Last Updated

May 15, 2025

Read Time

Share

Taxes! Nobody enjoys them, but we all have to pay. While tax evasion is illegal, tax avoidance is a smart way to pay less in taxes and is even encouraged by the tax code.

In this guide, we’ll walk you through our favorite tax planning strategies that are applicable to just about anybody looking to reduce taxable income and save money every year.

- Most typical American households

- People planning to retire and wanting to optimize what they pay in taxes

- Small business owners, freelancers, and solopreneurs

- Businesses and high net worth individuals

Free! Download our 2025 Tax Guide Resource.

Key Takeaways

Copy link to this section: Key Takeaways

Copied the URL to your clipboard!

- Even a little planning & strategy can go a long way.

- Tax planning is a year-round process.

- You can (and should) do a lot of tax planning yourself. Just know when to hire an expert.

- Our three-bucket tax strategy for reducing taxes and saving more for retirement.

- All of our very best free tools, resources, popular episodes, and recommendations for keeping the dollars you’ve worked so hard to earn and save.

The Importance of Proactive Tax Planning

Copy link to this section: The Importance of Proactive Tax Planning

Copied the URL to your clipboard!

There is one issue that unites the country across party lines. Less than 10% of both Republicans and Democrats believe that they are paying too little in taxes, and the majority believe they are taxed too much. While our tax system is not a “pay what you want” model, there is tax planning you can do to effectively lower your tax burden.

There are many misconceptions about what tax planning looks like. Here’s what tax planning is not:

- It is not shady or unethical.

- It is not a magical solution to pay nothing in taxes.

- It is not only available to the rich or high income individuals.

Good tax planning optimizes your current financial life by making minor changes to save on taxes. We’ll talk much more about strategies you can implement to optimize your tax situation, but here is one example of good tax planning:

Joanne contributes $10,000 per year to her favorite charity. She takes the standard deduction on her taxes each year. Her financial advisor suggests she “bunch” charitable contributions and instead contribute $30,000 to her favorite charity every three years. By doing this, Joanne can itemize on her taxes once every three years and use her charitable contributions to lower her tax burden.

In this example, Joanne doesn’t drastically need to change her current behavior. She still contributes the same amount to charity, but changes when she contributes to save on taxes. This is great tax planning because it takes an existing behavior (contributing to charity) and alters it slightly to save on taxes.

It’s easy to see there is nothing shady or unethical about changing when you contribute to charity, and it’s just smart tax planning. Smart strategies like this are available across all different incomes, and tax planning should not be thought of as something only for the rich.

There is plenty of tax planning you can do yourself without the help of a professional; your tax planning can be as simple as contributing to a Roth IRA! However, you always want to err on the side of caution and consult a licensed tax professional if you ever have any questions or concerns about your taxes.

Tax planning isn’t a single step in the Financial Order of Operations. You’ll find that tax planning can be done anywhere in the FOO, whether you find yourself on Step One or Step Nine.

Money Guy’s Three-Bucket Tax Planning Strategy for Investing

Copy link to this section: Money Guy’s Three-Bucket Tax Planning Strategy for Investing

Copied the URL to your clipboard!

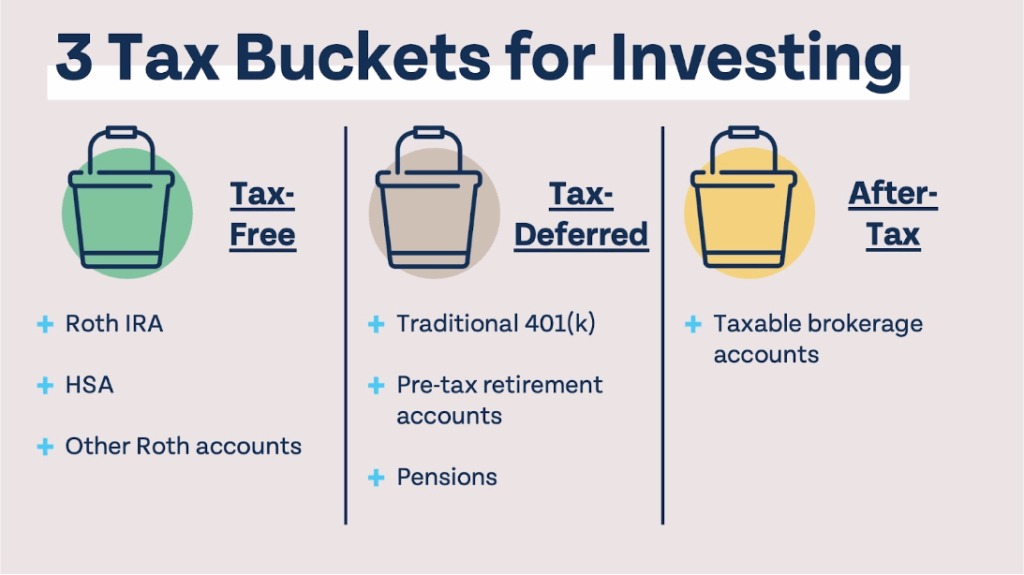

Our three bucket strategy for retirement investing is a simple way to optimize your retirement investing strategy (and contribute to accounts in the most tax-efficient way possible). We believe that there is a certain order you should contribute to retirement accounts in order to build your assets in the most efficient way possible and save money on taxes.

The first place you’ll invest for retirement is your employer-sponsored retirement account if you have an employer match. This account isn’t the most powerful from a tax savings perspective, but a dollar-for-dollar employer match offers a 100% rate of return on your investment, which more than makes up for any lost opportunity cost.

If you don’t have an employer match, or have already taken full advantage of the employer match, the next place you may consider investing for retirement is in tax-free accounts. These accounts include a Roth IRA, HSA, and other Roth employer-sponsored accounts. The best part about contributing to tax-free retirement accounts isn’t the tax savings in the present, although you do save on taxes by contributing to an HSA; it’s the future tax savings that make these accounts so powerful. As long as money is taken out of tax-free accounts as qualified distributions, every dollar you take out is completely tax-free.

This means if you have a large amount of tax-free assets in retirement, you will in turn have a large amount of tax-free income in retirement. There may not be any better strategy to reliably save money on taxes than contributing to tax-free retirement accounts.

Tax-deferred retirement accounts offer a tax benefit in the present, but are taxed at ordinary income rates in retirement. These include pre-tax 401(k)s, other employer-sponsored tax-deferred accounts, and pensions. Contributions to these accounts are not taxed as income in the present, so they can lower your taxable income and reduce your tax burden. However, if these accounts grow substantially by retirement, you could experience a large tax burden when taking distributions from these accounts.

After-tax accounts offer no special tax advantages, but eligible assets held for one year or more are taxed at long-term capital gains rates. This can be very beneficial, especially if you are in a lower capital gains tax bracket. There are several advanced tax-saving strategies that can be deployed in taxable brokerage accounts, including tax-loss harvesting, capital gains avoidance, and more. If you are interested in learning more about using these advanced strategies in your own life, feel free to reach out.

Money Guy’s Tax Planning Resources

Copy link to this section: Money Guy’s Tax Planning Resources

Copied the URL to your clipboard!

Every year, we update our popular Tax Guide to reflect the latest IRS contribution limits and other information you need to succeed.

- Free Resource – 2025 Tax Guide Download (looking for the 2024 Tax Guide?)

- Article – The IRS Just Announced 2025 Tax Changes!

- Show Episode – 2025 Tax Changes You Can’t Afford to Ignore!

Doing Your Own Taxes

Copy link to this section: Doing Your Own Taxes

Copied the URL to your clipboard!

Does it make sense to do your own taxes or should you hire a professional? There is no one-size-fits-all answer, and if you are ever in doubt, it is best to consult a licensed professional. If your tax situation is very simple and you only have one W-2 job, filing your own taxes might be quite simple. If you are in a more complex tax situation with multiple sources of income and own a business, it may be possible to file your own taxes, but that doesn’t mean it’s necessarily a good idea.

The risk of not getting your taxes right is substantial, so if you ever doubt your ability to file your own taxes, please seek the help of a trusted, licensed professional. The cost of using a professional is a bargain compared to the headaches and trouble that could come from filing your taxes yourself and doing something wrong.

No matter whether you are filing your taxes yourself or hiring a professional, keep all records related to your income, tax deductions and credits, if applicable, all business records if you own a business, and any other information that may be required to file your taxes. If there is ever an issue with your tax return, it is imperative that you keep meticulous records and are able to back up all of the information on your tax return.

Let’s Review Tax Fundamentals

Copy link to this section: Let’s Review Tax Fundamentals

Copied the URL to your clipboard!

No matter how much experience you have with the US tax system, it’s important to have a base level of knowledge about how taxes in America work to understand what type of tax planning may be effective for you.

Types of Taxes

Copy link to this section: Types of Taxes

Copied the URL to your clipboard!

Understanding how different taxes affect your financial picture is crucial for effective planning.

Federal Income Tax

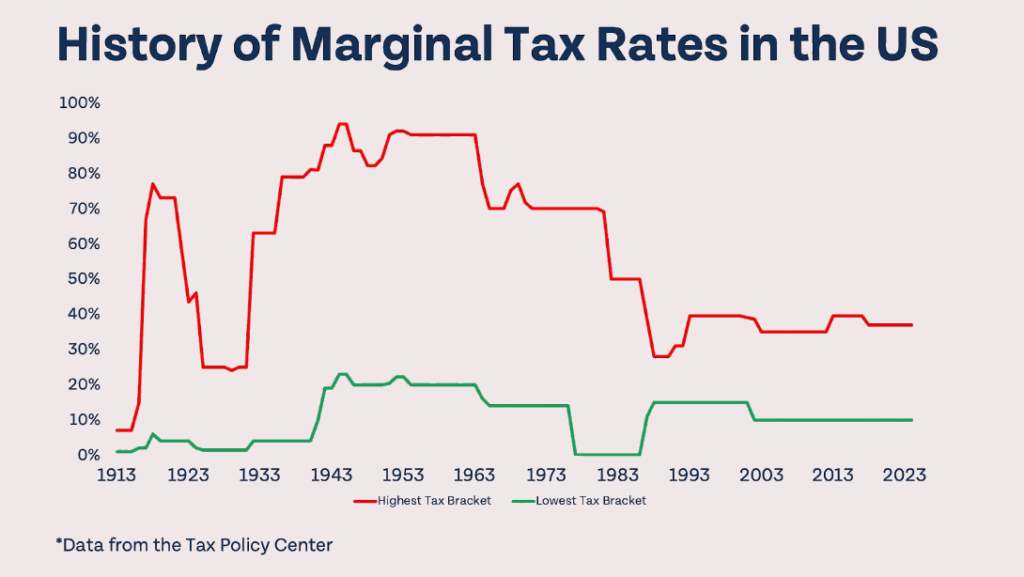

When politicians talk about raising or lowering taxes, they are usually talking about federal income tax. It is the largest tax in the US, by total amount collected, and raising or lowering it is always a hotly debated subject. In the US our federal income tax system is progressive, which simply means that as your income increases, so does your tax rate. The chart below shows how marginal income tax rates in the US have changed over the last 100 years.

Share image

Rates currently range from 10% to 37% based on your taxable income, however that does not mean that all of your income is subject to a certain rate. For example, if you are single and make over $609,350 in 2024, any taxable income over that amount will be subject to the highest 37% rate. However, income at and under $609,350 is taxed at lower rates (your first $11,600 of taxable income is taxed at 10%, the next $35,550 is taxed at 12%, and so on). Check out the IRS federal income tax brackets and rates for more information about what level your income may be taxed at.

The income tax brackets someone falls into doesn’t determine how much tax they will actually pay – it just determines what they will pay on their taxable income. Due to deductions and credits, taxable income is less than actual income and therefore your effective tax rate – the percentage of your total income you pay in taxes – is less than your tax bracket. Those making under $50,000 per year have an average effective tax rate below 5%, and those making between $50,000 to $100,000 pay an effective tax rate of just over 7%. The highest income Americans, making $5 million or more per year, pay an effective tax rate of 26%.

State and Local Taxes

It should come as no surprise that state and local taxes vary substantially depending on where you live. Some states have no income tax, and make up the difference through other taxes, like sales tax and property tax. Others have relatively high state taxes, but lower sales tax or property tax (there are five states with no sales tax, but no states without property tax).

Depending on how much money you make, it may actually be more financially advantageous for you to move to a different state. States with a higher income tax place more of the tax burden on high-income individuals, while states with no income tax and higher sales and property taxes place more of the tax burden on the lower and middle class.

Not only do states have different taxes and tax rates, they also may offer unique tax advantages (or disadvantages) to living in a certain state. For example, lawmakers may pass a retirement income tax credit to encourage retirees to move to their state, or business tax credits to encourage economic development.

Property Taxes

While you aren’t directly responsible for paying property taxes if you don’t own any property, the property tax rate in your state, county, or parish will still affect you. If you live in an area with a high property tax rate, it will not only be more expensive to own a home, but more expensive to own a business, rent an apartment, and buy from local businesses.

Property taxes do tend to increase over time, either by the value of your property increasing or the tax rate itself increasing. This can significantly impact homeowners who otherwise are paying a fixed cost for their home each month. They could even get pushed out of an area if they are no longer able to afford property taxes or homeowners insurance costs.

Sales Tax

Unlike income tax, sales tax is considered regressive because low-income taxpayers pay a larger portion of their income than high-income taxpayers, consumption being equal. Sales tax applies to most goods and services purchased, but states or localities may exempt certain necessities like groceries and medicine. Some also have certain days or times of the year that are “tax holidays” where most or no goods purchased are subject to sales tax.

The amount of tax owed on a good can be a big deciding factor for major purchases. Rules are different across the US. Sales tax rates range from 0% (five states have no sales tax) to California with a base rate of 7.25% (if you include local sales tax, the highest is Arab, Alabama at 13.5%).

Less Common Tax Types

There are a number of other types of taxes that are important but less common for ordinary filers. We’ll be covering these more in-depth in an upcoming part II of this article called “Advanced Tax Planning”.

Tax Brackets and How They Work

Copy link to this section: Tax Brackets and How They Work

Copied the URL to your clipboard!

Tax Filing Statuses and What They Mean for You

There are five tax filing statuses, single, married filing jointly, married filing separately, head of household, and qualifying surviving spouse. You might be able to file as more than one status, in which case you typically choose the most advantageous tax filing status. Your filing status affects:

- Tax bracket thresholds

- Standard deduction amount

- Available credits and deductions

- Overall tax liability

Tax-Advantaged Accounts

Copy link to this section: Tax-Advantaged Accounts

Copied the URL to your clipboard!

Tax Free Retirement Accounts (TFRA) and Others

Tax-Free Retirement Accounts (TFRAs) and similar vehicles like Roth IRAs allow you to invest after-tax dollars that grow tax-free and can be withdrawn without paying additional taxes in retirement, providing a valuable tax diversification strategy alongside traditional retirement accounts.

401(k) and 403(b) Plans: Maximizing Employer Contributions

Pre-tax retirement plans such as employer-sponsored 401(k) and 403(b) plans offer a great tax advantage for qualified contributions: they aren’t subject to federal, state, or local income tax. Contribution limits for 401(k) plans and similar employer-sponsored plans are $23,000 for 2024 (or $30,500 for those 50 and older), which can mean a substantial saving on your taxes if you maximize your contributions.

There’s a huge potential benefit to employer-sponsored plans that isn’t available in Roth IRAs or HSAs: a potential employer match. If your employer offers a match on your contributions, take full advantage of it as soon as possible. This is essentially free money from your employer. 401(k)s may have some downsides that aren’t in your control. It isn’t uncommon for investment options to be more limited and fees to be higher than in Roth IRAs. Loan provisions and hardship withdrawals should only be used as a last resort, but are available if you find yourself in a really tough situation.

Traditional and Roth IRAs: Choosing the Right Option

Due to the powerful tax-free nature of the Roth IRA, we believe that everyone who has the ability to contribute should take full advantage. Traditional IRAs are similar to pre-tax 401(k) plans. Contributions are not subject to income tax, but distributions are. Roth IRAs are one of the most powerful retirement savings accounts available because qualified distributions are entirely income tax-free in retirement. Here’s a breakdown of the differences between traditional, or pre-tax, IRAs and Roth IRAs.

Traditional IRA

- Tax-deductible contributions (income limits apply)

- Tax-deferred growth

- Required Minimum Distributions (RMDs) starting at age 73

- 2024 contribution limit: $7,000 ($8,000 if age 50+)

Roth IRA

- After-tax contributions

- Tax-free qualified withdrawals

- No RMDs during owner’s lifetime

- Income limits for direct contributions

- Backdoor Roth strategy for high earners

SEP IRAs and SIMPLE IRAs

Self-Employed and Small Business Owners, you might be wondering about the SEP and SIMPLE IRAs. We’ll cover those in a forthcoming follow up to this article covering more advanced tax planning.

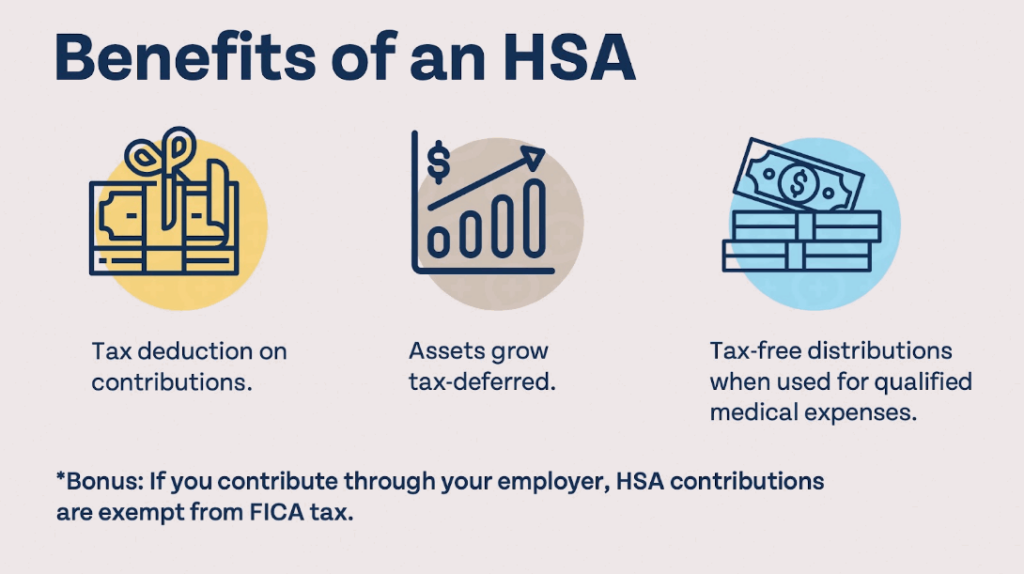

Health Savings Accounts (HSAs)

HSAs are one of our favorite retirement accounts, for good reason. Contributions qualify for a tax deduction, assets grow tax-free, and qualified distributions are also entirely tax-free. No other tax-advantaged savings vehicle offers a tax deduction on contributions and tax-free qualified distributions. The catch is distributions must be used for eligible medical expenses to be considered qualified, but even if you have more HSA dollars than medical expenses, the account can be used similarly to a traditional IRA starting at 65.

HSA Triple Tax Advantage

- Tax-deductible contributions

- Tax-free growth

- Tax-free withdrawals for qualified medical expenses

Share image

HSA Eligibility and Contribution Limits

Not everyone is able to contribute to an HSA; you may only contribute if you meet all of the following requirements below. It is important to note that these requirements only apply to HSA contributions; you do not need to be HSA-eligible in order to spend money from an existing HSA.

Requirements:

- Must have qualifying high-deductible health plan (HDHP)

- No other disqualifying coverage

- Not enrolled in Medicare

- Not be claimed as a dependent on someone else’s tax return

2024 Contribution Limits:

- Individual: $4,150

- Family: $8,300

- Age 55+ catch-up: Additional $1,000

Using HSA Funds

HSA money can be used for a wide range of medical expenses. If you are unsure if a medical expense is HSA-eligible or not, check out this list of common expenses that have been deemed HSA-eligible.

Qualified Medical Expenses for HSAs generally include, but are not limited to:

- Doctor visits and prescriptions

- Dental and vision care

- Medical equipment and supplies

- Long-term care insurance premiums

- Medicare premiums (except Medigap)

What if we told you that paying for medical expenses directly from an HSA is actually not the optimal way to use it? If you are able to let the money saved in the HSA invest and grow instead of using it for medical expenses in the present, those tax-free dollars could multiply many times over. There is no time limit on reimbursing yourself for qualified medical expenses, which means you can incur eligible expenses now and reimburse yourself decades later in retirement. Make sure you keep meticulous records of any expense that you plan to reimburse yourself from in the future.

HSA Investment Strategies:

- Consider paying medical expenses out-of-pocket

- Invest HSA funds for long-term growth

- Use as supplemental retirement account

- Keep receipts for future reimbursement

529 Plans: Education Savings

529 plans are the Roth IRAs of saving for education. Contributions are not federally tax-deductible, although you may receive a state income tax deduction in certain states. Accounts grow tax-free, and distributions used for qualified education expenses are also tax-free. In recent years, 529 plans were expanded to allow distributions to be used tax-free for eligible K-12 tuition expenses. (For those familiar with Coverdell ESAs, the expansion of 529 plans to include K-12 expenses has largely made Coverdells irrelevant since they have an income limit and a much smaller contribution limit).

529 plans do not have an income limit, and per-beneficiary lifetime contribution limits are very generous, ranging from $235,000 to $529,000 (some plans have annual contribution limits of $15,000). Contributions over $18,000 per individual per year (2024 limit) will count against your lifetime gift tax exclusion and you will be required to file a gift tax return.

529 plans are offered through your state, and they may only offer one or two plans with limited investment options and high expenses and fees. However, you can often enroll in an out-of-state plan and get the same state tax break as you would with the in-state plan.

Benefits and Features

- Tax-free growth for qualified education expenses

- State tax benefits in many states

- High contribution limits

- Flexibility to change beneficiaries

- Estate planning advantages

Qualified Expenses

- College tuition and fees

- Room and board

- Books and supplies

- Computer equipment

- K-12 tuition (up to $10,000 annually)

- Student loan repayment (lifetime limit)

Strategy Considerations

- Front-loading contributions

- Age-based investment options

- Multiple state plan options

- Coordination with other education benefits

- Impact on financial aid

Tax Deductions – Lowering Your Taxable Income

Copy link to this section: Tax Deductions – Lowering Your Taxable Income

Copied the URL to your clipboard!

Close to 90% of Americans take the standard deduction, so deciding which you are going to take could be a very easy decision. If your income is higher and your tax situation is more complicated, it could be worth looking at itemizing instead.

Taking The Standard Deduction (2024)

- Single: $14,600

- Married Filing Jointly: $29,200

- Head of Household: $21,900

- Additional amounts for age 65+ or blind

When to Itemize

The decision to itemize or not comes down to which one is more beneficial to you and will save you more in taxes. You can only deduct certain expenses, like charitable contributions, mortgage interest, and state and local taxes if you itemize, so if the deduction you will get from itemizing is greater than the standard deduction, it makes sense to itemize.

Common Itemized Deductions

- Mortgage Interest and Property Taxes

- Medical Expenses

- Charitable Cash Donations:

- Charitable Non-Cash Donations

Stay tuned for our follow up article on advanced tax planning where we’ll cover more strategies for maximizing tax deductions, end-of-year planning, and long-term tax planning.

Tax Credits: Direct Reductions in Your Tax Liability

Copy link to this section: Tax Credits: Direct Reductions in Your Tax Liability

Copied the URL to your clipboard!

Credits vs. Deductions

Unlike tax deductions, which lower your taxable income, tax credits directly reduce the amount of income tax you owe. These can be extremely powerful tools for reducing your tax burden, but they can be difficult to qualify for and only apply to certain financial situations.

Types of Credits

There are two types of tax credits, refundable and non-refundable credits. Non-refundable credits can reduce your income tax liability to $0, but stop there. Refundable tax credits can reduce your tax liability beyond $0 and make your effective tax rate negative, meaning you are receiving tax credits without owing any federal income taxes.

Popular Tax Credits to Explore

- Child Tax Credit

- Earned Income Tax Credit

- Education Credits

- Retirement Savings Contributions Credit (Saver’s Credit)

- Residential Energy Credit

- Clean Vehicle Credit

Interested in learning more? Check out this article: 6 Tax Credits and Deductions That Not Everyone Knows About

Special Situations and Life Event Tax Planning

Copy link to this section: Special Situations and Life Event Tax Planning

Copied the URL to your clipboard!

Marriage and Divorce

Did you know your relationship status can have a big impact on your tax status? If you legally change your relationship status by getting married or divorced, your tax filing status will also likely change. One filing status is not necessarily more advantageous than the other, but if you and your partner have a large income differential the changes could be quite drastic.

Homeownership

Ah, the joys of homeownership: owning your property, no longer beholden to the whims of a corporate landlord, nailing all of your pictures to the wall, and suddenly paying a lot of mortgage interest, homeowners insurance, and property taxes each year. Fortunately the government does incentivize home ownership by offering a mortgage interest deduction if you itemize on your taxes. Property taxes may vary drastically depending on where you live, and change based on the value of your home. If you work from home and have your own business, you may qualify for home office deductions.

When it’s always bittersweet to sell your home, a capital gain exclusion of up to $250,000 (single) or $500,000 (married) on the sale of your primary residence can help to ease the pain.

Starting a Family

In addition to incentivizing Americans to buy homes, the government also provides different tax incentives for those looking to have children and start a family. One of those incentives, the child tax credit, is worth up to $2,000 per qualifying child in 2024, and up to $1,700 of that credit is refundable. Only children under 17 qualify, and you can only claim the full credit if your MAGI (modified adjusted gross income) is under $200,000/single or $400,000/married (income phaseouts start at those thresholds).

The child and dependent care tax credit is for reimbursing parents for childcare while they work. Only parents with children 12 and under can qualify (unless your spouse or other person(s) claimed on your tax return require paid care). You and your spouse (if married) must have earned income to qualify, and you must have paid for care so you could work or look for work.

The amount of qualified expenses is $3,000 for one person or $6,000 for two or more. Depending on your income, you can claim 20% to 35% of those qualified expenses as a tax credit. The credit does not phase out for high-income earners, but the percentage of expenses they can take as a credit is reduced.

Small Business Planning

We will cover more advanced tax planning topics with a focus on business owners in a forthcoming follow-up article on taxes. Stay tuned for coverage of entity structure options, tax deduction strategies, and employee benefit choices for small business owners.

Conclusion

Copy link to this section: Conclusion

Copied the URL to your clipboard!

Taxes is a big, ugly topic, but an unavoidable one for anyone wanting to keep what they earn.

Nobody really enjoys paying taxes, but knowing you are doing everything you can to lower your tax burden can make it a little easier to stomach.

Tax planning is not just for the high-income, but lower income and middle income families have opportunities to seriously optimize their financial life by doing some good, old fashioned tax planning.