Change your life by

managing your money better.

Subscribe to our free weekly newsletter by entering your email address below.

Subscribe to our free weekly newsletter by entering your email address below.

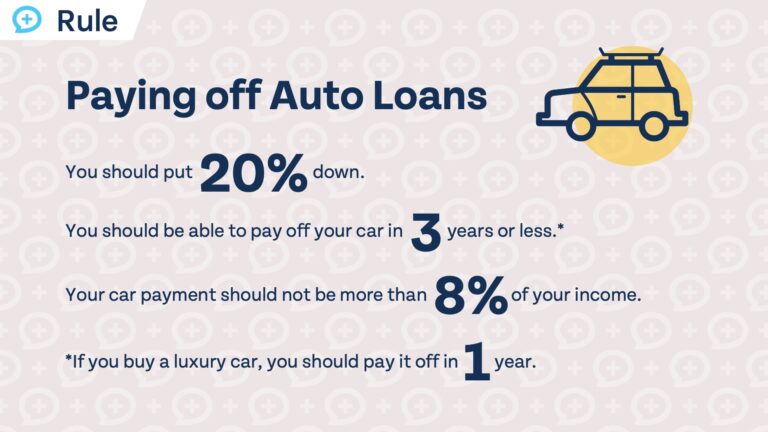

The pandemic broke the car market, causing prices of both new cars and used cars to skyrocket. Prices are still working their way back to…

Read More

As mortgage rates have held relatively steady over the past few years, with average fixed 30-year rates between 6% and 8% since September of 2022,…

Read More

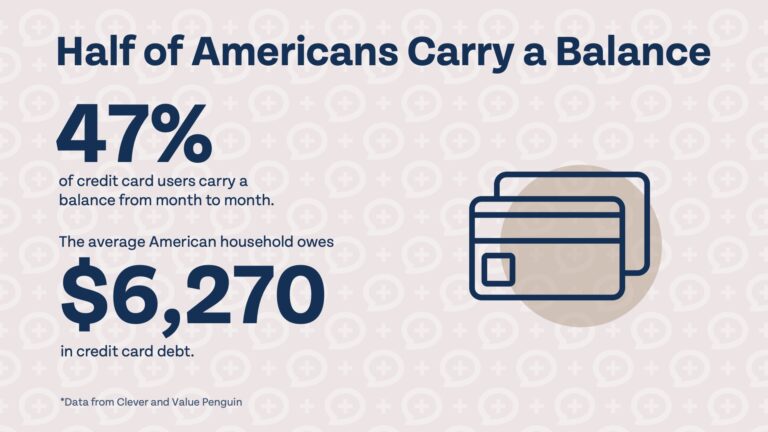

Some financial influencers say you should never use credit cards, while others believe credit cards can be a beneficial tool in your financial life. Are…

Read More

There’s not a great way to say it: estate planning requires you to think about what happens when you die. That’s not a pleasant thing…

Read More

The desire to become an entrepreneur is alive and well in the United States. 62% of Americans wish to be their own boss, and among…

Read More

Check for blindspots and shift into the financial fast-lane. Join a community of like minded Financial Mutants as we accelerate our wealth building process and have fun while doing it.

Subscribe to our free weekly newsletter by entering your email address below.