Cash, meaning savings accounts, money market funds, and other cash-equivalent investments, have been yielding next to nothing since the beginning of the pandemic. Even before the pandemic, the federal funds rate† peaked around 2.40% in early 2019. If we go back even further, the federal funds rate was near zero from the beginning of 2009 through the end of 2015. For over a decade, except for a brief period a couple years ago, cash has been yielding essentially nothing. It may feel like the opportunity cost of keeping your emergency fund and other short-term savings in cash is enormous.

Since 2009, while cash was yielding next to nothing, the S&P 500 annualized over 15%. Out of those 12 years, the S&P 500 has only been down in one of them (and only lost 4.41%). If you started investing in 2009, you might think the stock market only goes up. And you’d probably wonder why anyone keeps anything invested in cash, as the S&P 500 has not been down for a significant period of time. Is the opportunity cost of keeping your emergency fund and other short-term savings invested in cash greater than the safety and security of your money? In today’s market, what is the value of cash?

The importance of cash

It is easy to forget why cash is important and why it makes sense to save for short-term goals (less than five years in the future) in cash. Especially in times when the stock market is doing great and cash is not, the safety and security of keeping money in cash seems to pale in comparison to the opportunity cost of not investing that money.

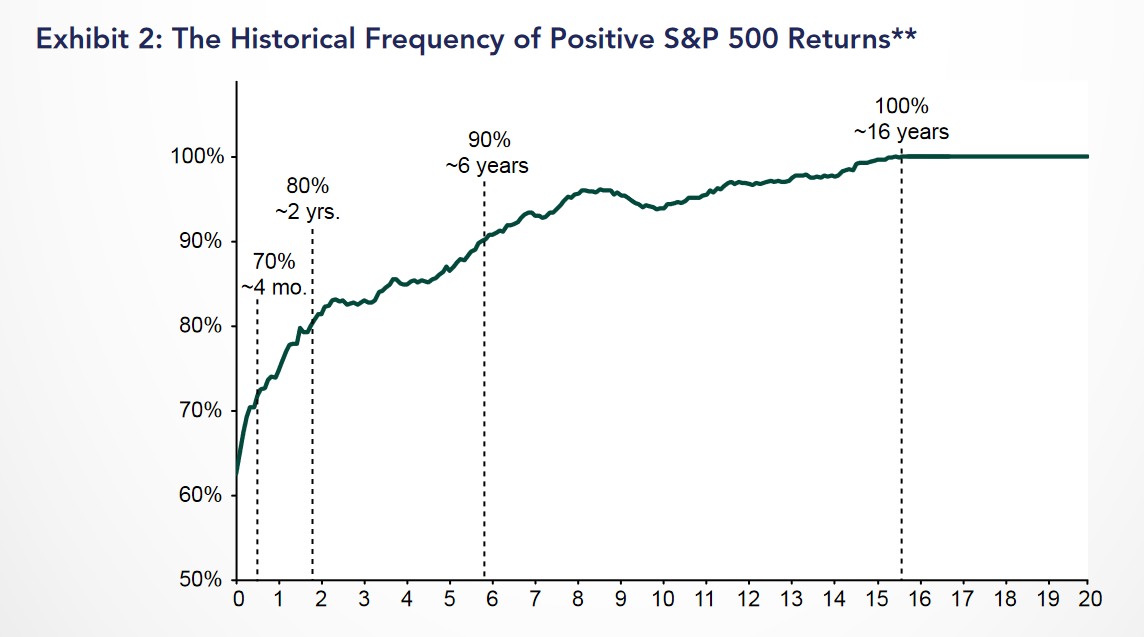

The stock market is pretty predictable over the long-term, but much less predictable over the short-term. The S&P 500 is positive in about 95% of rolling 10-year periods, and positive in 100% of rolling 20-year periods. However, over one-year periods, the S&P 500 goes down 25% of the time, and over five-year periods the S&P 500 has a one in eight chance of being down. The chart below, from Fisher Investments, shows the relative unpredictability of the market in the short-term, and predictability over the long-term.

If you are investing for the long-term, unpredictability over the short-term is fine. A down year, or even a down five-year period, shouldn’t have much of an impact on a young person saving for retirement. But what if you have your emergency fund invested in the market? The S&P 500 is down in 37.2% of all months and in 31.3% of all quarters. An emergency fund needs to be liquid and there when you need it. It is very risky to accept a 30% to 40% chance that your emergency fund won’t all be there when you need it. The true risk may be even higher since negative events usually happen all at once (when the market is down, you may be more likely to lose your job and need to access your emergency fund).

The risk of investing money saved for short-term goals, like a house downpayment or car purchase, are not as great as keeping your emergency fund invested, but still high. Are the returns you can make in the market for a couple of years really worth the risk of delaying a home purchase or car purchase? Shelter and transportation are necessary expenses, and while you may have acceptable substitutes while you are saving, there is a reason why you are saving for a new car or house; your current home may not be big enough to meet your needs, or your car may be on its last leg.

Cash-equivalent accounts aren’t exciting. Nobody enjoys seeing their emergency fund earn $5 per month in interest while watching the S&P 500 reach new highs what feels like every day. The feeling of missing out on growth is the price we pay for our short-term savings to be safe and accessible when we need it. The goal of short-term savings is not to maximize growth, but to ensure it is there when we need it, whether it is for emergencies or to buy a new house.

Cash won’t always yield nothing

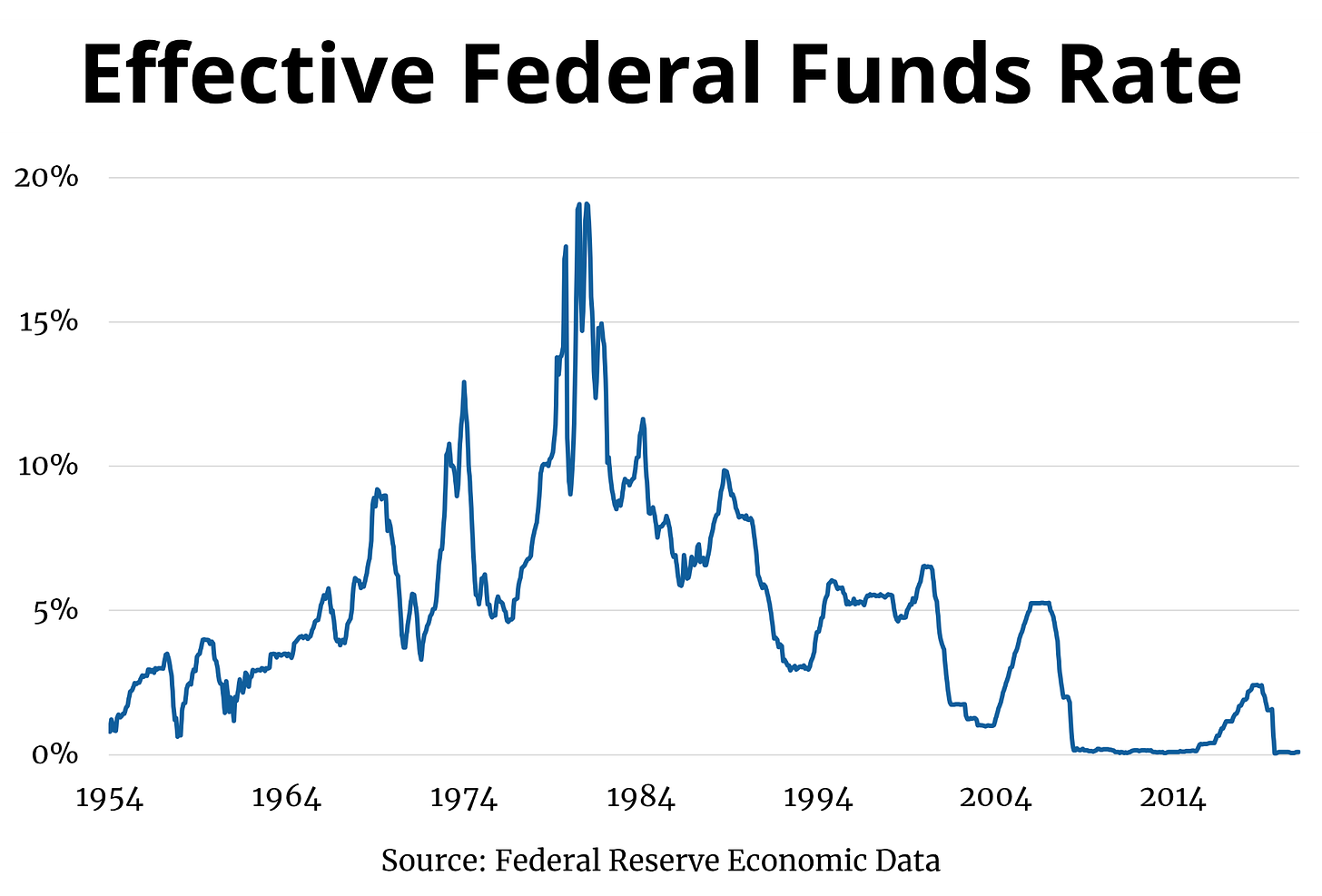

When looking at the effective federal funds rate† over the last 65+ years (see the chart below), the last decade appears to be an anomaly, not the norm.

Throughout the 1990s rates mostly hovered around 5%, and in the 1970s and 1980s rates went as high as 10%, 15%, and nearly 20%. It’s probably difficult to imagine earning 5% or 10% interest on a savings account, especially for generations that have never experienced higher interest rates, but if history is any indicator we could very well experience higher rates in the future. At the very least, interest rates are unlikely to remain near zero long-term; officials at the Federal Reserve have said rate hikes could come by 2023, and aim to achieve “moderate” long-term interest rates.††

Alternatives to cash

So far we’ve only compared cash-equivalent accounts to the stock market, but there are alternatives to cash-equivalent investments that aren’t as risky as investing in the stock market, such as bonds and CDs. While these accounts aren’t as risky as the stock market, they still come with significant drawbacks when compared to cash-equivalent investments. Bonds aren’t as risky as stocks, but can still go down in value. With CDs your money is typically locked up for a period of time and the interest rate you can get is not significantly better than you would get on a savings account.

There are cryptocurrency “savings accounts” out there that promise extremely high interest rates, in some cases 12% or more, but these vehicles are very risky and largely unregulated. Your money in the account is invested in crypto, not cash, and is not protected by the FDIC. There are “stablecoins” that are pegged to other assets to prevent price fluctuations, but they don’t always work. SafeDollar recently plummeted to zero, despite being a stablecoin. High-interest cryptocurrency “savings accounts” and stablecoins sound like a great idea in theory, but are, at least for now, unregulated and very risky (and may work against your ultimate goal of serving as an emergency reserve for a financial rainy day or upcoming expense).

Why cash is the safest option

There is no great alternative to cash that is just as safe and secure and pays a reasonable rate of interest. One of the basic rules of finance is that you must increase the amount of risk you are willing to take if you want to increase your potential return. Savings for short-term goals, like buying a house or car, and your emergency fund, need to be readily accessible and not go down in value. Cash can also be an opportunistic tool that allows you to buy when the market is down. Check out the clip below where we discuss the importance of cash and having an adequate emergency fund.

Cash-equivalent accounts may not pay much interest right now, but they provide safety and security that riskier investments just can’t offer. When the market is down and you need to access your emergency fund, you’ll be glad it is safe and sound in a boring savings account.

Notes

† The federal funds rate is the interest rate banks charge each other to borrow or lend excess reserves. This rate plays a large role in determining the interest rate on your savings account, on your mortgage, and more. When banks are getting a higher rate lending your money to other banks, they are able to pay you a higher rate for your deposits (and mortgage rates are higher when banks can earn more through other activities).

†† The Fed defines “moderate” as 2% inflation, and this is an average target, not a ceiling. This means if inflation is below 2% for several years, the target may be higher for a few years to bump the average up to 2%.