Is a permanent life insurance policy a good investment for retirement? It’s a question we are often asked on our Tuesday livestream. There is no shortage of people wondering if a permanent life insurance policy could offer tax benefits in retirement and provide for your family when you’re gone. As with nearly every great debate, there are three different camps: those who believe permanent life insurance makes a great investment, those who are strongly opposed to the idea of life insurance as an investment, and those who aren’t sure what to believe.

“Life insurance is a great investment!”

23% of Americans who purchase life insurance use it to build cash value and save for retirement. In other words, nearly a quarter of Americans with life insurance purchased a permanent policy because they were led to believe it is a good investment or a good way to save for retirement.

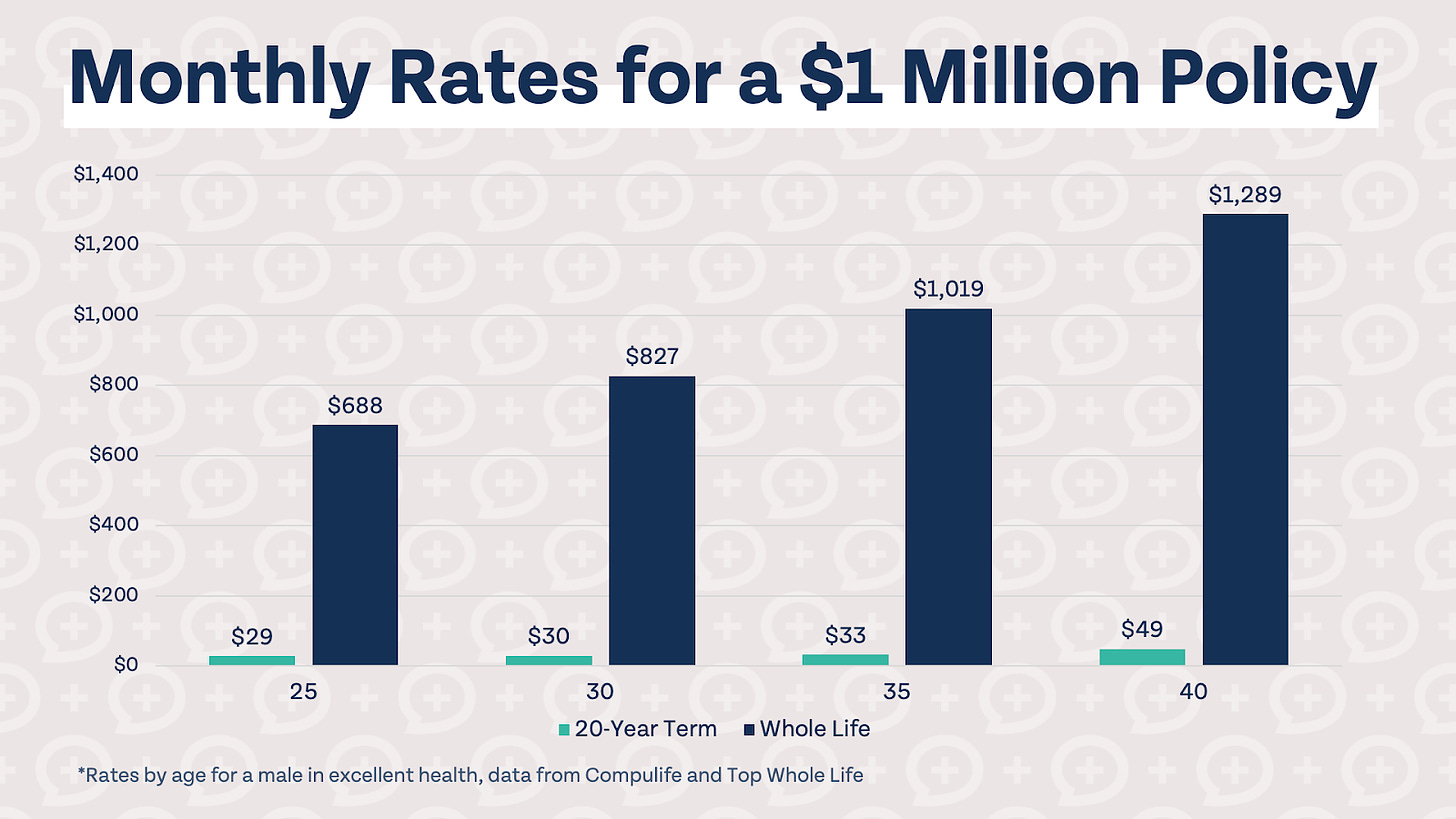

Is this true? Permanent life insurance can come with front-loaded sales charges, surrender charges, much higher premiums, and other fees and expenses. Permanent policies are often over 20x more expensive than comparable term life policies. Consumer Reports has estimated the annual rate of return for whole life insurance at 1.5%. Different insurance products with a component that “tracks the market” seem more exciting, but policies typically have participation rates, caps on returns, and fees.

Participation rates, or the amount of the “return” that you get to keep, are typically around 80%, with top-end caps that are normally in the high single digits, and expenses can vary greatly depending on administrative charges, fees, commissions, and surrender charges.

In a case study comparing the S&P 500 to a hypothetical indexed universal life insurance policy, with an 8% rate cap, 0% floor, 80% participation rate, and total expenses and fees of 1%, it underperformed the S&P 500 by nearly 8% annually over the last 40 years (the S&P 500 has annualized 12.01% over that period while the hypothetical IUL policy returned 4.22%). The selling point of these types of policies is that you can never lose money, unlike with the stock market, but they often fail to capture the majority of the upside of the market due to participation rates and caps on returns.

Why do people believe permanent insurance products are good vehicles to save for retirement when the evidence suggests otherwise?

In the financial services industry, most products can be categorized in one of two categories: those that sell themselves and those that require a great deal of work and persuasion to be sold. We fortunately have our fair share of financial investments that don’t require much, if any, work to be “sold” to consumers. Index funds are low-cost investments with a long track record of positive returns, and an easy way to participate in ongoing economic expansion and innovation. Often all people need to be convinced to invest in a Roth IRA and/or low-cost index funds is education about how it works and the benefits it can provide in retirement. The historical returns, low fees and expenses, and long track record of performance speaks for itself.

On the other hand, there are some financial products that require a great deal of work to be “sold” to a customer. These products may not be in the best financial interest of the person being “sold” (but usually work out pretty well for the seller, with lucrative commissions and sales loads). It is very difficult to get concrete historical returns for different life insurance policies, for good reason. The nicknames of products being sold change almost too frequently to keep up with (an “investment engine with death benefits” sounds a lot better than a permanent life insurance policy).

To put it frankly, some financial products continue being sold not because of the benefit to the consumer, but because of the benefit to the seller. We’ve seen a countless number of influencers on social media that promote financial products that promise to lead their followers to financial abundance, but in reality exist to further enrich the seller of the product. These products are not limited to any single area of finance, and can be found in insurance, cryptocurrency, mutual funds, ETFs, and more.

Should I worry about life insurance at all?

While we believe that permanent life insurance doesn’t make sense for everyone, and shouldn’t be viewed as a retirement investment vehicle, we are big fans of life insurance and of the protection it provides. Term life insurance policies offer protection for a period of time at an affordable cost. Check out the chart below of monthly premiums for a $1 million dollar policy, for a male in excellent health.

Term life insurance is pure insurance protection without any investment or cash value component. We believe it’s best to keep your insurance protection and investments separate. What do you think the insurance company does with the cash value portion of your permanent insurance policy? It’s invested in a mix of risk-on and risk-off assets. You can cut out the middleman, and sales charges, commissions, fees, and expenses, by investing directly in the market.

One of the arguments against term life insurance is that you are “throwing your money away” because the death benefit only covers a certain term. In fact, 99% of term life insurance policies never pay a death benefit to a beneficiary or beneficiaries. This is not a downside, but a feature. Term life insurance is designed to cover a low-probability, high-impact event. Coverage is so affordable because it is unlikely you will ever receive a payout. This is a good thing! Never receiving a payout means you outlived your insurance policy. Once your invested assets are large enough to pay off any debts and provide for your dependents, you may be able to self-insure. Term life insurance is meant to cover that period of time in your life when you have a need for life insurance (debts like a mortgage, and dependents, such as a spouse and children) and aren’t yet able to cover that need yourself.

How do I know what’s a “good” financial investment?

It’s difficult to find financial professionals you can trust. We get it! There are a lot of people out there that put their own financial interests ahead of those of their clients and customers. We created a resource, “8 Questions To Ask Your Financial Advisor,” to help you understand whether or not your advisor is a good fit for you.

We are advocates of the fiduciary, fee-only model of financial planning (and this is how our firm operates). Fee-only advisors get paid from clients for the advice and services we provide. We don’t get paid by Fidelity for our love of index funds or from Ally for saying how much we like high-yield savings accounts. This is not to say we don’t have any financial incentives for the information we provide, though we like to call it the abundance cycle: we load you up with free information and resources to accelerate your financial growth knowing that in the future, financial complexity will naturally find you and you’ll benefit from a fee-only financial advisor.