Health insurance is a financial necessity for everyone, regardless of age or how healthy you are. About 25 million Americans don’t have health insurance, which means if they experience a medical emergency they could be in severe financial trouble. It is not uncommon for medical bills to negatively affect a family’s finances, and the country as a whole carries over $220 billion in medical debt. Medical debt isn’t talked about as often as student loans or auto loans, but it is a huge problem that is often easily avoidable. Here’s how health insurance can protect you from the unexpected and how to choose the right plan for you and your family.

Do I need health insurance?

The answer to the question of whether or not you need health insurance is almost always yes. Unless you are a billionaire and have more than enough money to cover any medical bill that could possibly arrive, health insurance is a good idea. No matter how young or old you are, how healthy or unhealthy you are, how much you dislike insurance or hate going to the doctor, you probably need health insurance. The benefits of health insurance may seem mundane; most people just save a little bit at the doctor here and there and don’t experience much savings, if any, from having health insurance. However, the greatest benefit of health insurance is that it covers you if you find yourself needing major medical care for whatever reason.

Without health insurance, what we think of as routine medical events, such as having a baby, could end up costing six figures if there are complications. It is impossible to predict when certain medical diagnoses will occur. A cancer diagnosis can happen to anyone at any time; treatments are always improving and your odds of getting a severe diagnosis may be low, but health insurance protects against those unknowns.

What type of health insurance do I need?

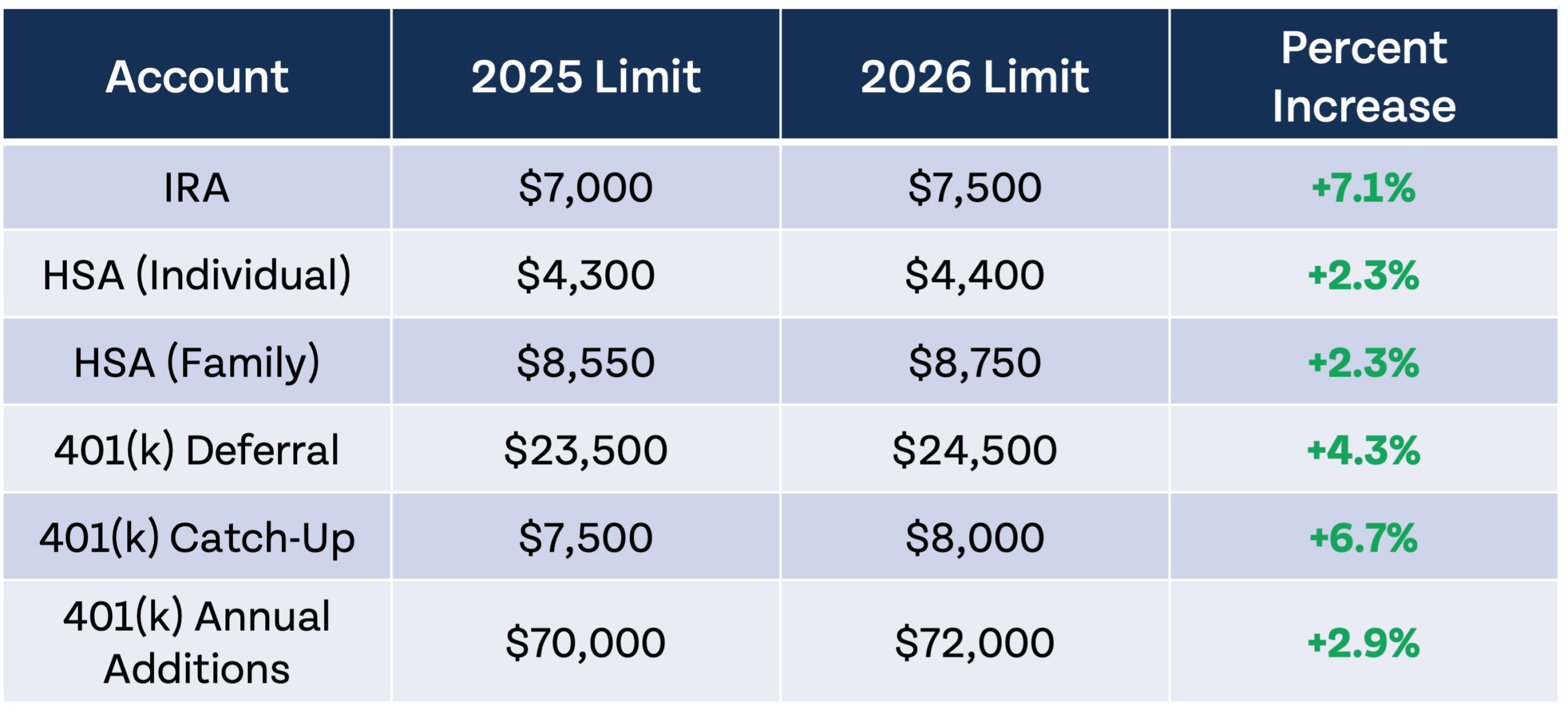

Health insurance isn’t always easy to understand and the options available may confuse you. While the available insurance options differ for everyone, there are two basic categories of plans to choose from: high-deductible health plans or traditional health plans. What is a deductible? This is the amount of money the policyholder pays before the insurance company starts paying benefits. The lower your deductible, the less amount of money you must pay before insurance kicks in. High-deductible plans have higher deductibles when you need care, but your monthly premium is generally lower. For 2024, a high-deductible health plan is any health insurance plan where the annual deductible is $1,600 or greater for single coverage or $3,200 or greater for family coverage. Additionally, annual out-of-pocket expenses must not exceed $8,050 for single coverage or $16,100 for family coverage.

High-deductible health plans (HDHP) come with the added benefit of HSA eligibility, which is one of our favorite retirement savings vehicles. If you are healthy and not expecting any medical expenses outside of a few visits to the doctor, an HDHP may be worth considering. Even though you will pay more if you experience a major medical emergency, an HDHP is infinitely better than not having any health insurance. Plus, choosing a higher deductible plan may save you money each month on premiums and give you the option to invest in the extremely powerful HSA.

Major medical needs can’t always be predicted, but some, like having a baby or opting for an elective surgery, can be. If you are generally healthy but will experience one of these events in a given year, it may be worth opting for a traditional insurance plan with better coverage, at least temporarily. The additional monthly cost may be worth the savings you get if you were to reach your deductible or out-of-pocket maximum. If you have medical conditions that require a great deal of care or are at an age where your medical expenses have increased significantly, a traditional health insurance plan may be the right choice for you.

How can I save money on health insurance?

Choosing the right type of health insurance plan for you and your family can help you save money by minimizing premiums, or if you have more medical expenses, maximizing the amount that insurance will cover. But insurance may still seem very expensive even after picking the right plan for you. Is there anything you can do about it?

Unfortunately we can’t fix the health insurance industry in the US, but you may have some options to make your plan more affordable. If you have health insurance through your employer and it isn’t working out for you or your family, try talking with your employer or HR to see if there is any possibility they may add additional health insurance options in the future. It may be worth looking at options outside of your employer and shopping around to see what else is available. Be wary of certain health share plans that aren’t actually insurance and aren’t subject to the same regulations. These plans can be less expensive, but aren’t legally required to pay claims and have other drawbacks such as limited or no coverage for preexisting conditions.

Make sure you know the ins and outs of what your plan covers so you know the best, and financially optimal, ways to seek the medical care you need. It may be cheaper to use a service like GoodRX to fill prescriptions instead of billing them through your insurance.

Nobody enjoys paying for medical insurance. Chances are you are paying for significantly more than you are receiving, but if you are one of the “lucky” ones who receives more benefits than they pay for, you are likely experiencing a major medical event and it’s pretty hard to be grateful for insurance coverage under those circumstances. No matter how much you dislike health insurance, you can’t go without it. Over 60% of personal bankruptcies are partially or totally caused by medical debt. Choosing the right health insurance plan for you and your family has the potential to save you money and give you access to super-powered tools like HSAs, but can also help put your mind at ease knowing an unexpected medical emergency won’t destroy your finances.