The pandemic broke the car market, causing prices of both new cars and used cars to skyrocket. Prices are still working their way back to a new normal; used car prices have declined sharply over the last few years, but are still well above pre-pandemic trends, and new car prices have stopped increasing sharply but aren’t going down. Vehicle prices have not yet been impacted by tariffs, but analysts say that if tariffs go into effect as proposed, car prices would go up by about 15%. Even US auto manufacturers would be hit hard because the proposed tariffs apply to all imported car parts. While it is common for cars to be assembled in the US, parts come from all over the world, and tariffs on car parts would impact all car manufacturers.

Despite the murky outlook for the future of car prices, and the fact that new and used car prices are still elevated compared to where they were before the pandemic, it is still possible to buy an affordable and reliable vehicle. Here’s how.

1. Look for “undervalued” cars

Certain car manufacturers have a reputation for producing really reliable vehicles and they can command a premium. From my own personal experience car shopping, it’s difficult to find a Toyota (or their luxury brand Lexus) or Honda (their luxury brand is Acura) at a relatively affordable price. When I was researching reliable car brands, I noticed something interesting. The usual suspects are near the top of every list; Consumer Reports has found the most reliable used car brands to be Lexus, Toyota, Mazda, Honda, and Acura, in that order. J.D. Power’s latest vehicle dependability study found Lexus, Buick, Mazda, Toyota, and Cadillac to be the most reliable brands.

There are some names on that list I wasn’t expecting. I didn’t know that Mazdas were rated so highly, and they don’t have the same “reliability premium” of Toyota or Honda manufactured cars. We went from a Toyota house to a Mazda house, saving a bunch of money in the process and, knock on wood, haven’t had a single issue with either of our (used) cars since we purchased them last year.

If you are getting sticker shock at the cost of some of your preferred cars, don’t be afraid to broaden your horizons and check out other makes and models. Read up on the most reliable used cars or new cars and determine which reliable vehicles you can expect to purchase for a fair price. If you can afford new or used Toyota and Honda prices and prefer those brands, there is nothing wrong with that. If you’re like me, though, and aren’t able to justify the costs of those renowned brands, there are some great cars out there that don’t have a large reputation premium.

2. Find a desperate dealer or manufacturer

Some manufacturers and dealers are sitting on significantly more inventory than they would like. It’s generally better to buy a car towards the end of the year if you can wait, but with the uncertainty of tariffs and the massive amounts of inventory some dealers are sitting on, this summer may not be a bad time to go car shopping. The usual suspects aren’t going to be having fire sales anytime soon: Toyota, Honda, Lexus, and Subaru all have less than 50 days of supply of new cars in the US. A couple brands that appear on many lists as more reliable, Buick and Mazda, have 82 days and 87 days of inventory in the US, respectively.

Some brands that are not as highly regarded have an even bigger supply of cars currently in the country, which would presumably make them even more desperate to make some deals.

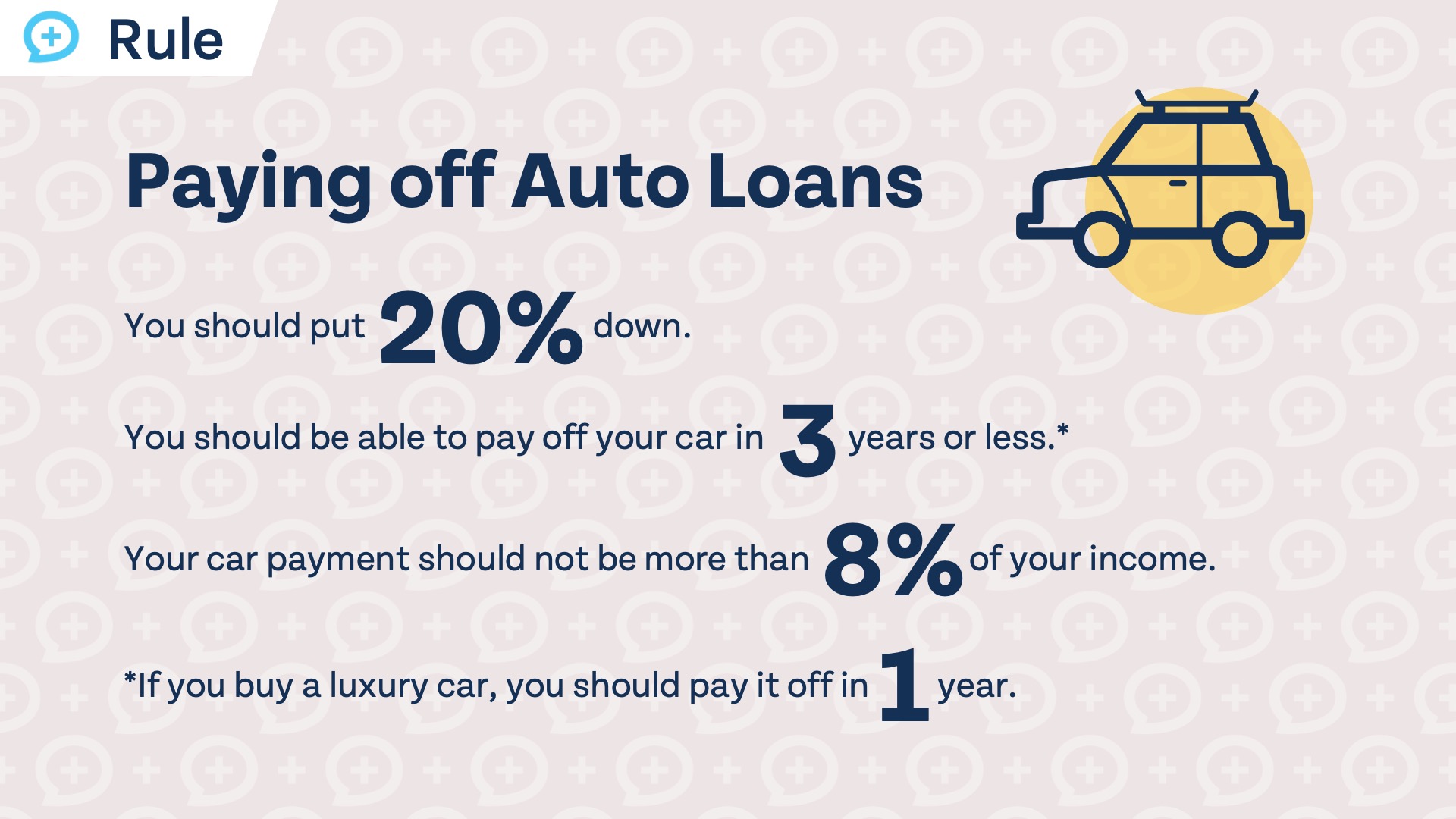

3. Follow 20/3/8

It doesn’t take much for a car to appear affordable on paper. The average auto loan term for new cars is nearly six years, and the average monthly car payment is $745 for new cars and $521 for used. Car dealerships have an incentive to sell you on the monthly loan payment instead of the total price of the car, and by stretching the loan out over a longer period of time, they can make the car seem more affordable than it is. I visited a dealership to purchase a car (after having already picked out the exact car I wanted, which I advise you to do) and the salesman pushed better cars and optional add-ons by emphasizing how little it would change the monthly payment.

You can make almost any vehicle seem affordable if you push out the length of the loan far enough. So how much should you spend on a car and how long should it take you to pay it off? We believe in sticking with a loan term of 3 years or less, keeping all monthly car payments to 8% or less of your gross income, and putting 20% down when you buy your car. The cash down provides a buffer against being underwater on your vehicle right when you drive it off the lot.

Check out our nifty car affordability calculator to get an idea of how much you could spend on a car while following our 20/3/8 rule.

No matter which way you slice it, buying a car is a major purchase that should not be taken lightly. Much has changed in the car-buying market over the last few years, and we could be subject to more major changes in the near future if tariffs on cars and car parts go into effect. With all of this uncertainty, it is still possible to buy an affordable and reliable car. You may have to get creative and look at makes and models different from those you’ve driven in the past, or look at used cars instead of new cars. No matter which car you end up purchasing, make sure to follow 20/3/8 to prevent a car from derailing your finances.