I don’t know if there’s anyone out there that looks forward to tax season. The average American certainly doesn’t, and it’s the least favorite time of the year for overworked tax professionals. Those set to receive a refund may look forward to filing, but for everyone else it is a stressful time of year. There may be uncertainty around what you will owe in taxes and it may take a lot of time and energy to file your taxes. The more complicated your tax situation, the less you probably look forward to tax season.

I’ve had years in college where I only had one job and only had one form to worry about at tax time. Those were the days. Now, I have an entire stack of 1099s, W-2s, and other miscellaneous correspondence I need to file my taxes. It seems like a new form comes in the mail everyday. I’m certainly not looking forward to the work of filing our taxes, but it can be made easier and less stressful. I’ve compiled the top resources for filing your taxes, starting with resources for those with simple returns and gradually building to more advanced tax situations.

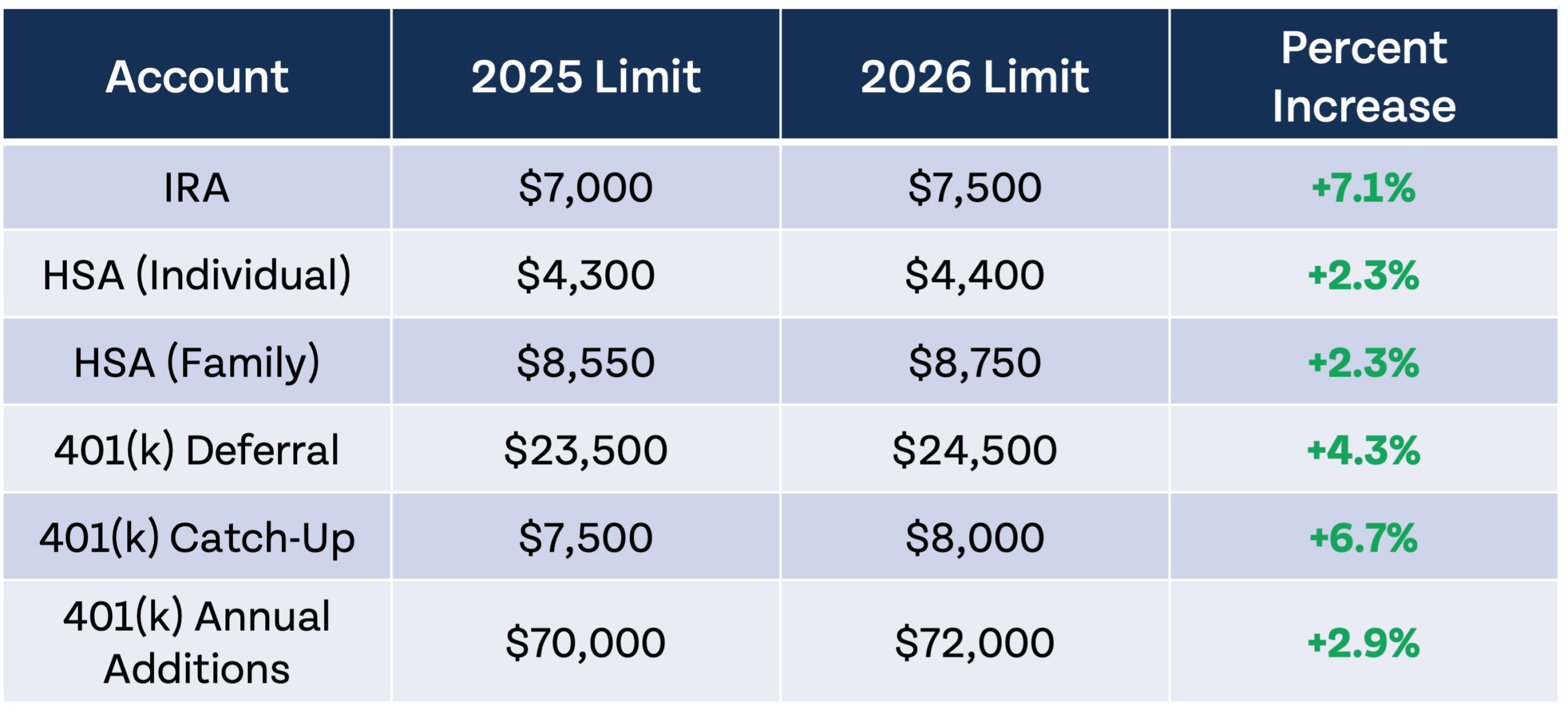

1. The Money Guy 2025 Tax Guide

The annual Money Guy Tax Guide has all of the latest inflation-adjusted tax information from the IRS. The free download includes income tax rates, standard deductions, retirement account contribution limits, and Social Security tax information. This guide is a great starting point for those who want to refresh themselves on the tax-filing basics.

2. VITA (Volunteer Income Tax Assistance)

There’s no better free resource than the IRS’s Volunteer Income Tax Assistance (VITA) program. Qualifying taxpayers, including those making under a certain amount, persons with disabilities, and those with limited English-speaking ability, may qualify for assistance filing their taxes. If you think you may qualify, I highly encourage you to check out the IRS VITA page to find a center near you and make an appointment. It’s best to make an appointment sooner rather than later.

In college, I worked in the VITA program and helped local residents file their taxes. Not only was the experience extremely useful, it was really satisfying to help people file their taxes for free. There are many large corporations and businesses out there that want to squeeze every last dollar out of taxpayers, so it was refreshing to provide a valuable service completely free of charge with no strings attached.

3. FreeTaxUSA and IRS Free File partners

We don’t have any affiliation whatsoever with FreeTaxUSA, it’s just the best tool I’ve found to file our taxes. It is significantly cheaper than some other tax-filing services because they don’t spend nearly as much on marketing and advertising. Consequently, not as many Americans are aware of FreeTaxUSA or other software that is just as good (or better) than the big names at a fraction of the price. With FreeTaxUSA, filing your federal income tax return is always free and state returns are under $20, according to their website. FreeTaxUSA is an IRS Free File partner along with several other companies. Check out the other IRS partners for some more tax filing software options.

4. Hire a professional

Unless you are a tax professional yourself, you may get to a certain point where the time and energy required to file your own taxes simply isn’t worth it anymore. There’s also the obvious risk of making a mistake when filing your own taxes that a professional would not have made. When we say a “tax professional,” we usually mean a trusted CPA that is experienced in filing tax returns. If you aren’t sure how to find a trusted CPA, ask friends and family what their experiences are like with their tax professional and if they are taking on new clients. The cost of hiring a CPA to do your taxes might seem expensive at first, but the benefits of having an experienced professional do your taxes can be substantial.

As far as filing my taxes goes, I really miss being in college. I didn’t make much money and only had one job, so filing taxes was super quick and I always got a refund. Now that I’ve gotten older and our tax situation is more complex, I really appreciate the value of high-quality tax-filing software. We are currently in our FreeTaxUSA era, but I have no doubt that if I wasn’t a CFP® professional I would be paying someone else to do our taxes. Even so, I don’t think we will file our own taxes for much longer.

If you aren’t a financial professional but have a simple return, using FreeTaxUSA or other similar software may be a great option for filing your taxes. If you qualify for VITA assistance, I can’t recommend the program enough. If you have a more complicated tax return, it may be a good idea to reach out to a tax professional for assistance. No matter what your tax situation looks like, I wish you a low-stress tax filing season filled with nothing but joy.