Last Updated

December 17, 2025

Read Time

Share

Who Needs to Read This?

Whether you’re wondering “should I start investing?” or “am I investing enough?”, this guide is for you. We help:

- People ready to start investing but unsure where to begin or what to invest in

- Those who have investments but don’t understand the “why” behind their strategy

- Anyone asking “how much should I be investing?” or “is 25% of income too much?”

- Investors looking to avoid expensive mistakes that cost millions over a lifetime

- Parents wanting to invest for their children’s future

- Anyone trying to decide between paying off debt or investing

Key Takeaways

- Understand what investing really is and why it’s your path to financial independence

- Learn where investing fits in the Financial Order of Operations (hint: it starts at Step 2)

- Discover the 25% savings rate rule and how to reach it at any income level

- Know exactly what to invest in (spoiler: low-cost index funds beat 76% of active managers over 10 years)

- Understand the difference between investment vehicles and why most people overcomplicate this

- Learn your risk tolerance and how it should change as you age

- Avoid the behavioral mistakes that cost investors far more than fees or fund selection

- Know when DIY investing makes sense versus working with a financial advisor

What Is Investing? (And Why It's Your Path to Financial Independence)

Copy link to this section: What Is Investing? (And Why It's Your Path to Financial Independence)

Copied the URL to your clipboard!

The Money Guy Definition

Investing is the act of saving money in a tax-advantaged account, like a Roth IRA, HSA, or 401(k), or a taxable brokerage account. The act of investing requires not just depositing money into an account, but choosing what securities to purchase (or invest in…get it?). You can invest for many different goals, like a home purchase, your child’s college education, or a once-in-a-lifetime vacation, but when we talk about investing, we are talking about investing for retirement.

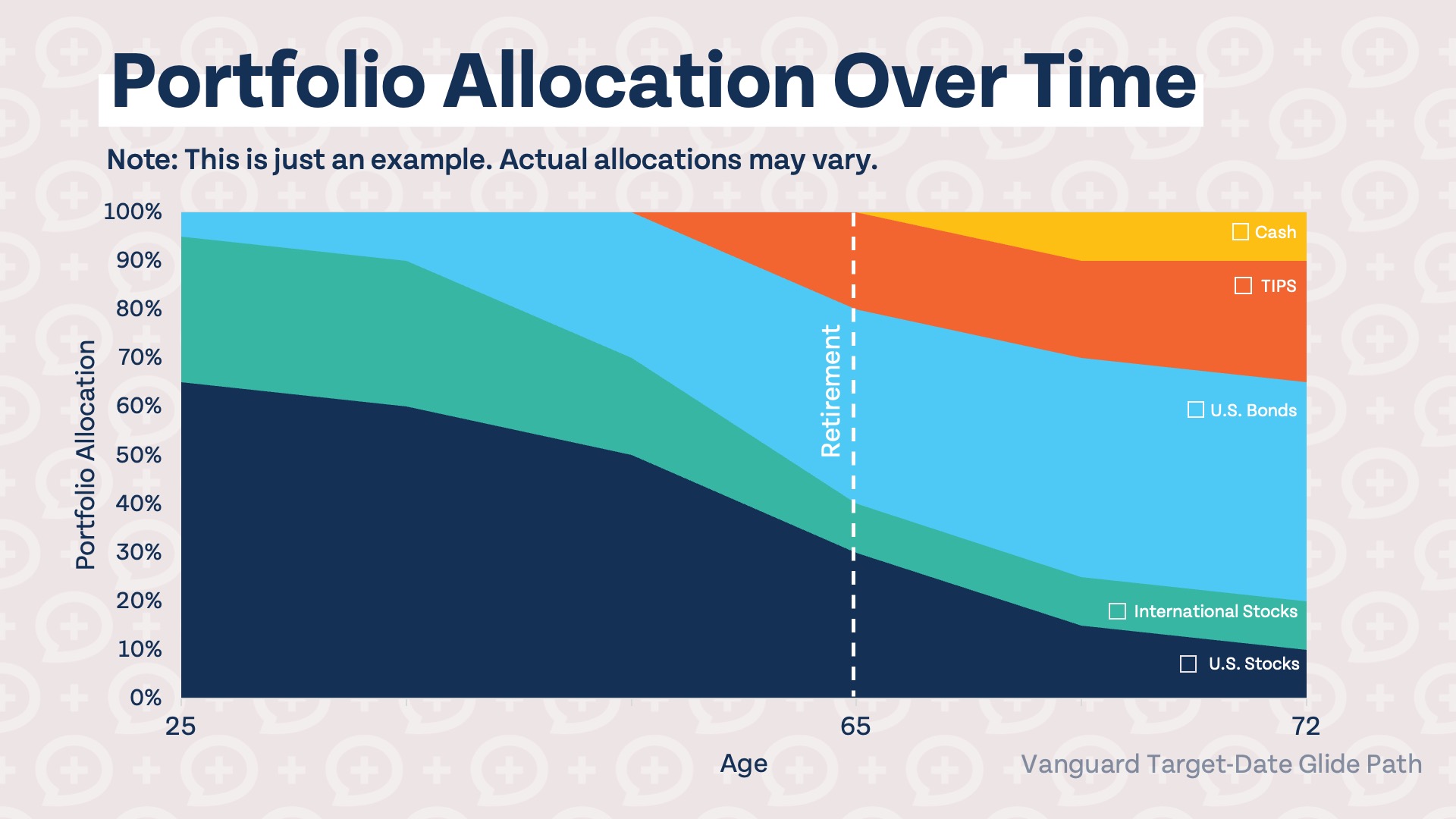

The longer you have until retirement, the more risk you may be able to take in your investment accounts. We don’t mean putting everything in individual stocks or cryptocurrency – we believe low-cost index funds are a great way to invest for most people. Someone who is 20 will likely have more invested in index funds made up of stocks, while someone who is 60 and about to retire will likely have more invested in risk-off assets such as bonds.

Why Investing Matters More Than Ever in 2025

Retirement is a relatively modern invention. In the not-too-distant past, most Americans worked until their death. Your parents or grandparents may have had access to pensions and didn’t have to worry much about investing. But here’s why investing matters more than ever:

- The average life expectancy in the US is 78.4 years of age, and the average age at retirement is 62. It’s not uncommon for Americans to be retired for 30+ years.

- It’s impossible to know with any degree of certainty what Social Security will look like when you retire, but Americans are worried. Only 36% are confident it will be there when they retire.

- The cost of living has risen drastically since 2020, which means you will need to invest more for retirement to maintain the same standard of living.

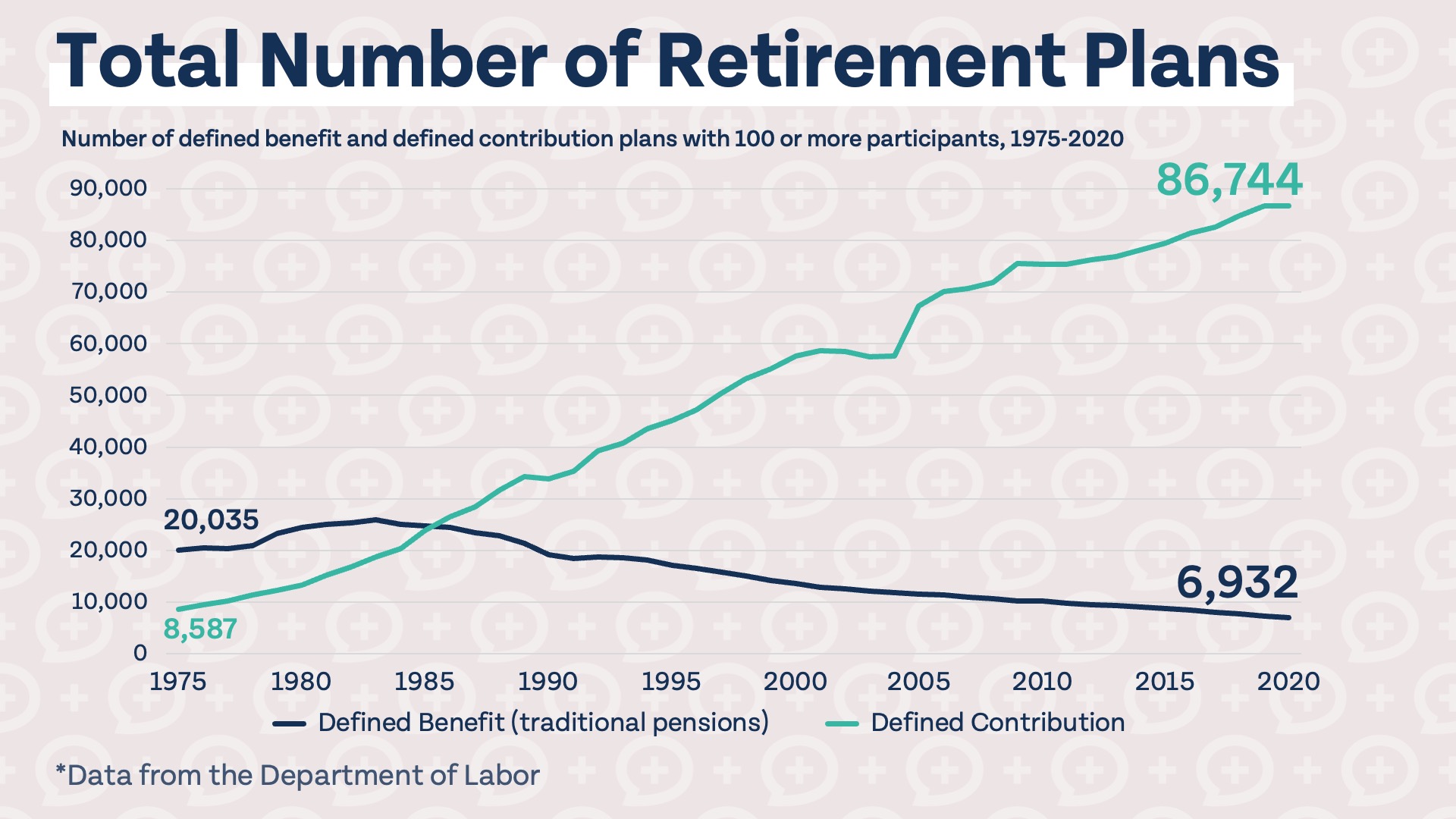

- In the past, pensions outnumbered defined contribution plans, like 401(k) plans, almost 3:1. Now, defined contribution plans outnumber pensions by a factor of more than 10:1. Without pensions, the responsibility of saving for retirement lies squarely on your shoulders.

Share image

Common Misconceptions Debunked

There are many misconceptions about investing, some entirely untrue and others that are grounded in reality, but not completely accurate.

Isn’t investing gambling?

Long-term investing for retirement is not at all like gambling, but some forms of high-risk short-term investing can closely resemble gambling. We believe investing in a diversified mix of low-cost index funds, with risk dependent on age, has an extremely high probability of long-term success. However, investing in speculative and risky individual stocks does not have the same chances of success and is more akin to gambling than investing.

Don’t I need a lot of money to start investing?

The more money you can invest for retirement, the better, but you do not need a large amount of money to start investing. Low-cost providers like Fidelity allow you to get started with as little as $10. So you don’t need much money to invest, but surely you need to invest a lot for any chance at retirement, right? Wrong again! Here’s how much you need to invest each month to become a millionaire. If you are 20, investing just $95 per month, assuming a rate of return of 10%, will make you a millionaire by age 65.

Share image

Do I have to pick individual stocks?

It’s difficult to be a successful investor picking individual stocks. Fortunately, stock picking is not required to invest. In fact, we believe that over time, investing in low-cost diversified index funds gives you a higher chance of success than picking single stocks. For those unsure exactly what index funds to invest in, consider target date index funds where the date is the year you’d like to retire. Target date funds contain the diversity of an entire portfolio in one fund, so you don’t need to worry about what funds to invest in or adjusting your investment allocation over time.

Should I wait for the ‘right time’ to invest?

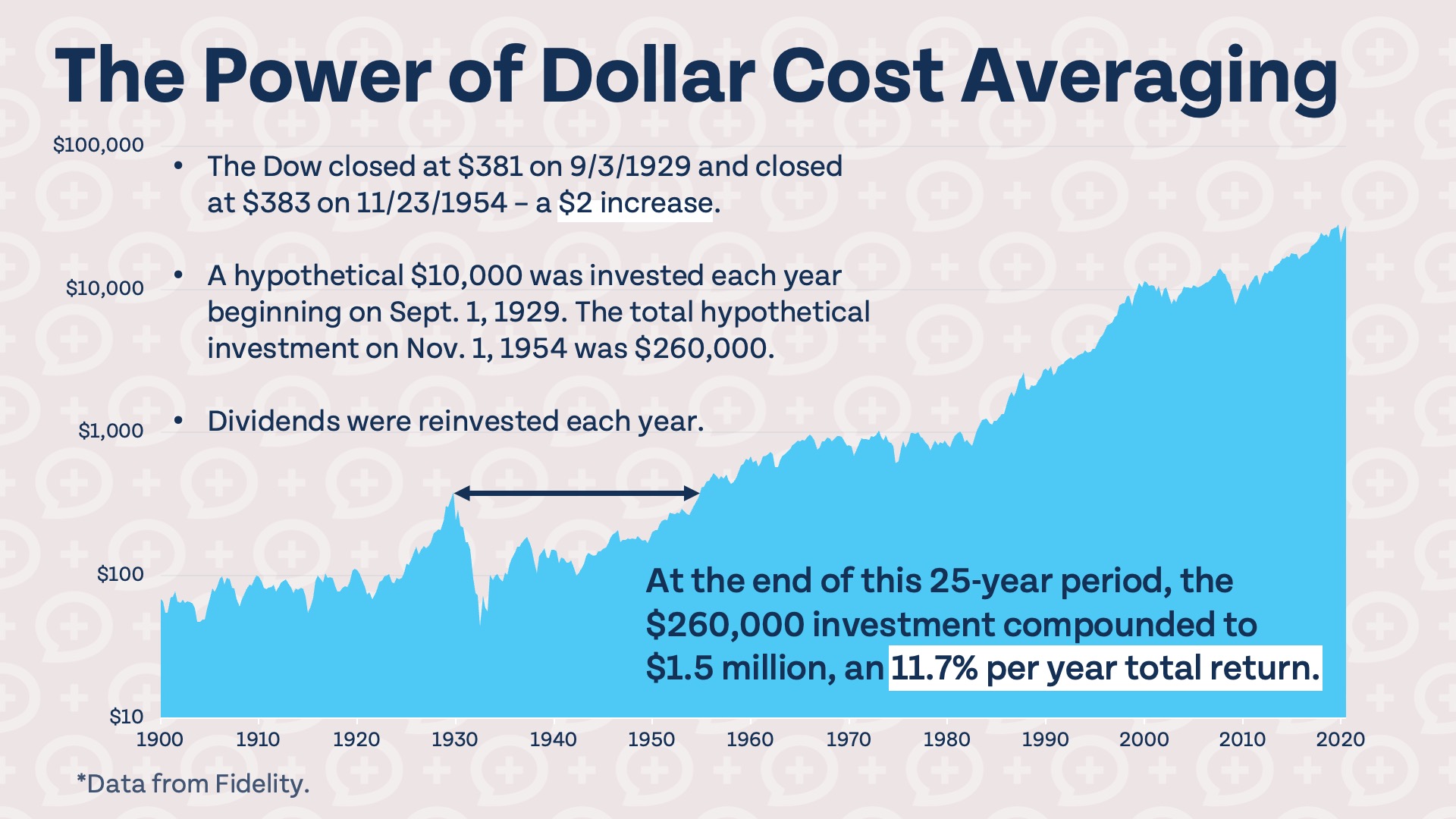

We commonly hear that right now is a terrible time to invest in the stock market. The truth is that it rarely seems like a good time to be an investor. There’s always something going on in the world that makes investing seem scary and uncertain. But what if right now is a terrible time to be investing? What if we are at the beginning of the next Great Depression? Well, let’s take a look at what investing during a period in time like this would have actually been like.

Share image

With the power of dollar cost averaging, you can make money investing even when the stock market is flat over long periods of time. Younger investors with a long time horizon until retirement should get a little excited when the market is down because they have the opportunity to buy cheaper investments. Older investors should have a more conservative portfolio so that fluctuations in the stock market don’t affect their portfolio as much as they do younger investors.

Where Does Investing Fit? Following the Financial Order of Operations

Copy link to this section: Where Does Investing Fit? Following the Financial Order of Operations

Copied the URL to your clipboard!

The most common question we get is, “Should I pay off debt or invest?” Our Financial Order of Operations lays out what to do with every dollar, including when to pay off debt, when to build an emergency fund, and when and where to invest for retirement. Investing for retirement can be confusing for newcomers because the steps of the Financial Order of Operations don’t fit neatly into everyone’s financial life.

Not everyone has an employer plan, which means steps 2 and 6 may be impossible to achieve. Not everyone can contribute to an HSA or Roth IRA, which eliminates step 5. No matter what retirement plans you have access to or don’t have access to, here’s how to think about investing for retirement. You’ve heard of the Financial Order of Operations, or FOO, now it’s time for the Investing Order of Operations (IOO).

1. Get your employer match

If you have an employer match, contributing enough to your retirement plan to get the full match should be your first priority when it comes to investing for retirement.

What if I don’t have an employer match?

If you don’t have an employer match, skip to the next retirement savings bucket (which is contributing to your Roth IRA and HSA).

What if I don’t need to contribute to get my employer match?

Some employers make contributions to your retirement plan no matter if you contribute or not. If your employer match does not require a contribution from you, skip to the next retirement buckets, Roth IRA and HSA.

What if my employer match is very generous?

Some employers offer very generous employer matches. Some are so generous that you may not be able to fully maximize the match right now. What do you do in this situation? Will you be stuck on maximizing your employer match forever?

Employer matching contributions are so powerful that you should prioritize getting every potential dollar you can, even if that means being “stuck” trying to maximize your employer match for a little while. Being “stuck” getting your employer match should be viewed as a blessing. Go give your employer a big sloppy bear hug!

What if my employer offers a discount on company stock?

Employee stock purchase plans, or ESPPs, may include a discount on company stock of up to 15%. Does this count as part of your employer match? The short answer is yes. Even though an ESPP discount typically isn’t as lucrative as a traditional employer match, it is still free money from your employer. Take full advantage of any discount on company stock you get before moving on to other retirement accounts.

2. Maximize your Roth IRA and/or HSA

Maximizing both your Roth IRA and HSA, if you are able to contribute to both, is the next step on your retirement investing journey.

Should I contribute to my Roth IRA or HSA first?

If you have access and are able to contribute to both, you may be wondering which you should prioritize. This is an often debated question on the show, and they are both amazing retirement savings vehicles, but the HSA may have a slight edge on the Roth IRA.

Both are considered tax-free accounts, since qualified distributions for both are not taxed, but only the HSA allows contributions to enter pre-tax and qualified distributions to be taken tax-free. We are of the belief that most of us will spend a generous amount on medical expenses throughout our lives, which will allow you to use the HSA without ever being taxed on that money.

It is worth noting that HSAs aren’t as flexible as Roth IRAs. You can’t take out your contributions at any time, and to qualify for all tax advantages money can only be used for qualified medical expenses. However, after age 65, HSA dollars can be distributed for any reason (but will be taxed).

What if my income is too high to contribute to a Roth IRA?

If your income is too high to contribute to a Roth IRA, should you just skip it? No! Many high-income earners are able to still contribute to Roth IRAs using what are called backdoor Roth contributions. If you are able to use this strategy to contribute to a Roth IRA, do it. Get details about this backdoor Roth strategy and how to implement it.

Should I really contribute to my Roth IRA before my Roth 401(k)? Aren’t they the same thing?

Depending on the quality of your 401(k) plan, your Roth 401(k) may be very similar to your Roth IRA. However, no matter if you have a great 401(k) plan, we still give Roth IRAs the slight edge. You can choose your Roth IRA provider, which means you can get access to a wider range of investments that may be less expensive.

Roth IRA contributions can be withdrawn at any time, which gives you flexibility in very tough situations (although we believe you should avoid touching Roth dollars unless absolutely necessary). 401(k) plans do have some additional legal protections that Roth IRAs do not have. This may not be relevant for some, but read up on ERISA protections if they may come into play for you.

3. Maximize your employer-sponsored plan

Maxing out your employer retirement plan, such as a 401(k), comes next. This means contributing the maximum you are able to, but does not include strategies like mega backdoor Roth contributions (that comes next).

What if I don’t have an employer-sponsored retirement plan?

Not all employers offer retirement plans, and if your employer is one that doesn’t, you may skip to the next retirement savings bucket (taxable brokerage account). However, you may have other options.

If you work for a small employer, lobbying for a retirement plan could give your employer the extra nudge they need to add one. Chances are they have been considering it already, and if they know employees are interested, that might be the extra push they need.

If your employer won’t add a workplace retirement plan, there may be other options. Any self-employment income you have can be used to open and contribute to a self-employed retirement plan such as a solo 401(k). If you don’t work a traditional W-2 job or have side income, it can be a great opportunity to start your own retirement plan.

What if I don’t have the income to max out my employer-sponsored plan?

Maximizing your employer plan takes a lot of income. The overall goal is to invest 25% of your income for retirement; if you start early, less may be required, and if you are a late bloomer, you may need to contribute more.

If you are contributing what you need to contribute for retirement, you may never need to maximize your employer plan, and that’s perfectly fine! In fact, getting your employer match and maximizing your Roth IRA and HSA may put you over the 25% investing benchmark. Check out our Know Your Number course for a deep-dive into how much you should invest to meet your retirement goals.

4. Hyperaccumulate for retirement

If you reach this stage of saving for retirement, it’s likely your employer doesn’t offer a retirement plan or you have a high income. Most folks will be able to invest what they need for retirement without ever thinking about going above and beyond, and that is totally fine. For those who do need to invest more after going through the above steps, the next place you’ll turn will be mega backdoor Roth contributions, if your employer plan offers them, or taxable brokerage contributions.

Watch this video about the mega backdoor Roth and how it works. If your employer plan is compatible, you may be able to build even more tax-free retirement assets. If you are unable to use this strategy or still need to invest more for retirement, consider utilizing a taxable brokerage account.

Brokerage accounts have no contribution limits and no restrictions on when money can be withdrawn or used. They have no special tax advantages like other retirement accounts and gains are taxed at long-term or short-term capital gains rates depending on the holding period of your assets.

How Much Should You Invest? The 25% Rule Explained

Copy link to this section: How Much Should You Invest? The 25% Rule Explained

Copied the URL to your clipboard!

When it comes to investing for retirement, there’s no one-size-fits-all amount to save. How much you should invest depends on when you want to retire, how much money you plan to spend in retirement, what other sources of income you have, like pensions or Social Security, what inflation and rate of return you expect, and more.

The Money Guy Philosophy

- We believe you should start investing as soon as possible, even if it’s only $20 a month. The sooner you start investing, the less you need to save due to the power of compounding interest.

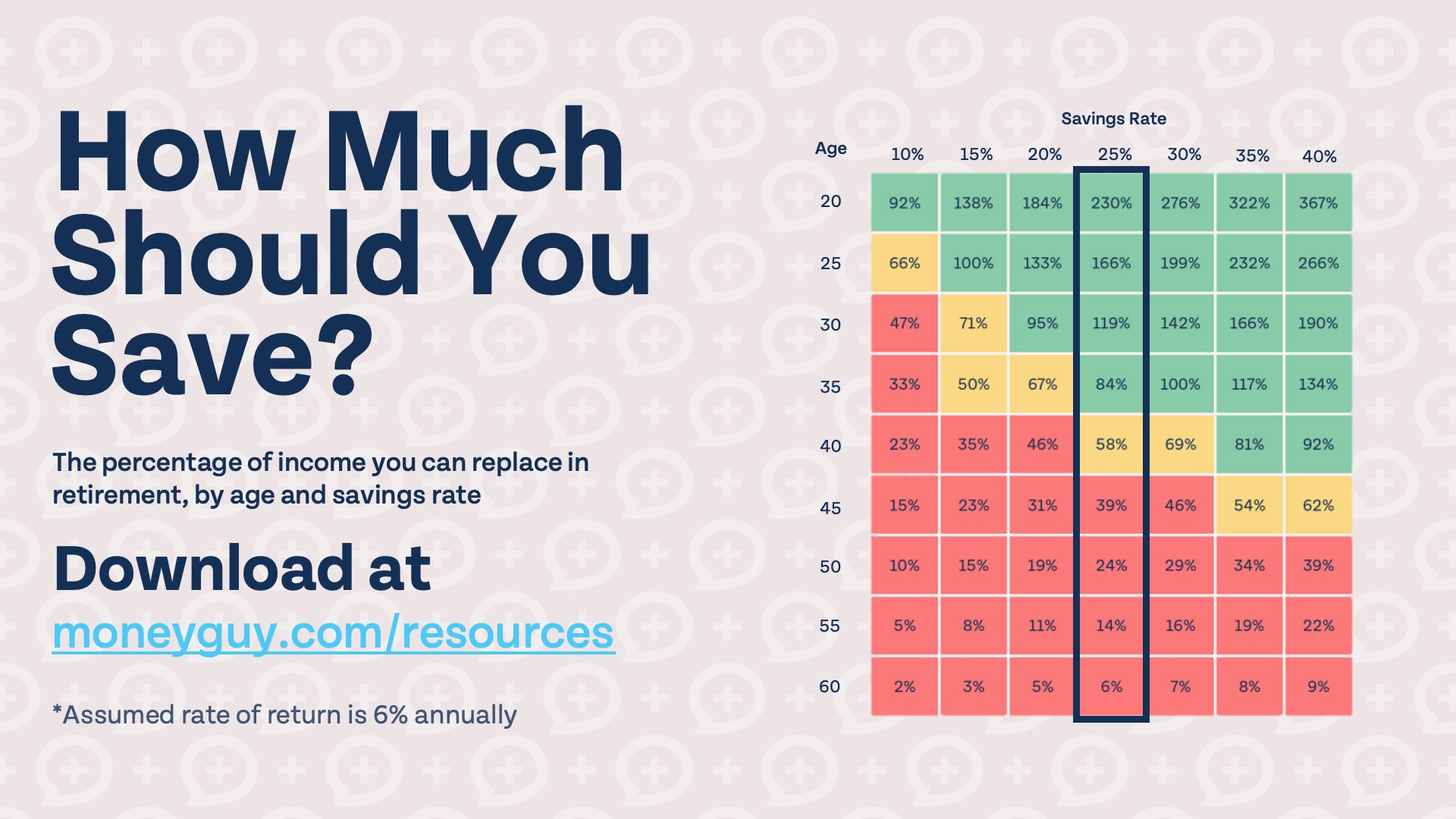

- Aim to be investing 25% of your gross income by age 30. This includes all money saved for retirement, and if you make under $100,000 per year (single) or $200,000 per year (married), you can include employer retirement contributions.

Why 25%?

- The chart below shows why we advise investing 25% for retirement by age 30. If you can do that, you can replace 119% of your pre-retirement income if you retire at 65.

- Is 25% the magic number for everyone? No, but it’s a great starting point. You may need to invest less or more for retirement depending on your retirement needs and aspirations.

Share image

Calculating YOUR 25%

To calculate if you are investing 25%, simply divide all of your retirement contributions by your gross income.

Example: If you make $200,000 per year in gross income and invest $50,000 across all retirement accounts, you are investing 25% of your gross income ($50,000/$200,000 = 25%).

Common questions

Can I include my employer contributions in my own savings rate?

Yes, you can include employer contributions if you make under $100,000 (single) or $200,000 (married).

Should I include pension contributions in my savings rate?

You can always include your own pension contributions in your savings rate, but only include employer contributions if you make under $100,000 (single) or $200,000 (married).

Do I count 529 contributions or my emergency fund in my savings rate?

No, only include money specifically earmarked for retirement. This includes money invested in your 401(k), Roth IRA, taxable brokerage, pension, HSA (if you are saving it for retirement), and any other retirement account.

Know Your Number

Our Know Your Number course can help you calculate your own retirement number and determine how much you should be investing for retirement based on your own goals, assumptions, savings rate, and more.

Understanding Investment Vehicles (What Should You Actually Buy?)

Copy link to this section: Understanding Investment Vehicles (What Should You Actually Buy?)

Copied the URL to your clipboard!

Stocks

A stock is an investment representing a share of ownership in a particular company. The price of the stock goes up and down as investors trade shares of the stock on the stock market.

Bonds

A bond represents a loan taken out by a company or government. When you own a bond, you are lending money to the bond issuer, and in return receive interest and face value at maturity. Bonds are typically considered safer investments than stocks, but bonds issued by troubled companies can be very risky.

Investment Products: Your Complete Glossary

Index Funds

What is an index fund?

Index funds are investments (either ETFs or mutual funds) made up of all stocks in a particular group or category. For example, an S&P 500 index fund will contain every stock in the S&P 500 index. Some indexes are equal-weighted, which means the index fund will contain equal allocations to all companies in the index. Most, though, are capitalization-weighted, which means they contain larger allocations to bigger companies.

When to use index funds

We love index funds and believe everyone should use them as part of their investment portfolio. Depending on your age, goals, and risk-tolerance, your mix of index funds may be more conservative or riskier.

Target Date Funds

What is a target date fund?

Target date funds are investment products designed to grow your money for use at a specific time, most commonly retirement. If you plan to retire at age 50, in the year 2060, you may consider investing in a target date 2060 fund. These funds can also be used to invest for college, where the target date is the year of enrollment in college. Target date funds come in two different flavors, indexed or actively managed.

When to use target date funds

Target date funds are a simple investment that require no knowledge or skill to invest in. The allocation changes with time, so they are a perfect set-it-and-forget-it investment for those who wish to keep things simple.

Active Mutual Funds or ETFs

What are actively managed funds?

Actively managed funds are investments where a fund manager picks individual stocks with the goal of outperforming their market benchmark. Due to the higher turnover and work involved with managing a fund, expenses are typically much higher than index investments.

When to use actively managed funds

Actively managed investments can make sense in certain sectors, but overall index funds outperform most actively managed investments. For example, 88% of large cap funds underperformed the S&P 500 over the last 15 years (SPIVA).

Individual Stocks

What are individual stocks?

If you own individual stocks, that means you have a small share of ownership in a company. Individual stocks can be very volatile, especially for smaller companies, and it generally isn’t a great idea to invest in single stocks if you are saving for retirement. However, if you receive shares in your company stock as a employer benefit, you should speak with a professional to see when it makes sense to divest and how much you should be investing in your company.

When to use individual stocks

After you are investing 25% of your gross income for retirement, you can invest a small portion (no more than 5% of your income) into single stocks if you are so inclined.

Bonds & Bond Funds

What are bonds?

Bonds are fixed-income investments that allow you to lend your money to the government or private companies in exchange for interest payments and the full principal amount at maturity of the bond. Fixed-income investments like bonds are a staple of a retirement portfolio and will likely increase in allocation as you get older.

When to use bonds

When you are young you may not need to own a significant amount of bonds (or any at all). However, as you get older and wealth preservation becomes a primary concern, the portion of your portfolio allocated to bonds will increase.

CDs / High-Yield Savings Accounts (HYSAs)

What are CDs and HYSAs?

High-yield savings accounts are interest-paying bank accounts that have some restrictions on the number of transactions and amount of money that can be transferred out of your account in a single billing period. CDs are similar to high-yield savings account, but with pay a fixed interest rate over a set period of time instead of a variable interest rate.

When to use CDs and HYSAs

CDs and high-yield savings accounts are great for keeping liquid cash that you will need to access, or may need to access, in the near future. They are not great long-term investing vehicles, and should only be used for emergency funds, cash savings, and future living expenses if you are retired.

REITs

What are REITs?

Real estate investment trusts, or REITs, are companies that either own, manage, or finance real estate. Shares in REITs can typically be bought and sold on exchanges just like stocks. REITs can be a great way to get additional exposure to real estate in your portfolio. Instead of investing in individual REITs, consider a REIT index fund that contains many different REITs.

When to use REITs

Consider investing in a REIT (or REIT fund) when you want additional exposure to real estate beyond what you get from regular index funds.

Crypto / Bitcoin

What is crypto?

Cryptocurrencies are digital currencies secured through cryptography. They can be highly volatile, so are often used as speculative investments rather than digital currencies. Bitcoin was the first, and is the most notable, cryptocurrency.

When to use crypto

After investing 25% of your gross income for retirement you can consider investing a small amount of your income, no more than 5%, into cryptocurrencies.

Why Index Funds Win (The Data)

Actively managed investments can make sense in certain market sectors, but broad market indexes largely outperform actively managed funds. In addition to the difficulty of picking stocks that consistently beat the market, active managers must overcome higher expenses and fees and generating more taxable income from trading. Most active fund managers cannot accomplish these feats consistently over longer periods of time. The headwind to beat the market while charging higher fees is too much to overcome.

Index funds are typically more tax-efficient than active funds because they don’t tend to change very much. The goal of an index fund is to mirror a broad market index, such as the S&P 500, and it doesn’t require much trading or turnover to do that. Active investments, on the other hand, aim to beat market indexes. Attempting to beat the market often involves more trading and investment turnover, which in turn could generate more taxes.

Index funds are also cheaper than actively managed funds, which makes sense. Active managers need to spend more time and energy managing their investments because they are trying to beat the market indexes. Index fund managers need to only mirror their index, which keeps costs down.

The Investment Company Institute studies trends in mutual fund and ETF expenses, and their most recent annual report, released in March, found that index funds still have much lower expense ratios than their actively managed counterparts. The average expense ratio for index equity mutual funds (such as S&P 500 indexes) is 0.05%, and active equity mutual funds sit at 0.64%. That makes actively managed equity funds over 10x more expensive, on average, which is significant over a lifetime of investing.

Okay, so actively managed funds might not be as tax efficient and might be a little more expensive to invest in, but their higher returns are worth the trouble, right? Data from SPIVA finds, time and time again, that passive investments outperform active investments the majority of the time.

In their most recent report, market indexes outperformed over 80% of active funds over the past 15 years in every single category of domestic funds that SPIVA tracks, from small-cap to large-cap to real estate. In some categories, over 90% of actively managed funds were outperformed by their respective benchmarks.

To beat the market, one would have to overcome the tax efficiency and low cost of index funds, in addition to picking an active fund that can consistently outperform its respective benchmark. The data shows that simply investing in index funds will give you much higher odds of success.

Understanding Diversification

Diversification is important even when investing in index funds. As a younger investor, your portfolio allocation will likely consist of more stocks than bonds. Your primary focus is growing your investable portfolio and that means investing in risk-on assets like stock funds. As you get older, and your main goal becomes asset preservation, bonds, and other risk-off investments like cash, become a more important part of your portfolio.

Asset allocation by age/risk tolerance

The chart below shows a sample glide path by age. This is an example portfolio allocation that one could reasonably expect to use as they begin investing as someone in their 20s through their working life into retirement. Notice that in their 20s, the portfolio consists of over 90% stocks, but by retirement, more than half of the portfolio consists of bonds, TIPS, and cash.

Share image

Common Investing Mistakes That Cost Millions (And How to Avoid Them)

Copy link to this section: Common Investing Mistakes That Cost Millions (And How to Avoid Them)

Copied the URL to your clipboard!

Mistake #1: Trying to Time the Market

The stock market can have wild swings up and down during periods of volatility. It can be tempting to try to time the market. If you could take your money out before it went down, and put it back in at the bottom, you could make more money investing.

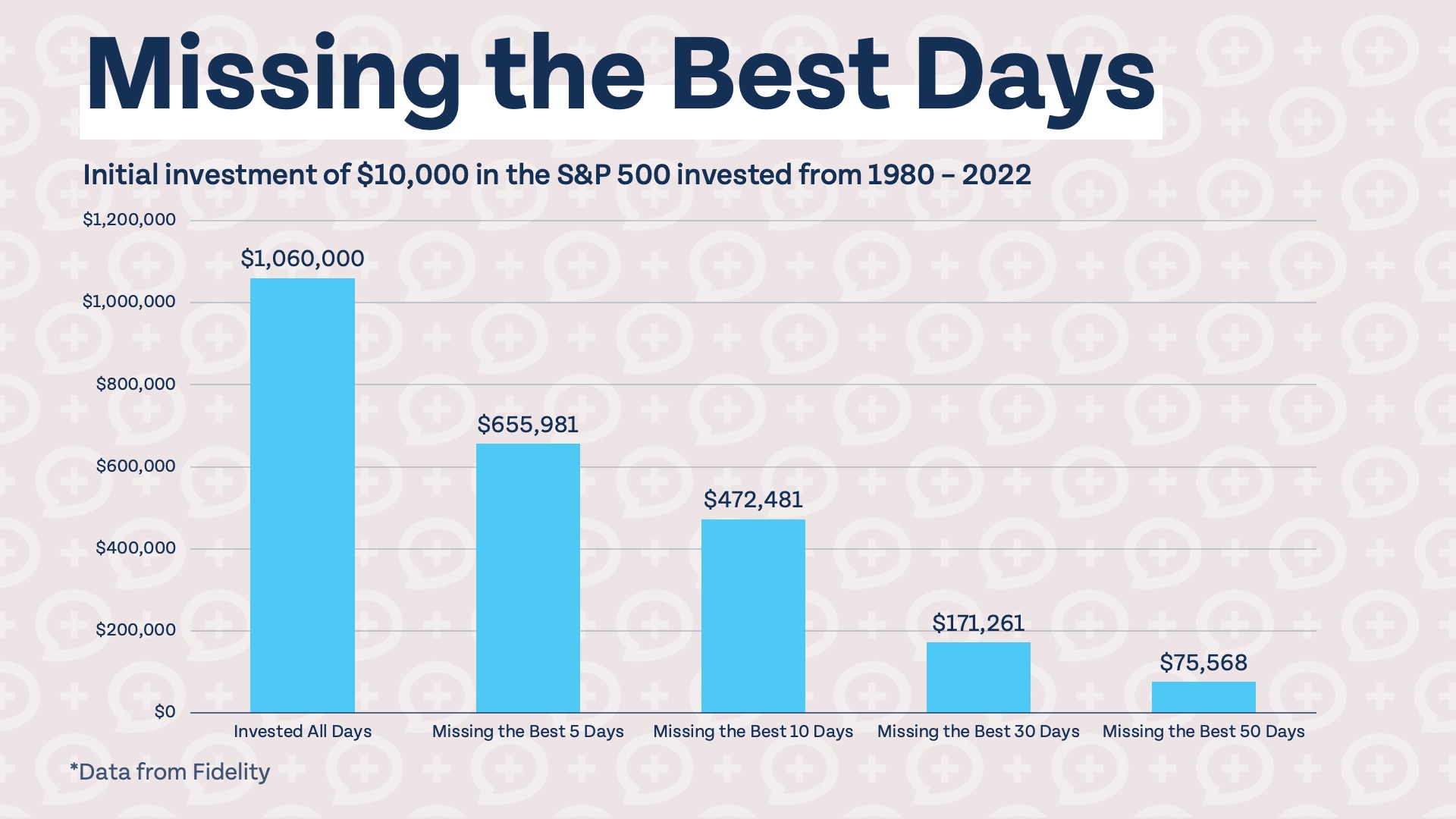

The problem is nobody knows exactly when the market will go up or down. And some of the best days to be an investor come in times of extreme volatility and fear in the stock market. Missing just a few of these incredible days could significantly hurt your returns over time. Take a look at the chart below, which shows that you would have over 50% less if you missed the best 10 days in the market vs. keeping your money invested the entire time.

Share image

Mistake #2: Taking an Improper Amount of Risk

You can be the best saver in the world, but if you take an improper amount of risk when investing, you could set yourself up for failure in retirement. The risk sword cuts both ways; if you take too little risk, your retirement accounts may not ever grow enough. If you take too much risk, your retirement accounts may lose more than you can afford. Use the risk tolerance questionnaire below to get an idea of your relationship with risk.

Mistake #3: Not Investing Enough

Some more traditional personal finance experts, such as Dave Ramsey, say you should aim to invest 15% of your gross income for retirement. That may be enough if you will have a significant pension and Social Security income in retirement, but we believe you should aim to be investing 25% of your gross income by age 30. 61% of Americans 50 and older are worried they won’t have enough money for retirement, and investing at least 25% will help ensure you aren’t one of them

If you would like to know if you are on-track for retirement, or how much you should be investing based on your personal goals for retirement, our Know Your Number course can help you calculate your own retirement number and determine how much you should be investing for retirement based on your own goals, assumptions, savings rate, and more.

Understanding Your Risk Tolerance & Asset Allocation

Copy link to this section: Understanding Your Risk Tolerance & Asset Allocation

Copied the URL to your clipboard!

Your asset allocation depends on when you want to retire and your retirement goals, but also depends on how much risk you are willing to take, or your risk tolerance. The portfolio of someone who is more risk-averse may look vastly different from someone who is less risk-averse, even if they have the same retirement timeline and goals.

Your willingness to take risk may be overshadowed by your capacity for risk. We find that many retirees still have the tolerance to take more risk in their portfolio, but they no longer have the capacity to take that risk because it would jeopardize their retirement income.

It is easy to have a higher risk tolerance when markets are doing well, but those with a higher risk tolerance need to have the ability to tolerate the bad times as well as the good. Not sure what level of risk tolerance you are at? Take the short quiz below!

Instructions

Score each question on a 1-5 scale. Add up your points and use the scale at the end to see where you stand.

- 1 = Strongly Disagree

- 2 = Disagree

- 3 = Neither Agree Nor Disagree

- 4 = Agree

- 5 = Strongly Agree

Questions

- I would rather have a 50/50 chance to win $1,000 than a 100% chance to win $500.

- When I think about taking financial risk, I feel excited and thrilled more than nervous and uncertain.

- I am very comfortable investing in the stock market.

- If I unexpectedly received an inheritance of $100,000, I would rather invest it mostly in medium to high-risk investments instead of safe, low-risk investments.

- My friends would describe me as a gambler and risk-taker rather than a cautious risk-avoider.

- If I lost my job, I wouldn’t change my spending habits at all and rely upon getting a new job before running out of money.

- I would rather risk spending too much money now and not having enough saved for retirement than saving too much and dying with millions of dollars.

Scoring Scale

- 7-15 = Less Risk Tolerant

- 16-25 = Average Risk Tolerance

- 26-35 = More Risk Tolerant

Tax-Efficient Investing

Copy link to this section: Tax-Efficient Investing

Copied the URL to your clipboard!

If all of your assets are in tax-advantaged retirement accounts, you don’t need to worry about paying taxes on your investments until you take the money out (or never, if you are investing in a tax-free account like a Roth IRA). Tax-efficient investing becomes a concern when you start investing in taxable brokerage accounts.

Tax location is just one aspect of your finances a fee-only, fiduciary financial advisor can assist you with. If your portfolio has reached the point where you have a large taxable brokerage account, investing in mutual funds that may not always be tax-efficient could leave you with a surprise tax bill of thousands of dollars. If you have a larger portfolio, and a large taxable account, it is very important to pay attention to the location of your assets.

High-flying growth assets, like equity mutual funds, can make sense in a tax-free account such as a Roth IRA or HSA. Since the growth and distributions from tax-free accounts are entirely tax-free, if taken as qualified distributions, getting as much growth as possible out of these accounts maximizes your tax benefit.

In pre-tax accounts, like a traditional 401(k), you may hold assets that generate ordinary income, non-qualified dividends, or other assets that may not necessarily be the most tax-efficient. All qualified pre-tax distributions are treated the same, no matter what assets are inside the account, so sticking less tax-efficient assets in a pre-tax account is worth considering.

For your taxable bucket, such as a taxable brokerage account, it is very important to consider the tax-efficiency of assets held in the account. Tax-efficient assets could include ETFs, municipal bonds, or tax-efficient mutual funds.

I don’t fully understand tax location. Now what?

Tax location isn’t always easy for investors to master, especially if you don’t have a background in finance. The good news is you don’t have to do it alone. If your portfolio has reached a critical mass, which generally can happen as you cross the $500k threshold in invested assets, it may be time to consider working with a financial advisor.

Feeling that you don’t have enough hours in the day, that you aren’t as confident in your financial decision making, or that you don’t know if you are doing everything you should be are just a few signs it may be time to consider bringing on a co-pilot.

For those that are thinking about hiring an advisor, or already talking to potential advisors, we created a free resource for you: “8 Questions to Ask Your Financial Advisor.” It can be difficult to know what to look for in an advisor if you aren’t in the financial world. Asking the right questions can help determine if a financial advisor is a good fit for you and if they will truly have your best interests at heart.

Too often, “investment management” gets mistaken for “financial planning.” Investment management includes managing a portfolio, asset allocation, asset location, and strategies like tax-loss harvesting, but a fee-only financial advisor can help with so much more.

Financial planning includes all of the above, and insurance planning, estate planning, tax planning, cash flow management, college planning, retirement planning, and any other financial questions you may have. You can learn more about our day job as a fee-only financial advisory firm. If you’re ready to take it to the next level then you can fill out this form to work with us.

Dividend Investing

Copy link to this section: Dividend Investing

Copied the URL to your clipboard!

Stocks that pay cash to investors, known as dividend stocks, have become a popular way to invest in recent years. Known as dividend investing, shareholders receive a portion of profits as well as stock appreciation.

There are many fine companies that issue dividends and there is nothing inherently wrong with investing in dividend stocks, but proponents for dividend investing believe that they generate outsize returns, which may not be the case.

The money companies distribute as dividends does not come out of thin air, of course, it comes from the profits generated by the company. Instead of distributing some profits as dividends, that money could instead be invested back into the company. Oftentimes, it is better for the long-term growth and profitability of a company to reinvest that money instead of distributing it to shareholders.

The data shows this to be the case. An analysis conducted by Morningstar in 2025 found that the US market overall has outperformed their US dividend growth index and their US high dividend yield index over the last 10 years.

Frequently Asked Questions

Copy link to this section: Frequently Asked Questions

Copied the URL to your clipboard!

Is investing only for people with high incomes?

Investing is for everyone, even if you don’t have a high income. You don’t need to start investing with a large sum of money and low-cost providers, like Fidelity, allow you to get started with as little as $10.

Should I invest or pay off debt first?

The short answer is “it depends.” If you get an employer match in your retirement account, you should get your full match before you pay off any debt. But before investing in a Roth IRA, HSA, or your 401(k), you should pay off any high-interest debt, like credit cards or consumer debt.

How do I invest during a recession/bear market?

We believe your investing strategy should not change due to market conditions. If your plan was solid before a bear market, it will be solid during and after a bear market.

What if I started investing late?

The earlier you start investing, the better – but not everyone starts investing at a young age. If you get a late start, you may need to invest more aggressively or adjust your retirement goals to compensate for a lower income in retirement.

Can I lose all my money investing in index funds?

If you were to lose all of your money investing in index funds, you would have much bigger problems to worry about and wouldn’t even remember the money you lost in index funds. Could society collapse and bring down your index funds with it? Sure, anything is possible, but we are optimistic about the future and don’t believe any good can come from worrying about something you can’t control or do anything to prepare for.

How often should I check my investments?

We’ve found that those who check their investments less frequently are generally less anxious and less worried about their investments. It is healthy to check your investments regularly, like once per month, but checking everyday can cause more stress and could cause you to make unnecessary changes to your portfolio.

Should I invest if I don’t have an emergency fund yet?

Following the Financial Order of Operations, you should get your employer match before building a full emergency fund. However, building a full emergency fund comes before contributing to a Roth IRA, HSA, maximizing your 401(k), or contributing to a taxable brokerage account.

“I’m self-employed, how do I invest?”

If you are self-employed, you don’t have access to traditional retirement accounts like a 401(k). However, there are self-employed retirement accounts available. Solo 401(k) accounts are worth considering if you are self-employed and looking for other places to save after maximizing your other tax-advantaged retirement accounts.

“My 401(k) has high fees—should I still invest?”

Some 401(k) plans have high fees and poor investment options. That’s why we believe you should maximize your Roth IRA and HSA before contributing more to your 401(k) (beyond getting the employer match). Due to the tax-advantaged nature of 401(k)s, we believe it still makes sense to invest in even if it has high fees and/or poor investment options.

If you find yourself stuck with a bad 401(k), try advocating for a change with your employer. If your employer is unwilling or unable to change, you can move money out of your 401(k) into a better tax-advantaged account as soon as possible.

“Is 25% too much? What about enjoying life?”

We get it, investing 25% of your gross income for retirement is a lot of money. We believe by allocating that significant portion of your income to retirement, you can create flexibility and live your more beautiful tomorrow in retirement.

“Roth or Traditional IRA?”

Everyone who can take advantage of the tax-free growth and distributions that a Roth IRA offers should do so. You can build traditional pre-tax retirement assets in your 401(k), if it makes sense for your personal situation, but when it comes to IRAs, go Roth.

“How to invest $400k windfall?”

If you receive a large windfall such as an inheritance, how do you invest it? When it comes to allocation, it depends what you are investing it for. If you are saving it for retirement, you should allocate it like your existing retirement portfolio. If you are investing it for short-term goals, investing it in conservative assets or a savings account may be more appropriate.

If your windfall makes up a significant portion of your overall net worth, it may be better to invest it into the market over time instead of all at once. This reduces the risk of investing it all right before a market downturn.

Conclusion

Copy link to this section: Conclusion

Copied the URL to your clipboard!

Investing is essential for a successful retirement. Nobody wants to work until they die, but many Americans give themselves no other option by living above their means during their working years. The hard part is saving a little bit of today for a more beautiful tomorrow. Once you are able to live on less than you make and invest 25% of your income for retirement, the rest is easy.