We’ve been known to refer to Roth accounts as the apex predator of building wealth. They have the incredible ability to grow tax-free and qualified withdrawals are entirely tax-free in retirement. We believe that everyone, regardless of income, should use Roth accounts as a retirement planning tool. While it is difficult to overstate the benefits of Roth accounts, it isn’t always better to contribute to Roth over pre-tax.

Roth accounts include the Roth IRA and any Roth employer-sponsored accounts, such as a Roth 401(k). While HSAs aren’t technically Roth accounts, they can still be used as tax-free apex predators, like Roth accounts, when used for qualified medical expenses, so they fall into the same bucket. Following the Financial Order of Operations, you will maximize your Roth IRA and HSA, if you have the ability to do so, at Step 5. No matter your income or tax bracket, we believe it makes sense to maximize these tax-free accounts at Step 5.

Step 6 is where it gets tricky. This is where you maximize your employer-sponsored retirement account, like a 401(k), 403(b), TSP, or other plan. About 93% of 401(k) plans offer a Roth option, in addition to the traditional pre-tax contribution option, so the majority of those with an employer-sponsored plan have a decision to make. Do you contribute to Roth or pre-tax?

If it makes sense for most to contribute to a Roth IRA over a pre-tax IRA, shouldn’t it also make sense to contribute to a Roth 401(k) over a pre-tax 401(k)? Not necessarily. Pre-tax IRAs have lower income phaseouts than Roth IRAs, which means if your income is high enough that contributing to a pre-tax IRA would make sense, you don’t have the ability to do so. However, high-income individuals can contribute to a Roth IRA through what is commonly referred to as the backdoor Roth strategy. It’s not necessarily always better for everyone to contribute to a Roth IRA over a pre-tax IRA, but those that would be better off contributing to a pre-tax IRA likely don’t have the ability because their income is too high. Plus, we believe in tax diversification of your assets, and even if you could construct a portfolio solely consisting of pre-tax accounts, it may not be wise.

The decision to contribute to a Roth 401(k) or a pre-tax 401(k) is a bit different. Both have no income phaseouts, so those with higher incomes have a choice. Choosing which account is more beneficial for you is actually quite simple: is your tax rate lower now than it will be in retirement? If so, contribute to Roth. Is your tax rate higher now than it will be in retirement? If so, contribute to pre-tax. It is impossible to know with certainty what your tax rate in retirement will be, which creates an advantage for Roth accounts: they create tax certainty.

Roth creates tax certainty

If you contribute to Roth retirement accounts, it doesn’t matter what your tax rate will be in retirement. It could be 10%, 50%, or 98%; no matter what, qualified Roth distributions will not be taxed at all (barring any unprecedented changes to Roth accounts by the government). This is a big advantage, even for those that could be looking at lower tax rates in retirement.

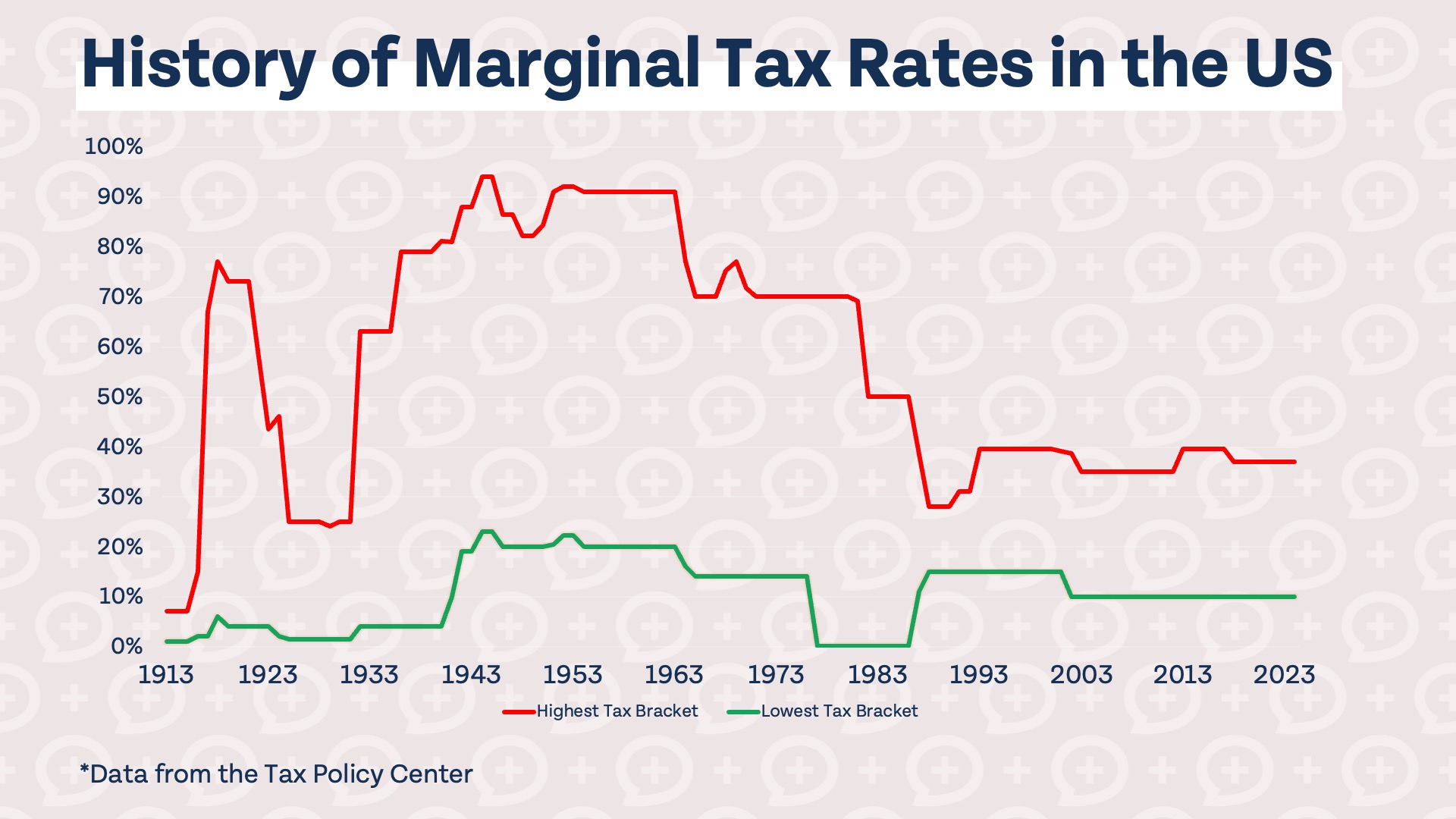

We are currently experiencing a period of historically low taxes on high-income individuals. The only extended period of time with lower rates on the highest income Americans was right before the Great Depression. We don’t like to speculate about future tax rates, but it is easy to look at a chart like this and see that tax rates could be higher in the future, even if your income stays the same. Roth accounts are a way to essentially pre-pay your taxes and lock-in whatever tax rate you are at now. That could be a great thing if you are uncertain whether your tax rate will remain the same in retirement.

Pre-tax could lower your tax burden

The obvious benefit of contributing to pre-tax retirement accounts is they lower your tax burden in the present, which could be more beneficial than delaying that tax benefit until retirement. It is very difficult to know with certainty if your tax rate will be higher or lower than it is now in retirement, so we created a rule of thumb to help you decide if contributing to pre-tax accounts is worth considering. We believe if your combined marginal income tax rate, including any local income tax rate, state income tax rate, and federal income tax rate, is above 30%, you should consider contributing to pre-tax employer retirement accounts instead of Roth. That’s a little confusing, so here’s an example:

Mary is single and makes $150,000 per year. Her highest federal income tax rate is 24%, and she lives in California where her highest state income tax rate is 9.3%. She does not pay any local income tax. Her combined marginal income tax rate is 33.3%, so it may make sense to consider contributing to pre-tax over Roth.

If your combined marginal income tax rate is under 25%, it may be worth considering contributing to Roth accounts over pre-tax accounts. If you are in-between 25% and 30%, take a closer look at your personal tax and retirement account situation. How much do you currently have in Roth accounts vs. pre-tax accounts? Will your taxable income be significantly higher or lower in retirement than it is now? How much are you concerned about the risk of tax rates rising in retirement?

Roth accounts are an incredible tax and retirement-planning tool that we believe everyone should take advantage of. However, high-income Americans especially should consider the advantages of contributing to pre-tax retirement accounts. It is very possible that the present tax benefit of contributing to pre-tax accounts outweighs the benefit of tax-free growth and tax-free distributions in retirement.