Some financial influencers say you should never use credit cards, while others believe credit cards can be a beneficial tool in your financial life. Are credit cards harmful or are they good? The truth is more complex than simply “credit cards are good” or “credit cards are bad.”

Take iPads, for example. iPads are an incredible tool that can be used for so much good: you can read books, watch educational videos from The Money Guy Show, create art, write articles, get in shape using fitness training apps or videos, and so much more. Just as much as iPads can be used to improve your life, though, they can be harmful. Maybe you use your tablet to watch 8 hours of mind-numbing television per day or have developed a sports gambling habit on one of many betting apps available on tablets.

Credit cards, just like any other tool, can be helpful or harmful depending on how you use it. Here’s how to use credit cards the right way, so they can be a valuable tool in your financial life, and what to avoid doing with credit cards.

Pros of using credit cards

Credit cards are usually the most convenient way to pay for a transaction. It is quick; all it takes is a simple tap or insert of your credit card chip into a card reader and the transaction is done. Long gone are the days of counting out the change in your coin purse or writing a paper check. One of the greatest “conveniences” of credit cards, and the biggest dangers, is that you don’t even need to have the money in your bank account to complete the transaction.

It costs merchants more to accept credit cards due to processing fees, and while some business owners charge credit card users more, the majority charge the same prices to both credit card users and those that pay in cash or cash-equivalents. This means that if you use cash or equivalents (like a debit card with no rewards) you are subsidizing credit card fees. The Federal Reserve has estimated that each household in the United States that uses credit cards receives an annual wealth transfer of $1,133 from cash users.

The benefits of credit cards go well beyond convenience and having cash users subsidize the prices you pay. Here are some other common benefits credit cards offer.

1. Fraud protection

Shop with a credit card anywhere you’d like a little extra protection. By law, your liability is limited to a maximum of $50 for unauthorized transactions, but most card issuers have zero fraud liability policies.

2. Points or rewards

Some credit cards offer cash back rewards that can be redeemed as statement credits or other cash equivalents. Others offer rewards that may only be redeemed for certain things, like miles for traveling or points for gift cards.

3. Extended warranties

Potentially one of the greatest features of a credit card is extended warranties. If you are making a big purchase, like an expensive home appliance or television, using a credit card with an extended warranty feature. This could help replace the purchase later down the road if something goes wrong.

4. Price matching

Some credit cards will price match items, which means if you make a purchase with your credit card and the price later drops, you can get a credit for the difference.

5. Insurance

Credit cards may offer travel or trip insurance that covers you if your flight is delayed or you use your luggage. Using a card with this feature can be great for frequent travelers.

Credit card pitfalls to avoid

Why would anyone not use credit cards? It’s the most convenient way to pay, you are essentially paying less for every purchase if you are receiving credit card rewards, and your card issuer may also offer benefits like price matching, extended warranties, and insurance. All of those benefits come at a price, though, and credit card companies aren’t operating out of the goodness of their heart.

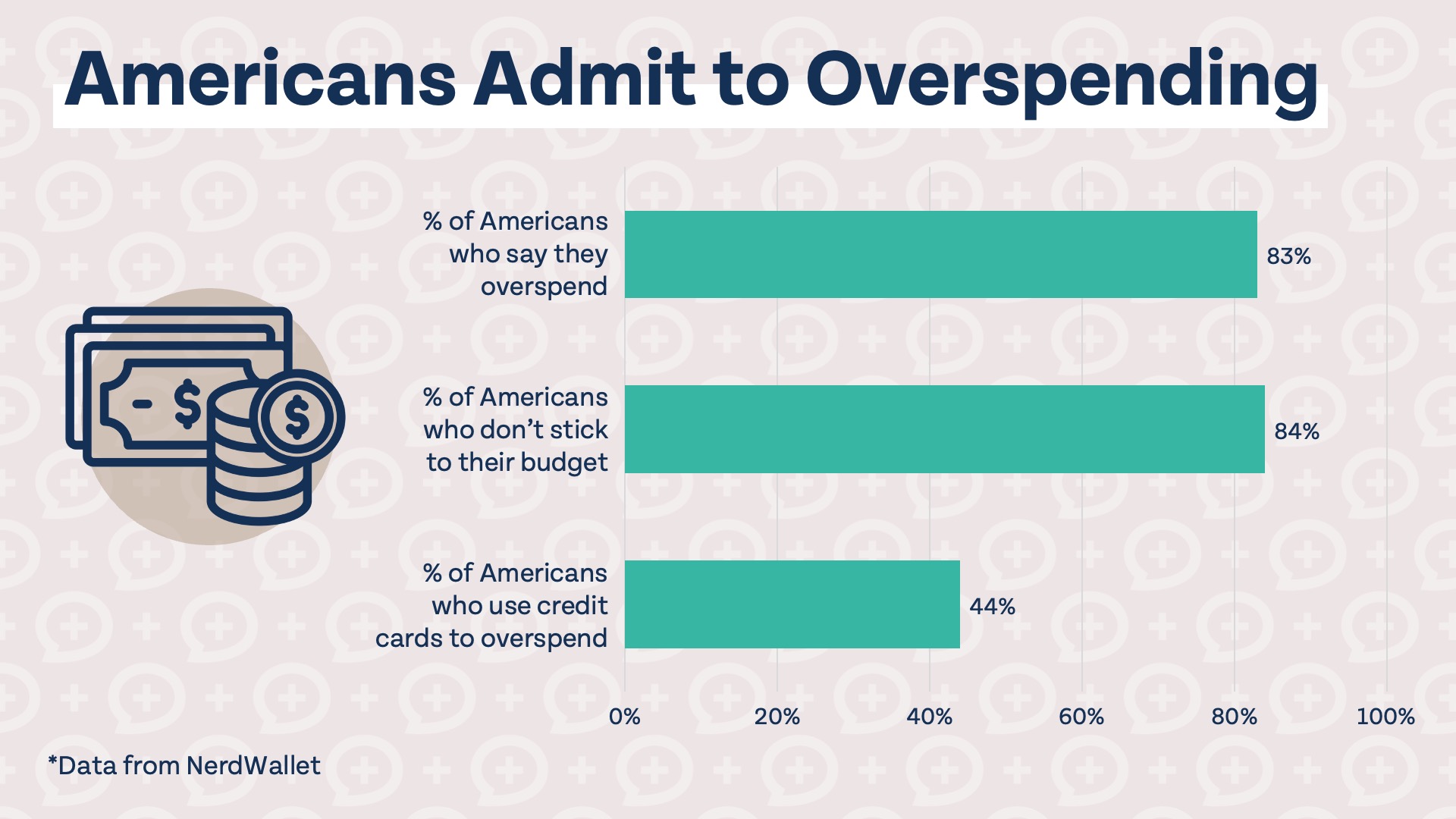

The biggest pitfall is overspending. Studies show that people spend about 12% to 18% more, on average, when using credit cards. Credit card spending often doesn’t feel as “real” as seeing money come out of your bank account or handing over cash. Even if you pay your credit cards in full every month, you still might be spending more than you would if you weren’t using them at all. Credit card rewards and other benefits can make up some of the difference, but not all. If most Americans spend 12% to 18% more when using credit cards, it’s safe to say that most Americans would be better off not using credit cards.

Unless you have the excess income to cover credit card overspending, it will naturally lead to credit card debt. That sounds scary just to type; almost like a dentist warning you that not brushing will lead to cavities, tooth decay, and eventually, root canals. Credit card debt might even be less pleasant than having work done at the dentist.

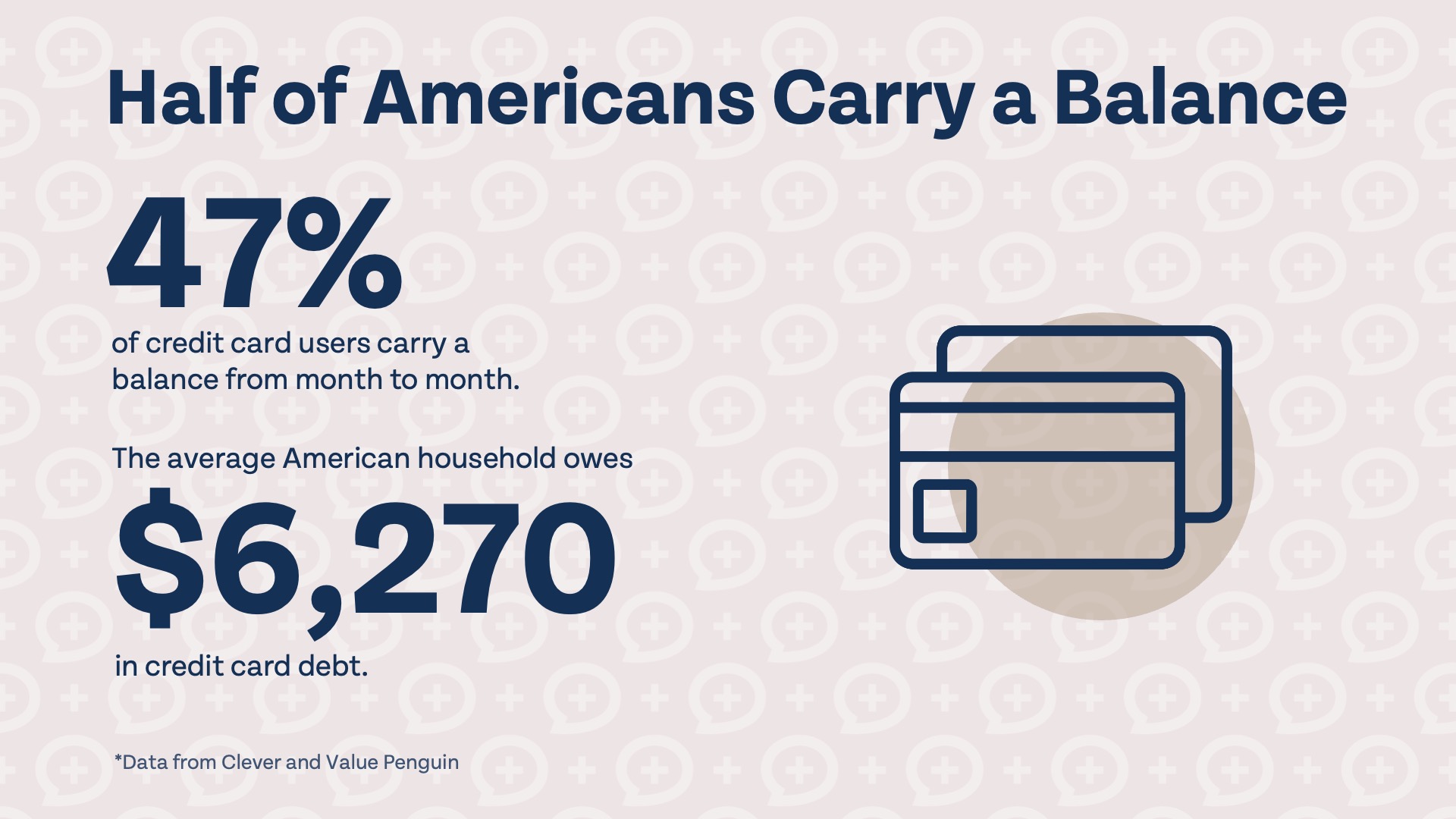

Credit card debt is extremely harmful because it weaponizes compounding interest. Not only does it use compounding interest to harm you, the average interest rate on credit cards, at 24.20%, is substantially higher than you can expect to earn by investing in the stock market. Unfortunately, almost half of all credit card users carry a balance from month to month.

Credit cards can be financially beneficial when used properly, but they can be extremely damaging to your financial life if you carry a balance. If you have trouble controlling your spending when using credit cards, there is nothing wrong with foregoing the benefits of credit cards and using only debit cards. If you are an overspender and will carry a credit card balance, the benefits of using credit cards pale in comparison to the harm that carrying credit card debt can cause.