The younger you are, the more powerful the dollars you save. How can you help your kids get a head start without neglecting your own financial life?

Dollars are more powerful the younger you are, and many parents want to take advantage of this by giving their kids a head start on saving for the future. If you invest just $1,544 for your newborn, they could be a millionaire at age 65 without saving another dollar, based on an annual rate of return of 10%. It may be tempting to prioritize saving for your children as early as possible to set them up for a great future, but how do you know when it is okay to start saving for the kids?

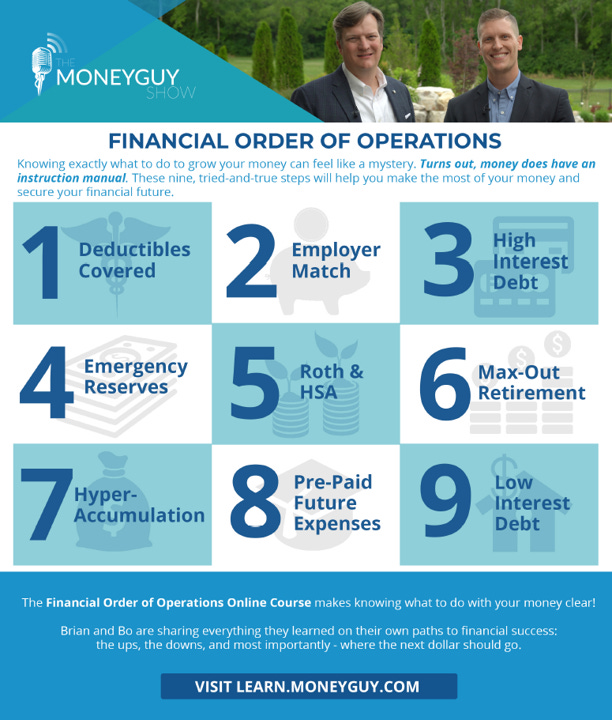

Where does saving for children fall in the FOO?

There is no such thing as a retirement loan, so it’s important to make sure your own financial future is secure before worrying about your children. Saving for your children’s future education or retirement expenses falls in Step 8 of the Financial Order of Operations (shown below). This means before you start saving for your children, you should have your deductibles covered, be getting your employer match, have no high-interest debt, maintain a full 3-6 month (or more) emergency fund, max out your Roth IRA and HSA, max out any other retirement plans, and hyper-accumulate in a taxable account.

It may be difficult to wait until your own financial life is in order to save for your children, as it is hard to ignore how powerful dollars saved for your kids can be. However, your kids have their entire lives ahead of them; for college, they can work through school, earn scholarships, receive financial aid, or take out student loans. They have decades and decades left to get motivated and save for retirement. Parents do not have the luxury of putting off saving for retirement, and it is important to put your own retirement first.

Even if you did nobly sacrifice your own retirement to pay for your child’s education, your children may end up footing the bill eventually anyway by supporting you financially in retirement. Millions of parents live with their adult children, often not out of choice but to cut expenses, and 17% of children will become caretakers for parent(s) at some point. Saving for your own needs before those of your children is best for all parties involved.

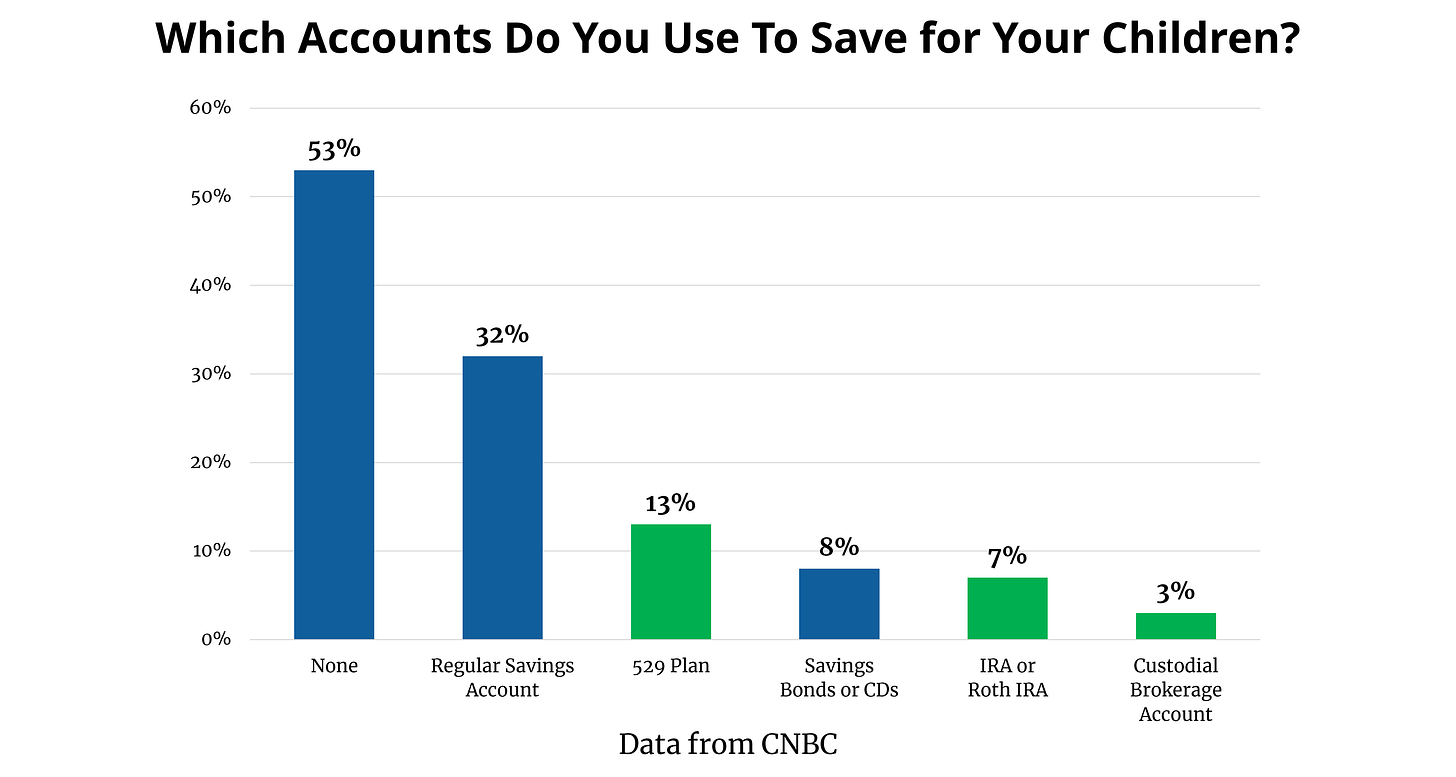

About half of all American parents have already started saving for their children in some capacity. Even if they are all at the stage where saving for their children makes financial sense, they are not saving in the most appropriate vehicles. The chart below shows which savings vehicles, if any, parents are using to save for their children. 32% of parents are saving for their children in a regular savings account, compared to only 13% using a 529 plan, 7% using an IRA/Roth IRA, and just 3% saving in a custodial brokerage account. 8% of parents use savings bonds and CDs, which makes them more popular than Roth IRAs and custodial brokerage accounts.

The best savings vehicles for kids

If you are saving for your child’s future, and know the money won’t be needed for at least five years, there are savings vehicles that may be better than traditional savings accounts, government bonds, or CDs. Even if you already know which accounts are great for investing for your children (hint: they are the green bars in the chart above), you may not know how to open an account or if you are eligible to contribute on behalf of your children. Let’s dive into the best savings vehicles for children, advantages of each type of account, and how you can use each most effectively.

1. Roth IRAs

One of the best vehicles for saving for your child’s future is a Roth IRA, the apex predator of retirement savings vehicles. Roth IRA contributions are not tax deductible, but grow tax-free, and qualified distributions are also entirely tax-free. Roth accounts are great for children because they are typically in a lower tax bracket and will benefit from decades of tax-free growth and tax-free distributions in retirement. Roth IRAs have no required minimum distributions (RMDs), and there are many low-cost providers that offer a wide range of investment options.

Roth IRAs do have some restrictions. To contribute, your child must have earned income from a job. Household chores and other miscellaneous income doesn’t count unless they are paying taxes (children may not owe federal income tax if they earn below the standard deduction, but are still required to pay FICA taxes). They are allowed to contribute the lesser of $6,000 (2021 limit) or total taxable compensation for the year. You can offer to “match” your child’s Roth IRA contributions; Brian does this, and it is a great way to encourage children to invest, but total Roth IRA contributions can not exceed your child’s earned income for the year or $6,000, whichever is less.

How to open a custodial Roth IRA

If your children have earned income, get them investing in a Roth IRA as soon as possible. Three of the biggest custodial account providers are Fidelity, Vanguard, and Charles Schwab. Accounts can be opened quickly and easily online. Whichever provider you decide to go with, make sure they offer access to a wide range of investments without excessive fees or expenses. For younger investors, target date index funds are worth considering.

2. 529 plans

529 plans are the Roth IRAs of saving for education. Contributions are not federally tax-deductible, although you may receive a state income tax deduction in certain states. Accounts grow tax-free, and distributions used for qualified education expenses are also tax-free. In recent years, 529 plans were expanded to allow distributions to be used tax-free for eligible K-12 tuition expenses. (For those familiar with Coverdell ESAs, the expansion of 529 plans to include K-12 expenses has largely made Coverdells irrelevant since they have an income limit and a much smaller contribution limit).

529 plans do not have an income limit, and per-beneficiary lifetime contribution limits are very generous, ranging from $235,000 to $529,000 (some plans have annual contribution limits of $15,000). Contributions over $15,000 per individual per year will count against your lifetime gift tax exclusion and you will be required to file a gift tax return.

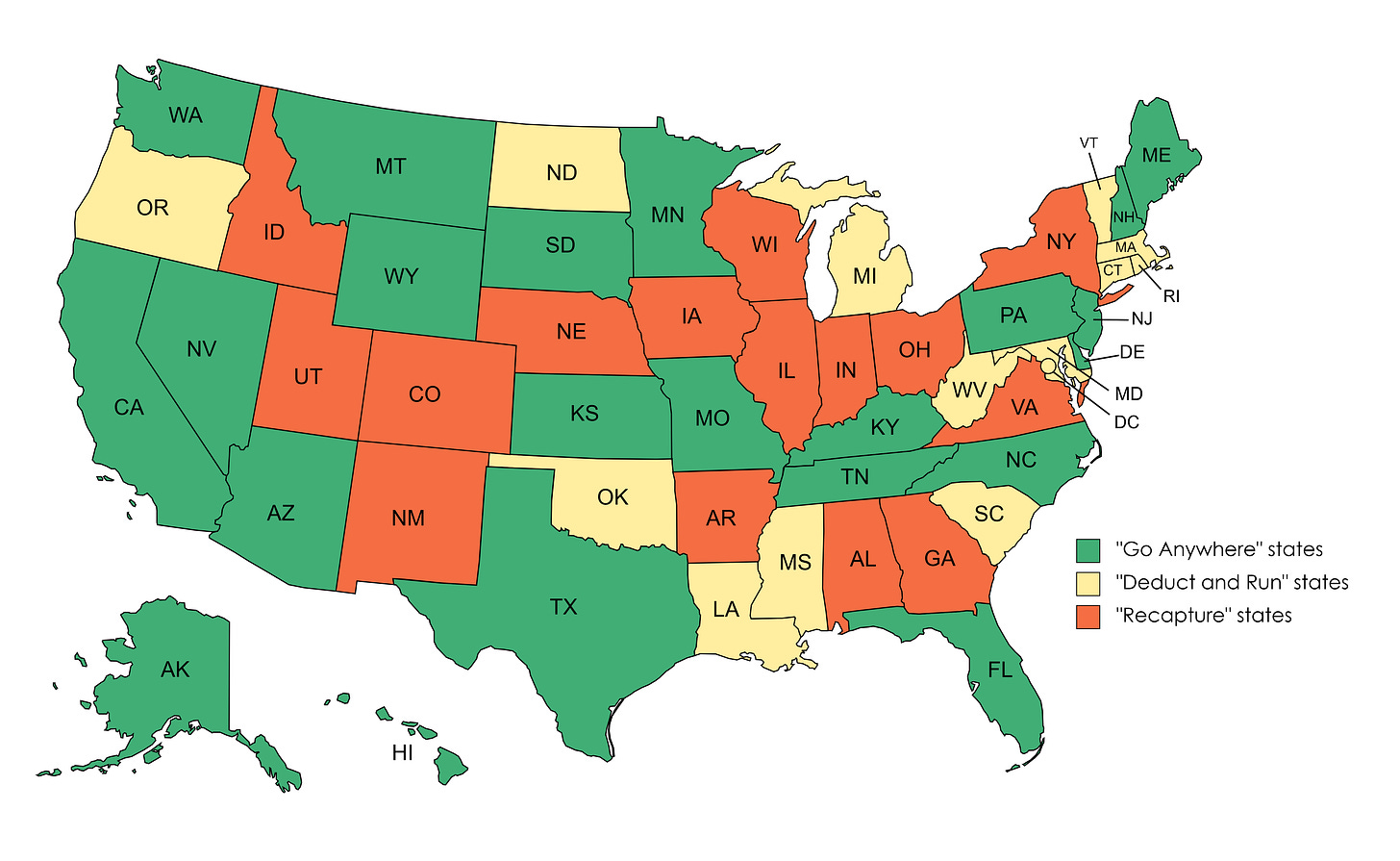

529 plans are offered through your state, and they may only offer one or two plans with limited investment options and high expenses and fees. However, you can often enroll in an out-of-state plan and get the same state tax break as you would with the in-state plan. Some states allow you to “Go Anywhere,” (the states in green, below) which means you can enroll in an out-of-state plan and receive the same tax benefit as someone in the in-state plan. These states either offer no tax break to any 529 plans, have no state income tax, or allow you to receive the same state income tax break for contributing to an out-of-state plan (it is very rare for a state to offer a tax break for any plan; those that do include Arizona, Kansas, Minnesota, Missouri, Montana, and Pennsylvania).

Other states allow you to ‘“Deduct and Run” (the states in yellow, below); in these states you must contribute to the in-state plan to receive the tax benefit, but the states allow you to transfer assets to an out-of-state plan and keep the tax benefit. “Recapture” states (in red, below) only give you a tax break for contributing to the in-state plan and will claw that tax benefit back if you transfer assets to an out-of-state plan. Be careful when choosing an out-of-state 529 plan, and make sure you know how your state treats out-of-state plans and whether or not you can get the same tax benefit. It may be worth choosing an inferior in-state plan if you are offered a generous tax benefit that you can’t get with an out-of-state plan.

How to open a 529 account

If your in-state plan is less than ideal and you can receive the same tax benefit by contributing to an out-of-state plan, consider shopping around. Morningstar maintains an annual list of the best 529 plans, and Saving for College gives all plans an overall rating, fee score, and performance score. Their website includes links to each plan’s website where you can learn more and open an account.

529 accounts can only have one beneficiary, but you can transfer from one student to another. This means if your first child doesn’t use all of the assets in their 529 plan, the beneficiary can easily be changed to the next child to attend college. If your children do end up with leftover 529 assets and there are no younger siblings or relatives for the assets to be used on, the earnings portion of distributions not used for qualified education expenses will be subject to income tax and a 10% penalty. As of the passage of the SECURE Act, a maximum of $10,000 can be used to pay off student loan debt tax-free.

3. Custodial brokerage accounts (UGMAs/UTMAs)

Custodial brokerage accounts are more flexible than Roth IRAs and 529 plans. Money saved is not earmarked for a certain purpose, like education or retirement. There is no income limit or contribution limit (but the gift tax limit of $15,000 will still apply); you can contribute on behalf of your children, and they do not need to have earned income. Up to $2,200 in earnings from a custodial account may be taxed favorably ($1,100 exempt from federal income tax and $1,100 taxed at the child’s tax rate), however custodial brokerage accounts do not have the same tax benefits as Roth IRAs and 529 plans. Accounts do not grow tax-free, and withdrawals are taxed at either ordinary income tax rates or more favorable long-term capital gains rates, depending on the holding period of the asset.

If you are saving for your children’s education, consider saving in a 529 plan. If your child has earned income, try setting up a custodial Roth IRA. If you are looking to save for other goals, and 529 accounts or Roth IRAs do not meet your savings needs, custodial brokerage accounts are a great all-purpose savings vehicle (although they do not offer the tax breaks of Roth IRAs and 529 plans).

How to open a custodial brokerage account

Many of the same providers that offer custodial Roth IRAs offer custodial brokerage accounts, including Fidelity, Vanguard, and Charles Schwab. Make sure your provider offers a wide range of low-cost investments and has minimal expenses and fees.

Honorable mention: ABLE accounts

ABLE accounts are very powerful tax-advantaged savings vehicles for those with disabilities. ABLE accounts offer tax-free growth and tax-free withdrawals when used for things like college, job training, healthcare, and financial management. If you have a child with special needs, ABLE accounts are a great way to save for their future. Brian has found the ABLE National Resource Center to be an invaluable resource for information about ABLE accounts, including who is eligible, how funds can be used, impact/limits on other government benefits, and how to open an account.

Saving for your child’s future, or even helping them learn how to save on their own, can set them up for success once they leave the nest. Saving for your children the right way means putting your own finances first. Once you have reached Step 8 of the Financial Order of Operations and are ready to start saving for their future, make sure you do it the right way. Consider utilizing tax-advantaged accounts like 529 plans or Roth IRAs, and custodial brokerage accounts if tax-advantaged accounts don’t completely meet your needs.

Even if you are working through the Financial Order of Operations and have not yet reached Step 8, you can still help your children work on their Financial Mutant skills by teaching them deferred gratification, reading personal finance staples (such as The Wealthy Barber and The Millionaire Next Door), and recognizing that time is the most valuable resource of wealth building. Download some of our free resources, including our “Wealth Multiplier for Young Savers” and resource “Are You on Track To Be a Millionaire?” to get your children excited about saving today.