Health Savings Accounts, or HSAs, just might be one of the best retirement accounts available to Americans. These accounts were created in 2003 to help Americans save for ever-growing medical expenses, but have morphed into something few saw coming: one of the most powerful retirement accounts available. The stats show just a small percentage of the population is fully taking advantage of HSAs – more on that later – so an explainer about the benefits of HSAs, how to properly use them, and how to get access if you don’t already have an HSA is clearly needed.

Why are HSAs so powerful?

Claiming the HSA is the best retirement account is a very bold claim. Who could forget the mighty Roth IRA with its magnificent tax-free growth? Or how about the Roth 401(k), also with magnificent tax-free growth but higher contribution limits? Here’s why the HSA trumps both of them, when it is at its best.

Contributions to an HSA can be invested, and those contributions grow entirely tax-free, just like with Roth accounts. HSA money can be withdrawn entirely tax free, just like with Roth accounts. The catch is distributions must be used for eligible medical expenses.

Fortunately and unfortunately, most Americans will have plenty of medical expenses to utilize the money in their HSA. A study found that the typical American will spend over $300,000 on medical care over their lifetime. With an average HSA balance of $4,607, it’s safe to say that most Americans won’t have to worry about over-contributing to their HSA anytime soon. Even if you were to have more money saved in an HSA than eligible medical expenses to use it on, you could still use that money for any expenses at age 65 and beyond without penalty. The catch is that money is taxable, so HSA money used for non-medical expenses functions like a traditional IRA or 401(k) without the required minimum distributions (RMDs).

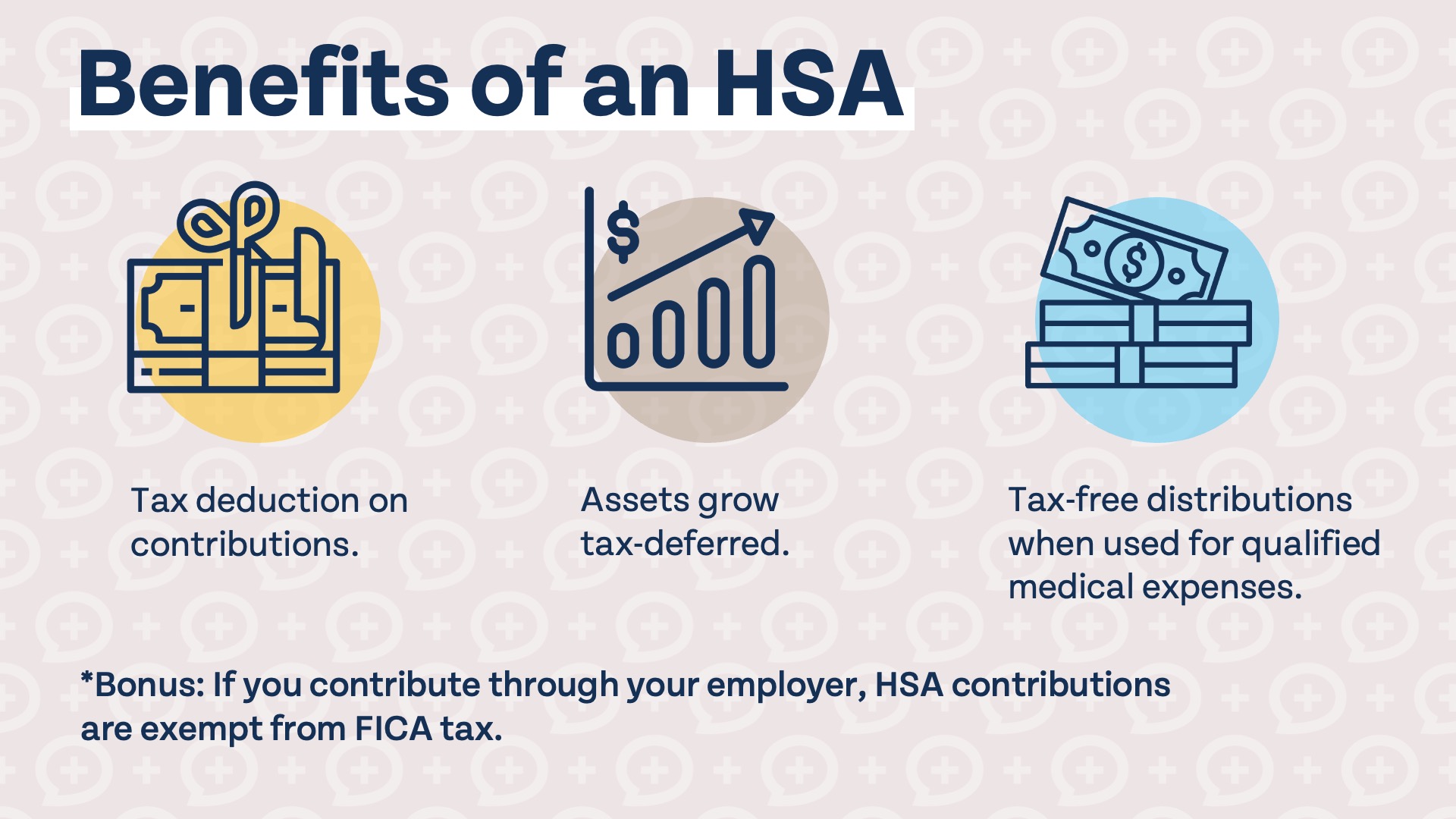

There is one great feature that takes HSAs a step above Roth accounts. Unlike their Roth counterparts, HSA contributions are tax deductible. To summarize, HSAs offer a tax deduction on contributions, assets grow tax-deferred, and distributions for qualified medical expenses are tax-free. This makes the HSA the only retirement account where your contributions may never be subject to federal income tax.

Now that we’re on the same page about how powerful HSAs are, how do you contribute and use them?

How to open an HSA

About 45% of employers in the US offer HSAs to their employees, so you may have access to a Health Savings Account through work. If you do, it could be best to contribute through your job as your contributions will be exempt from FICA tax. Your workplace plan might not have the best investment options, but you may be able to move money from one HSA to an outside HSA after getting the FICA tax break.

You could still be able to open and contribute to an HSA if it is not offered through your employer. If you meet the eligibility requirements to open an HSA, the biggest of which is to be covered by a high-deductible health plan or HDHP, you can open an account on your own without your employer. If you are eligible to open an account and contribute, look for a low-cost provider with a wide range of HSA investment options. There are many providers out there, and one we like is Fidelity for the ease of opening an account and the access to plenty of low-cost investment options.

How to take full advantage of an HSA

Only 10% of Americans even have an HSA, so if you made it this far, congratulations on being in the top 10%! There is still more work to do to fully utilize your HSA and make the most of this extremely powerful retirement account. One big mistake many Americans make is not investing HSA contributions. A study found that only 4% of HSA owners actually invest within their HSA. Doing some quick napkin math, if only 10% of Americans have an HSA, and only 4% of those Americans invest in their HSA, that means about 0.4% of the population is fully utilizing an HSA.

Now you might be thinking, “Okay, I know how to open an HSA and to invest my contributions, which puts me in the top 0.4% of Americans. Surely I’ve reached the pinnacle of HSA usage, right?” Not so fast, friend! Believe it or not, HSAs can be even more powerful if those invested assets are saved for the long-term.

There are two main ways to use the dollars in your HSA. The first is as a slush fund to pay for medical expenses in the present year. If you are using an HSA this way, it won’t make much of a difference if you invest the dollars in your account because they are spent so soon after contributing. The second way to use an HSA is to pay for medical expenses out-of-pocket and invest the money in your HSA and let it grow. That’s because there’s no time limit on reimbursing yourself for eligible medical expenses.

What this means in practice is you can save all of your medical receipts for years or even decades, let the money in your HSA grow, and take those reimbursements in retirement. We don’t know how many Americans use an HSA this way, but it’s certainly less than 0.4% of the population that invests in their HSA.

HSAs might just be the most powerful retirement account available to Americans, but only a small percentage of Americans are taking full advantage of all HSAs have to offer. When used properly, HSAs offer tax-free contributions, tax-free growth, and tax-free qualified distributions. That’s a combination that can’t be matched by any other retirement account available. If you aren’t currently investing for the long-term in an HSA, check to see if you are eligible, open an account through a low-cost provider like Fidelity if you don’t have one through your employer, and save all medical receipts and let your HSA grow for as long as possible.