Yourself, the debt ceiling crisis. Is the financial system really at risk, Brian? I’m excited to talk about this one because I feel like there is so much noise out there in the world right now that you cannot turn on financial media or pull up a website without this being front and center. It sounds like something horrible must be going on, and so we should all be aware of what’s happening and what we should do right now. I feel like in a moment like this, context and information can really give perspective and help our audience out. So, Bo, you know, nothing is better than just going out there on Google, typing in “Give me the definition” for anybody who has just been sleeping or just too scared to ask the public, “What is the debt ceiling crisis?”

Yeah, so here’s the definition: the federal debt ceiling is the limit on the amount of money the government can borrow by issuing securities used to pay for things like military spending, federal employees, social welfare programs, and more. So, it’s the cap, it’s basically the credit limit on the federal government on what they can spend, and it sounds like we are rapidly approaching maxing out our card. This is what it feels like.

So, bringing this back to the context portion, anyone who goes back to middle school or high school civics knows that Congress is the branch of government that controls spending. That’s why we have a little standoff in the fact that the Republicans control the House and we have a Democrat-controlled Senate as well, kind of split in the Senate, but then we have a Democrat president. So, there’s lots of opportunity for politics to be driving a lot of this, but I want everybody to take a deep breath because, first of all, this is not the first time we’ve run into the debt ceiling. I think a little perspective could probably help on this.

Yeah, this isn’t the first time or the second time or the 20th, 40th, 50th. It’s really interesting when you look at how often the debt ceiling has been raised. We just did this by decade, going all the way back to the 1960s. It was raised 12 times in the decade of the 1960s, 15 times in the 1970s, 20 in the 80s, so only 7 times in the 90s, 9 times in the 2000s, 12 times in the 2010s, and so far in the 2020s, 3 times. Well, and here’s the key thing I want you to know. If you, by the way, we’ll save you the math, you don’t have to pull the calculator out, that’s 78 times. But let’s look at this. Let’s just take this because people, you go back to the 60s, you start losing people, they start going, this isn’t back to the future.

I don’t want to go that far back, so think about this in these terms: the 2000s. It was nine times, that’s almost once a decade. I mean, once a year. Um, the 2010s, 12 times, that’s more than once a year. Yep. And here we are in 2023, the beginning part of 2023, and we’re already at our third time that we’re talking about doing this. This is an annual tradition at this point. It certainly seems like it’s an annual tradition. And I gotta tell you, this is the part that I think is interesting. I feel like if this is happening so much, why is there so much fanfare about this? Yeah, it’s really interesting because people are wondering what is going to happen, right? Okay, this is happening, oh, headline news, headline news. But it seems like if we have approached the debt ceiling 78 times over the past 50 plus years, we probably ought to know what’s going to happen. We probably know what the outcome is because we’ve seen this movie before, right? We’ve seen this happen before, and every single time, it seems like we get drummed up and the tension rises and the anxiety rises. But perhaps there should not be a reason for it. Well, and look, I do want to say if we actually defaulted on our debt, it would be bad. I don’t want to minimize that. But the part that I want to remind people of is that we have never defaulted, and there are a lot of levers that they pull to create the political theater. If you remember in the past, I remember this is something you ought to pay attention to because it depends on how much this ramps up between now and, I think, June-ish, when Janet Yellen is saying that we’ll have issues.

As we get closer, they will start doing some things to try to slow the expenditure of our government. Like if you think you’re going to go tour the mall and go to the Smithsonian and other things like that, I’ve seen times where they have actually pulled that back, where they don’t let you go to the national parks. I’ve seen times where they actually don’t pay some of their employees. Now here’s the part that always annoys me: they create this drama over the debt ceiling, we don’t pay employees, but then as soon as the negotiations end, they do it backwards, they pay everybody. So we’re going to pay this money. I mean, if probably if I’m a federal employee, I’m like, hot diggity dog, it’s my favorite time of the year, debt ceiling crisis. Let’s hope that this gets ramped up enough so I actually catch a few days off while I’m paid. And that’s the part, and I’m not trying to minimize, but it’s just I have been there, done that with the crying wolf that we are in full-on catastrophic crisis mode, and boy, we have proof of this. Yeah, so we’ve seen this, right? We’ve seen us bump up against the debt ceiling, and then we’ve seen the debt ceiling ultimately be raised. And so if we’ve seen this over and over and over again, why does it still seem like an issue? Why is it still something so top of mind? And it’s because the news media and the financial media have recognized that this is what causes people to tune in, this is what causes people to check it out. And we have proof of this. Look at some of these headlines. This is from CNN Money back on June 28th of 2011, over a decade ago.

Debt ceiling delay would be, quote, chaotic. Sounds frightening. And then you just fast forward to August of that same year. Obama, besides debt ceiling, Bill ends crisis. In crisis, wham bam, end over, right done. How about this one? In September of 2013, here are some of the apocalyptic things that could happen if the debt ceiling is breached. Now we’re talking about apocalypse. That’s how big of a deal this could be. Again, fast forward less than a month later, October of 2013. Stop fretting. Debt ceiling crisis is over. Oh man, this stuff is tiring and stuff. So, what would they say in 2023? So, now here we are, right now. This is Financial Times, as of April of this year. A U.S. debt ceiling crisis might be closer than you think. And then we don’t know when or how or what the headline will be, but it seems likely that what’s gonna happen is that they’re going to reach an agreement in the 11th hour and they’re going to raise the debt ceiling. So, it seems to be what’s going to happen. I’ve noticed the trend, and this is not the first place I’ve seen it within our media, is that the financial media has figured this out. Daytime media as well as your nightly news, trying to scare you. But then I’ve also noticed something with our weather, have you not? I mean, it’s probably been, maybe this has been forever, but as an adult, I’ve noticed this, especially in the last decade, is that anytime there’s a struggle with weather, you have to, you know, the weather people, it feels like they almost become theatrical with how they’re being impacted with things. And I can’t help but feel like that’s going on. But we have a perfect representation of what we’re talking about here, and I feel like this is going on with this debt ceiling crisis. So, let’s hit the video. Now, we took the audio out, just to let everybody know, but y’all have seen this. We’ve talked about this before. I feel bad for the guy. Or, is anybody worried about his safety? And then, wait a minute, there are two gentlemen in the background that are blowing this for him because they’re just sauntering into the background. And meanwhile, this person can barely keep his base. I mean, you can see that the wind is almost just blowing him over with this weather. And I feel like that is exactly what’s going on.

I was even, for preparation for this Q&A show today, I went and watched a few clips. And here’s something that hit me that kind of angered me a little bit. In the fact that they first laid out the facts, like we have tried to do. And I was likely very happy with that because I think data and information and education is so important. But then the talking heads on TV proceeded to say, “I am tired of the market not participating in this because don’t they realize how serious this is?” And I could sense the frustration from the commentator is that they want you to be an active participant in this noise. Because a lot of the political theater, a lot of the financial theater that is occurring, even though we’ve seen this happen 78 times in the past, is to try to get you to panic, to get you to go sell your portfolio, to get you to start freaking out so that your behavior becomes a variable in this entire discussion. And that drives me crazy because, as Bo started and I love it when we go full circle on something, this is noise.

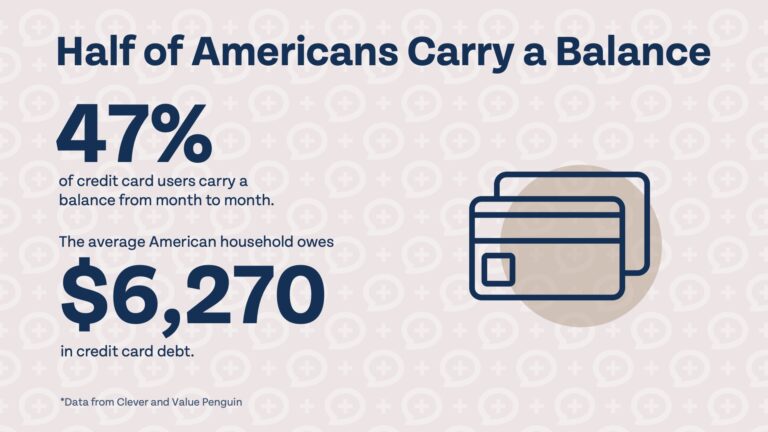

You have zero control over what happens with the debt ceiling, but I’ll tell you what you do have: an active role and many other decisions in your personal finances. That’s what you should be focusing on. So, how can you think about this debt ceiling thing and use it to your benefit? Well, one, as Brian mentioned, if you’re someone who’s effective, let’s tune out the noise. Maybe turn off the news, shut down the Twitter feed, and don’t allow yourself to be consumed by it. And then, two, and I feel bad saying this, but I would caution you against running your personal financial household the same way the government runs its financial house. I mean, imagine this in terms of your own situation. Let’s say you have credit card debt, and you’re about to max out your credit card. You think, “Oh, I’m getting close to the limit. I’ll just put a few less things on it as I approach the limit.” But then you keep getting closer and closer to the limit, and you think, “I’ll just raise the credit limit and repeat the cycle.” That is not going to lead you to financial abundance. So, don’t practice those behaviors in your personal financial life. Recognize that if you’re letting debt control you and you’re forced to make drastic measures, you need to change something. Cut something out and fix it so you can start moving in the right direction. Now, let’s talk about the personal finance side of things. If you’re watching news reports and they’re creeping in, causing you stress and restless nights, let’s reevaluate. The first thing you can do is look at your emergency reserves. That’s the most important thing. If you’re having trouble sleeping and worrying about being caught off guard by the ups and downs of the financial markets, remember that you’re a long-term investor. This money should be there for five to seven years or longer. Set it and forget it.

If you’re stressed out and it seems like you don’t have enough cash in the bank to handle emergencies or the craziness of our society, government, or political system, make sure you have enough money for peace of mind. Especially while it’s earning five percent, as it’s becoming easier and easier to make that return on your cash. Reevaluate your situation to gain more stability and peace of mind. Now, what else can you do to find peace? Besides cash reserves, make sure you’re covering risks and protecting yourself against unknowns. Ensure that you have adequate health insurance, life insurance, disability insurance, and property and casualty insurance. Offload those risks onto someone else. It’s an easy way to have peace of mind. If you’re worried about becoming disabled and not being able to work, insure against that. If you’re worried about a premature death and its impact on your family, insure against that too. Make sure you have these protections in place. Additionally, take care of your loved ones by having updated estate documents, wills, living wills, healthcare directives, and powers of attorney. Prepare as best as you can for whatever life throws at you and the unknowns that may come your way. Now, here’s one more step: get plugged in with us. Think about the Money Guy Show. We always strive to keep you informed without trying to manipulate you like many other information sources do. We’ll provide you with the basics and all the ingredients to create success and wealth for the long term. So, subscribe to the Money Guy Show. Visit moneyguy.com, access our resources, and download some of our free stuff. Sign up with your email address so we can stay connected and continue to be a resource for you.