In the One Big Beautiful Bill Act (OBBBA) passed last year, a new type of account called a 530A account or Trump account was authorized. These accounts launch officially later this year, and an account can be opened for anyone under the age of 18 with a valid Social Security number.

Up to $5,000 per year can be contributed for each eligible child. Additionally, children born between January 1, 2025 and December 31, 2028 may be eligible to receive a $1,000 contribution from the government. The CEO of Dell has agreed to contribute $250 per child for up to 25 million children born between 2014 and 2024 who live in zip codes where the median household income is less than $150,000.

These accounts are not quite IRAs and come with fewer tax benefits, restrictions on using the funds, and limits on what you can invest in. Here’s what you need to know about Trump accounts and whether or not you should consider investing in one for your children.

How Trump accounts work

How Trump accounts are taxed

Contributions made to Trump accounts by individuals are with after-tax dollars, while contributions from other sources (such as the government, if your child qualifies for the free $1,000) are with pre-tax dollars. Contributions to the accounts do grow tax-deferred, but investment earnings are taxed at ordinary income tax rates upon withdrawal. This is a major drawback to Trump accounts.

Contributions to Roth IRAs are also made with after-tax dollars, and accounts not only grow tax-free, but qualified withdrawals are entirely tax-free. However, custodial Roth IRAs require earned income from the child in order to contribute, a major restriction which Trump accounts do not have.

A better comparison may be custodial brokerage accounts. Contributions to both of these types of accounts are made with after-tax dollars. Trump accounts grow tax-deferred while custodial brokerage accounts do not. Trump accounts are taxed at ordinary income rates while brokerage accounts are taxed at more favorable capital gains rates.

Investments available in Trump accounts

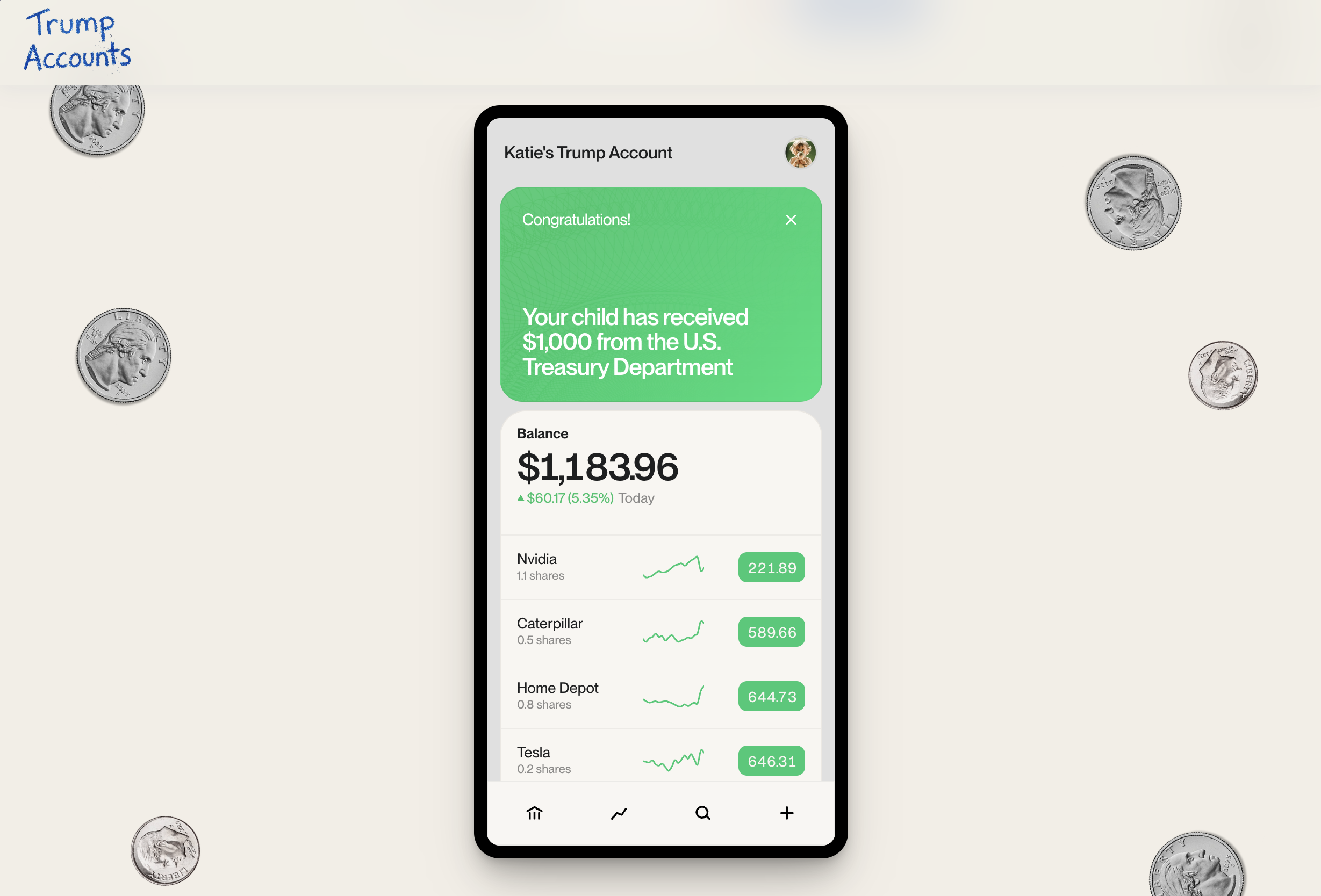

We don’t know exactly what investment options will be offered in Trump accounts. Robinhood Markets agreed to provide technology to power the accounts, and in a screenshot on the official government website for Trump accounts (shown below), the UI looks very similar to Robinhood. The example account is invested in Nvidia, Caterpillar, Home Depot, and Tesla.

The FAQ section on the website states that “funds will be invested in a diversified portfolio of low-cost index funds designed to maximize long-term growth while minimizing risk.” According to Fidelity, mutual funds or ETFs in Trump accounts must be at least 90% invested in US companies, so no international funds will be available. Funds may not have an expense ratio of greater than 0.10%, but, according to the IRS, broker sales commissions can be charged and are not subject to the 0.10% expense ratio limit.

Restrictions on Trump accounts

Since these accounts are designed for children, there are naturally restrictions on how they can be used and when funds can be accessed. Money may not be withdrawn from Trump accounts until January 1st of the year the child turns 18. The rules regarding withdrawals are the same as traditional IRAs, which means money may not be taken out before 59.5 without penalty unless for eligible education expenses, first-time home purchase (up to $10,000), birth or adoption costs (up to $5,000), qualifying medical expenses, disability, or terminal illness.

Trump accounts essentially become traditional IRAs when the child turns 18, and in fact the account may be rolled into a traditional IRA at 18 or kept as a separate account. The money would be treated and taxed the same whether or not it is rolled into a separate account.

Should I open a Trump account?

Trump accounts become available starting July 5th, 2026, and you can open an account by filing Form 4547 with your taxes this year or by using the online portal slated to become available sometime this summer.

For most families, it may not make sense to open a Trump account for your children. The tax treatment of the accounts makes them inferior to just about every other type of investment account you would consider opening for your child (custodial Roth, custodial brokerage, and 529). Contributions are taxed, and investment earnings are taxed at ordinary income rates upon withdrawal. A custodial brokerage account works similarly, but contributions are taxed at more favorable capital gains rates and there are no restrictions on contributions, investment options, or withdrawals.

If you have or are planning to have a child born between January 1, 2025, and December 31, 2028, though, you should absolutely open a Trump account to take advantage of the free $1,000 contribution from the government. You may also consider opening an account if your child is eligible for the $250 private contribution (they were born between 2014 and 2024 and live in a zip code where the median household income is less than $150,000). Don’t turn down free money even if the account structure isn’t ideal.

Trump accounts are a creative new invention designed to give kids a head-start when it comes to saving for retirement. Unfortunately, the tax treatment of the accounts, limits on investment options, and restrictions on withdrawals limits the use case outside of opening an account to get the free money from the government.