If you plan on retiring before normal retirement age, or before you can take penalty-free distributions from your retirement accounts, you may be wondering if you need a bridge account to retire. A bridge account is exactly what the name implies – an account that bridges that gap between when you retire and when you have access to traditional retirement accounts.

Tax-advantaged retirement accounts like 401(k)s, IRAs, pensions, and more all restrict access by age or have penalties for accessing funds early. This may not be a problem if you plan to retire at a “normal” age – most allow penalty-free access starting at age 59.5 – but not everyone plans to retire at a “normal” age. If you plan to retire early, you may need to build what is commonly called a bridge account.

What is a bridge account?

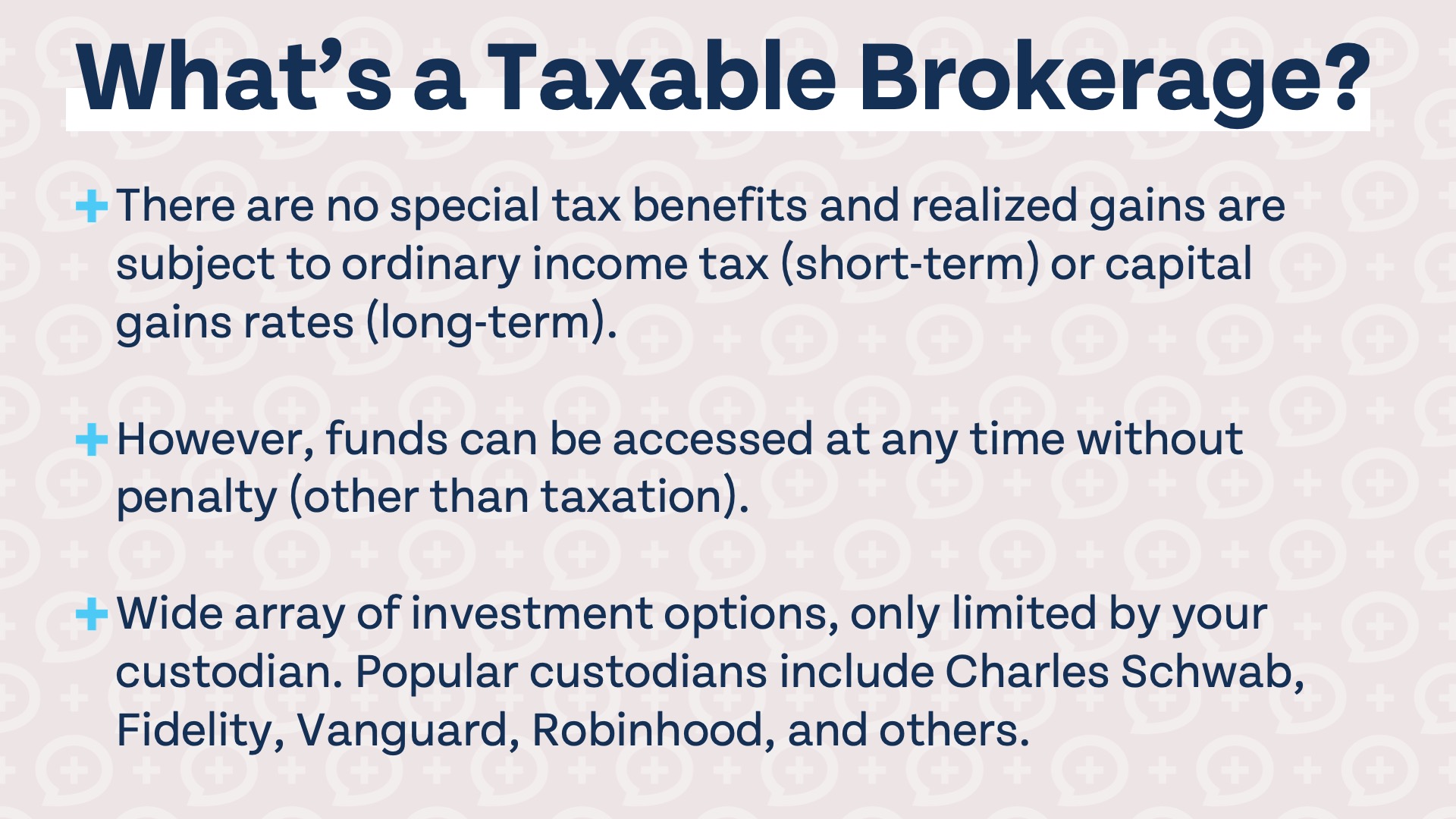

Not just any type of account can be considered a bridge account. Traditional retirement accounts like Roth IRAs and 401(k)s have age limitations on penalty-free access, which creates the need for bridge accounts in the first place. Bridge accounts are most often taxable brokerage accounts.

Taxable brokerage accounts are one of the investment “buckets” in the three bucket strategy, and building taxable assets falls into Step 7 of the Financial Order of Operations, hyperaccumulation. If you follow the FOO, you may find yourself building taxable brokerage assets even if you don’t plan to retire early. Or if you never reach Step 7 you may not build any taxable assets, even if you plan to retire early. Who exactly should worry about building a taxable account and when should you start?

Do you need a bridge account?

Let’s start with the question that’s easiest to answer: if you don’t plan to retire early, but reach Step 7 of the Financial Order of Operations, should you still invest in a taxable account? The short answer is yes, for several reasons. For starters, reaching Step 7 of the FOO means you are already maximizing your Roth IRA, HSA, and employer-sponsored accounts. It might be better for you to contribute more dollars to tax-advantaged accounts, especially if you don’t plan to retire early, but you no longer have that option.

Taxable brokerage accounts have more benefits than just early access. Taxable accounts provide another level of tax diversity in your retirement plan. These accounts are not tax-free, and are not tax-deferred, but subject to short-term or long-term capital gains tax. Unlike all tax-advantaged plans, there are no contribution limits for taxable accounts. Unlike many employer-sponsored retirement plans, investment options in your taxable account are almost unlimited.

Can you retire early without a bridge account?

Now for the tougher question: what if you plan to retire early but will never reach Step 7 of the Financial Order of Operations (and never contribute to a taxable account)? If you follow the FOO to a T, you wouldn’t contribute to a taxable account until you reach Step 7, hyperaccumulation. That means you are already maximizing your Roth IRA, HSA, and employer-sponsored retirement account. In 2024, the combined contribution limit for those accounts, for a single individual under 50, is $34,150.

Unless you have a high income, it’s likely you may never get past investing in your Roth IRA, HSA, and employer-sponsored account. That is totally fine. You can consider Step 7 of the FOO completed as long as you are investing 25% of your income, even if you never contribute to a taxable brokerage account. But for those planning to retire early, not having taxable assets could complicate early retirement.

There are ways to access tax-advantaged retirement accounts early that may negate the need for a taxable brokerage account. For a Roth IRA, you can withdraw contributions at any time without penalty. Gains are still limited to age 59.5, but accessing contributions early could give you some flexibility in your retirement plan. Additionally, the Rule of 55 may allow you to take distributions from your 401(k) and other employer retirement accounts as early as the year you turn 55 if you become unemployed.

If you plan to retire early, it may not be necessary to build a taxable account if you have access to enough assets in other accounts that you can access before traditional retirement age. Every situation is different, though, and you may need to contribute to a taxable brokerage account “out of order” in the FOO in order to retire early. A fee-only financial advisor can help create a personalized plan for you and make sure you develop a plan of action to achieve your retirement goals.

Depending on what your retirement accounts look like, a bridge account may be necessary for early retirement or early access to Roth IRA contributions and your 401(k) may be enough to retire early. Making decisions like whether or not you need a bridge account and how much to contribute, if you do, is extremely stressful and not easy. If you get it wrong, you may not be able to retire when you want – or even worse, you may run out of money in retirement. You only get one retirement and we want it to be as successful as possible. We’ve helped clients navigate hundreds of successful retirements and would love to chat about how we can work with you.