Health Savings Accounts, or HSAs, are extremely powerful savings and investment vehicles for medical expenses and retirement. They are right up there with Roth IRAs in our Financial Order of Operations – and might even be a bit better. HSA contributions are tax-deductible, money grows tax-free, and comes out tax-free when used for qualified medical expenses. If you contribute through an employer HSA, contributions are also exempt from FICA taxes (for more about the basics of an HSA, including who can contribute, what expenses are eligible for reimbursement, and the best way to use an HSA, check out my article here).

Despite the power of contributing to an HSA, it may not always make sense to contribute to one. You must have a high-deductible health plan in order to contribute, which means you may be paying more out-of-pocket if you experience a large amount of medical expenses. Choosing a plan with better coverage may be worth considering in years where you may have costly medical procedures, surgeries, or when you are expecting the birth of a new child.

How do you know exactly when it might be worth considering getting better coverage? Let’s take a look at a few case studies that show the costs and benefits you will need to weigh.

Scenario One: You are having a baby and deciding between an HDHP and non-HDHP.

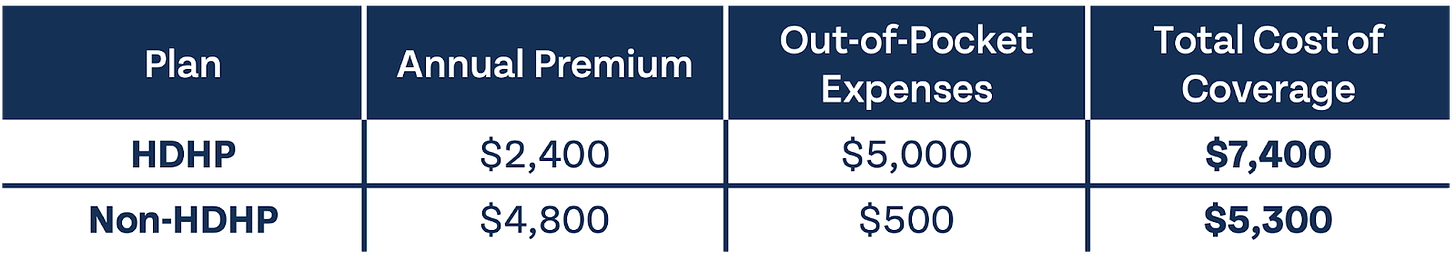

Let’s say you are trying to decide between two employer-subsidized health plans, an HDHP with a monthly premium of $200 and a “Cadillac” health insurance plan for $400 per month. You are also expecting a baby in the plan year, which will cost approximately $5,000 out-of-pocket under the HDHP and only $500 under the Cadillac plan.

Choosing the higher cost but better health plan would save you approximately $2,100 if you were expecting a large medical expense like having a baby. Choosing a great health plan may also make sense if you are planning to have an expensive surgery or in general expect more medical expenses.

If your employer offers more than one health plan, and one of the plans is HSA-eligible, run the numbers for yourself to see how the plans compare. It is impossible to know exactly how much you will owe in medical expenses in a given year, but you can at least know which plan will be better for you with different amounts of medical expenses. If you plan to use your HSA as a slush fund to pay for medical expenses, chances are better employer health coverage may be worth considering. If you plan to invest HSA dollars for decades, it could be a tougher decision.

Scenario Two: You are young and healthy with few medical expenses.

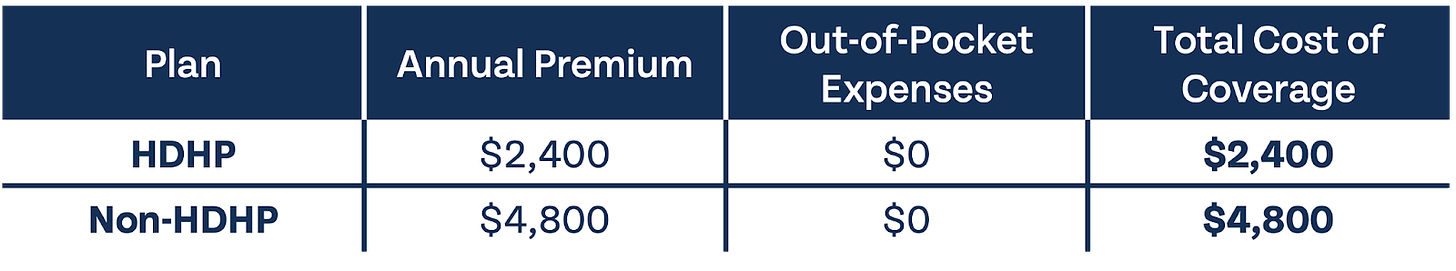

Assuming your employer offers the same health plans as above, an HDHP with a $200 monthly premium and “Cadillac” health insurance plan with a $400 monthly premium, here’s how the comparison might look for someone expecting little to no medical expenses in a given year.

Not only is the HDHP $2,400 per year less, you are also eligible to contribute to an HSA. If you invest the $2,400 difference and let it grow for 30 years earning 8%, you would have $26,246 in your HSA. Do that each year for a decade when you’re younger and you’re well on your way to paying for the $315,000 in medical expenses an average retired couple may need to cover healthcare expenses in retirement.

If you are trying to decide between an HSA-eligible health plan or better coverage that is not eligible for an HSA, I highly encourage you to crunch the numbers for yourself. The examples above are almost certainly different from what you anticipate paying in premiums and medical expenses.

Here’s what you need to know to compare the total cost of coverage for different health insurance plans:

- Insurance premiums

- Estimated out-of-pocket medical expenses

- Tax benefits of using an HSA

- Do you plan to use it as a slush fund or invest it for the long-term?

- If investing, how long do you anticipate that money will grow?

Better health insurance plans have a huge benefit that may not always show up when comparing the numbers: more coverage. If you anticipate having a low amount of medical expenses, that benefit may not show up when crunching the numbers. However, you can never anticipate exactly what you will pay in medical expenses in any given year, so the benefits of better coverage should not be overlooked.

Choosing a health insurance plan is a decision that should not be taken lightly. Make sure you weigh all pros and cons of having better coverage or contributing to an HSA before making a decision.