It’s a question anyone that’s serious about investing for retirement has asked themselves a thousand times: how much do I need to retire? Savers often want a direct, straightforward answer, like “You need $1,529,651 invested to retire.” Unfortunately, coming up with that number isn’t so easy. Before you try to determine your retirement number, there are a few different factors that come into play you need to understand.

Factors that affect your number

1. Expenses

How much you spend is the biggest factor in determining your retirement number. The more you spend, the more you need to have invested for retirement. If you are more frugal, you may be able to get by with less or retire early. Let’s say we have two individuals making $100,000 annually. One wants to really live it up in retirement, spending $200,000 per year, and the other plans to live more frugally, spending just $50,000 per year. Assuming a 4% withdrawal rate, the individual spending $200,000 per year will need $5,000,000 to retire; the other will need just $1,250,000.

You can control your number by controlling how much you plan to spend in retirement, at least to a degree. There are several more factors that have a big impact on your retirement number that aren’t as much in your control.

2. Inflation

There’s a big problem in the example above. Depending on when our two individuals plan on retiring, $200,000 and $50,000 may be worth significantly less. Even if they are already retired, the true value, in today’s dollars, of their retirement distributions will decrease every year they experience inflation. The table below shows how much those retirement distributions would be worth at different points in the future, assuming an annual inflation rate of 3%.

Unless you plan on spending less and less each year in retirement, you need to factor inflation into calculating your number.

3. Life expectancy

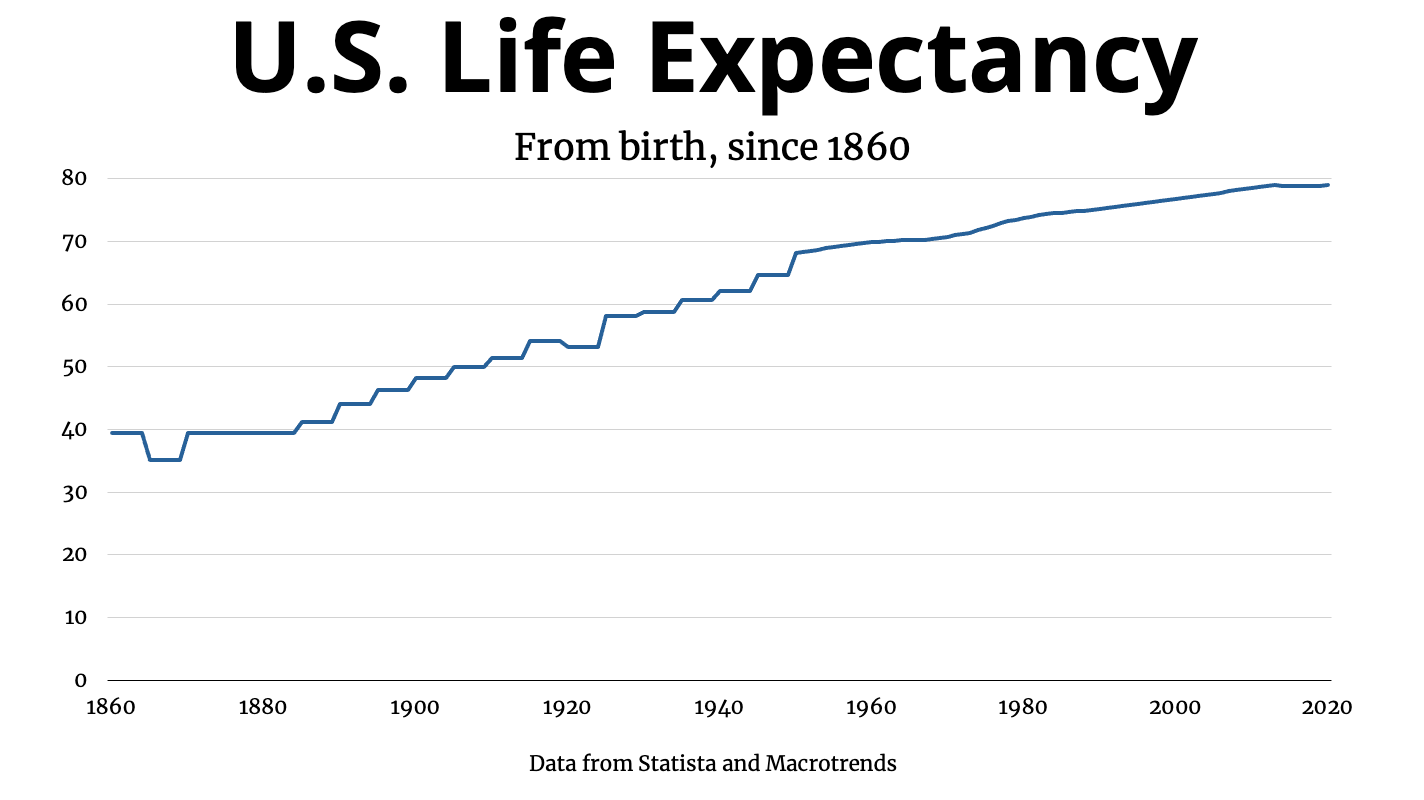

We are very fortunate to live in times where a long retirement is not just a hope, but often an expectation. Since 1900, the life expectancy in the U.S. has gone from 48 to 79. If you make it to age 65, you can expect to live even longer. At 65, men can expect to live to age 83 and women to 86. Someone retiring at 65 can expect to spend a couple decades in retirement, and possibly much longer if retiring early and/or living longer.

Obviously living longer is never a bad thing, but it is something that must be planned for. You need to plan on living a long time, which may mean planning for extra medical expenses in retirement, long-term care, and of course additional years of everyday expenses.

4. Taxes

Here’s a riddle for you: two individuals have the exact same amount invested for retirement, $5,000,000. They both take distributions of $200,000 annually in retirement. However, one is able to spend significantly more than the other. Why is this?

The answer is taxes. More specifically, the account structure of one portfolio is different from the other. An individual with $5,000,000 in a Roth account in retirement will have $5,000,000 to spend in retirement. Someone with $5,000,000 in a pre-tax account will not be able to spend all of that money in retirement. Depending on the state someone lives in, their effective tax rate on $200,000 of retirement income could be around 25% or a little more, based on current federal income tax rates. Out of that $5,000,000, they may only get to spend $3,750,000, or 75% of it. A higher income in retirement can also affect Medicare premiums and the taxation of Social Security benefits.

Optimizing account structure, and when and where you take distributions from, can significantly impact your retirement. If you have questions about account structure and maximization techniques as you get closer to retirement, it may be worth reaching out to a fee-only, financial advisor.

5. Other retirement income

We often hear from individuals with pensions that are concerned they don’t have enough invested for retirement. They may have trouble investing 25% of their income outside of their pension and feel like they don’t have enough in other accounts to retire. In many cases, they aren’t properly counting their pension towards their retirement savings. You can always include your own pension contributions in your gross savings rate, and can include employer contributions if you make under $100k/single or $200k/married.

Pensions work a little differently from 401(k)s and other retirement accounts, but they both can provide you with a stream of income in retirement. Even if you don’t have an account balance, a pension can replace living expenses in retirement. All cash flow opportunities in retirement (pension, social security, and distributions from investment assets) should be considered when calculating your number.

Bringing It All Together

Determining how much you need to have invested to retire is no easy task. There are many factors to consider when calculating your number, some of which you have no control over. We don’t know what inflation will look like in retirement, it’s impossible to know how long we will live, and while you can optimize your accounts in a tax-efficient way, it’s difficult to predict what tax rates will look like decades in the future.

But there are many things we do know. We do know what tax rates have been in the past (and how they have fluctuated). We know how inflation has varied over the last 100+ years in the United States. We also know how long the average American is expected to live at birth and age 65, and we likely know how long our parents, grandparents, and great-grandparents lived. Knowing your number isn’t about knowing everything, but about making informed, conservative estimates based on historical data, retirement goals, family history, and more.

This can feel daunting, whether you are a beginner or your financial life is more complex. We are planning more content regarding the concept of knowing your number, so make sure you keep an eye on our channel and social channels over the next few months! What questions do you have? We’d love to hear how we can help you determine your retirement plans and ultimately Know Your Number.