Last Updated

September 2, 2025

Read Time

Share

How's Your Relationship with Money?

Being “good with money” is often thought of as an inherent trait that you either have or you don’t.

That couldn’t be further from the truth.

A healthy relationship with money is cultivated over time, just like going to the gym, eating healthy, or brushing your teeth. If you neglect your relationship with money, bad habits will replace good ones and your financial life will decay.

Building a healthy relationship with money isn’t necessarily difficult (although it can be if you are trying to overwrite a poor relationship with money), but it does require consistent reinforcement of positive financial behaviors. Spending less than you make, investing for retirement, and paying off debt are a few high-level examples of these positive financial behaviors.

In this guide, we will discuss how to cultivate a healthy money mindset, whether you are starting from ground zero or working to overcome a negative relationship with your finances.

Expect to learn tools to combat money stress, create a mindset of abundance, compare yourself to others in a positive way, and make consistently good financial decisions.

Money Guy’s Money Mindset

Copy link to this section: Money Guy’s Money Mindset

Copied the URL to your clipboard!

One of our core beliefs is that you can build wealth. Yes, you, reading this article right now. No matter whether you were born rich or poor, no matter whether you are a CEO or school teacher, no matter whether you are debt-free or have a mountain of bills, and no matter whether you have $5 million invested for retirement or are just getting started, you can build wealth and financial security.

How do we know that you can build wealth? The Money Guy has been helping people just like you build positive financial habits for decades.

We’ve learned that it is possible for anyone to build wealth and climb the economic ladder, no matter where you are from or your past relationship with money.

Build Your Foundation

Copy link to this section: Build Your Foundation

Copied the URL to your clipboard!

The majority of Americans live paycheck to paycheck, but nobody really wants to be living paycheck to paycheck.

If you are spending everything you make, or more than you make, that means you have nothing left over to invest or save for emergencies. It means you will have to use high-interest debt to cover unexpected expenses or big purchases. It means you are more stressed, which can affect not only your financial life but your emotional well-being, relationships, and more.

Building a healthy money mindset, the Money Guy way, starts with a solid foundation of basic financial habits.

Teach yourself about money

Many Americans are financially illiterate, and you may be one of them – and that’s okay! It is easier than ever to educate yourself about money and learn how to actually build wealth.

The Money Guy Show is a great place to educate yourself about money. No matter whether you are just trying to get out of debt and stop living paycheck-to-paycheck or are searching for advanced investing strategies beyond your run of the mill Roth IRA and 401(k), we have content to help you. The Financial Order of Operations is an incredible starting point for anyone that isn’t sure exactly what to do next.

When it comes to educating yourself about personal finance, take a proactive approach rather than a complacent one. Approach it with an open mind. What you learned when you were younger may not be true.

Make a plan to spend less than you make.

The most basic step to being successful financially is spending less than you make. You must spend less than you make in order to save, invest, or pay off debt. If you are in a tough situation financially, it is much easier said than done.

To spend less than you make, you have two options: decrease your spending or increase your income. There’s no right answer for everyone. You may not have any room left to decrease your spending, or it may not be possible for you to increase your income much, or you may need to both decrease your spending and increase your income to be successful.

If you don’t know if you can lower your expenses, or how much you could lower your expenses, I’d like you to open a spreadsheet (Google Sheets is a great free option) and enter in every single expense you had last month. Use the cell shading feature to color code the cells.

You can use whatever colors you’d like, but we suggest using green to notate necessary expenses (rent or mortgage payment, gas, utilities, groceries, loan payments, etc.), yellow to notate non-essential expenses (dining out, fun money, etc.) and red to notate any “regretted” expenses (why did I spend money on that?).

How much could you save every month if you cut out all of the red spending? How much could you save if you cut out some of the yellow spending? If you don’t normally track your expenses, this experience could be eye-opening for you.

You might realize that all you need to do to be successful financially is eliminate certain expenses. However, that may not be the case. Maybe you don’t have any expenses left to cut, or feel like expenses you could cut would cause more harm than good (let’s face it, not getting that weekly Starbucks isn’t going to solve all your financial problems).

If you feel like you don’t have any room to cut your expenses, or if solely cutting your expenses isn’t enough, the other way to spend less than you make is to increase your income. Increasing your income is more possible than ever, and it can take MANY different forms.

Maybe for you it’s as simple as taking on extra hours at work, if you have the capacity. If you have marketable services you could consider taking on clients as a freelancer if your full-time job allows.

Changing industries entirely may be necessary if you feel like you are in a dead-end career without the potential for growth. If you have extra time, there are plenty of side hustles out there that require little to no skill.

Rewire your brain to practice deferred gratification.

Everyone who is able to spend less than they make and invest for the future has one thing in common: the ability to practice deferred gratification. It comes naturally to some but for most of us it is very difficult to do.

Our brain naturally wants gratification now. Saving for retirement is especially difficult because you don’t have to delay gratification for hours or days or even weeks or months, but years and likely decades. How in the world do you put money away and not touch it for decades when you have the option to enjoy that money now?

A great first step is to know what every dollar invested today could turn into by retirement. Sure, it doesn’t feel great investing $100 for retirement when you can instead spend that $100 today. But what if I told you the decision isn’t between $100 now and $100 in retirement?

If you are 20 and invest $100 earning 10% for 45 years, until age 65, you would actually have $8,835. So the decision now is between spending $100 now or $8,835 at age 65. Even though our brains are wired to want gratification now, it’s pretty easy to see how much you can be rewarded by waiting.

It can still be really difficult for us to actually save that money instead of spending it. Sure, you might have $8,835 at 65, but what does that even look like? You know exactly what that $100 will get me today and how much I’ll enjoy it.

A zero-based budgeting software such as YNAB can essentially help trick you into living below your means. The idea is that by giving every dollar a job and a purpose, you don’t feel like you have money left over every month.

You may feel “broke” because you are utilizing every single dollar you make. Except instead of spending every single dollar you make, you are investing for retirement and saving for emergencies and other large expenses.

Start the Financial Order of Operations

Once you have a cash surplus every month and are spending less than you make, you are ready to tackle the Financial Order of Operations. Check out our ultimate guide to the FOO if you are unfamiliar with the steps or want to learn more about starting.

The first step is to build a baseline emergency fund to cover your highest insurance deductible. Check all of your policies, like homeowners, car insurance, and health insurance, and use your new-found cash surplus to build enough to cover the most expensive deductible in a high-yield savings account.

Building this baseline protection from emergencies can keep you from going into debt to cover unexpected expenses. You are well on your way to being a regular Financial Mutant – before you know it you’ll be contributing to Roth IRAs, HSAs, and tracking your net worth every single year. The difficult part of the journey is already behind you – once you are living below your means and practicing deferred gratification, building wealth is surprisingly simple.

Share image

Give yourself permission to spend a healthy amount

A big part of having a healthy relationship with money is being able to spend money that you know you can afford to spend without feeling guilt or shame. People of all levels of wealth and income struggle with this.

One major reason we’ve noticed people struggle to spend money on unnecessary expenses is uncertainty about their financial habits. They don’t truly know whether they are saving enough for the future, so out of an abundance of caution, they severely restrict their spending to save even more. It is difficult to find a perfect balance, and you can quickly go from not spending enough (as crazy as that sounds) to overspending.

The key to finding a perfect balance is identifying all of your financial goals, determining what you need to do to achieve those goals, and implementing a plan that aims to account for as many “unknowns” as possible (such as investing returns, changes in income, big life events, and inflation, just to name a few).

Our Know Your Number course is a good place to start thinking about those goals and what they will take to accomplish. Meeting with a fee-only financial advisor is a great next-step for those who would benefit from a second set of eyes or financial co-pilot.

A healthy relationship with money doesn’t develop overnight. If you currently believe you have an unhealthy relationship with money, it is possible to overcome prior habits and beliefs, but it takes time. Starting the work today is very much worth it and can lead you to feeling happier, more secure, and confident in your finances.

Start Rebuilding a Healthy Relationship With Money Today

Subscribe to our free newsletter to start thinking differently about money and joining others on the path to financial success.

From Scarcity to Abundance

Copy link to this section: From Scarcity to Abundance

Copied the URL to your clipboard!

Being tight with money can be a great financial habit when you are earlier in your wealth-building journey, but can hinder you later in life. You will reach a point in life where you need to have the ability to give yourself permission to spend money on nice things. It can be difficult to flip the switch from saver to spender and many of our own clients at Abound Wealth struggle to give themselves permission to spend.

How do you know when you can give yourself permission to spend? There are three main signs. The first one is that you are following the Financial Order of Operations. This doesn’t mean you’ve completed the steps, but just that you are generally doing the steps in order.

The second sign is when you are able to invest what you know you should be investing for retirement, generally 20% to 25%. Reaching your target investing rate is a big milestone on the way to financial success.

The third sign is when your portfolio is working harder than you are. This happens when you make more from your portfolio than you do from working. Once you meet all three criteria, it’s probably safe for you to start spending.

Share image

Most of us work hard and live below our means so we can have a retirement (and maybe even an early retirement) filled with abundance and freedom.

Some people have difficulty finding the “off” switch. We all know people like this; these are the doers, those who retire but still work part-time to keep themselves busy. These are the millionaires and billionaires of the world.

There’s nothing inherently wrong with not having an off switch; in fact, it may be your fuel for success. It can be a problem when it interferes with your ability to enjoy life. We all need to be able to take a break from time to time, and stop doing and start enjoying ourselves.

You’ll probably spend most of your early years doing. Once you reach the point where you have the resources to be able to take a break every now and then, don’t be afraid to temporarily hit the off switch.

Being tight about money when you don’t need to be can affect your relationships negatively. More importantly, the point of being tight with money is so one day you won’t have to.

Giving yourself permission to spend is the “I’ve finally made it to the big leagues” moment of building wealth. It’s what you’ve been working for and dreaming of. Don’t let that slip away.

Begin Your Own Millionaire Mission Today

Millionaire MissionIf you are starting out, your future is bright if you can grab these financial truths. If you are a seasoned, seven-figure success story, you will find tips to help you fine-tune the details. If you are behind, this can be your resource to catch up and overcome. I hope Millionaire Mission is your financial rocket fuel, propelling you to your more beautiful tomorrow!

– Brian Preston

Knowing Where You Stand

Copy link to this section: Knowing Where You Stand

Copied the URL to your clipboard!

Comparison can be a thief of joy and that is especially true when it comes to money. There will always be someone who makes more money than you, has a nicer car, and a bigger house. Comparing your progress to others can be a useful tool when used correctly. Looking at the average net worth by age, for example, can tell you whether you are ahead or behind your peers when it comes to accumulating wealth.

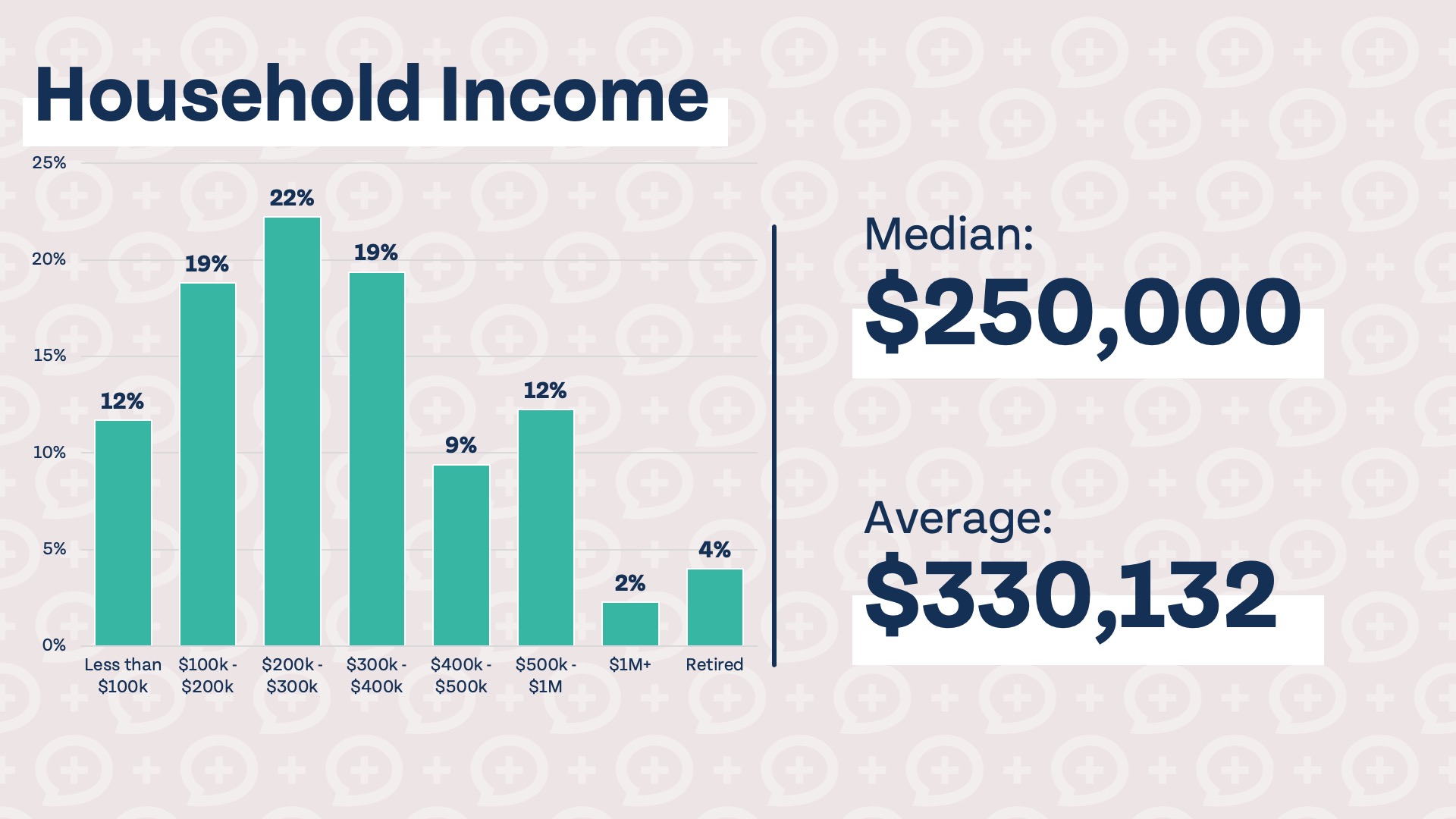

We conduct an annual survey of our millionaire clients that allows a glimpse behind the curtain of how the wealthy actually live. The truth is probably more boring than you’d think, but by understanding how real millionaires live and what they prioritize, you can better understand what’s required to become a millionaire.

High incomes make it easier, but aren’t required

All else being equal, the higher your income, the easier it will be for you to build wealth. But an extremely high income is not a requirement to build wealth. A sizable portion of our clients have a household income under $100,000 annually.

In fact, it’s astonishing how little you need to invest to reach $1 million by retirement if you start saving at a young age. Assuming a 10% annualized rate of return, you would need to invest just $95 each month starting at age 20 to reach millionaire status by 65.

Check out our Wealth Multiplier to see how much you need to invest each month to become a millionaire.

Share image

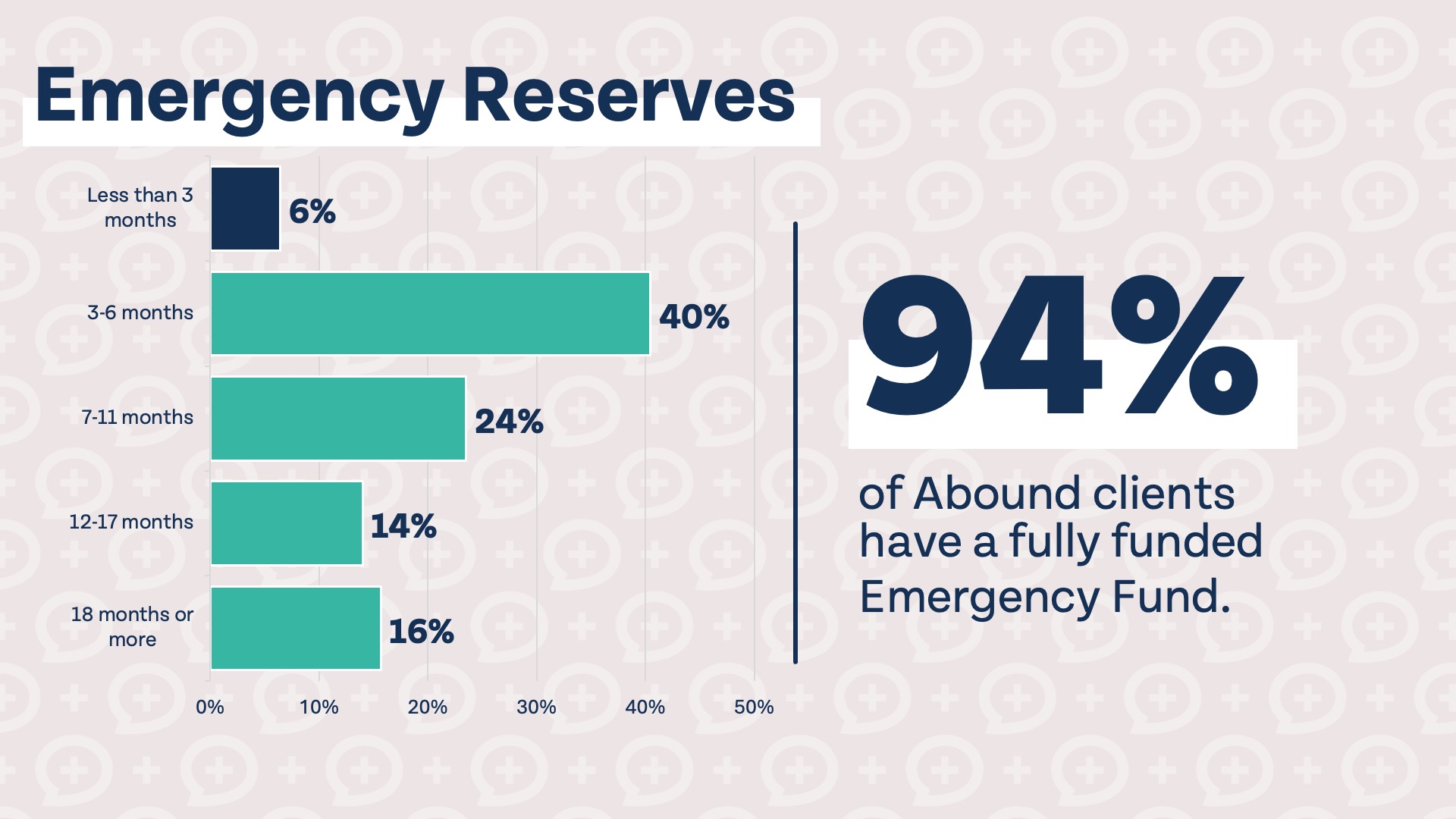

Emergency funds are a must

An adequate emergency fund helps keep your financial life out of the ditch and is a must. It should come as no surprise that 94% of our clients have a fully funded emergency fund.

The general guideline for a fully funded emergency fund is three to six months worth of expenses, but may be different for you depending on your cash needs, job situation, and more. Check out this article for more on how big your emergency fund should be.

Share image

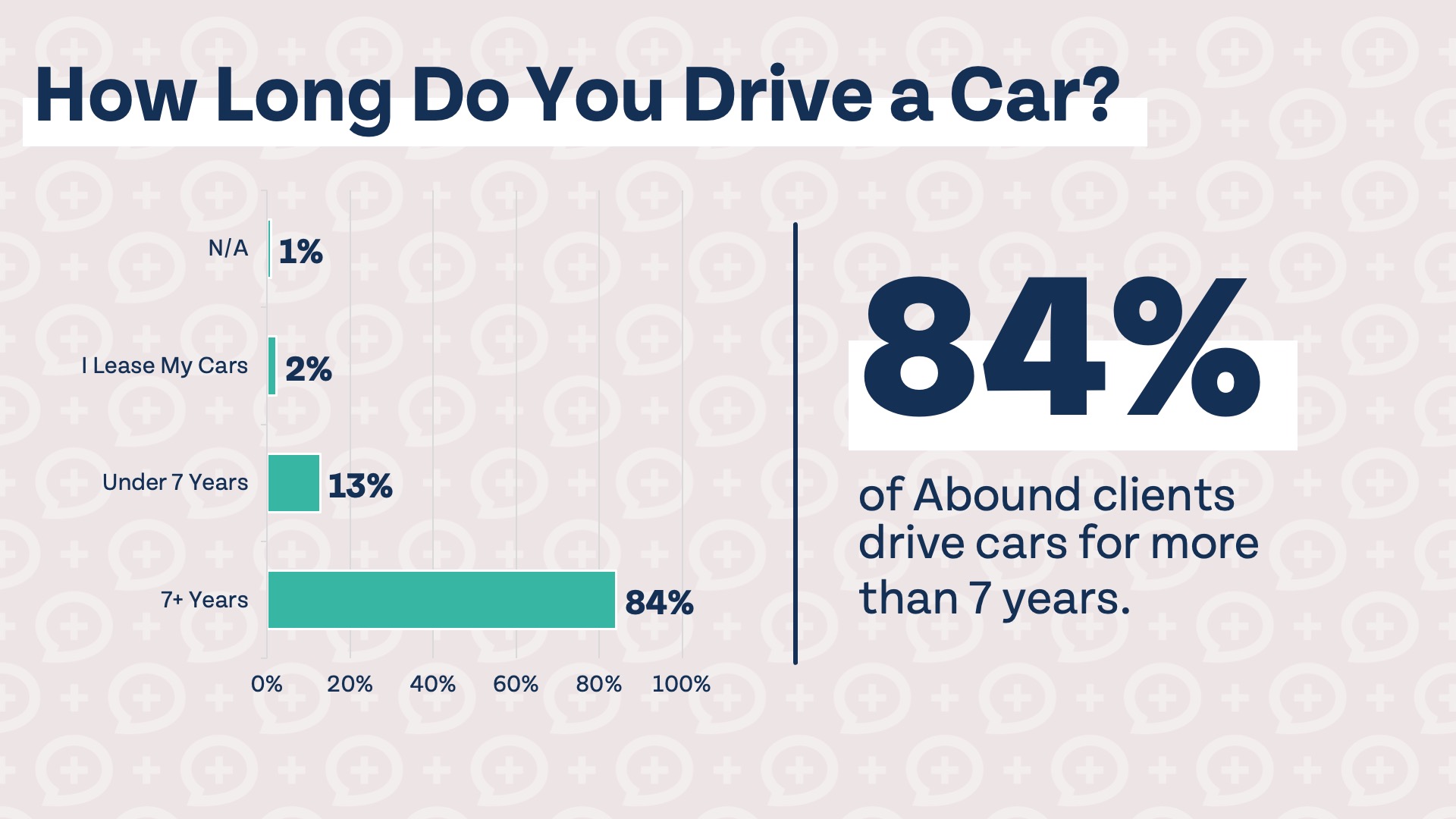

Drive your car until the wheels fall off

Cars are financial liabilities. They start depreciating the second you drive it off the lot. Millionaires know this, and that’s why 84% of our clients drive their cars for seven or more years before replacing them. Having reliable transportation is very important, but don’t upgrade your vehicle more often than necessary.

Share image

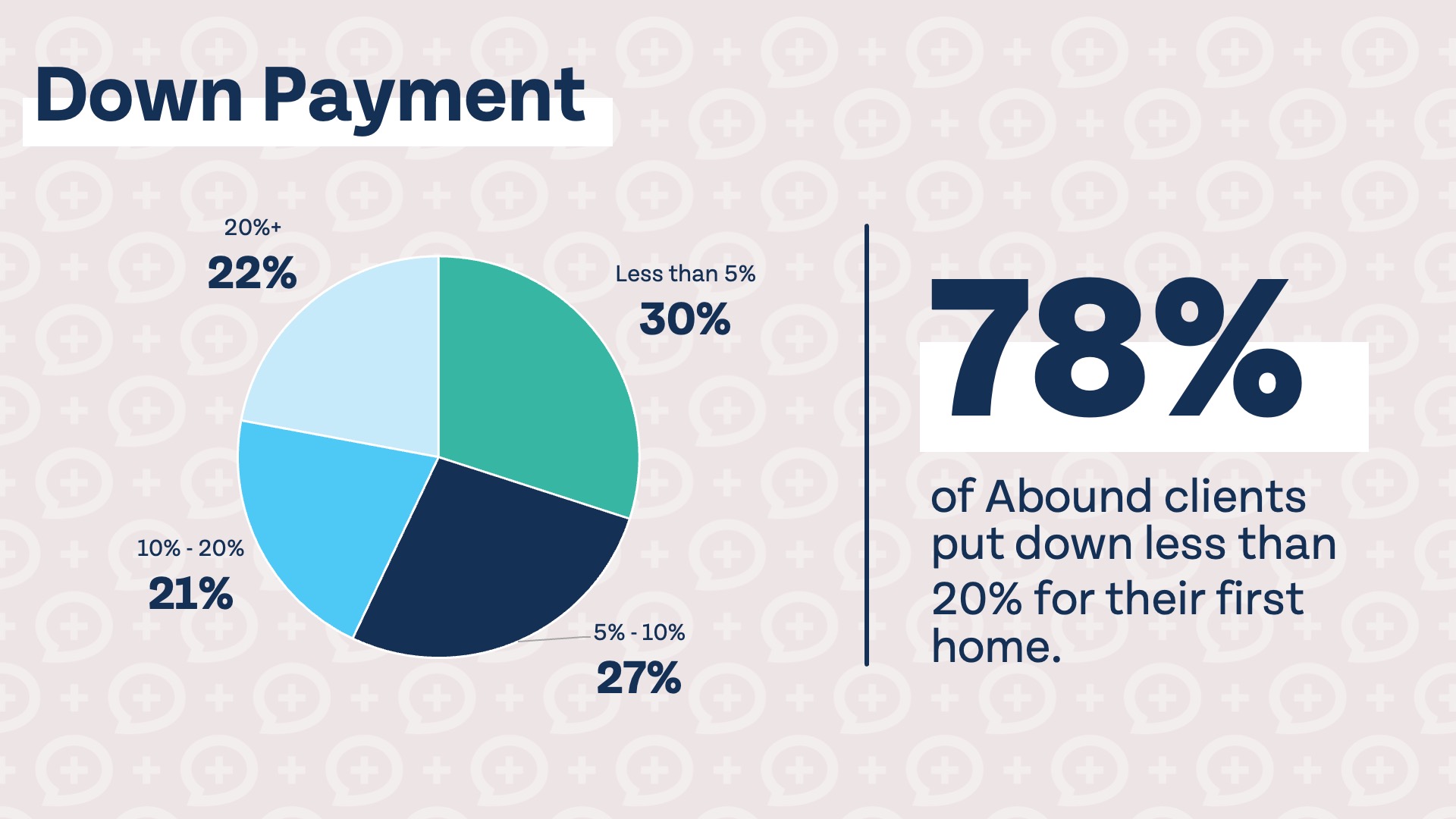

20% down on your first home is uncommon

Putting 20% down when buying your first home is extremely difficult to do. That’s why our Money Guy rule for buying a home allows you to put down 3% to 5% (on your first home only).

While some of our clients have put down 20% or more on their first home, the majority, 78%, put down less than 20%. Putting down 20% on your first home is not a requirement to build wealth.

See how much house you can afford by using our home buying calculator.

Share image

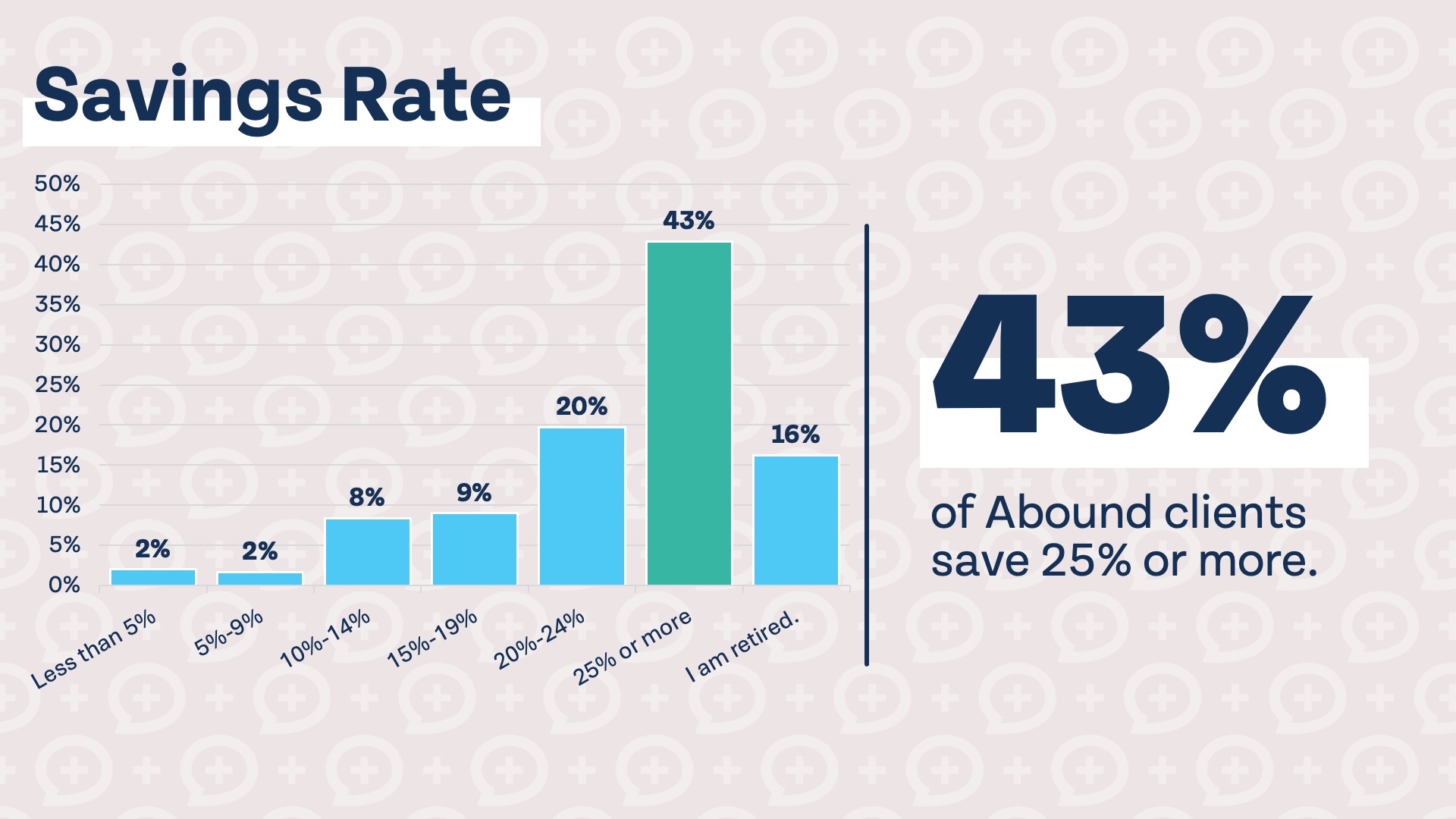

Invest 25% for retirement

Investing a healthy amount for retirement is almost required to build wealth. Sure, you can build wealth by saving cash, becoming an entrepreneur, or winning the lottery, but getting rich slowly by investing is the easiest and most-followed path. It should come as no surprise that a majority of our millionaire clients are investing 25% or more for retirement or are retired.

Share image

Free Calculator: Are You a Prodigious Wealth Accumulator?

How have you done so far accumulating wealth? Enter your age and income along with your current net worth to see how you stack up.

Are You a Prodigious Accumulator of Wealth?Rebuild Your Relationship with Money Today

Copy link to this section: Rebuild Your Relationship with Money Today

Copied the URL to your clipboard!

Becoming wealthy, and building a healthy relationship with money, is possible for anyone and obtained by intentionally building a solid financial foundation and smart money habits.

By learning the basics, spending less than you earn, and practicing deferred gratification, you can create a solid foundation that reduces stress and puts you on a path to building true wealth where you own your time.

A healthy relationship with money doesn’t mean restricting yourself and saving as much as possible. You need to build, grow, and protect your wealth while also giving yourself permission to enjoy it once you’ve put in the work.

A strong money mindset allows you to move from scarcity to abundance, to spend with confidence, and to live a life filled with freedom and security.