This article was originally published in October of 2022.

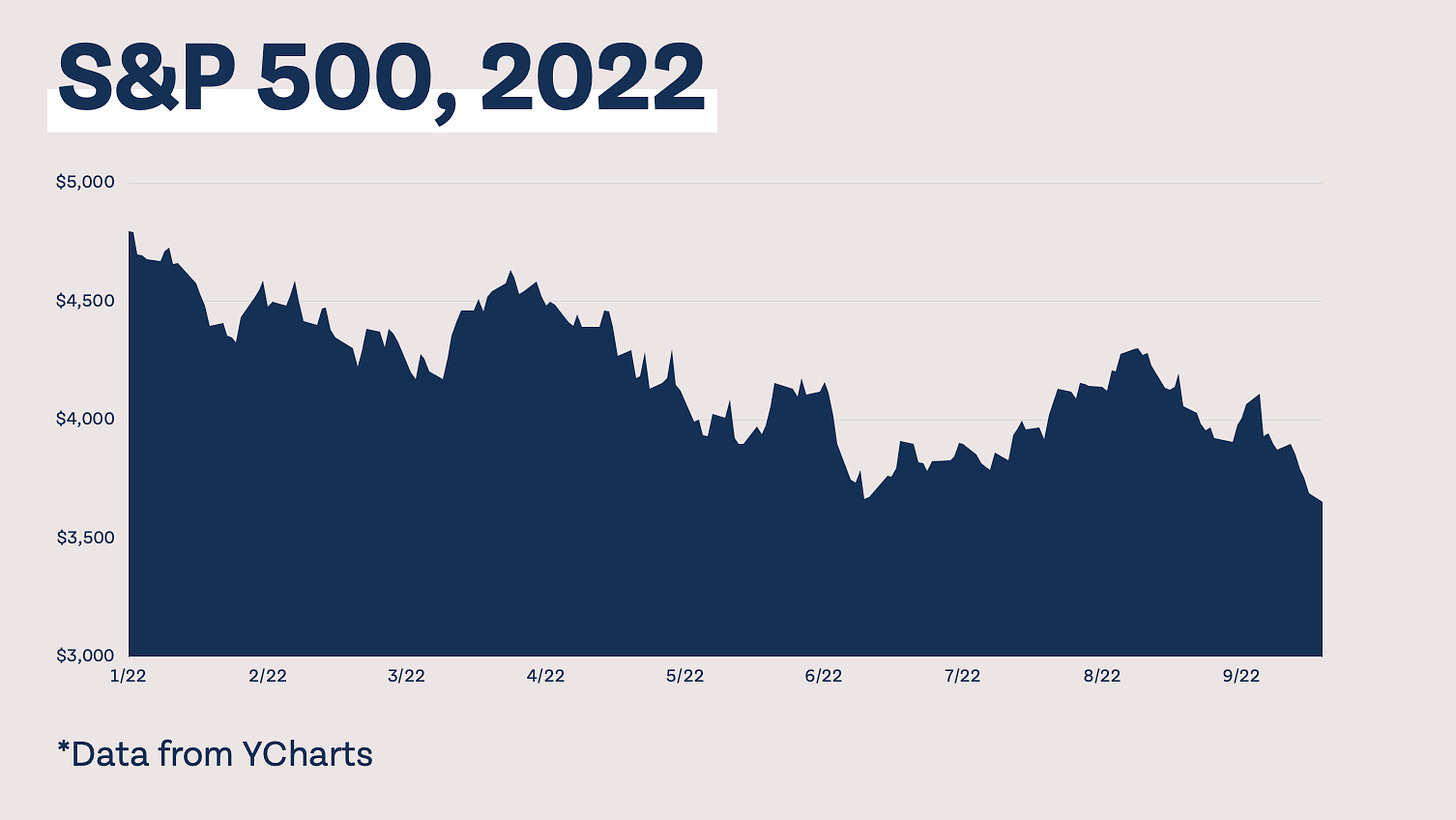

If you’ve been paying attention to financial markets at all this year, you know the stock market has not been doing great. The chart below shows the S&P 500 year-to-date, which is down a little over 20%.

After a bear market rally from June to August of just over 17%, the market has since been on a steady decline, driven partially, if not mainly, by persistently high inflation and a commitment by the Federal Reserve to raise interest rates until inflation comes down. Jerome Powell has said “we must keep at it until the job is done.”

Unlike the brief downturns at the end of 2018 and March of 2020, this bear market is more prolonged (the decline began in January) and has many wondering what they should be investing in, or if they should be investing at all right now. Although this downturn is unlike the downturns in 2018 and 2020, we are not in uncharted territory.

In the last 70 years, the S&P 500 has dropped by 20% or greater on 11 separate occasions, and over those 70 years, 46.3% of trading days have seen the S&P 500 decline. We are currently experiencing about a once every seven years event, but we experience market declines nearly every other day.

We are currently experiencing the longest bear market since 2008. Many investors today were teenagers or young adults in 2008 and weren’t investing. The current downturn feels bad because it happens so infrequently; this is a normal but only occasional occurrence, which is a great reason for optimism.

Our friend Jeremy from Personal Finance Club recently posted the graphic below on Instagram. I think it’s a great visual reminder of how the market works: we experience a lot of UP, a short DOWN, and then back to more UP. The periods of DOWN vary in length, but over longer periods of time, there has always been significantly more good times than bad (which you can see visually by the amount of green or the direction of the line in the chart).

If we know that markets go up much more often than they go down, and that downturns are a normal but infrequent part of investing, how does that impact where you should put your money?

Where should I put my money?

We believe there is a tried-and-true nine step process you can follow to know where you should put your next dollar (cue Brian holding up the FOO deliverable).

For those in the earlier steps of the Financial Order of Operations, listed below, current market conditions may not impact the plan for your dollars.

1. Deductibles Covered

Covering your highest insurance deductible is essential to keeping your financial life out of the ditch if something were to go wrong. This is why it is the first step of the FOO and one that can not be ignored.

2. Employer Match

The free money that your employer offers through your retirement plan is a priority no matter what the market is doing. The 100% or even 50% rate of return is more powerful than even high-interest debt.

3. High-Interest Debt

Speaking of high-interest debt, paying down any you may have might feel especially good when the market is down. The average interest rate on credit cards is currently 18.16%, which means Americans paying down credit card debt right now can expect an average return of 18.16%, no matter what the market does.

4. Emergency Reserves

Your emergency reserves are an expansion of the deductibles you covered in step one. Needless to say, building a full emergency fund is a priority especially when the market is down because you may also experience a greater likelihood of losing your job.

Those in later steps of the Financial Order of Operations may have additional actions they can take during market downturns. Let’s take a look!

5. Roth IRA & HSA

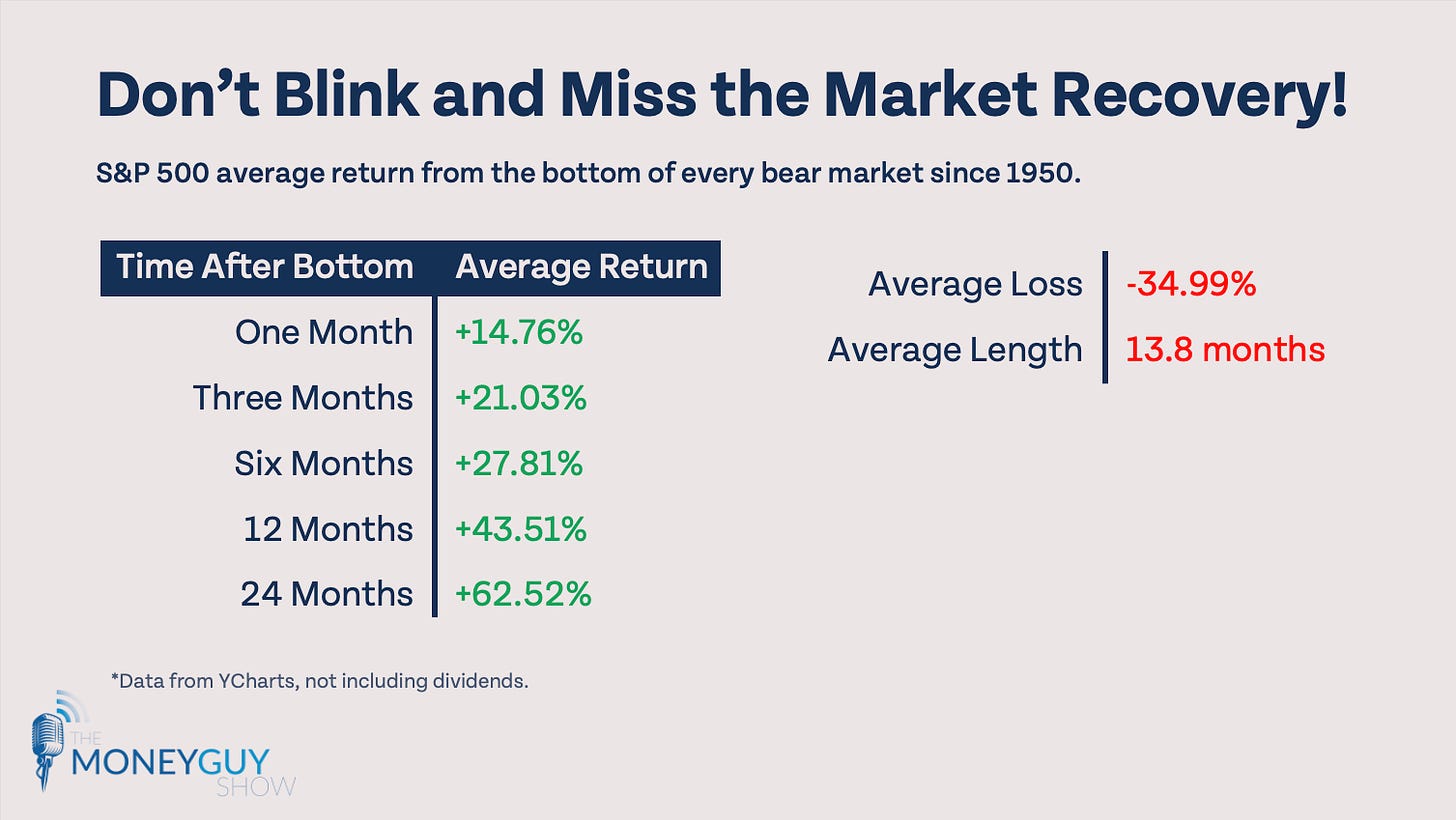

Contributing to your Roth IRA and HSA remains a priority even when markets are down. In fact, these can be some of the most powerful dollars you will ever invest. Take a look at market returns after hitting the bottom of a bear market.

Not only are down markets a great time to stay the course, there are also opportunities to convert pre-tax dollars to Roth while the market is down. Check out our upcoming show, “The Market Is Crashing (Where Should I Put Money Now?)” for a full case study on converting assets when the market is down.

6. Max-Out Retirement Accounts and 7. Hyper-Accumulation

The above chart showing returns after a market bottom applies to everyone investing, not just those contributing to their Roth IRA or HSA. How do you know which account to contribute to, though? In this past article of FYI by FTE, I broke down when to consider contributing to Roth vs. pre-tax. Generally, if your combined marginal tax rate is under 25%, you may want to contribute to Roth; over 30%, pre-tax; and in-between is a gray area. The article “Should I Contribute to Roth Accounts?” has several more factors that should also be taken into consideration.

Tax-advantaged retirement accounts typically take priority over taxable accounts, but that doesn’t mean taxable accounts should be ignored altogether. They offer you valuable flexibility in retirement as they have no age restrictions on access and come with additional tax diversity.

8. Prepaid Future Expenses and 9. Low-Interest Debt

The current market downturn doesn’t really impact saving for future expenses, but it could impact your plan to pay off your low-interest debt. As Brian recently mentioned on the show, he is slowing down a bit on pre-paying his low-interest mortgage in this down market. It could be worth not prioritizing low-interest debt early when the market is so attractive, especially if you are under age 45.

What should I invest in?

Should the current market conditions cause you to completely rethink your investment strategy? Although tweaks here and there may be helpful, overall, your investment strategy should be good before a downturn, during a downturn, and after a downturn. Index funds consistently outperform actively managed funds, with about 90% or more of passive funds outperforming active funds over longer periods of time. For younger investors, low-cost index funds and target date index funds are worth considering in your investment allocation. If you’ve reached the point where a more personalized portfolio makes sense, and feel like your portfolio can be more optimized to your specific situation, don’t be afraid to reach out to a professional.

Nobody likes when the market is down, especially when it’s down for multiple months. Bear markets are a normal but fortunately uncommon part of the investing journey. It can be tempting to try something new when it feels like investing isn’t working like it used to, but staying the course is most often the right decision.