Everyone knows that the cost of college has risen significantly since 1980. While the cost has gone up by a factor of 8.3x, it doesn’t necessarily mean that college is no longer worth it. I wanted to dive into the numbers to see exactly how much extra income you would need to make for college to be worth it financially.

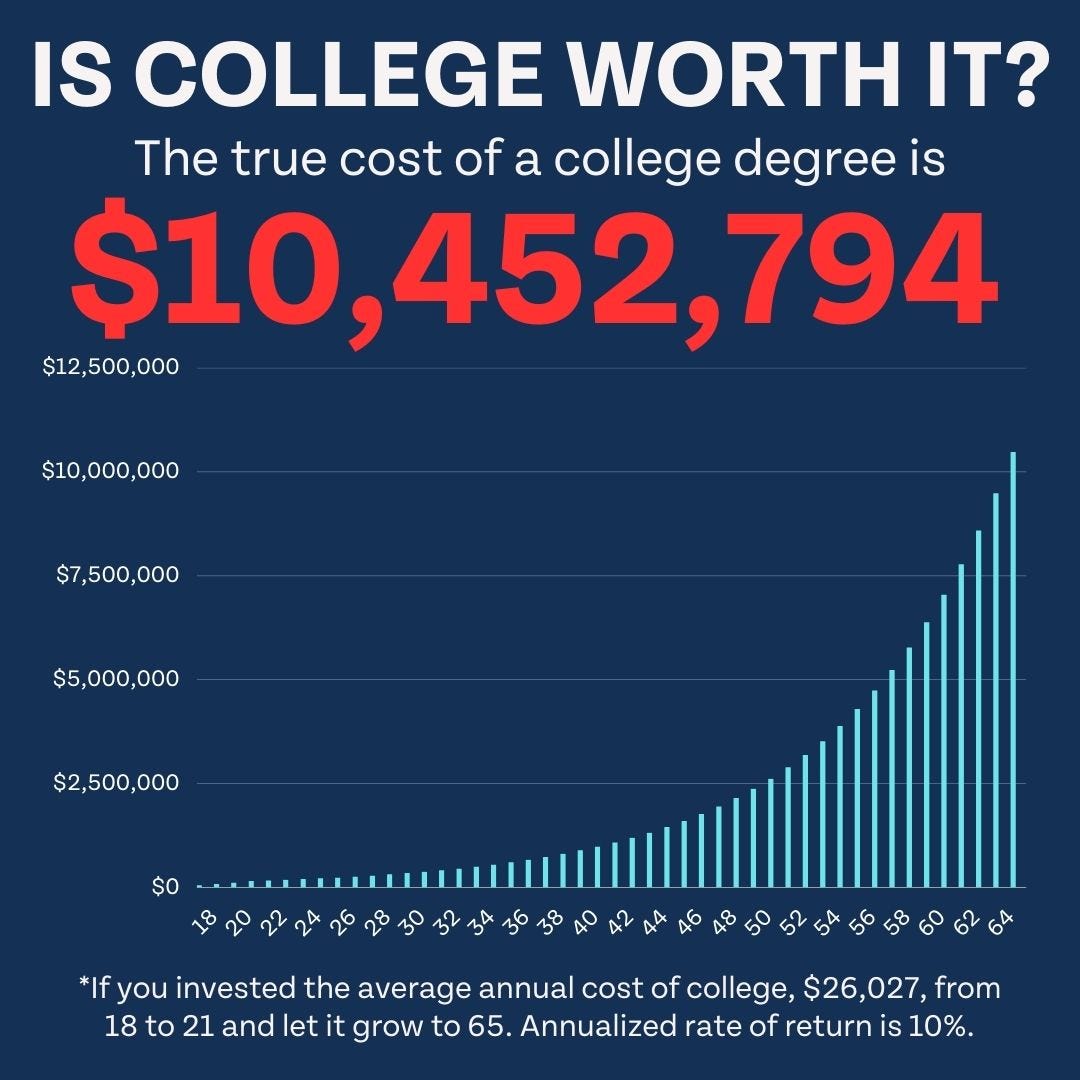

The average cost of attending college for one year is $26,027. If someone instead invested that amount each year from ages 18 to 21, for a total of $104,108, they would have $10,452,794 invested by age 65 (assuming a 10% annual rate of return).

The opportunity cost of spending the average annual cost of college attending rather than investing could be over $10 million by retirement. It’s a number that sounds almost incomprehensible and impossible to overcome – but starting at such a young age makes it more attainable than you would think.

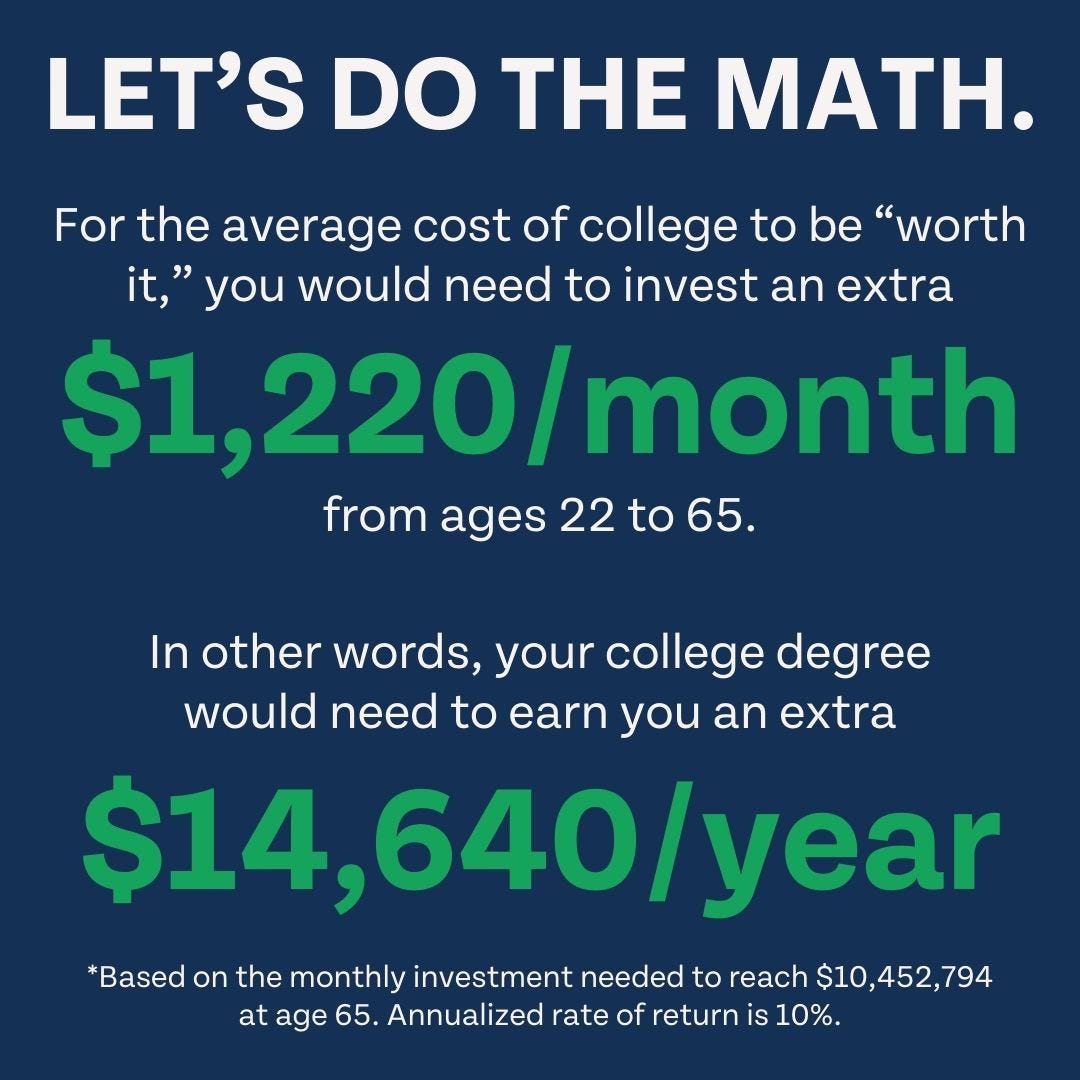

To reverse engineer the math we just did, let’s assume someone graduates college at 22 and wants to invest an amount per month to catch up to the person who did not attend college. To reach $10,452,794 by 65, the college attendee would need to invest $1,220 per month every month from age 22 to 65. In other words, their college degree would need to earn them an extra $14,640 per year for it to be “worth it.”

That’s certainly not a small number, but it’s much smaller than $10 million. It’s very possible for a college graduate to earn $14,640 per year more than someone who didn’t attend college, and many DO, which makes college worth it in many situations. Ultimately, college being a smart decision often hinges on choosing your major wisely. Check out the list of the top 5 highest-paying college degrees below.

- Petroleum Engineering

- Industrial Engineering

- Computer Science

- Interaction Design

- Public Accounting

The average cost of college may not be representative of what college will cost for you. If you attend private college, the opportunity cost of going to college could be well over $20 million by retirement. There are many ways to lower the cost of college.

How to Do College Right

- Apply for scholarships.

- Work for a company that offers tuition reimbursement.

- Take core classes at more affordable alternatives (like community college).

- Apply for all financial aid you can.

- Keep student loan debt below your expected first year salary.

Some colleges offer scholarships to students when they are accepted, and some take a little more work to apply for. While not every student will receive scholarships, every student should at least see which scholarships they may be eligible for and apply for all they can. I worked for a company that offered tuition reimbursement as an employee perk while I was in college. There may be certain requirements; in my program, you had to be taking classes for a certain major and maintain good grades, but it can be a huge opportunity for college students to get extra money to pay for school.

I enrolled at a major university right out of college and didn’t even consider taking core classes at a community or technical college, but I wish I had. Classes can be a fraction of the cost and they count the same as courses taken at a more expensive university. Outside of scholarships, FAFSA, and tuition reimbursement, there may be even more opportunities for financial aid. Grants, apprenticeships, work-study programs, and other aid may be available.

If you do need to take out student loans to help pay for college, keep your total student loan debt below your expected first year salary. Following this rule will not only keep your student loan debt manageable, but will ensure you do your research about your major and know your earning potential.

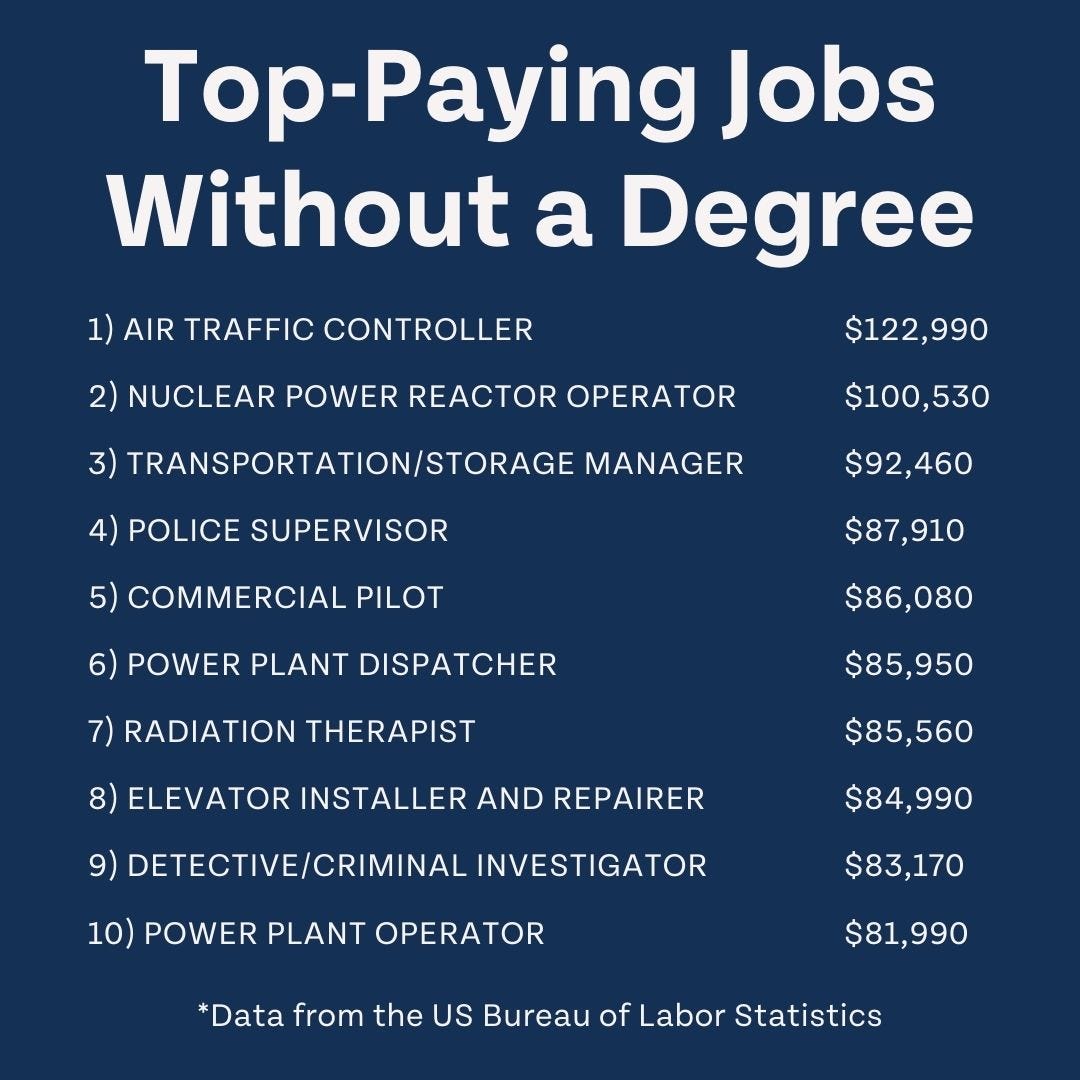

Not everyone needs to attend college! There are plenty of good-paying jobs that don’t require a four-year college degree. These jobs still require highly-skilled, trained employees, but can be a less costly path for those that don’t believe college is for them. The list below shows the top 10 highest-paying jobs that do not require a college degree.

Top-Paying Jobs Without a Degree

- Air Traffic Controller ($122,990)

- Nuclear Power Reactor Operator ($100,530)

- Transportation/Storage Manager ($92,460)

- Police Supervisor ($87,910)

- Commercial Pilot ($86,080)

- Power Plant Dispatcher ($85,950)

- Radiation Therapist ($85,560)

- Elevator Installer and Repairer ($84,990)

- Detective/Criminal Investigator ($83,170)

- Power Plant Operator ($81,990)

When I was in high school, I remember getting the impression that anyone who didn’t go to college was considered a failure and would never have the chance to earn much money. The jobs most commonly associated with not going to college were what we traditionally think of as “dead-end” jobs, such as in fast food, customer service, or other similar industries.

Fortunately, I think attitudes about college are slowly changing. The rising costs have certainly been a catalyst for change. Just 35% of Americans 25 and older have a four-year college degree or higher, and 3 out of 10 billionaires do not have a college degree. College can be a great tool to increase your earning potential, and makes sense for many, but there’s no shortage of extremely smart and talented individuals that are successful without ever attending college.

Ultimately, the path you choose is up to you – becoming successful and wealthy can be possible if you go to college and take out student loans. It can be possible if you never attend college. Understanding the value of your time and return on your investment can help you build wealth no matter how your journey begins.