Believe it or not, the concept of saving for your own retirement is a fairly recent creation. Brian, our Money Guy, predates the 401(k) plan. Previous generations either worked until they died, relied on Social Security, or were fortunate enough to have a pension that covered most or all of their retirement expenses. These days, only 15% of private company employees have access to pensions. The burden of retirement saving shifting from employer to employee has not been taken in stride. 83% of Americans believe everyone should have a pension, 79% say we have a retirement crisis, and 55% are concerned about their own retirement.

How do you know what amount you need to save to retire comfortably? Will you be able to count on Social Security? What about inflation and investment returns? Here’s how you can estimate how much you need to retire and feel better about unknowns like Social Security, investment returns, and inflation.

How much do you need to retire?

This shouldn’t surprise you, but there is no magic retirement number that everyone should be working towards. Your retirement number depends on many different factors.

- How much will you spend in retirement?

- While it is difficult to know exactly how much you will spend in retirement, you can estimate future retirement expenses. Try inflating today’s spending to retirement. If you aren’t sure what number to use for inflation, try 3%. You can use a free online calculator to inflate your expenses to retirement. If you know you won’t have certain expenses in retirement, like a mortgage payment, subtract those out. This estimate won’t be perfect, but it will give you a place to start in determining how much you need in retirement.

- Will you have fixed income in retirement?

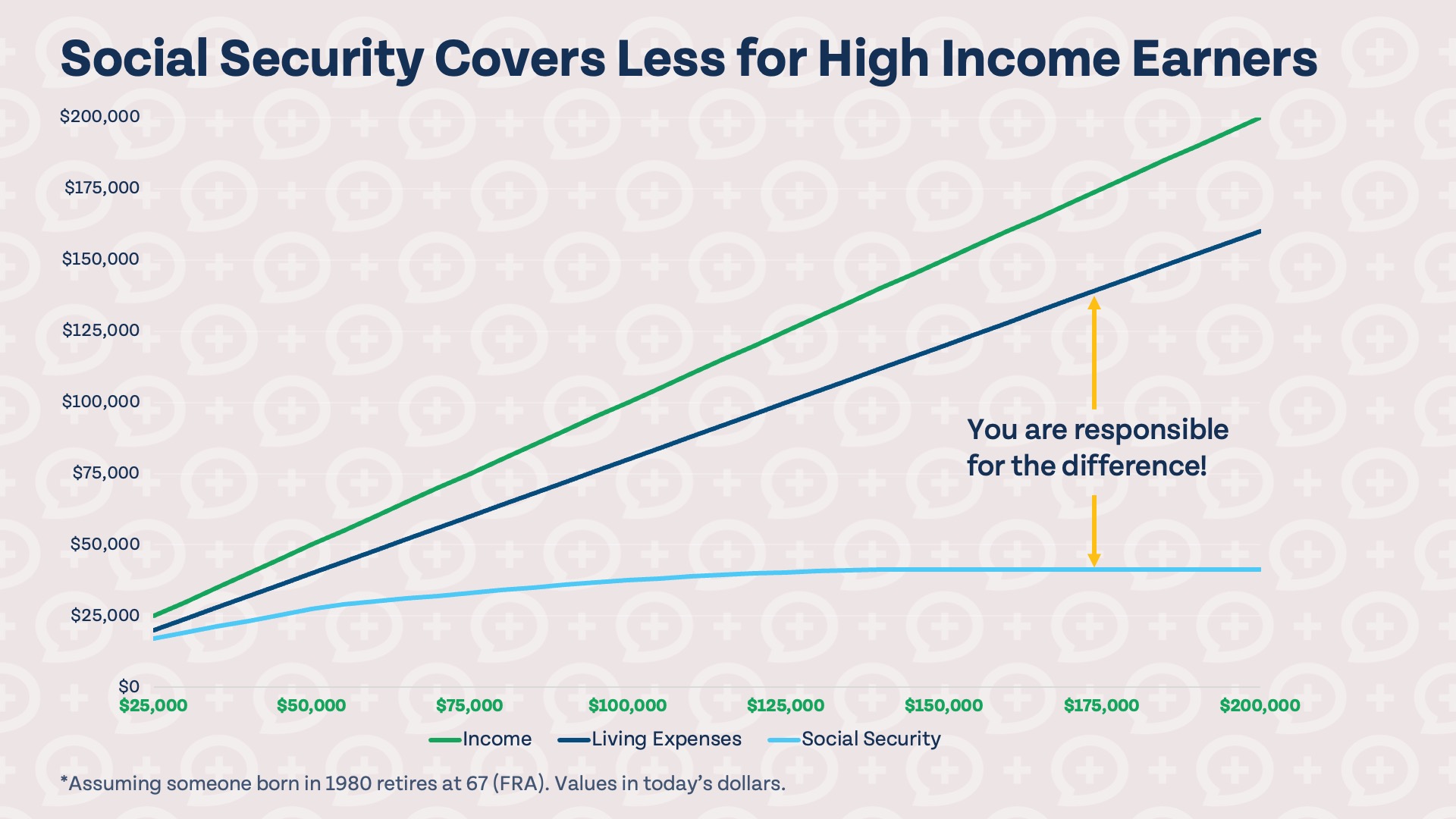

- If you are many decades from retirement, it may be best to not count Social Security quite yet. For those expecting Social Security, it may only cover a small portion of your living expenses (see the chart below). Are you expecting to have any other sources of fixed income in retirement, like a pension? Make sure to factor those into your retirement need.

- What will inflation and market returns look like?

- It’s impossible to know exactly what inflation and market returns will look like from now until you retire, but we can estimate what they could be based on past data. It is better to conservatively estimate investing returns and inflation; would you rather retire with too much money or too little?

- When will you retire?

- You might have a good idea of what age you want to retire, especially if you are closer to retiring, but that number could potentially change. Plan for the unexpected. What happens if you retire sooner or later than expected?

- How long will you live?

- Nobody likes predicting their own mortality, but as far as retirement investing is concerned, it’s usually best to assume you’ll live a long, healthy life unless there is strong evidence to the contrary. It is generally better to leave an inheritance to your descendants than die broke.

How much should you save for retirement?

Once you have an idea of how much money you need to retire, you can determine how much you will need to invest to reach that goal. The great news is if you start young, it takes much less. If you start investing at age 20 and want to reach $1,000,000 by age 65, you would need to invest just $95 each month to do so (assuming an investment return of 10%). If you wait until age 50 to start, though, that number jumps all the way up to $2,480 per month (assuming an investment return of 7%). The younger you start investing, the more your future self will thank you. Imagine big ole sloppy hugs from the retired future you.

Calculating your retirement need

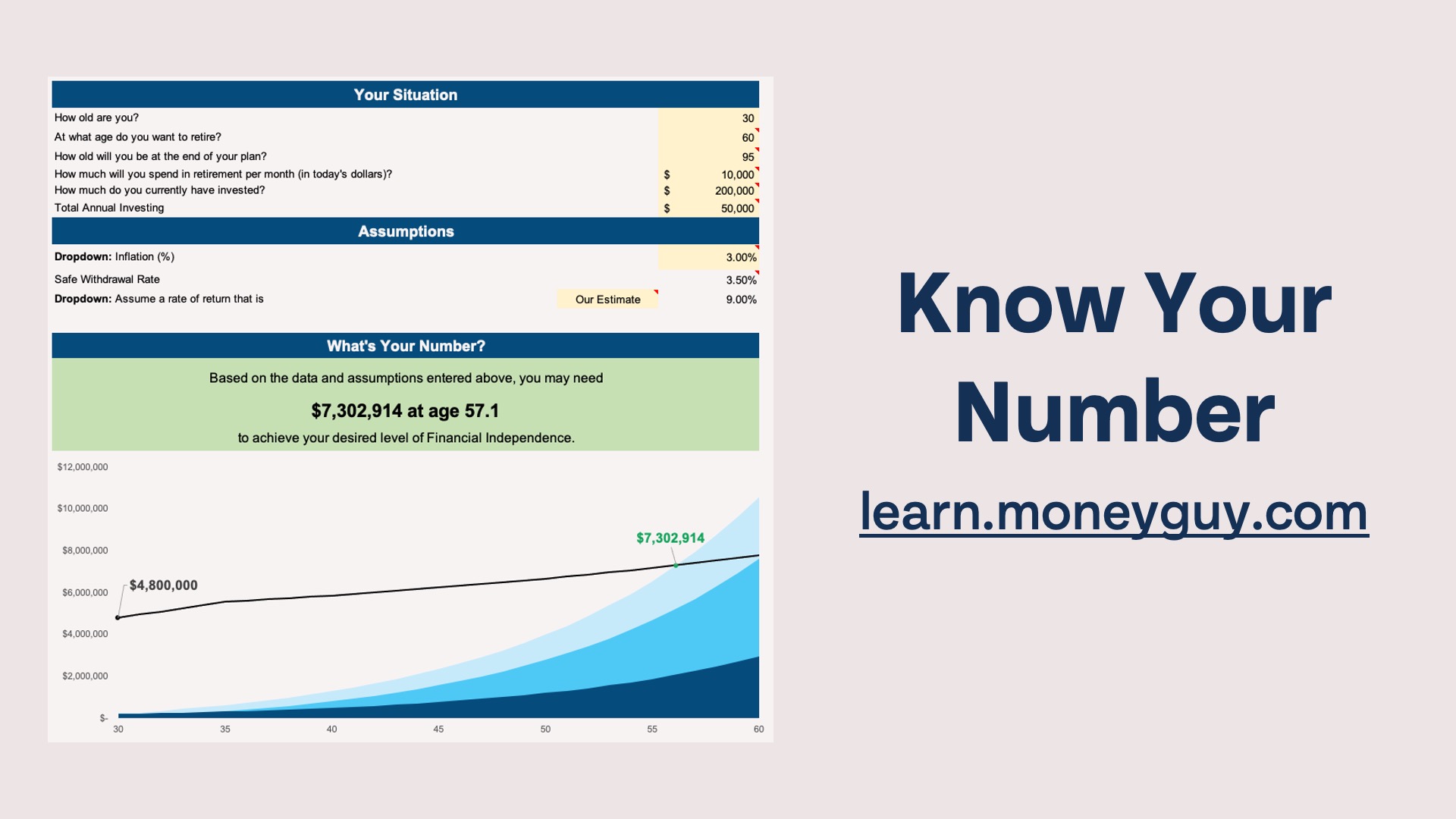

I highly recommend checking out our Know Your Number course if you are interested in calculating your retirement number. The course puts everything together and includes lessons to help you calculate your spending in retirement, different methods for determining your number, inflation, safe withdrawal rates, and so much more. The course also includes the spreadsheet shown below, which is how you will calculate your number.

Some variables are prefilled, but you can adjust different assumptions to see how they change your retirement number. The spreadsheet automatically updates after updating any cells, so it’s very easy to see how changing a single variable would affect your retirement number. Not sure exactly how much you may spend in retirement? See what your number looks like at different levels of retirement spending. Nervous about inflation? See what your number looks like at higher levels of inflation. Not certain what future investment returns will look like? Lower your expected investment return.

Calculating your retirement number is not an exact science because it is impossible to predict the future. So much can change between now and when you retire. Some of it may be in your control, like how much you invest, when you retire, and what you spend in retirement, but variables like inflation and investment returns are not in your control. A great retirement plan isn’t about knowing all of the unknowns, it’s about planning for the unexpected and designing a plan that isn’t heavily dependent on unknowns to be successful.