Last Updated

May 15, 2025

Read Time

Share

What is the 20/3/8 rule? And, how does Money Guy’s rule for car affordability compare to the 20/4/10 rule?

The value of a car drops like a rock as soon as you drive it off the lot, so it’s important to make sure you buy a car the RIGHT way. If it isn’t possible to pay in cash, follow our 20/3/8 guidelines to keep your finances on-track. Make sure you download our free Car Buying Checklist to keep handy as you go through the buying process.

Key Takeaways

Copy link to this section: Key Takeaways

Copied the URL to your clipboard!

- Not everyone can pay cash up-front for a car – and that’s okay!

- However, auto loans are dangerous liabilities on depreciating assets. We’ll show you how they can harm your financial life and how to do it the right way.

- The 20/3/8 car-buying rule is a proven rule of thumb for buying a great, reliable car while staying inside your financial guardrails.

- Use our free 20/3/8 calculator to figure out how much car you can really afford.

Share image

Share image

Do I Have to Pay Cash When Buying a Car?

Copy link to this section: Do I Have to Pay Cash When Buying a Car?

Copied the URL to your clipboard!

Paying for a car in cash is ideal. A solid car loan rule like 20-3-8 is your next best option. Unlike homes, cars are quickly depreciating assets, which means if you take out an auto loan you could become underwater on your purchase if you aren’t careful.

However, not everyone has the ability to pay for a car in cash. Rather than driving a clunker off the lot and spending more in maintenance and repairs than a dependable car would cost, we believe it is often more cost-effective to take out an auto loan and drive a safer, more reliable vehicle.

What is the 20/3/8 Car Buying Rule?

Copy link to this section: What is the 20/3/8 Car Buying Rule?

Copied the URL to your clipboard!

Not everyone can afford to pay cash for a car – and often, the car you could afford to buy in cash is a clunker. That’s why we created the Money Guy 20/3/8 car buying rule of thumb. This car affordability rule helps ensure you can buy a car the right way while staying within the Financial Order of Operations (FOO).

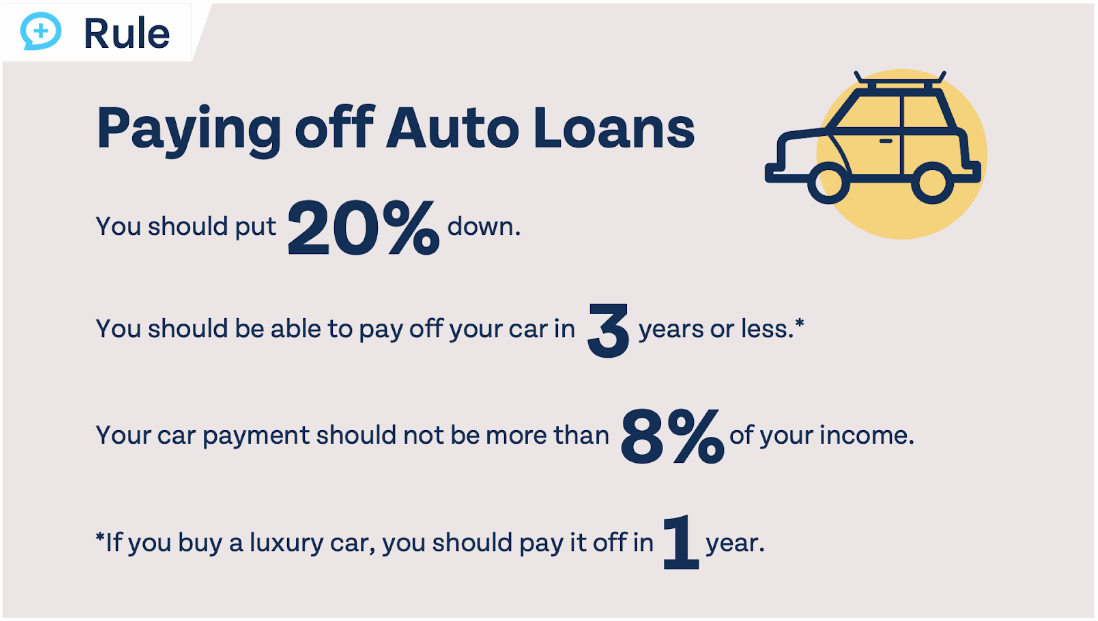

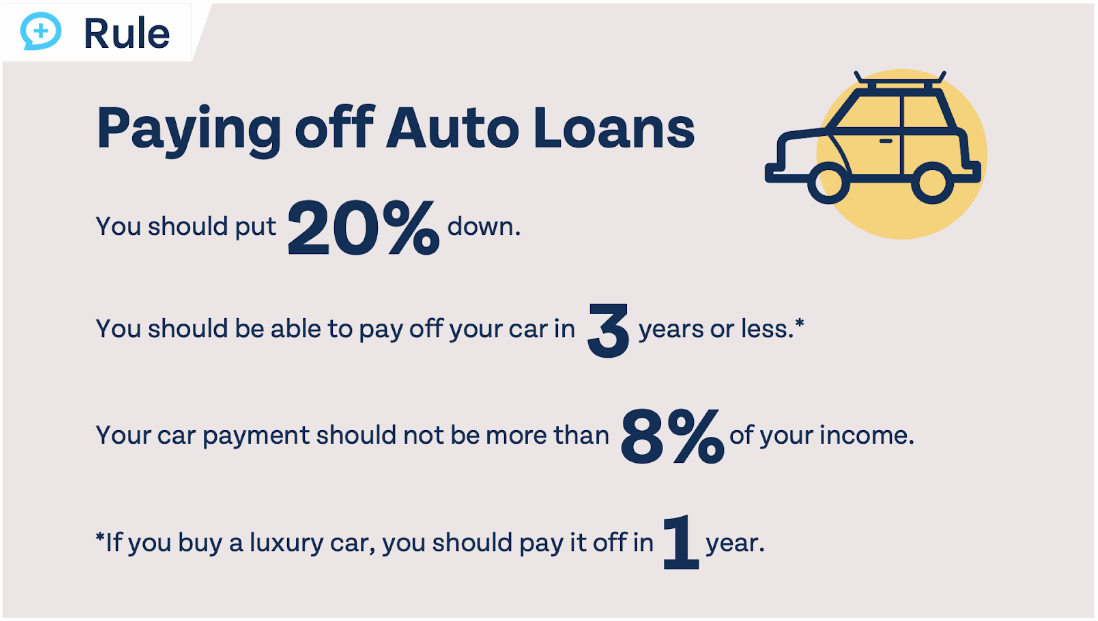

Following the 20/3/8 rule means:

- Putting 20% down

- Financing for (or paying your car off in) no longer than 3 years

- Keeping your total car payment(s) to no more than 8% of gross income

If there are special financing deals for choosing a term longer than 3 years, it is okay to select a longer loan term. However, you must still pay off the car in 3 years or less! Your monthly loan payment, or payments if you have multiple vehicles with loans, should not exceed more than 8% of your gross income.

Just because you followed 20/3/8 doesn’t mean you are done yet! We always want your monthly investments to exceed your monthly car payment(s). And if you buy a luxury vehicle, it should be paid for in cash or paid off completely in one year or less.

How Much Car Can You Afford with the 20/3/8 Car Buying Rule?

Copy link to this section: How Much Car Can You Afford with the 20/3/8 Car Buying Rule?

Copied the URL to your clipboard!

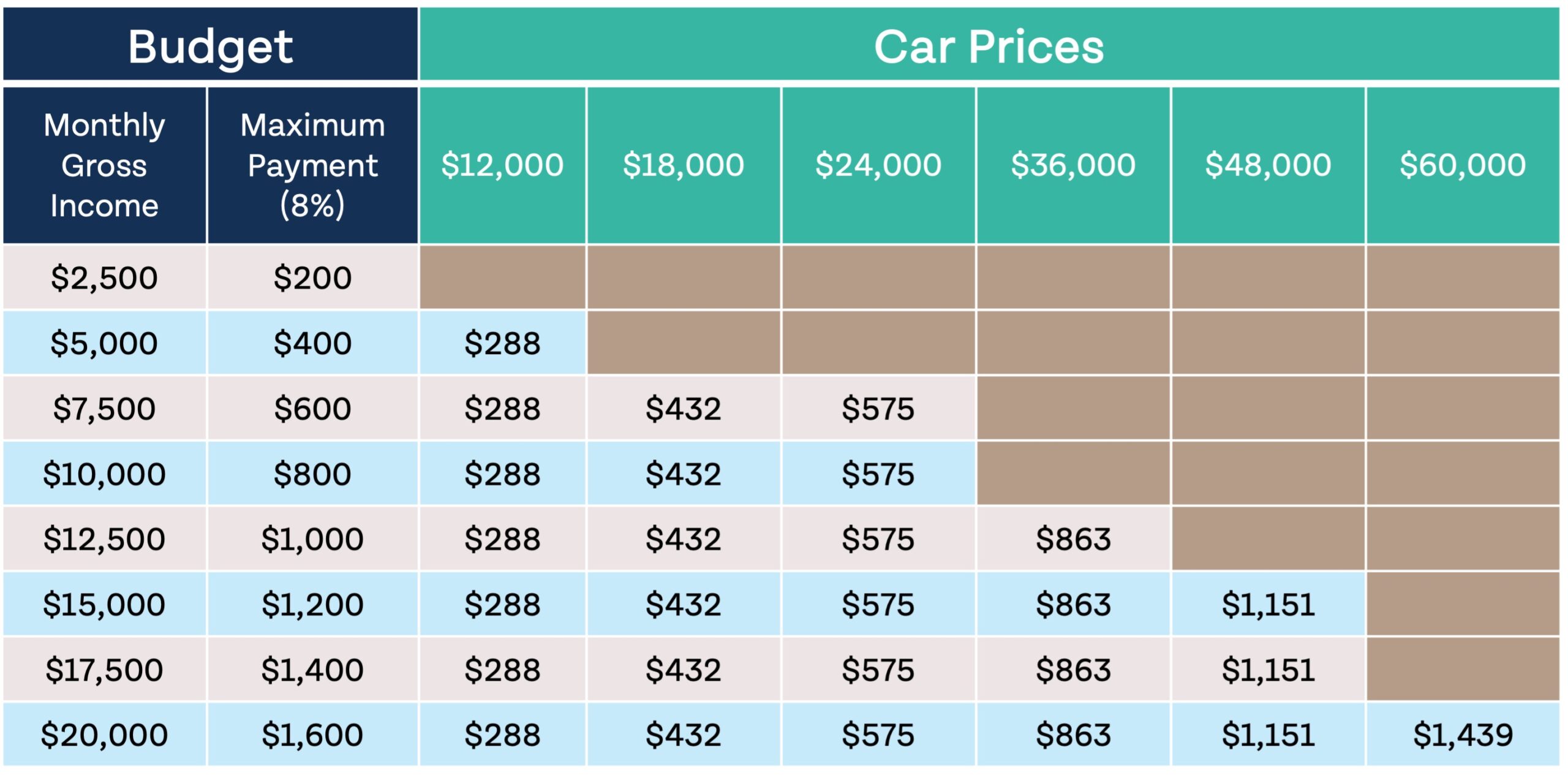

Use the following car payment rule calculations to help you determine how much car your family can afford. Remember, the maximum payment is for all vehicles, not each vehicle. The chart assumes you are following 20/3/8, putting 20% down, paying your car off in 3 years, and keeping your monthly payment at or below 8% of your gross income. The table assumes an interest rate of 5%, so if your interest rate is a little different, the car you are able to afford may be a little different, too.

How Strict is the 20/3/8 Rule for Financing a Car Purchase?

Copy link to this section: How Strict is the 20/3/8 Rule for Financing a Car Purchase?

Copied the URL to your clipboard!

The Money Guy car buying rules can help you buy a reliable car that fits in your budget, but it may not allow you to buy the car you want or even the car you need.

If you are struggling to follow 20-3-8 and buy a reliable car, try the following before bending the 20/3/8 rule:

- Put more down

A higher down payment means you are paying less per month. It may take you longer to save for a car, but it might help you purchase a nicer, more reliable vehicle. - Shop around for better interest rates

Car dealerships may not always offer the best interest rates on cars. Check with banks and credit unions to see if their rates are more competitive. - Sacrifice a little on your car

If the vehicle of your choice doesn’t fit in your budget, look at models a year or two earlier, base models, or cars with a little more mileage.

While the 20/3/8 rule may feel strict when purchasing a vehicle, in reality it allows you to spend more in other areas and meet your other financial goals, like investing for retirement, saving for a home, and more.

If you can be “strict” about what you spend on a car, you can have more freedom in other areas!

How Does the 20/3/8 Rule Compare to the 20/4/10 Car-Buying Rule?

Copy link to this section: How Does the 20/3/8 Rule Compare to the 20/4/10 Car-Buying Rule?

Copied the URL to your clipboard!

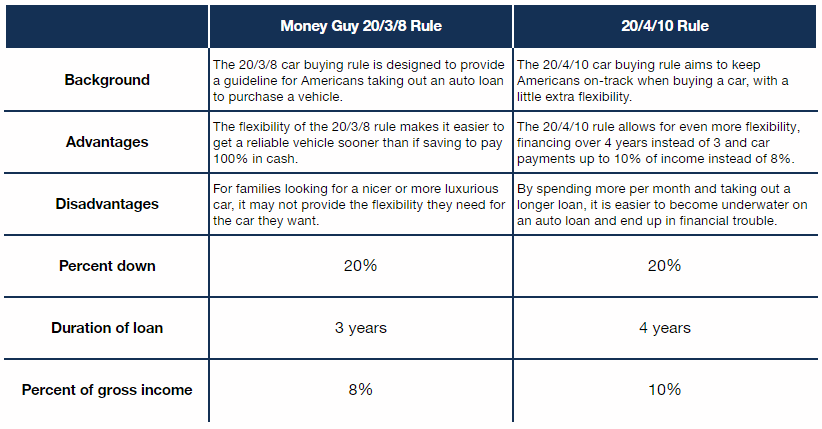

Critics of the 20/3/8 rule claim that the Money Guy car affordability rule makes it impossible for many families to get a reliable car. They propose a more generous rule called 20-4-10.

Here’s how the 20/3/8 rule stacks up against the 20/4/10 rule.

Comparison Table: The 20/3/8 Rule vs. the 20/4/10 Rule for Car-Buying and Affordability

According to Experian, the average amount financed for a used vehicle in Q4 of 2022 was $27,768. After putting 20% down, an auto loan for 3 years at 5% interest would have a monthly payment of $665. This means the average household in the United States, earning $97,962 per year, would spend 8.1% on a car payment for the average used vehicle financed over 3 years.

In many cases, for households looking to spend less than 8% of gross income or for households with income below the average, it is possible to get a reliable vehicle for much less than $27,768. Putting more than 20% down or getting a better interest rate will increase affordability as well, if a less expensive car isn’t an option.

“Many people who live in expensive homes and drive luxury cars do not actually have much wealth.”

Thomas J. Stanley, The Millionaire Next Door

Does the 20/3/8 Car-Buying Rule Help Me Negotiate a Good Deal at the Dealer?

Copy link to this section: Does the 20/3/8 Car-Buying Rule Help Me Negotiate a Good Deal at the Dealer?

Copied the URL to your clipboard!

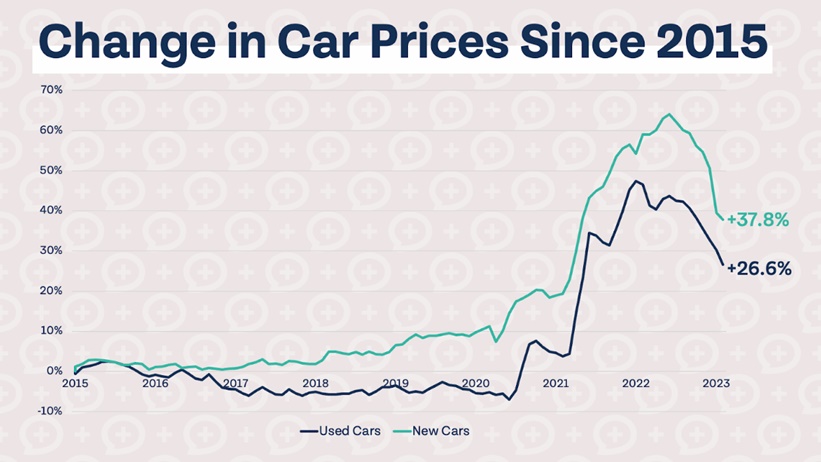

It’s no secret that car prices today are significantly higher than they were pre-pandemic, which means it’s important as ever to get a great deal at the dealership. Knowing your boundaries going into the dealer can help you get a better price than someone who is more willing to spend.

We don’t believe you should even step foot in a car dealership unless you know exactly what you want and how much you are going to pay.

Both used and new car prices are still elevated from pre-pandemic levels, but prices are dropping pretty significantly from their highs. If you can wait longer to buy a car, it may be worth seeing if car prices continue to drop closer to pre-pandemic levels.

Car Affordability Calculator for the 20/3/8 Rule

Copy link to this section: Car Affordability Calculator for the 20/3/8 Rule

Copied the URL to your clipboard!

Use our free 20/3/8 car affordability calculator to determine how much car you can buy and how big of a car loan you’ll need. Simply enter the price of the car you are interested in and your monthly gross income, and the 20/3/8 rule calculator will determine your monthly payment and if it is an affordable option for you.

20/3/8 Car-Buying Rule for First-Time Car Buyers

Copy link to this section: 20/3/8 Car-Buying Rule for First-Time Car Buyers

Copied the URL to your clipboard!

First-time car buyers are more likely to need to take out a loan and not to have the ability to pay for a car in cash. This means it’s even more important to follow a guideline like our 20 3 8 rule to ensure your finances stay on-track AND you can get a reliable vehicle.

We don’t believe your first car should be a clunker. Lemons cost more over time in repairs and maintenance. You don’t need to break the bank, or destroy your finances, to purchase a car if you follow 20/3/8.