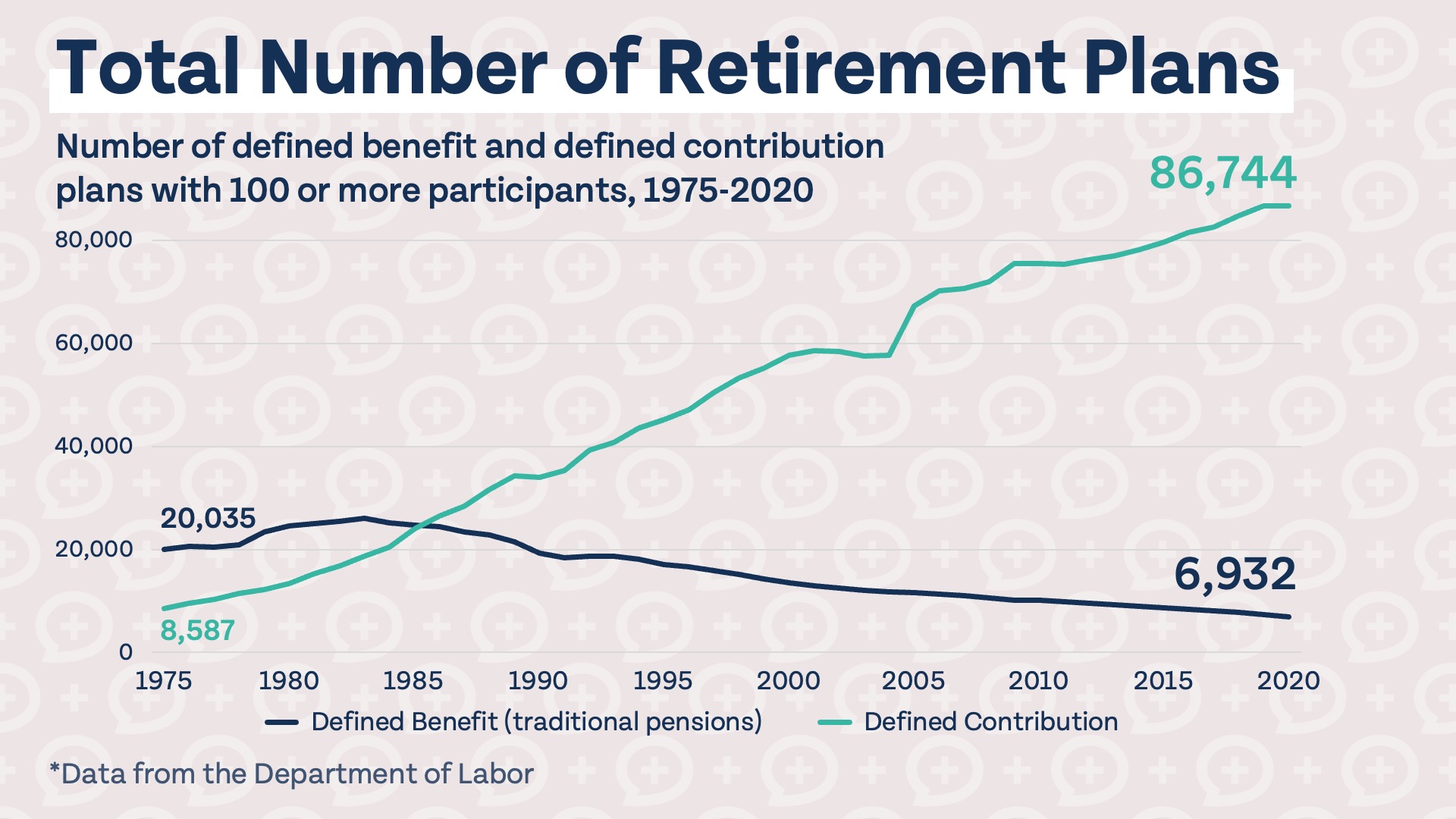

A pension plan is a retirement plan that provides a certain amount of income every month in retirement. Also called defined benefit plans, if you have a pension you will receive income from the plan from the day you retire until you die (or beyond, if you choose a survivorship option). Pension plans have become much more uncommon over the last few decades and have been replaced primarily by defined contribution plans, which includes 401(k) plans. While it’s estimated that less than 13 million private sector workers have pensions, there are over 20 million government employees in the US, the vast majority of which have pension plans.

If you are one of the fortunate Americans with a defined benefit pension plan, how should you think about saving for retirement?

How certain is your pension?

Will your pension still be there when you retire? Nearly one million Americans are currently receiving income from the PBGC, or Pension Benefit Guaranty Corporation, because they were enrolled in one of over 5,000 failed pension plans. It is not very uncommon for a pension plan to fail, but fortunately the PBGC covers most plans. They do not cover government pensions, military pensions, those associated with religious institutions, or small professional practices with less than 25 employees. While government pension plans aren’t covered by the PBGC, they are generally considered low-risk since governments can raise taxes to overcome a funding shortfall. Private companies don’t have this luxury.

If you have a government pension, it is worth reading up on the federal or state laws that apply to your pension and outline what steps will be taken if there is a funding shortfall. In general, most pension plans can be considered safe, but it is important to understand the protections in place if something were to happen to your own pension plan.

How much should you invest outside of your pension?

How much money should you invest for retirement if you expect to receive a pension? Before you completely factor your pension into your retirement need, make sure you will absolutely be eligible to receive your pension payments. There may be service requirements you need to meet before becoming eligible, so if there’s a chance you will leave your job before you meet the service requirements, it may be best not to count that pension just yet.

If you are certain you are eligible to receive benefits in retirement, how do you determine what you should invest outside of your pension? There are many factors involved, but at the end of the day, it is a simple math equation. If you reduce your expected retirement expenses by a conservative estimate of your pension income, you can calculate how much you need to invest to fund that goal.

If that sounds complicated, don’t worry! We created our Know Your Number course to help you determine your retirement number and how much you should be investing to reach that goal. The course includes a nifty spreadsheet where you can adjust different variables like your expected expenses in retirement, age at retirement, life expectancy, and more to see if you are on-track to meet your retirement goals.

How to think about investment allocation

If a pension plan is a safe investment that provides a certain amount of income in retirement, does that mean I can be riskier with my other investments? Not necessarily. There is no one-size-fits-all answer to risk in your investment portfolio. Everyone has different goals and risk tolerance that factor into how aggressive or conservative you may want to invest. In general, if you have a very large and safe pension plan, you may be able to invest more aggressively in other retirement accounts. If your pension plan is smaller and not as safe, it may be unwise to invest so aggressively in outside accounts.

What if something happens after you retire?

After you retire and start receiving income from your pension plan, you may feel like you’re in the clear. However, something could happen to your company after you retire that may affect your pension plan, like bankruptcy or underfunding. Most private pensions are covered by PBGC insurance, which would cover your pension income up to legal limits if something happened to your plan. It is important to research whether or not your pension plan is covered by PBGC and what would happen if your company went bankrupt or could no longer fund the plan.

What about your loved ones?

If both you and your spouse are dependent on your pension income, they could be in quite the pickle if you were to die before them. That’s why it’s so important to understand survivorship options available in your pension plan. Many plans have the option to choose a joint or survivor option, which will likely decrease your monthly benefit, but would provide income for the life of both you and your spouse. Without this option, your pension income would stop when you died, which could be very bad for a spouse that depends on that income to live.

Pension plans have become more uncommon in the US, but there are still tens of millions of Americans that will likely receive pension income in retirement. They are very different from 401(k) plans, and knowing whether or not you can depend on your plan, how much to invest outside your pension, and how to change your investment allocation, if at all, can help you reach your more beautiful tomorrow in retirement.