I was really excited about last year’s inflation-adjusted IRS numbers because they were the biggest changes we’d seen in years. The changes this year aren’t as large, percentage-wise, but I think they’re even more exciting. Last year, inflation was running pretty hot, and many of the IRS adjustments just kept up with inflation. Currently, inflation is only 3.2%, so many of the IRS inflation adjustments feel bigger this year. I think that’s something we can all be thankful for. So what is changing next year?

Changes to retirement accounts

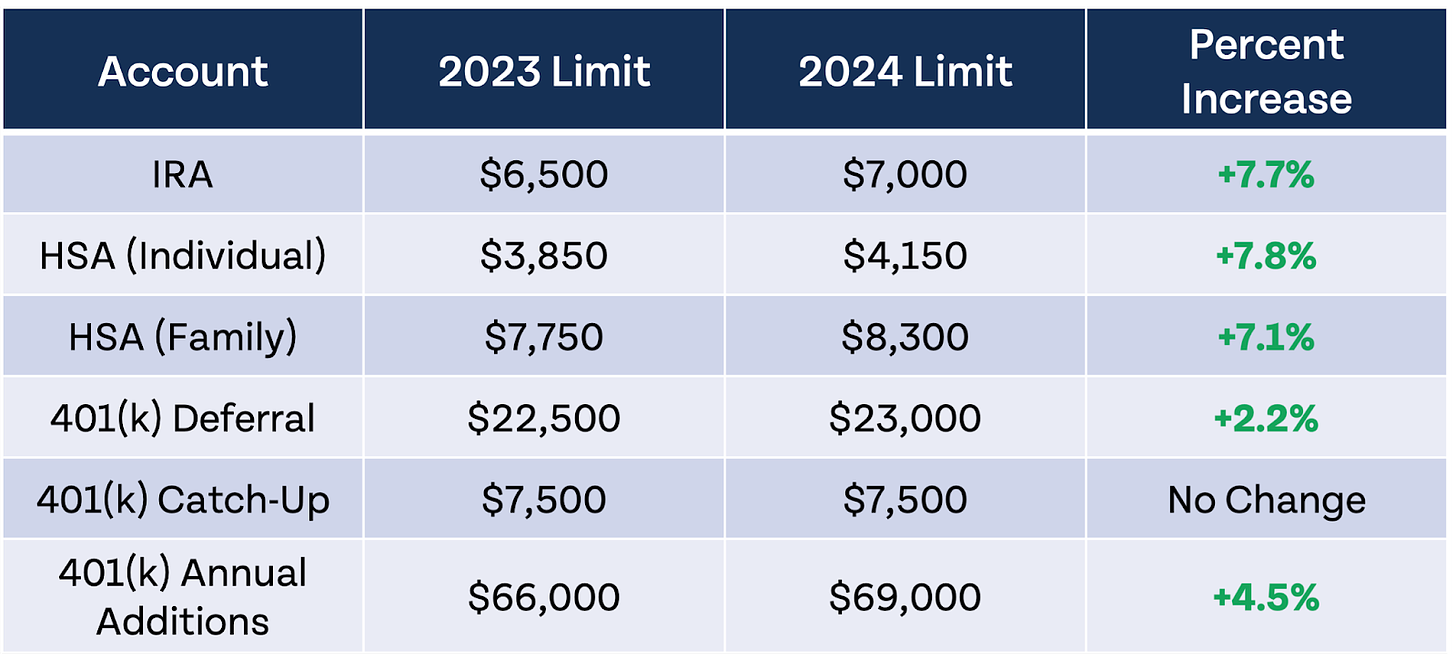

Most retirement account limits are increasing in 2024, and many are increasing greater than the current inflation rate. 401(k) limits also apply to 403(b) plans, most 457 plans, and TSPs.

401(k) limits went up 9.8% last year, more than IRAs and HSAs, so I guess the IRS felt like they needed to pump the brakes a little bit there. IRA limits went up again, but unfortunately $7,000 is not easily divisible by 12 for everyone contributing monthly. Like last year, I will once again be the old man on the front porch yelling about IRA limits. When IRAs were created in 1974, the contribution limit was $1,500. If it had been indexed to inflation since the very beginning, the limit would be over $9,000 today. I think we could take it one step further and increase IRA limits to match 401(k) limits. Not all jobs offer 401(k)s or equivalent retirement plans, and the $7,000 limit runs out very quickly for those who are serious about saving for retirement.

For a 30-year-old who has access to an HSA, Roth IRA, and 401(k), they can contribute a total of $34,150 to tax-advantaged retirement accounts. That means a single person would need an income of $136,600 to complete step 6 of the FOO without investing more than 25% of their gross income. Having a high income is not the only way you can complete step 6. As long as you are investing 25% for retirement, and know you are saving what you should be, you can move on to step 7 of the Financial Order of Operations.

Account limits aren’t the only thing going up next year; income phaseouts will also be increasing. For most, that just means you may have a little more time before you have to worry about using the backdoor Roth strategy. For the table below, “401(k)” is used as a proxy for all qualified workplace retirement plans.

Standard deduction and marginal tax rates

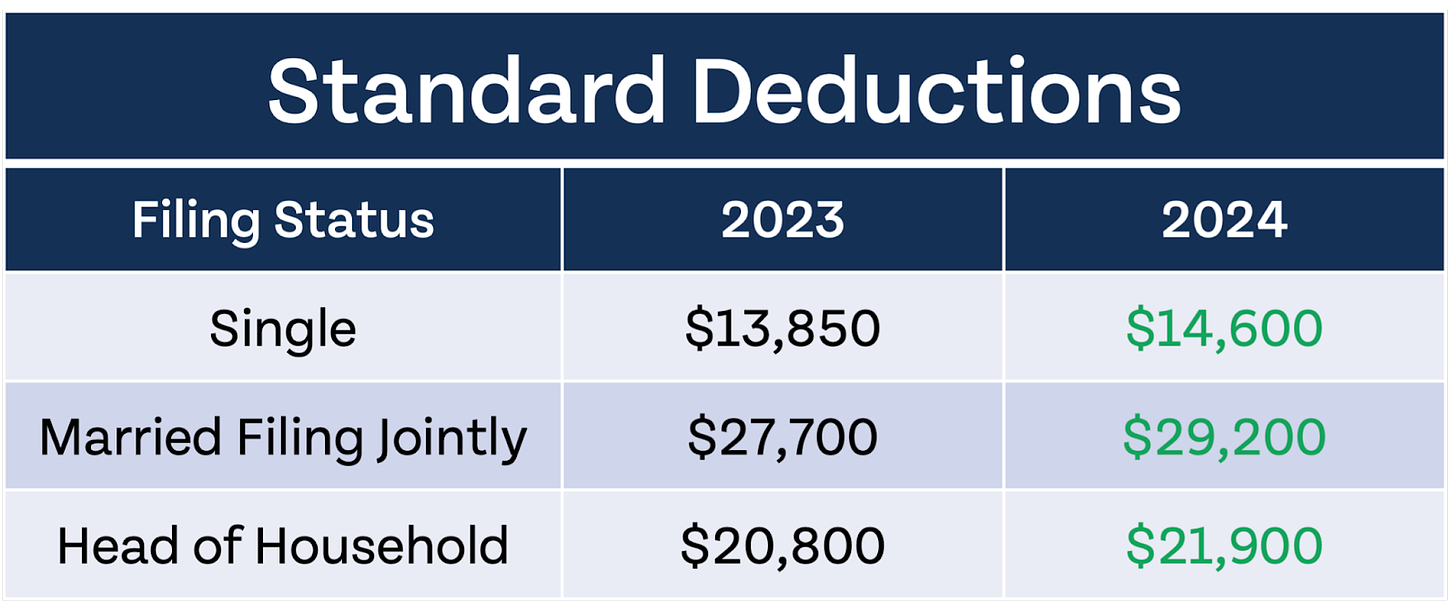

Standard deductions are raised yearly, and most taxpayers take the advantage of the standard deduction. However, this year we could see a rise in Americans not taking the standard deduction. Mortgage interest is an itemized deduction, and with 30-year mortgage rates currently over 7%, more Americans may now want to see if itemizing could be better for them. It doesn’t take an enormous mortgage for itemizing to start making sense, either: someone with a $400,000 mortgage at today’s rates (7.32% for a 30-year) would pay $26,735 in interest in the first full year of owning their home. Here’s what the standard deduction is this year and what it will look like next year.

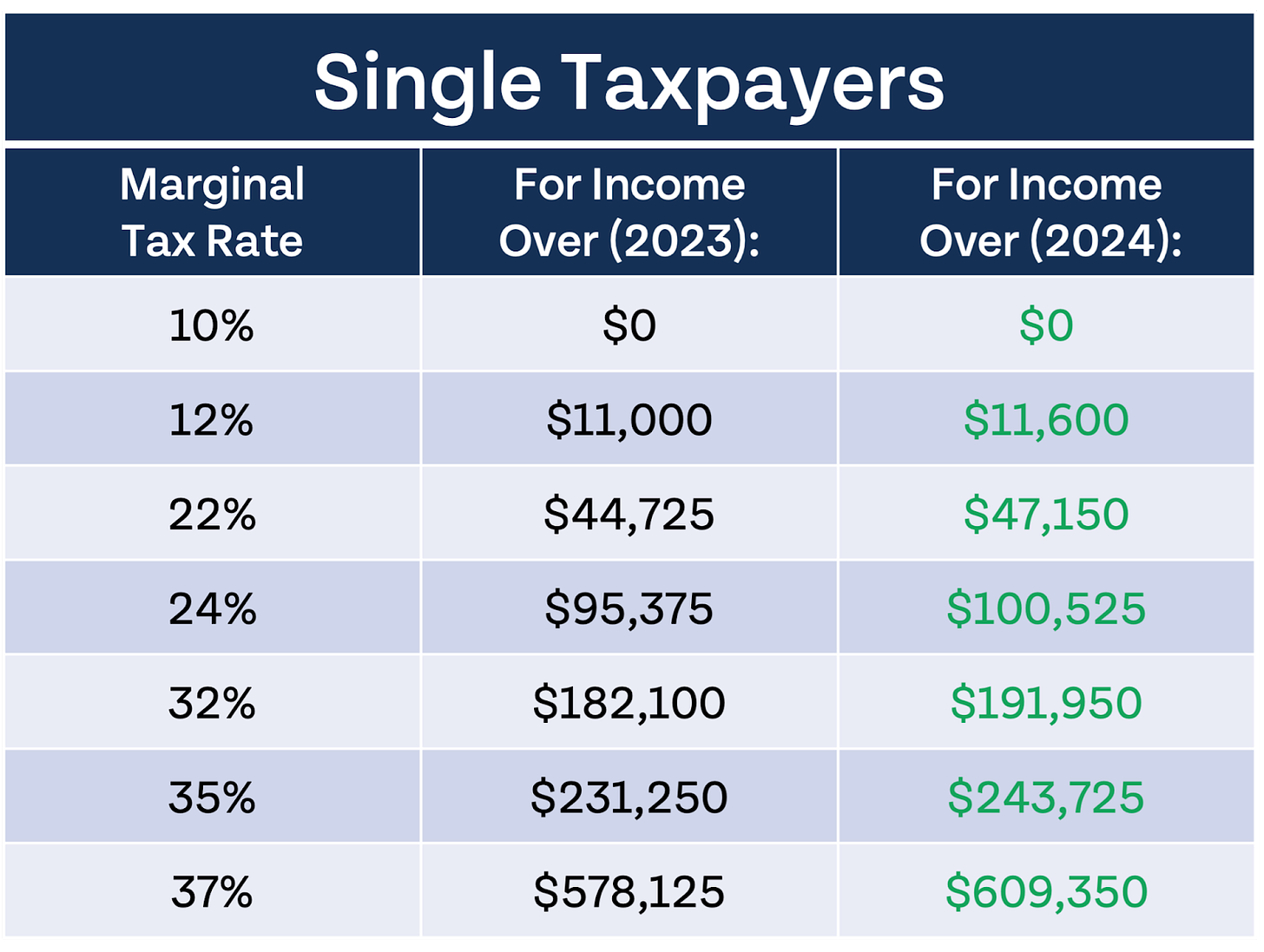

Marginal tax rates will once again remain the same next year, but income thresholds will increase for inflation. The table below shows single tax rates this year and next year.

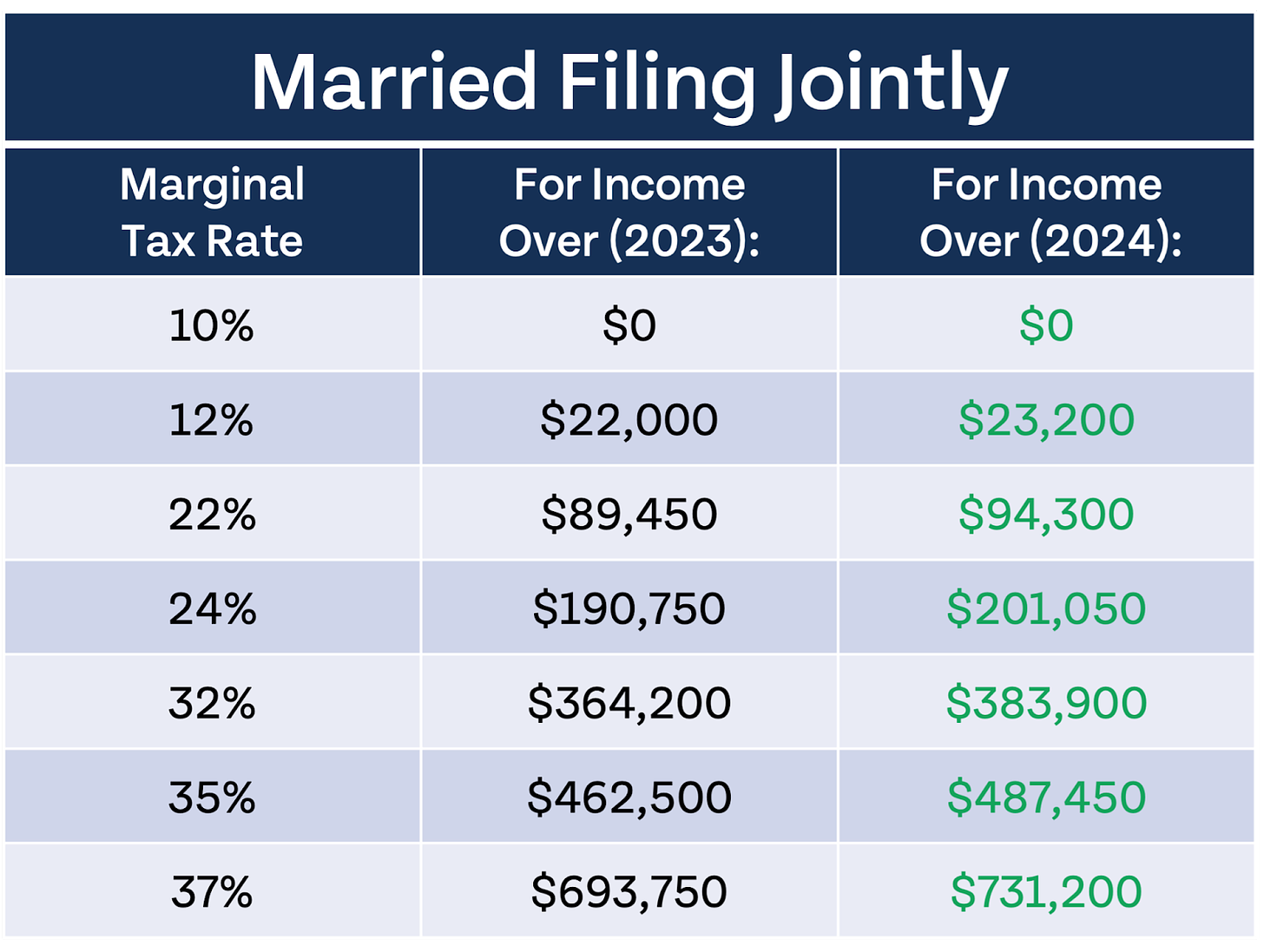

The next table shows marginal tax rate thresholds for married couples this year and next year.

Other IRS tax changes in 2024

Changes to retirement accounts, standard deductions, and marginal tax rates are just scratching the surface of all the IRS changes this year. Check out the IRS rundown of changes going into 2024 for other notable changes and notable items that aren’t changing. One always notable change worth mentioning is the Social Security Cost of Living Adjustment, or COLA, which is 3.2% for 2024.

We update our Money Guy Tax Guide every single year as you are heading into tax season. The current version covers all the numbers you need to know as you file taxes in 2024. This PDF is 12 pages full of tables, numbers, Money Guy tips, and more. If you find it useful, please consider sharing the resource with a friend or family member.