This question is from Alexandra. She wants to know, “My husband wants a new car, and we will probably end up with a payment around $1,000. I’m not happy about it, but happy spouse, happy house. I’m doing my best to keep it within 20/3/8 rule. Do you have any advice?”

Okay, I love this mantra, “Happy spouse, happy house.” I think that’s a neat thing, right? Whenever you’re in a marital relationship, your desire should be that you guys are on the same page. You want to, there’s a give and take. However, when “happy spouse, happy house” begins to lead down the path of making really negative financial decisions that could have a huge impact later on, I think that perhaps you’re doing a disservice trying to have a short-term happy spouse that could lead to a long-term very unhappy spouse if one day you decide, “Oh, we didn’t save enough for retirement,” or “We can’t leave work.” So, when I hear Alexandra’s question, if they’re not on the same page about this decision, it feels to me like their goals aren’t aligned. Like they’ve not had that conversation around, “Okay, what do we want to be doing with our dollars and where should we be putting them? I think that’s probably the first thing they’ve got to fix.

Yeah, I think, um, here’s the way I would handle this. We’re not counselors, psychologists or anything, but we have been married for 25 years, so I know a little bit about communication with your spouse. The first thing is you’ve got to overcome the bias towards instant gratification because that’s what I think your spouse is probably feeling very strongly about. Picturing themselves in this sexier car and how cool that is and how it’s just a lot of feel-good feelings that’s going to happen in the short term. And that might be causing a distraction from the long term or the heaviness of this actual one decision.

So, then, after you kind of know that’s what you have to overcome, how do you do this? I would, I just had to go to the eye doctor, and they did the whole A/B analysis, where, you know, does it look better this way, does it look better this way? And I want you to go to, um, you, and you can probably use our, we have some resources on our website, moneyguy.com. You can look at our 20/3/8 car buying hub. You could actually figure out what the car payments are as well as what the long-term ramifications on this. There’s a calculator you can use. There’s a calculator because if you put in the car, or the car payment you think would actually put you on the path of financial success for the long term, run that. Just like we just did a case study versus what the car that they want to buy that’s $11,000, and see what the A/B analysis difference is for your long-term self. And then, if you need to really add some turbocharging to this, put that to the time quantity, meaning look at what you all make as a household income-wise or what you spend, because that really, for retirement, it’s more tied to your expenses. And then see how much that difference in what the money could become is time. And I think that will break your spouse from thinking about how good it will feel to drive this sexy car versus how good it will feel to retire 10 years earlier or 15 years earlier from this one decision.

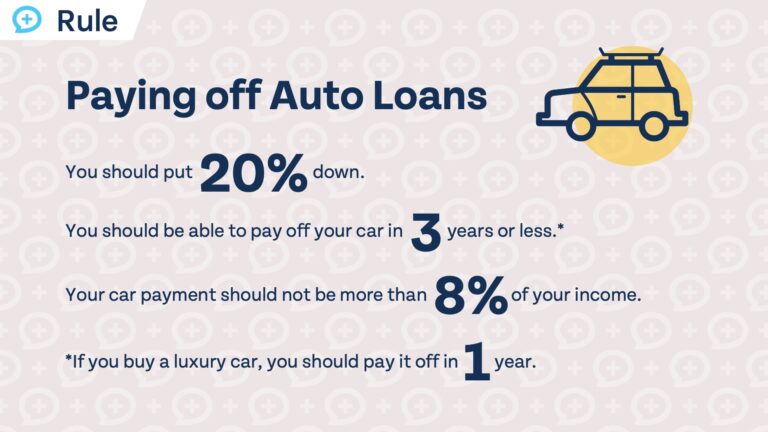

Because I will tell you the best driving car, and I know this sounds so hokey, but it’s true, is that paid-for car. And if we can get you there quicker and sooner, this is the goal, and this is the path. And I would say make us the bad guy. Go to your spouse and say, “Hey, look, I’m… This is the car buying checklist from the Money Guy Show, and we’re deviating from this. This is a luxury car. We’ve got to pay it all.” Or this, “We’re not doing the three, we’re not doing the eight.” Or if you are dead set on, “Okay, we are going to buy this. We are going to buy this. We are going to buy this. And to do this, we’re going to break the rules.” Then I would argue one of the things you have to do if you’re going to do 20/3/8 rule on a luxury automobile, which I don’t think that you should do that, that’s actually a “never,” but if you do that, right? I think that what you have to do is you have to put so much down on that 20 that you tell your spouse, “Hey, what we’re going to do is we are going to save and save and save for this goal and save for this goal and save for this goal so that we’re not breaking these 20/3/8 rule so that we’re not financing it for more than three.” If $1,000 is a car payment, because I don’t think she said that it was a luxury car. I don’t think she said it was a luxury car. So, let’s just assume the $1,000 car payment isn’t a luxury automobile. But just based on the numbers they’re using, that’s why they’re getting to $1,000. You need to put so much more down than 20% that you keep it inside the 8% and inside the three years financing. And if you cannot do that today, then I think you’ve got to save for a bigger down payment and a bigger down payment and a bigger down payment so that you don’t break the Money Guy Rules.

Yeah, I mean, 20/3/8 rule is supposed to air towards the sides of the Versa or the Corollas or the Civics. It’s not just so you can qualify for the Suburban, that’s right, or some of the other, the Sequoia or some of the other things that I think people, just because, you know, it’s a Toyota or even a Honda, doesn’t mean that it automatically qualifies for 20/3/8 rule. 20/3/8 is just a bridge so that you know when it’s okay to actually finance a vehicle for reliable transportation. It’s just putting the extra weight of you need to pay cash. Anything that’s extra, that’s more of a luxury, that’s just so you can feel good, to stroke the ego or how you feel about things, that’s not a 20/3/8 rule. That’s more of something that’s the preferential thing for all auto trans decisions. If you can pay cash. Yep. Love it. Agreed.