There are more ways to invest in real rstate than you may think.

Real estate investing is commonly believed to be one of the “best” ways to build wealth. Investors own tangible property that grows in value while also receiving cash flow. It’s a win-win, right?

While this strategy can act as a great source of income, it may be more difficult than you think. However, there are many ways to invest in real estate, and it may be a lot more accessible than you think.

The Truth About Rental Real Estate

Rental real estate investing sounds like easy money – put a small deposit down on a property, get a check each month to cover the mortgage, and sit back while your real estate appreciates.

However, these are three common myths about real estate investing that you may want to look into.

- Real Estate is Passive. A hot buzz word in the world of finance right now is passiveincome, particularly investing through real estate, but anyone who does real estate for a living will tell you it’s anything but passive. First, due diligence must be done on the front end to determine the location of the property, to find tenants, to figure out the logistics of the agreement, etc. Once you do get tenants in the door, life happens, and you (or a paid property manager) may find yourself dealing with maintenance and repairs as tenants wear the property down.

- Real Estate doesn’t take a lot of money. On the front end, you will likely need to put down 20-25% down for an investment property, especially if you hope to receive a low mortgage rate. On top of that, you will have transaction costs during the real estate purchase. After the property is purchased and leased, it will need to be maintained. You may need to hire a property manager, you’ll have property taxes due, and you could face costly repairs, such as needing to replace the roof or air conditioning unit. Also keep in mind that your real estate assets are not liquid, so the money that is tied up in the property is not easily accessible.

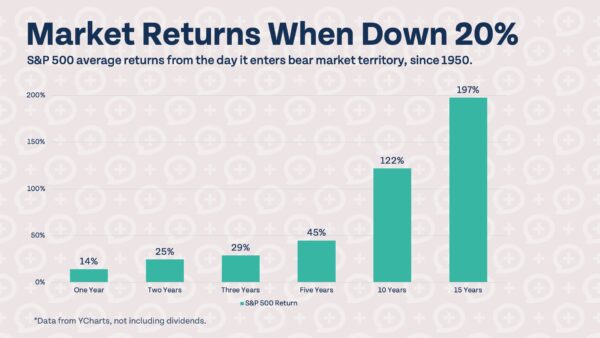

- Real Estate always goes up. Think of 2008. Real estate prices are not immune from volatility, and they are often less resilient than stock recovery. On average, real estate does increase in value, but this return is not something that can be relied on. In a down market, investors may lose tenants or value in their homes, but they are still responsible for home maintenance and mortgage payments.

What Is the Benefit of Real Estate Investing?

With all of that being said, there is a reason real estate investing is so popular.

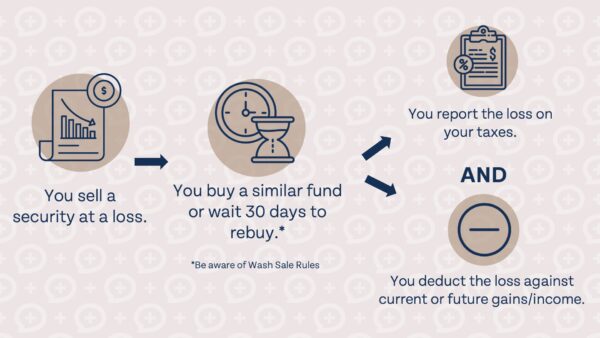

First, there are several tax benefits. Income received from the property can be offset by incurred expenses, and profits are taxed at a lower rate than traditional investment income. Second, instead of being sold and incurring a capital gain, properties can be exchanged via a 1031 exchange, which delays the taxes of a real estate transaction.

When Can I Invest in Real Estate?

Real Estate investing falls in Step 7 of the Financial Order of Operations. Before pulling the trigger on an investment property, be sure to have your cash reserves covered and maximize your tax-advantaged retirement accounts. After reaching these steps, it could be a good time to consider hyper-accumulation through real estate investing.

How to Invest In Real Estate

Real estate investing is not limited to “traditional” real estate investing.

- Primary Home Ownership. For the majority of people, their biggest personal asset is their primary home. Home ownership has many tax benefits, including mortgage interest deductions, capital gains exclusions, etc. One thing to consider is that your primary home is a use asset, and it is hard to turn your home equity into food on your table. Because of this, try keeping your home ownership costs below 25% of your overall income.

- Passive via Portfolio. This is the second easiest form of real estate investing, and often the choice that makes the most sense. Just like buying stocks and bonds, you can buy exposure to real estate through mutual funds and REITs within your IRA or brokerage account. Historically, real estate has performed strongly, similarly to US Large Cap stock. The caveat here, though, is that real estate does perform differently than equities, so you could be buying into diversification through this strategy.

- Residential Real Estate Property. This is the traditional method of real estate investing – buy residential real estate and rent it out. Residential real estate could include single family homes, multi family housing, or vacation rental property. While some investors are wildly successful with this strategy, other investors have the polar opposite experience. If a mortgage is used to buy the property, returns are leveraged. Because debt is used to purchase the property, returns are higher than what could be used with just your own money because you have a larger asset than what you could purchase on your own. The downside is that this does carry a lot of risk. In a bad economy, you may lose tenants or lose value in your investment, but you will still be on the hook for the mortgage payments. Another thing to consider is that active management – personal vetting of tenants, maintenance, etc. – is needed to maximize profits. Some analysis to think through before getting into rental real estate is the best, worst, and expected scenario.

- Commercial Real Estate. Commercial real estate can sound more appealing than residential property – you are likely to have more qualified tenants and longer lease terms – and you can still reap the profits of rental cash flow and an appreciating asset. There is a high barrier to entry for commercial real estate, though, as down payment requirements are generally 20-25%. Also, since this is a more niche market, transactions generally move more slowly than residential real estate – there are often longer vacancies and longer listing times on the market.

- Private Real Estate Deals. Private Real Estate deals are arrangements where investors pool their money together to buy into real estate – whether that is a single property or a diversified portfolio. These partnerships are more passive than traditional rental real estate because the goal is to “set it and forget it” and collect profits later. The success of these deals depends on several factors, but especially the General Partner – or managing partner – in the agreement. Making the decision of what to invest in requires a good deal of due diligence on the front end. There are often a lot of fees included in these deals, so you may want to get a full accounting of what will be due and when.

- Land Development. Land development involves finding a piece of land that is undeveloped and making a huge profit off of it by turning it into something people want such as a subdivision or commercial space. Returns can be astronomical, but these deals carry a ton of risk. First, in most cases, a lot of leverage is involved. Second, there are several logistical hurdles that involve working with a lot of people, such as attorneys, architects, contractors, etc. Finally, development is often either in boom or bust.

Video: Do This BEFORE Investing in Real Estate! w/ @BiggerPocketsMoney