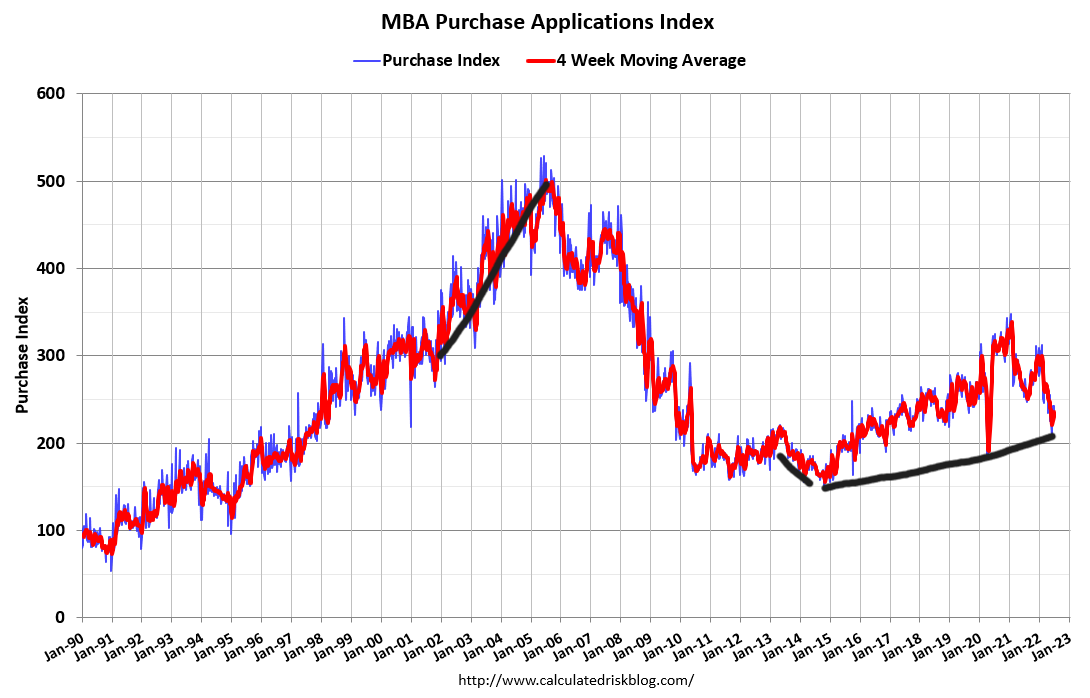

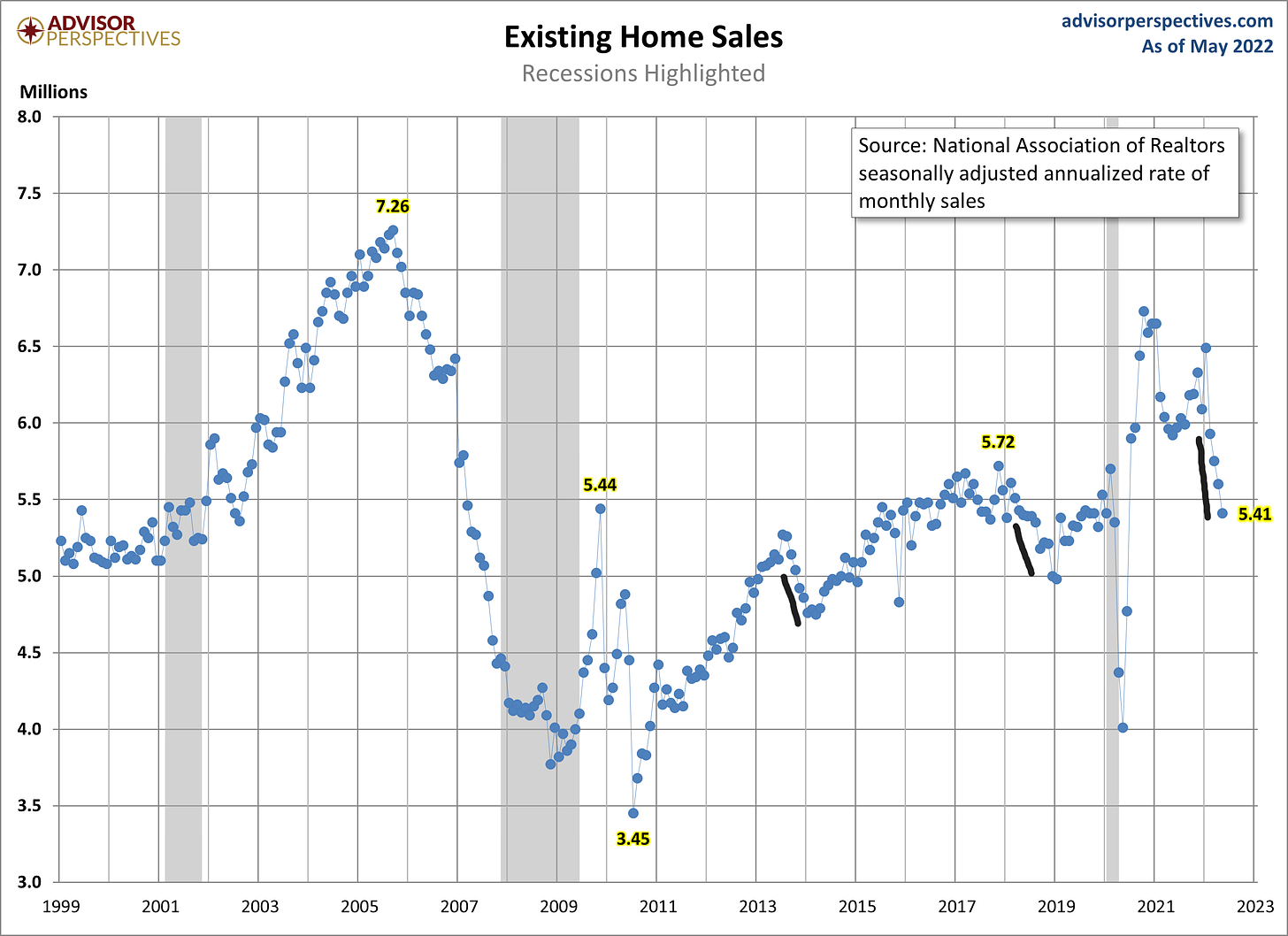

The housing market is slowing down. Higher interest rates and sky-high prices have curbed housing demand, and we’ve seen purchase applications and existing home sales both decline (illustrated in the two charts below).

Public opinion, and expert opinion, couldn’t be more divided. Some are predicting a housing crash while others strongly believe that housing prices will not decline at all. Experts on both sides are selectively presenting data to tell the story they believe to be true; those calling for a crash point towards the sharp rise in prices, unaffordability, and drop in demand as reasons that housing prices must crash. On the other side of the fence, those that believe prices will not fall point towards a lack of inventory and rarity of housing price declines as reasons to expect prices to continue to rise or stay flat.

Let’s dive into the data and examine claims made by both sides. Separating fact from fiction will give us a better idea of where the housing market has been and may give us a better idea of where it is headed.

Claim #1: Don’t expect a housing market decline because home prices almost never drop.

One big financial influencer recently said, “If you’re waiting on prices to come down, you’re not going to buy a house, ever; prices are not coming down.” Later, he added, “We’ve never seen house prices go down in modern America since the 1930s except one time, and that was for about six or eight months in 2008.”

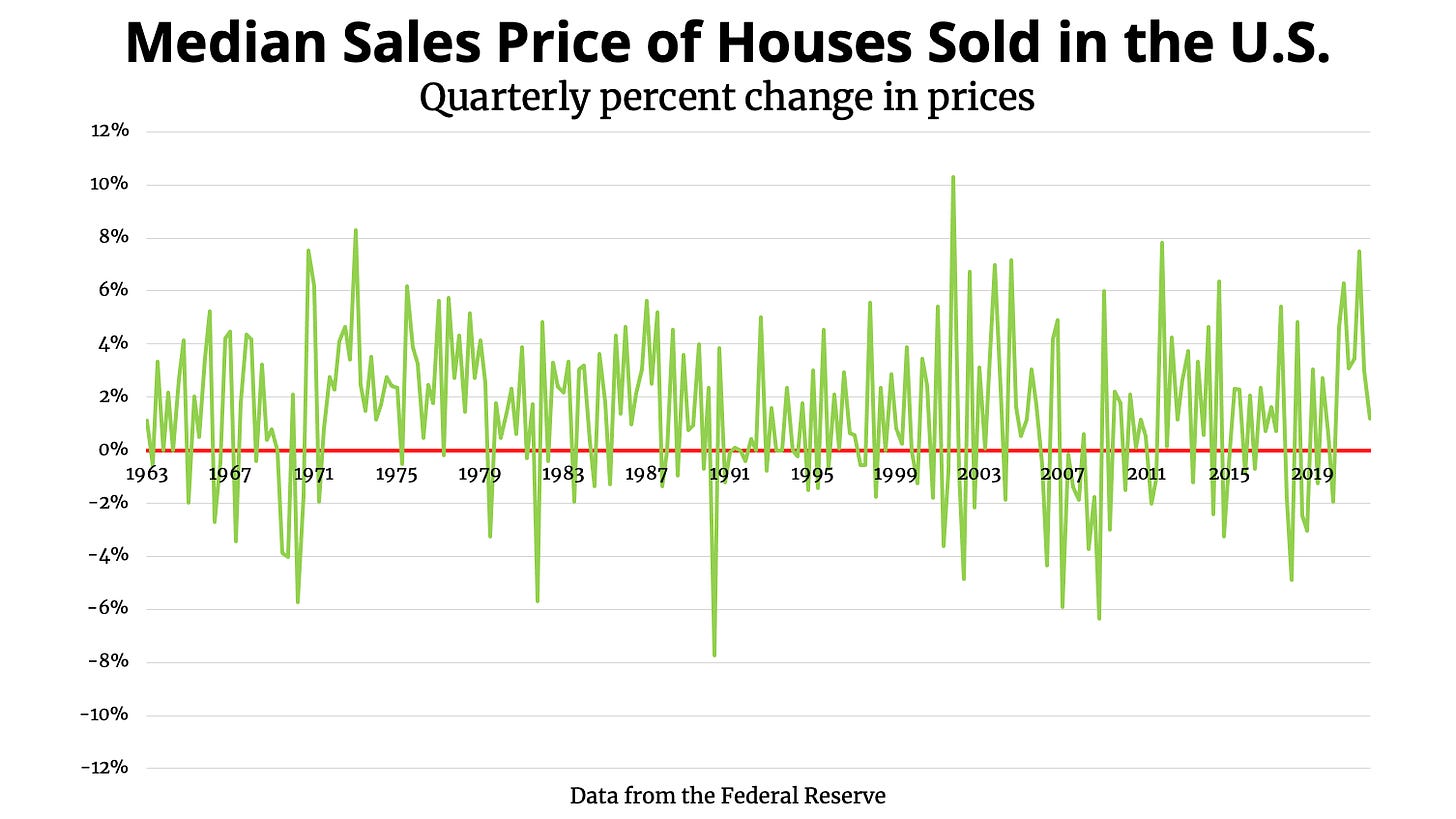

Time will tell on the first claim, but fortunately the second is easy to prove or disprove with data. The below chart shows the quarterly percent change in home prices in the U.S.; all points below the red line indicate a quarterly decline in housing prices. As you can see, quarterly declines in housing prices are very common.

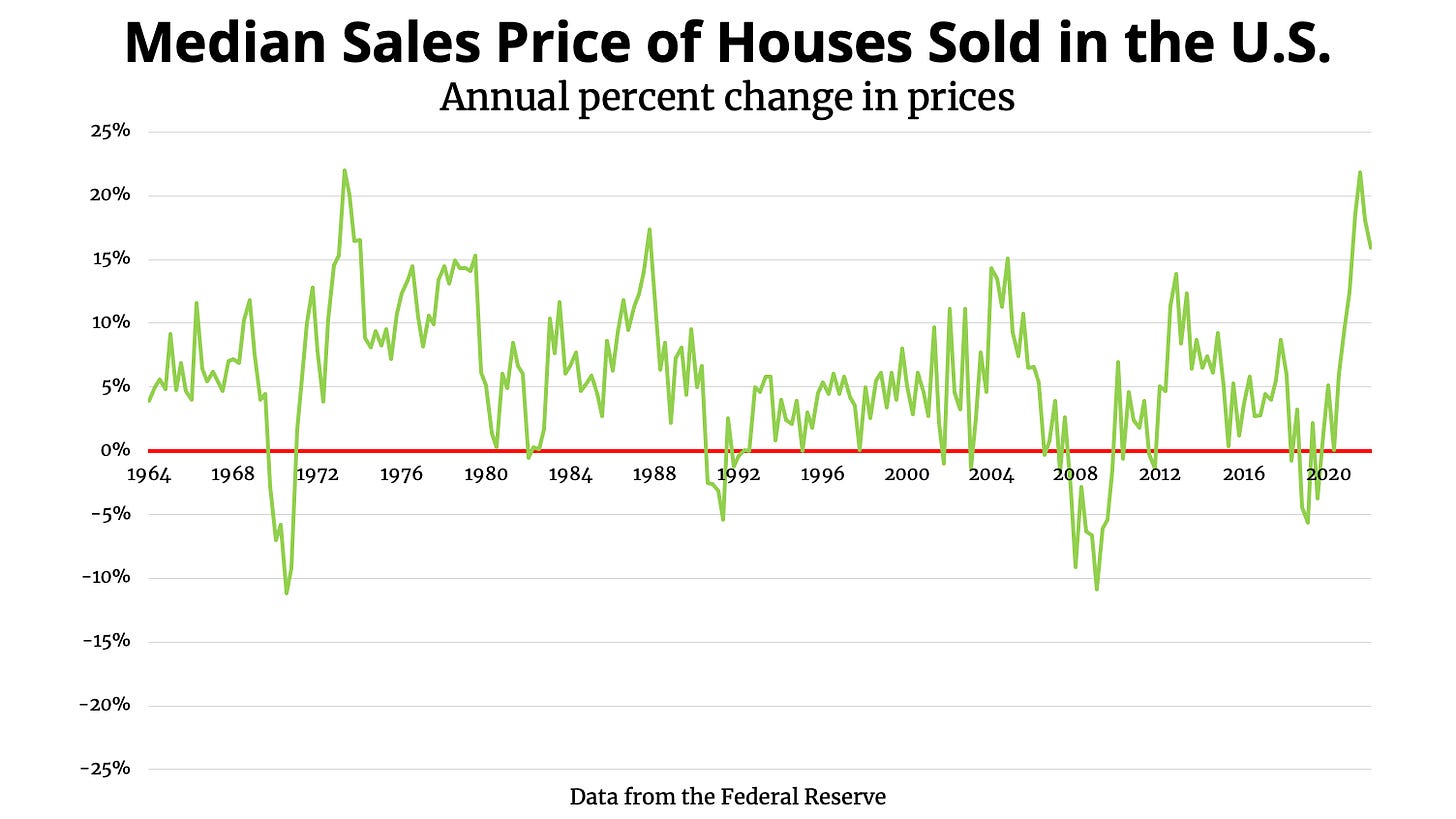

While quarterly price declines are very common, prices can and often do bounce back in the same year. The chart below shows rolling annual percent changes in housing prices, going back to 1964. All data points below the red line indicate annual declines in home prices. Declines are less frequent than the above chart since they indicate prices have been declining for longer (over the course of a year rather than quarterly).

Still, it’s easy to see that housing prices have declined several times since the 1960s, with declines lasting longer than six to eight months. Post-2008, real estate took years to find stable ground. In some parts of the country, it was not until the recent spike in values that houses reached the levels of pre-Great Recession (Brian has shared that his south Atlanta house lost over 50% of its value between 2008-2010).

Quarterly declines in home prices are very common, but it is true that annual declines in home prices occur much less frequently (about once a decade). However you slice it, though, declines in home prices in the U.S. are not as uncommon as some would have you believe.

Claim #2: Housing prices will not drop because inventory is still extremely low.

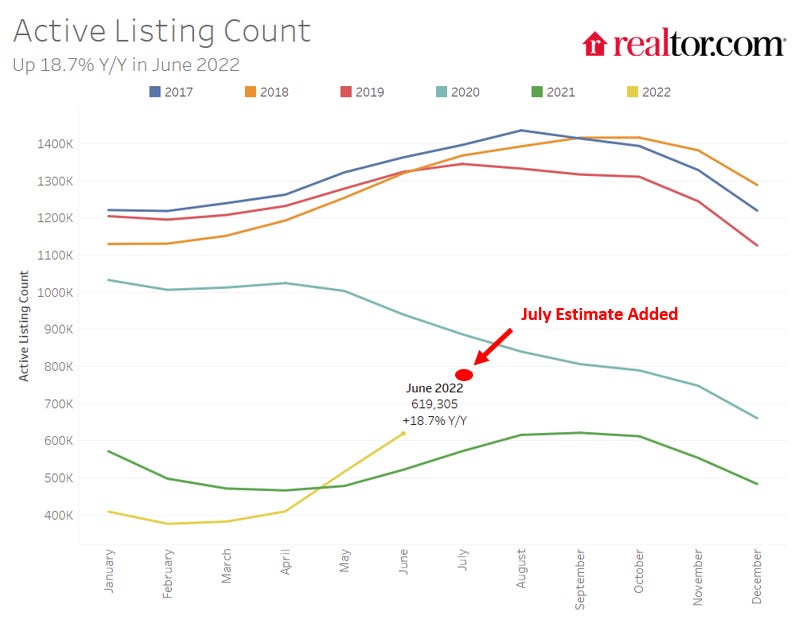

Extremely low levels of housing inventory in the United States is often cited as a reason prices may not go down. Housing inventory is very low, but there’s a bit more to the story. The chart below shows the number of active listings in the U.S., with estimates through July of 2022.

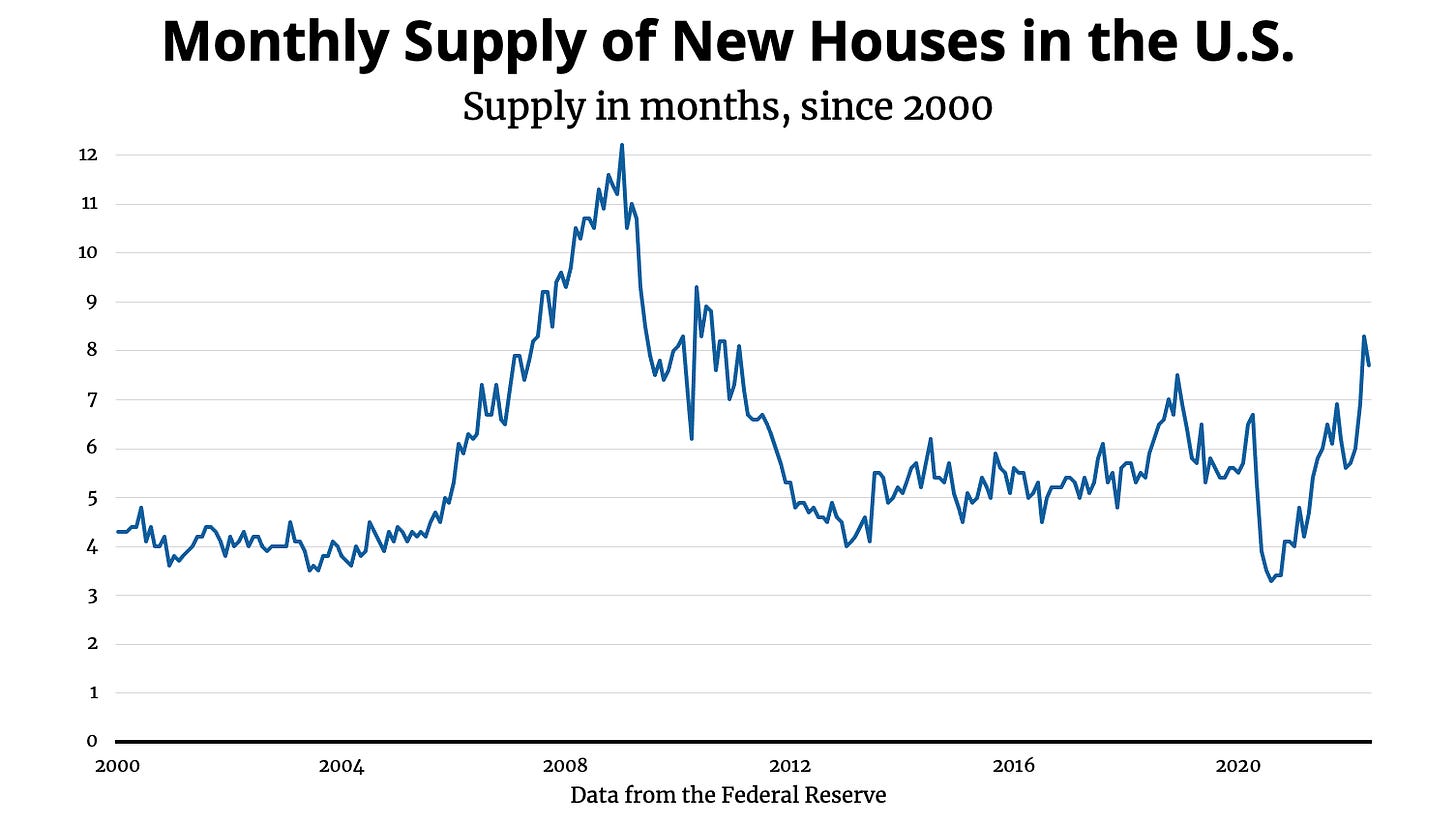

Housing inventory is very low and way below where we were at pre-pandemic. However, inventory levels are rising quickly, and at their highest levels since the summer of 2020. Buying environments are completely different than they’ve been in the past few years, so it isn’t fair to compare apples to oranges here. 800,000 homes for sale at mortgage rates over 5.50% will not create the same frenzy we saw in late 2020 with 800,000 homes for sale and interest rates under 3.00%. When accounting for lower demand, supply is pretty high right now. The following chart, using data from the Federal Reserve, shows the monthly supply of new homes in the U.S., based on inventory and the number of new homes being sold.

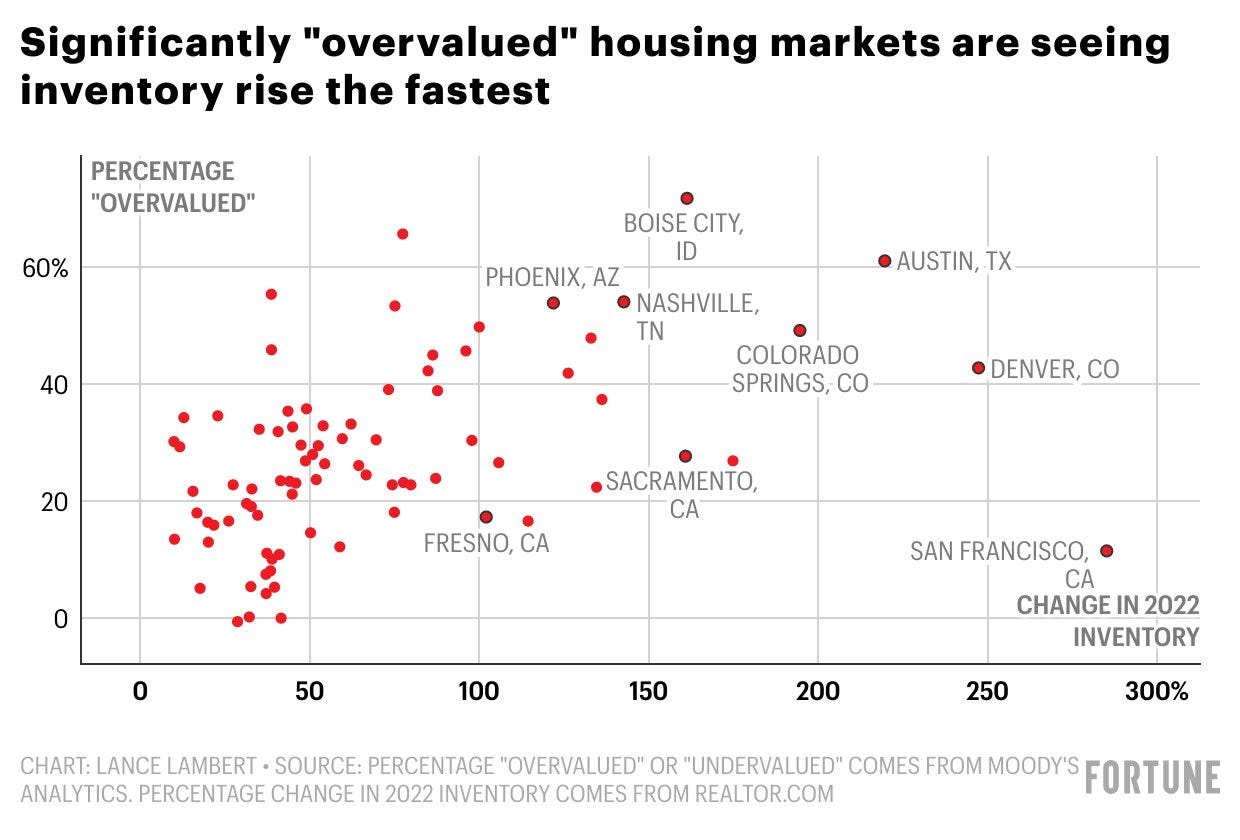

The supply of new homes for sale is the highest it has been since 2010 in the aftermath of the housing crisis. Looking more at local markets, we can see that inventory levels are rising fastest in cities that are more “overvalued.” Overvalued in this context compares household incomes to home prices. The more overvalued a housing market is, the higher the ratio of home prices to household incomes.

Bottom line: inventory levels are currently low, but when accounting for decreased demand, the amount of housing supply available is fairly healthy. Inventory levels are rising the fastest in more “overvalued” cities, which indicates home prices, if they were to drop, could drop first in these cities. It will be interesting to watch what side of supply and demand wins. Are there enough folks moving to these hot markets to overcome the damping impact of rising interest rates and new inventory coming on the scene?

Claim #3: There is going to be a really bad housing market crash, like 2008.

History shows us that drops in home prices aren’t all that uncommon, although longer declines fortunately occur only about once per decade. A decline in home prices nationwide is far from certain. A 2008-esque crash is even more uncertain, yet that is where some think we are headed. Are they right? Or does a housing crash in the U.S. seem improbable, if not impossible?

Homeowners now have locked in low fixed-rate mortgages, they are less burdened by debt, and balance sheets are healthier. The unemployment rate in the country remains near all-time lows. Homeowners are simply not currently likely to get in financial trouble that would cause them to lose their home. The mortgage crisis in 2008 was fueled by subprime mortgages given to borrowers who could not afford homes and were at high risk of defaulting. In 2006, 23.4% of all mortgages were subprime. By 2008, one out of five subprime mortgages were delinquent.

Overall delinquency rates peaked at over 11% post-2008. Now, mortgage delinquency rates are just 2.13%, the lowest they have been since before the housing crisis. Another contributing factor to the 2008 crash was overbuilt homes. New home starts peaked at 2.27 million in January of 2006 and haven’t reached that level since. Homebuilders have been more conservative, even with higher home prices, to avoid a repeat of 2008. Home starts appear to have peaked this cycle at 1.81 million in April, before falling to 1.55 million in May and 982,000 in June.

There are signs that home prices could decline in certain markets in the near future. Rising mortgage rates are causing a decrease in demand, which is driving up supply. If supply outpaces demand, it is possible for housing prices to drop – but don’t expect a housing crash like in 2008. Homeowners are in much better shape financially than they were back then, making mass delinquency and foreclosures appear unlikely.

What happens to home prices in the short-term can and will affect affordability of homes for those looking to buy, but it shouldn’t necessarily change your course of action. There are a few simple rules you can follow to successfully buy a home in inflationary times. Make sure you plan to be in your home for at least five years. It wouldn’t be a bad idea to plan to be in your home for longer if it is your first home and you are putting less than 20% down. The housing market can take years to recover from a decline, so buying with a long-term mindset will help you stay above water on your home if prices decline.

As demand cools, buyers should have an easier time doing due diligence like appraisals and inspections. At a minimum, get a pass/fail inspection so you can walk away from a home if it is in bad shape. Buying a home is often a multi-six figure decision, or even a seven figure decision, so it’s important to get it right and know what you are buying. Guardrails, like aiming to keep total housing-related payments below 25% of your gross income and maintaining a full emergency fund, can also help you stay on-track when buying a home in inflationary times.

It’s frustrating, for homeowners and those looking to buy, to not know where the housing market will go next. Homeowners don’t want to see their home decline in value, and those looking to buy are hoping prices stabilize and common sense due diligence allows them to have time to ponder and research the big decision that home ownership is in this crazy financial world. While you don’t have control over the housing market, you can control your personal finances. Following a few basic home-buying guidelines can help you buy a home (or not buy a home) the right way, no matter what the market throws at you.