There is at least one political issue that the vast majority of both major political parties are in agreement on: taxes. No, we don’t agree on whether or not everyone else is paying enough taxes, but Americans all agree that they are paying enough (or too much) in taxes. Proactive tax planning doesn’t sound exciting, and I almost fell asleep just typing it, but paying less in taxes is something that we can all get excited about.

What is tax planning really?

There are a lot of misconceptions floating around about what tax planning is and what it isn’t. First, let’s define what it isn’t. Tax planning is not a magical solution to pay nothing in taxes and may not even significantly reduce the amount of taxes you pay. It is not shady and unethical, and it is not only available to the rich or high-income earners. Good tax planning optimizes your current financial life by making (typically small and moderate) changes to save on taxes.

Contributing to a Roth IRA is good tax planning. Contributing to an HSA is good tax planning. Making sure you take all deductions and credits you are eligible for is good tax planning. While tax planning is available to anyone, regardless of income, there are some strategies that are available more broadly and others that may only apply in more specific situations.

Tax planning for all

There are some tax planning strategies that are more accessible than others. You don’t need a high income, a large investment portfolio, or a complicated tax situation to take advantage of these strategies.

Contributing to retirement accounts

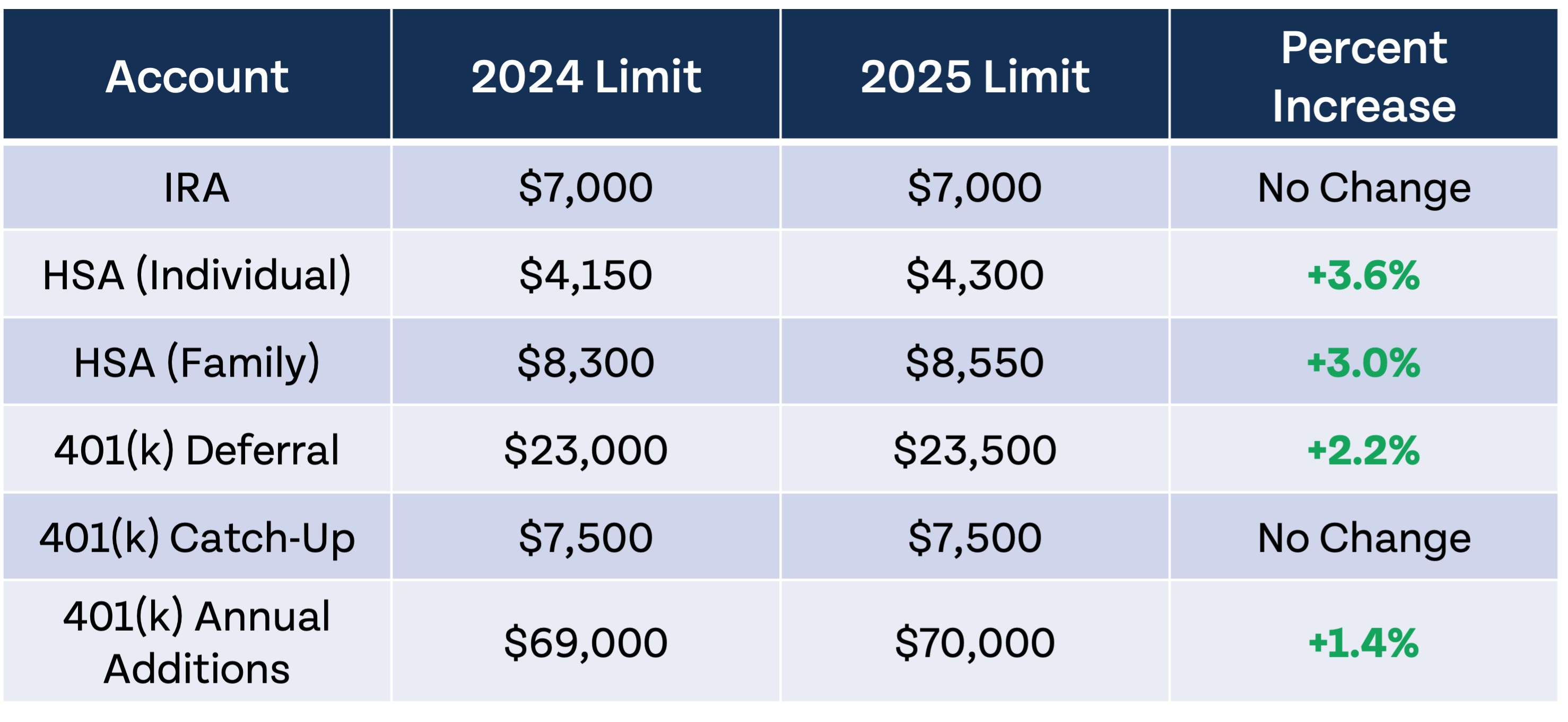

Making contributions to tax-advantaged retirement accounts is one of the best tax planning strategies out there. If you aren’t sure exactly which account to contribute to first, check out our Financial Order of Operations. Consider maximizing any employer match first, then maximizing your Roth IRA and HSA, and next maximizing your employer-sponsored account if you are able to. The following table shows the maximum amount that can be contributed to these tax-advantaged accounts.

All of the above accounts have tax advantages, but some work differently than others. Roth IRAs have no tax deduction at the time your contribution is made, but all contributions grow tax-free and qualified distributions are tax-free, which is an incredible benefit. HSAs do offer a tax break on contributions, and also grow tax-free and offer tax-free distributions, just like Roth IRAs. The “catch” is distributions are only qualified (and tax-free) when used for eligible medical expenses. Roth employer-sponsored plans, such as Roth 401(k), work very similarly to Roth IRAs. Pre-tax employer sponsored plans offer a tax break on contributions, but qualified distributions count as taxable income.

Tax deductions and credits

What are called “above-the-line” tax deductions and credits are available even if you don’t itemize, but are often narrow in scope. You might need to have paid student loan interest, or have children and make under a certain amount, or contribute to a retirement plan and have a low income. Most tax software and tax professionals are pretty good at recognizing tax deductions and credits you may qualify for, but it’s always worth double checking just to be sure. Check out our list of some of the lesser known tax deductions and credits.

Tax planning for some

Some more “advanced” tax planning may only be relevant to you if you have a higher income, large investment accounts, own a business, or have a more complicated tax situation. Being more advanced, these strategies may not always be easy to do yourself. If you are ever in doubt, consult a trusted tax professional and/or a fee-only financial advisor.

Business ownership

Owning your own business can have some great tax advantages. When you think of “owning a business,” you might imagine a wealthy store owner, but owning and operating your own business has never been more accessible. Do you drive for Uber Eats? You own your own business. Do you sell handmade goods on Etsy and at craft fairs? You own your own business. One of the biggest tax advantages of business ownership is that money you invest back in your business saves you money on taxes. If you have an extra surplus of cash one year, it might be a good year for major business purchases.

Itemizing deductions

Close to 90% of Americans take the standard deduction, as most Americans wouldn’t have enough itemized deductions for it to make sense. However, if you have a larger number of itemized deductions, there is tax planning you can do to maximize your tax breaks. One common example is with charitable contributions. If you are on the border of itemizing and taking the standard deduction and make generous contributions to charity, bunching charitable contributions could be a strategy worth considering. Here’s an example:

Joanne contributes $10,000 per year to her favorite charity. She takes the standard deduction on her taxes each year. Her financial advisor suggests she “bunch” charitable contributions and instead contribute $30,000 to her favorite charity every three years. By doing this, Joanne can itemize on her taxes once every three years and use her charitable contributions to lower her tax burden.

Capital gains avoidance and tax-loss harvesting

If you have a large amount of money invested in a taxable brokerage account, realized capital gains could be a big issue for you come tax time. However, there are strategies that may be worth implementing to reduce your tax burden. In some cases, it could make sense to sell an investment fund before capital gains are distributed to avoid taxation. If some of your investments have losses, it could make sense selling those at a loss to offset gains. Capital gains avoidance and tax-loss harvesting can be complicated, so if you ever have questions feel free to reach out to us at Abound Wealth.

Tax planning isn’t some shady area of financial planning that can drastically reduce your tax burden. Good tax planning is about optimizing your finances to keep more money in your pocket and in your retirement accounts. If there’s one thing the vast majority of Americans can agree on, it’s that paying a little less on our own taxes wouldn’t be a bad thing.