Chances are you’ve heard of the concept of using a whole life insurance policy as your personal bank. We often get asked about it on the show, and as an “outsider” – someone who doesn’t sell insurance or own a permanent life insurance policy – I was curious to learn more about the strategy and how it works.

Infinite banking, also commonly called “bank on yourself,” is a way to use whole life insurance to build savings and leverage cash values for self-financing. It seems like the name of this concept changes once a month. You may have heard it referred to as a perpetual wealth strategy, family banking, or circle of wealth.

No matter what name it’s called, infinite banking is pitched as a secret way to build wealth that only rich people know about. Those practicing infinite banking use it as an alternative to keeping money in the bank or investing in the stock market. How does infinite banking actually work and is it worthy of your time and money?

How infinite banking works

Infinite banking requires a dividend-paying whole life insurance policy, which can be over 20x more expensive than term life policies. You can use other types of permanent insurance, but dividend-paying whole life works the best because premiums do not go up and cash value whole life policies have a guaranteed rate, which is a minimum percent the cash value grows each year. Because of this component, infinite banking is often pitched as something that is “guaranteed” and “can’t lose money.”

The flow chart below shows the basics of how infinite banking works. You, the policyholder, put money into a whole life insurance policy through paying premiums and buying paid-up additions. This increases the cash value of the policy, which means there is more cash for the dividend rate to be applied to, which generally means a higher rate of return overall. Dividend rates at major providers are currently around 5% to 6%. Paid-up additions, or PUAs, have no ongoing premiums but one-time loads of between 5% to 10%, typically.

The entire concept of “banking on yourself” only works because you can “bank” on yourself by taking loans from the policy (the arrow in the chart above going from whole life insurance back to the policyholder). There are two different types of loans the insurance company may offer, either direct recognition or non-direct recognition. Direct recognition loans are subtracted from the dividend-earning portion of your cash value and you pay interest on the loan. Direct recognition loans don’t really work for infinite banking. Taking loans from the policy is such a big part of infinite banking that it doesn’t work if taking out the loans takes away from your cash value and costs you money to interest.

Non-direct recognition loans are loans where the amount is not subtracted from the cash value earning dividends. While you continue to earn dividends on the loan amount, you do have to pay interest on the loan still, and your interest rate could be higher than the dividend rate. One feature called “wash loans” sets the interest rate on loans to the same rate as the dividend rate. This means you can borrow from the policy without paying interest or receiving interest on the amount you borrow.

Is infinite banking a good idea?

The draw of infinite banking is a dividend interest rate and guaranteed minimum rate of return. It’s pitched as something that can never go down, unlike investing in the stock market.

The drawbacks of infinite banking are often overlooked or not mentioned at all (much of the information available about this concept is from insurance agents, which may be a little biased). Only the cash value is growing at the dividend rate. You also have to pay for the cost of insurance, fees, and expenses. Whole life insurance policies can have administrative costs, loads/commissions for the agent, loan fees (in addition to the interest you pay on the loan), and surrender fees. Companies that offer non-direct recognition loans may have a lower dividend rate. Your money is locked into a complicated insurance product, and surrender fees typically don’t go away until you’ve had the policy for 10 to 15 years.

Every permanent life insurance policy is different, but it’s clear someone’s overall return on every dollar spent on an insurance product could not be anywhere close to the dividend rate for the policy. The costs – expenses, fees, commissions, loads, interest – are just too high in aggregate.

To give a very basic and hypothetical example, let’s assume someone is able to earn 3%, on average, for every dollar they spend on an “infinite banking” insurance product (after all expenses and fees). This is double the estimated return of whole life insurance from Consumer Reports of 1.5%. If we assume those dollars would be subject to 50% in taxes total if not in the insurance product, the tax-adjusted rate of return could be 4.5%.

To be clear, in a very generous example, someone may be able to make about 4.5% doing infinite banking. We assume higher than average returns on the whole life product and a very high tax rate on dollars not put into the policy (which makes the insurance product look better). The reality for many folks may be worse.

This pales in comparison to the long-term return of the S&P 500 of over 10%. Right now, in September of 2023, many savings accounts are paying over 5%. Infinite banking is a great product for agents that sell insurance, but may not be optimal when compared to the cheaper alternatives (with no sales people earning fat commissions).

What are the benefits of infinite banking?

Here’s a breakdown of some of the other purported benefits of infinite banking and why they may not be all they’re cracked up to be.

1. Control

The simple idea behind infinite banking is that you can be your own banker without taking loans or relying on a normal bank. However, you don’t actually have more control over your own money. Your cash is locked into a complicated insurance contract with limited access. If you want to leave, like you can at almost any time with a savings account or Roth IRA custodian, there are substantial surrender fees involved for typically the first 10 to 15 years. It is common to see surrender fees 10% to 35% of the cash value.

2. Protection

At the end of the day you are buying an insurance product. We love the protection that insurance offers, which can be obtained much less expensively from a low-cost term life insurance policy. Unpaid loans from the policy may also reduce your death benefit, diminishing another level of protection in the policy.

3. No market volatility

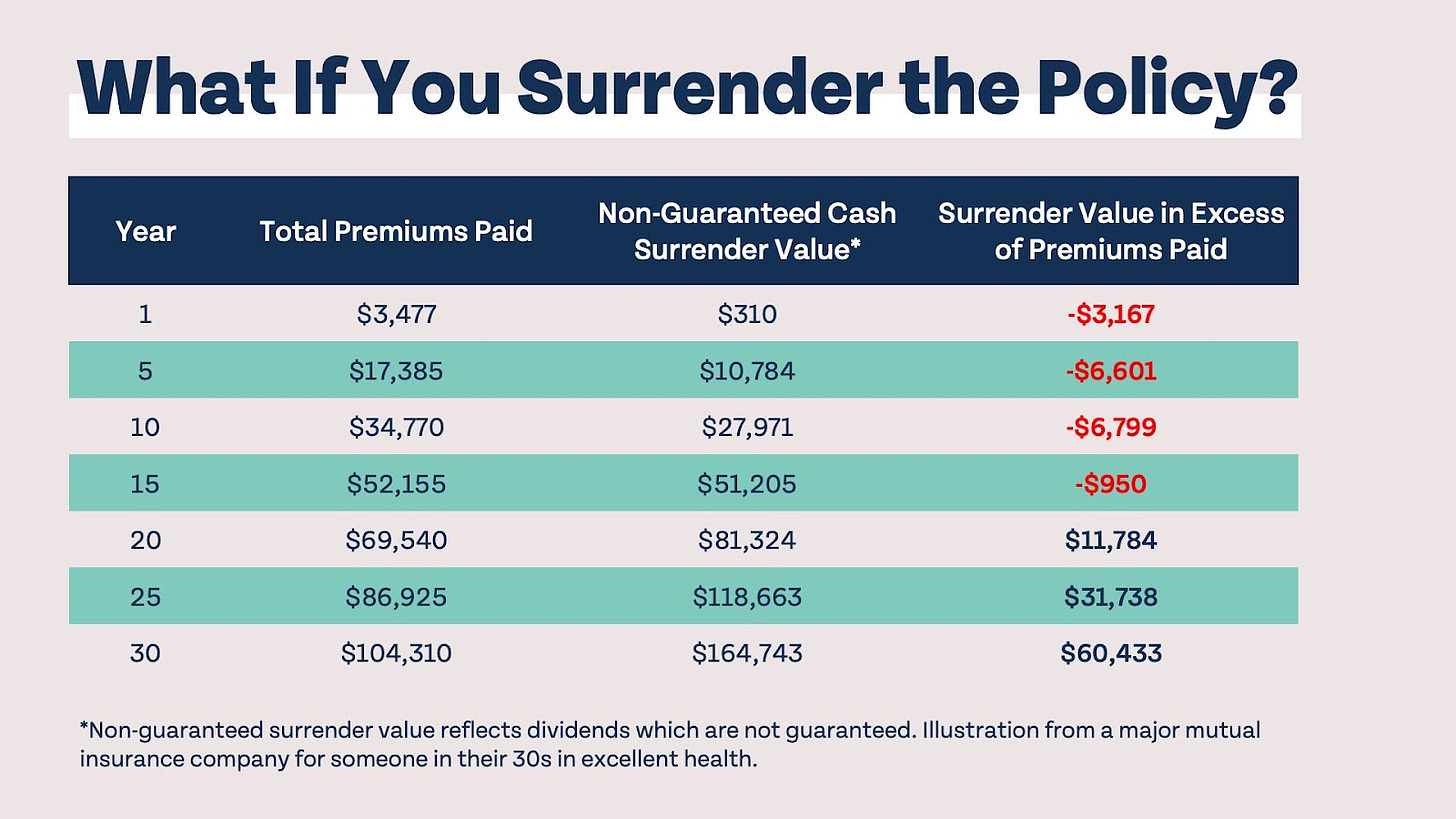

Permanent insurance products may seem attractive to investors with a low risk tolerance that like the idea of never losing money. While your cash value may not decrease in value, you can lose money by surrendering your policy early. The table below shows real numbers from a real policy that a friend of the show was kind enough to let us analyze – notice that you would not break even by surrendering the policy until over 15 years in.

How much do you need to start infinite banking?

The amount of money you need to do “infinite banking” is another huge drawback. The concept only works when you not only pay the substantial premiums, but use additional cash to purchase paid-up additions. The opportunity cost of all of those dollars is tremendous – extremely so when you could instead be investing in a Roth IRA, HSA, or 401(k). Even when compared to a taxable investment account or even a savings account, infinite banking may not offer comparable returns (compared to investing) and comparable liquidity, access, and low/no fee structure (compared to a high-yield savings account).