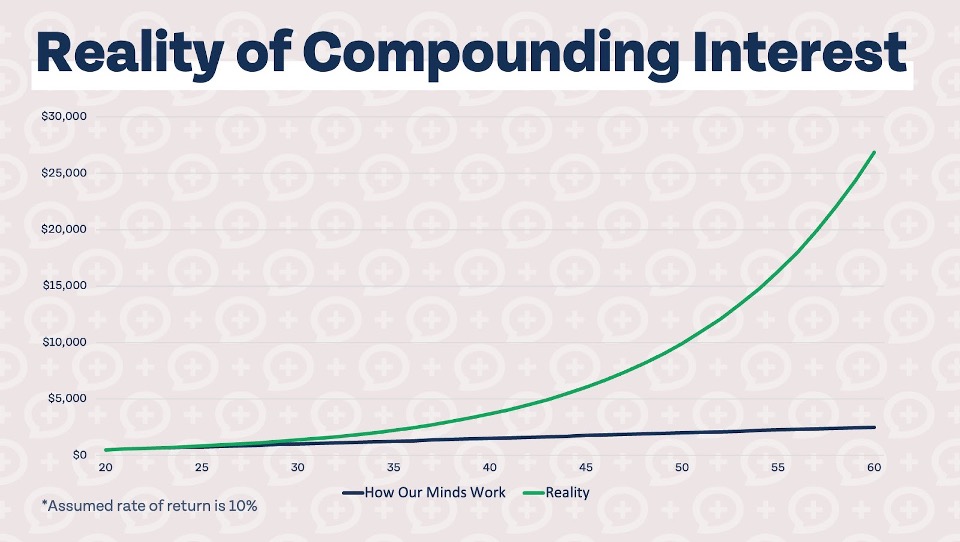

If you start with $500 at age 20, you might have $1,000 by age 30, $1,500 by age 40, $2,000 by 50, and $2,500 by age 60. Turning $500 into $2,500 sounds pretty great! But the reality of compounding interest is much more exciting.

Compounding interest takes time – if you notice, at age 30 the two lines are in about the same spot. However, by age 60 your $500 investment would turn into $26,850 growing at 10% (over 10x as much as the money that linearly grew).

There are many different ways to explain compounding interest, but we felt we needed to create a simple, easy to understand model that at the same time doesn’t downplay the magic of compounding growth.

Our Money Guy Wealth Multiplier concept combines both simplicity of money growing and the power of compounding interest.

The concept of compounding interest did not originate with The Money Guy Show. In fact, it can be dated back as early as 2,000 BC when Babylonians referenced “interest on interest.”

Compounding interest can be dangerous when used against us, such as with high-interest credit card debt, but can be extremely powerful when in the form of investing.

What is the Wealth Multiplier Formula?

Copy link to this section: What is the Wealth Multiplier Formula?

Copied the URL to your clipboard!

Our Wealth Multiplier formula calculates how much every dollar you invest can grow, depending on what age it is invested. While returns do change when investing at different ages (for example, 10% at 20, 9% at 30, and 8% at 40), if one dollar is invested at age 20, it is assumed that it will earn 10% from age 20 to 65.

You can easily calculate your Wealth Multiplier for yourself; this might be handy when you don’t have our free resource handy or want to determine what a specific amount can become by a certain age.

To start, you’ll need a TVM (time value of money) calculator or use a free online calculator such as this one. You may see this type of calculator also being called a wealth calculator.

There are some important assumptions we make when calculating your Wealth Multiplier. While returns are stated annually, they are calculated on a monthly basis.

Here’s how it breaks down:

- Starting Value: $1

- Period: 540 months (45 years)

- Rate of Return: 0.833% (10% annualized)

- Ending Value: $88.35

Our Wealth Multiplier shows what invested dollars could become by age 65, based on historical returns of the S&P 500 (which has annualized over 11% since 1950). However, it does not account for variables such as inflation and taxes. Since 1950, inflation has averaged 3.54% annually.

The taxes your dollars are subject to will depend on what account you invest in and how much money you make. If you invest in tax-free accounts or in a taxable account with a lower income, you may have no tax liability when taking distributions.

If you save in pre-tax accounts and have a high income, you might have a relatively large tax liability.

What’s the Between Wealth Multiplier, Money Multiplier, Great Wealth Multiplier, and Equity Multiplier?

Copy link to this section: What’s the Between Wealth Multiplier, Money Multiplier, Great Wealth Multiplier, and Equity Multiplier?

Copied the URL to your clipboard!

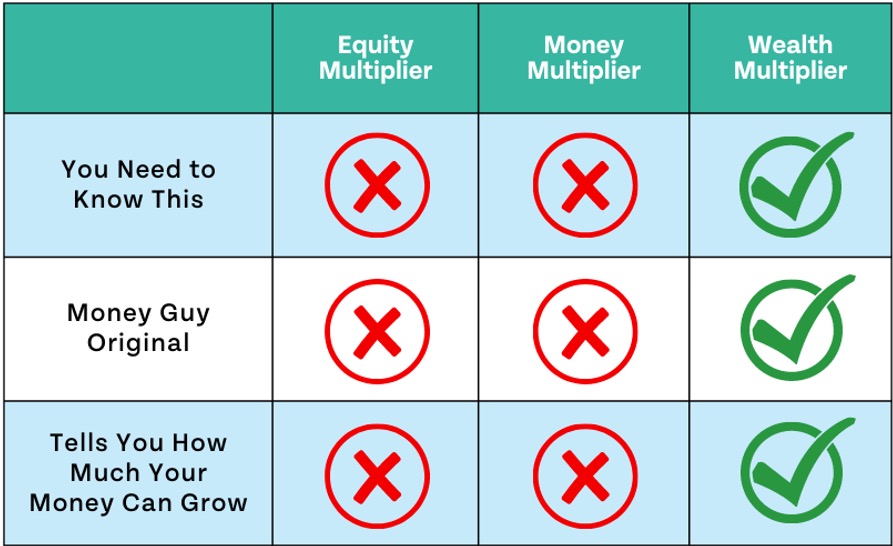

Both money multiplier and equity multiplier are technical financial terms with different meanings from our Wealth Multiplier. Only our Wealth Multiplier shows what every dollar you invest could turn into by age 65.

The term “money multiplier” is most commonly used in economics to describe the relationship between money at commercial banks and at central banks. Confused? Don’t worry! The money multiplier concept is a broader economic term and plays no role in your personal finances.

“Equity multiplier” is a ratio used in finance to measure a company’s financial leverage. If you are interested in analyzing companies and stocks you may need to know more about the equity multiplier concept, but it is unrelated to the Wealth Multiplier concept.

Still confused? Check out the comparison on the table below!

Frequently Asked Questions (FAQ) About the Wealth Multiplier

Copy link to this section: Frequently Asked Questions (FAQ) About the Wealth Multiplier

Copied the URL to your clipboard!

How accurate are the assumptions made about investment returns?

The Wealth Multiplier for ages 0-20 is based on historical returns of the S&P 500, which has averaged over 11% since 1950. Lifetime returns decrease by 0.1% for each year after 20, reaching a terminal return of 5.5% at age 65.

This decrease in returns reflects a more diversified portfolio including risk-off assets such as bonds. The Money Guy Wealth Multiplier is for educational purposes only and historical market performance does not guarantee future results.

Can I use the Wealth Multiplier for shorter or longer investment periods?

The Money Guy Wealth Multiplier is designed to show what your invested dollars could turn into by age 65. If you are curious what your dollars could turn into over a different period of time, try using a free, online time value of money calculator or a more advanced tool such as our Know Your Number Money Guy course.

Should I adjust the formula for retirement planning at different ages?

The primary purpose of the Wealth Multiplier is to get investors (or potential investors) excited about saving by showing what their dollars can become. It is not intended as a retirement planning tool or a replacement for professional financial advice.

Please utilize tools such as our Money Guy Know Your Number course and fee-only, fiduciary financial advisory services for your retirement planning needs.

What are the risks associated with long-term investing and how can I mitigate them?

The Wealth Multiplier assumes a flat percentage return every single year, which is simply not realistic. Instead of consistent 10% per-year returns, you may instead experience a gain of 40%, loss of 20%, gain of 0%, then a gain of 25%.

It is not uncommon for investment returns to vary wildly from year-to-year. However, over the long-term, the return of the stock market has consistently averaged around 10%.

Latest Updates to the Wealth Multiplier Formula

Copy link to this section: Latest Updates to the Wealth Multiplier Formula

Copied the URL to your clipboard!

We recently updated our Money Guy Wealth Multiplier to include all ages from 0-65. We know that many parents and grandparents invest on their children’s behalf, and seeing exactly what those dollars could turn into by retirement provides encouragement and motivation to invest even more.

In addition to seeing how much you need to invest to become a millionaire, for ages 0-35 you can now see how much to invest to reach $2 million by age 65.

Here’s what changed:

- Added Wealth Multiplier data for ages 0-19

- Added monthly investing required to reach $2 million for ages 0-35

Wealth Multiplier Myths & Misconceptions

Copy link to this section: Wealth Multiplier Myths & Misconceptions

Copied the URL to your clipboard!

The Money Guy Wealth Multiplier is based on historical returns of the S&P 500, going down as someone ages to reflect a more diversified portfolio over time. It is one method of projecting the future value of your dollars, but does not reflect every possibility.

Returns of the stock market and S&P 500 can vary wildly from year-to-year. At times it may even seem that returns are random and investing is gambling, but that is not the case. Over the long-term, broad market indexes such as the S&P 500 have historically returned around 10%.

We believe you should keep a long-term mindset and not get caught up in short-term fluctuations of the stock market.

Some believe that the popularity of index funds could create an index fund bubble. While index funds have become extremely popular, there will always be active managers and active investors aiming to beat the market.

The data shows that index funds consistently outperform active management over longer periods of time.

Practical Steps for Using the Wealth Multiplier Formula

Copy link to this section: Practical Steps for Using the Wealth Multiplier Formula

Copied the URL to your clipboard!

If you’ve already taken the time to review our Money Guy Wealth Multiplier, you probably understand how important it is to start investing as early as possible. The Wealth Multiplier at age 0 is a whopping $647! By age 20, it is still $88.

When you turn 40, your Wealth Multiplier drops to $7. While it’s important to start investing as soon as possible, a Wealth Multiplier of 7 is still extremely powerful.

While investing is one of the most important actions you can take to set yourself up for financial success, there may be greater priorities depending on where you are in the Financial Order of Operations.

Covering your highest insurance deductible, paying off all high-interest debt, and building a full emergency fund all come before investing (with the exception of getting your employer match, which is after covering your highest insurance deductible).

Don’t get discouraged if your Wealth Multiplier isn’t as high as you’d like it to be.

Remember, our values only go to age 65 – but many of your dollars will likely stay invested long after you retire! For example, someone who is age 40 would normally have a Wealth Multiplier of 7. But on dollars invested in equity assets from age 40 to, say, 85, their Wealth Multiplier could be 88!

So what if your money has the potential to grow 88x over if invested at 20. How do you even invest it? We suggest following our Financial Order of Operations and investing depending on what stage you are at. Here’s the Financial Order of Operations for investing:

- Get Your Employer Match

- Maximize your Roth IRA and/or HSA

- Maximize your employer-sponsored plan

- Contribute to a taxable account

Wealth Multiplier for Young Savers: A Primer (Share this with Your Kids!)

Copy link to this section: Wealth Multiplier for Young Savers: A Primer (Share this with Your Kids!)

Copied the URL to your clipboard!

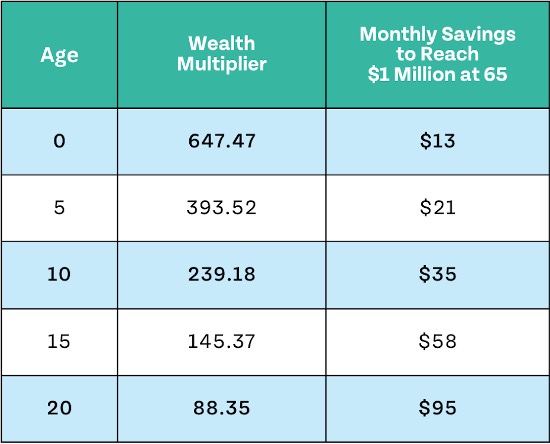

Not everyone starts investing early in life, but this is when your dollars are the most powerful. Check out the table below to see the Wealth Multiplier values and monthly investing needed to reach $1 million for ages 0 to 20.

In one’s early years, it will most likely be parents or grandparents investing on the child’s behalf. Accounts such as Roth IRAs are only available for those with earned income, but custodial brokerage accounts and 529 plans can harness the power of compounding growth for younger children.

Check out the episode of The Money Guy Show below for our breakdown on how anyone can become a young money millionaire!

Wealth Multiplier for Early Career Savers (20 to 30)

Copy link to this section: Wealth Multiplier for Early Career Savers (20 to 30)

Copied the URL to your clipboard!

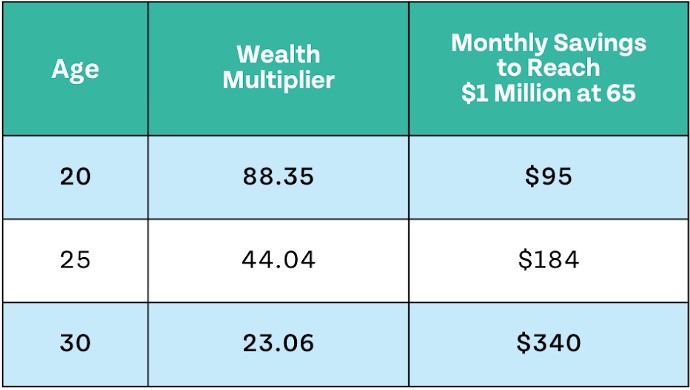

Investing early in your career can be difficult since your income may be lower and expenses high, but every dollar invested has enormous potential when grown to age 65. How much do you need to invest to reach millionaire status by 65? Check out the chart below.

If you’ve been a fan of the show for a while, you’ve probably heard stories of how cheaply Bo lived in his 20s. He infamously lived on buy one, get one free cereal and preferred bundling up rather than adjusting the thermostat.

You probably don’t need to be as cheap as Bo was, but anything you can do in your 20s to create a little extra margin to invest will go a long way as you get older.

Wondering how you stack up to your peers? In the clip below, we break down the average net worth for someone in their 20s.

Wealth Multiplier for Middle Career Families (30 to 50)

Copy link to this section: Wealth Multiplier for Middle Career Families (30 to 50)

Copied the URL to your clipboard!

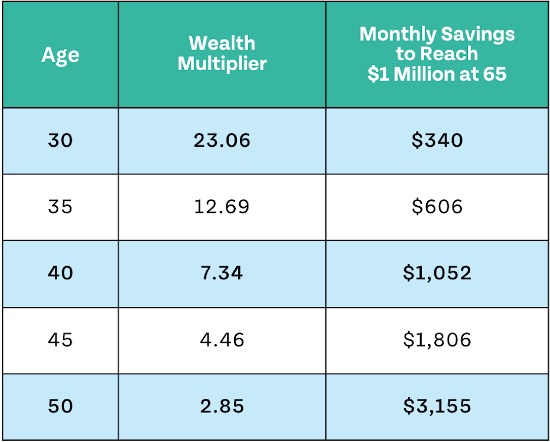

In your 30s and 40s, you might be feeling squeezed by life’s obligations. However, you may also be advancing in your career and earning more money, which can allow you to invest more money for retirement.

The average age Americans have their first child and buy their first home is in the 30s. The financial obligations of providing for a growing family can be tremendous, but it is important not to neglect investing for your future.

While your Wealth Multiplier isn’t as powerful as it was in your 20s, investing more now can help you catch-up, stay on-track, or build your life of abundance.

Feeling stuck in the Messy Middle of your 30s and 40s, with more obligations than time? Check out the video below where we discuss the most important financial planning concepts for those in their 30s.

Wealth Multiplier When Approaching Retirement

Copy link to this section: Wealth Multiplier When Approaching Retirement

Copied the URL to your clipboard!

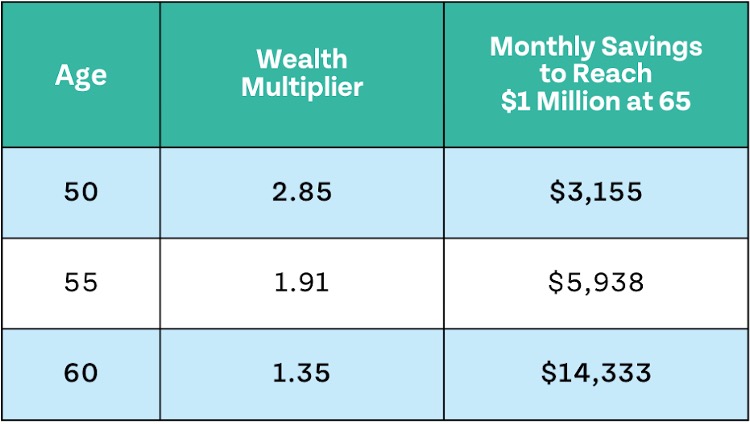

Thought your money was done growing? Think again! Even as you approach retirement, your money still has time and the opportunity to grow before age 65.

Your money can still grow as much as 3x over for dollars invested at age 50. This doesn’t include the decades of compounding growth you’ve hopefully already been experiencing.

What should you be focusing on in your 50s and beyond as you approach retirement? Check out the video below where we discuss the most important financial planning concepts for those in their 50s.

Wealth Multiplier Calculators

Copy link to this section: Wealth Multiplier Calculators

Copied the URL to your clipboard!

You can use a time value of money calculator to determine how much the money you already have invested will grow by retirement. Our Money Guy Wealth Multiplier calculator allows you to see what your initial investment can grow with additional contributions added monthly. Additionally, you can utilize our Know Your Number course as a Money Guy retirement calculator.

Download our Money Guy Wealth Multiplier for the latest nuanced charts and data to see what every dollar you save can turn into by retirement.

Conclusion

Copy link to this section: Conclusion

Copied the URL to your clipboard!

Our Wealth Multiplier is a powerful tool for explaining a simple topic: compounding interest. Use it to see exactly what your invested dollars could become by age 65 and how much you need to invest each month to become a millionaire by age 65.

Anyone can build wealth by harnessing the power of compounding interest, regardless of your background or income. Start by investing more today for your more beautiful tomorrow.

The Abundance Cycle, the core of what we do, is all about giving you the knowledge to apply to your own financial life and watch your money grow.

Once you reach a certain level of financial complication where a financial advisor can add value, we hope that you’ll consider working with us.