The college landscape is constantly evolving, and the top college majors for new college students and graduates change as much as technology is changing the world around us. 10 years ago, degrees in artificial intelligence didn’t even exist; now, the top universities in the country offer AI programs. With the cost of college over 8x more expensive today as it was in 1980, are the increased options students have worth the additional cost?

Is college worth it?

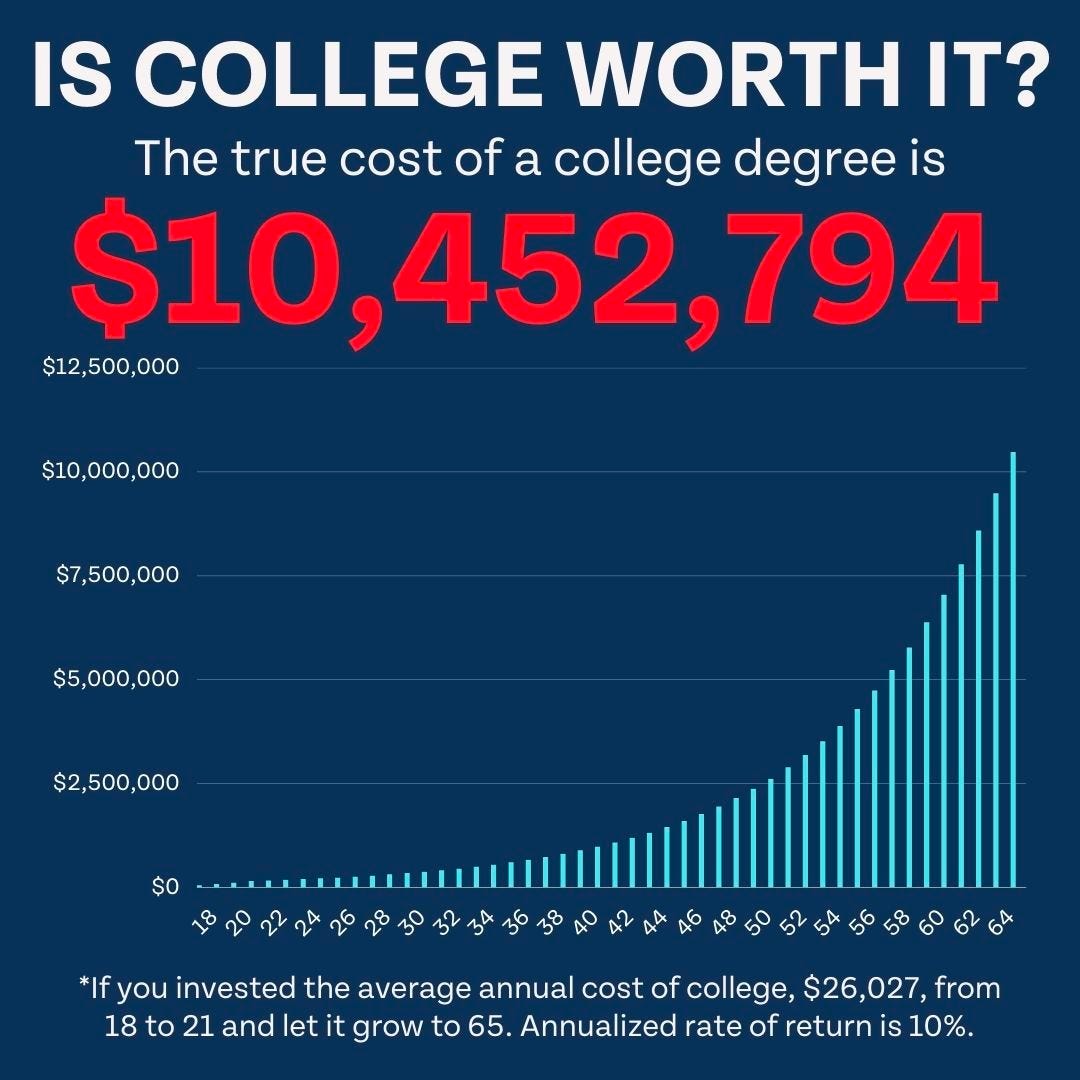

Ignoring all of the potential non-financial benefits of going to college, what does it take for college to be a smart financial decision? This is far from an easy question to answer, but we can at least do a financial spot check with a simple math equation that accounts for the opportunity cost of the dollars you would spend on education. The estimated opportunity cost of a typical degree comes in at a whopping $10 million if you were to instead invest the average annual college cost from ages 18 to 21 until you retire at 65.

$10 million is a LOT of money by retirement, but it isn’t crazy to think you could make up that difference with a college degree. If you went to college and were able to earn an extra $14,640 per year compared to someone not attending college, and invested that amount each year, you would end up with the same $10,452,794 by age 65. College graduates earn an extra $32,112 per year on average, although they are also more likely to live in high cost of living areas and may not be able to invest the full difference in earnings each year, even if they wanted to.

This is a very simplified example. Some students will be paying much less for college and some will be paying much more. Your experience at college has value too, and your expected career earnings are not the only benefit of attending college. College graduates are 72% more likely to have a retirement plan at work, 2.2x less likely to lose their job, 44% more likely to report their health as good or excellent, participate more in their community, are happier, and live for seven years longer than those who have never gone to college. I think it’s obvious that not all of this is causation and some is correlation, but it’s clear that college does have non-financial benefits.

Your future career aspirations are significantly more important than whether or not you attend college. There are plenty of high-paying jobs available to those who do not attend college, and plenty of college degrees have low starting wages. The bottom line is that you can be successful, in life and financially, whether or not you attend college.

If you are exploring what paths are available to you without attending college, check out our list of the top-paying jobs without a degree. Since the decision to attend college can be costlier and riskier, I’ll focus on the best and top-paying college degrees in this article.

Best college degrees in 2024

The Federal Reserve compiles data on outcomes by major, which looks not only at early career wages but mid-career wages, unemployment rate, and underemployment rate. This list will consider all of these factors.

1. Engineering

Looking at the numbers, it’s hard not to consider engineering the best college major out there. The top five highest-earning jobs for mid-career workers are all engineering: chemical engineering, computer engineering, aerospace engineering, electrical engineering, and mechanical engineering (in order from highest salary mid-career, $120,000, to mechanical engineering, with $105,000). If you look at early career wages, engineering majors still hold four of the top five spots. Unemployment rates are low, coming in around 3% to 6%.

2. Computer Science

It’s no surprise that computer science is one of the best college majors out there. Early career graduates earn about $73,000, with those further along in their career making $105,000. The unemployment rate among computer science is 4.8%, so they don’t have much trouble finding a job.

3. Pharmacy

Pharmacy graduates don’t make as much money starting out in their career as some other majors, at $55,000, but earn six figures when they reach the midpoint of their career. Job prospects are good for pharmacy majors too, with an average unemployment rate of 4.8%.

4. Finance

Hey it’s us! Jobs in finance are very well-paying, with a median early career salary of $60,000 and mid-career wages of $100,000. They have an easy time finding jobs as well, with an unemployment rate of just 4.1%.

5. Nursing

Nursing isn’t as lucrative as some other fields, with early career wages of $55,000 and mid-career of $75,000, but they are in HIGH demand. Only 1.3% of those with a nursing degree are unemployed. If you are concerned about your job prospects after graduation, nursing could be a great field to investigate.

Worst college majors in 2024

The “worst” college majors aren’t always worth avoiding, but it’s important to be aware of the downsides before you go into debt to get a degree that may not have the return on investment you were expecting. It is interesting and ironic that some of the worst majors also have higher advanced degrees as a percentage. Making you wonder if employment is the objective or nudging struggling graduates into more advanced degrees and potentially even more student loan debt.

1. Fine Arts

Those with fine arts degrees unfortunately have a high unemployment rate, at 12.1%, and median early career wages of $40,000. The share of those with a graduate degree is 23.2%, which means many attend college for longer than four years and may be more likely to take on student loan debt.

2. Family and Consumer Sciences

The unemployment rate for family and consumer sciences graduates is also higher, at 8.9%, and early career wages are $37,000. 32.9% of FACS graduates have graduate degrees, which again means more time spent in school and potentially more money spent on school.

3. Social Services

Those in social services don’t have a hard time finding a job, with an unemployment rate of 3%, but early career wages are $37,000 and mid-career wages are $52,000. The majority, 52.4%, also hold a graduate degree.

4. Early Childhood Education

Early childhood education majors have jobs, with 3.1% unemployed, but salaries start lower and don’t have much room for growth. The early career salary is $40,000 and mid-career salaries are just $43,000.

5. Philosophy

On average, philosophy majors have a more difficult time finding a job, with a 9.1% unemployment rate. Early career salaries start at $42,000 and reach $68,000 by mid-career. However, a whopping 56.5% of philosophy majors have graduate degrees.

What are good majors that will be in-demand in the future?

Your college major won’t determine just what you are doing for the next few years, it can determine your career path for the next 40 years. With that in mind, it’s important to pick a future-proof major that will continue to be in high demand later in your career. The Bureau of Labor Statistics projects the growth rate of different career fields over the next 10 years, and predicts careers in software development and computer science to continue to grow very quickly. With our aging population, other fields expect to see a surge in growth, including actuaries, nurse practitioners, home health aides, and physical therapist assistants.

Choosing whether or not to attend college, and which college and degree program to choose, is a decision that should not be taken lightly. You can be happy and successful without attending college, but if your path leads you there, you must do it right. Choosing one of the best majors can help you ensure you have a job after graduation and earn a higher salary than your peers. The biggest takeaway is to be purposeful in your higher education decision. Around 70% of college graduates work in fields outside of their college major. As with most big decisions in life, make sure you begin with the end in mind and measure twice and cut once to ensure you are happy with the outcome and set yourself up for success.