Last Updated

May 15, 2025

Read Time

Share

Some financial influencers believe that everyone should pay for their car in cash. The value of a car drops like a rock as soon as it’s driven off the lot, so it makes sense to pay in cash if you are able. However, it just isn’t possible to pay for a reliable vehicle in cash for many Americans. We created our 20/3/8 car buying rule to help keep your financial life on-track when taking out a car loan.

Check out how much car you can really afford with Money Guy’s 20/3/8 car affordability calculator!

Buying a car soon? Download our free Car Buying Checklist that walks you through a smart decision.

What is the 20/3/8 car buying rule?

Copy link to this section: What is the 20/3/8 car buying rule?

Copied the URL to your clipboard!

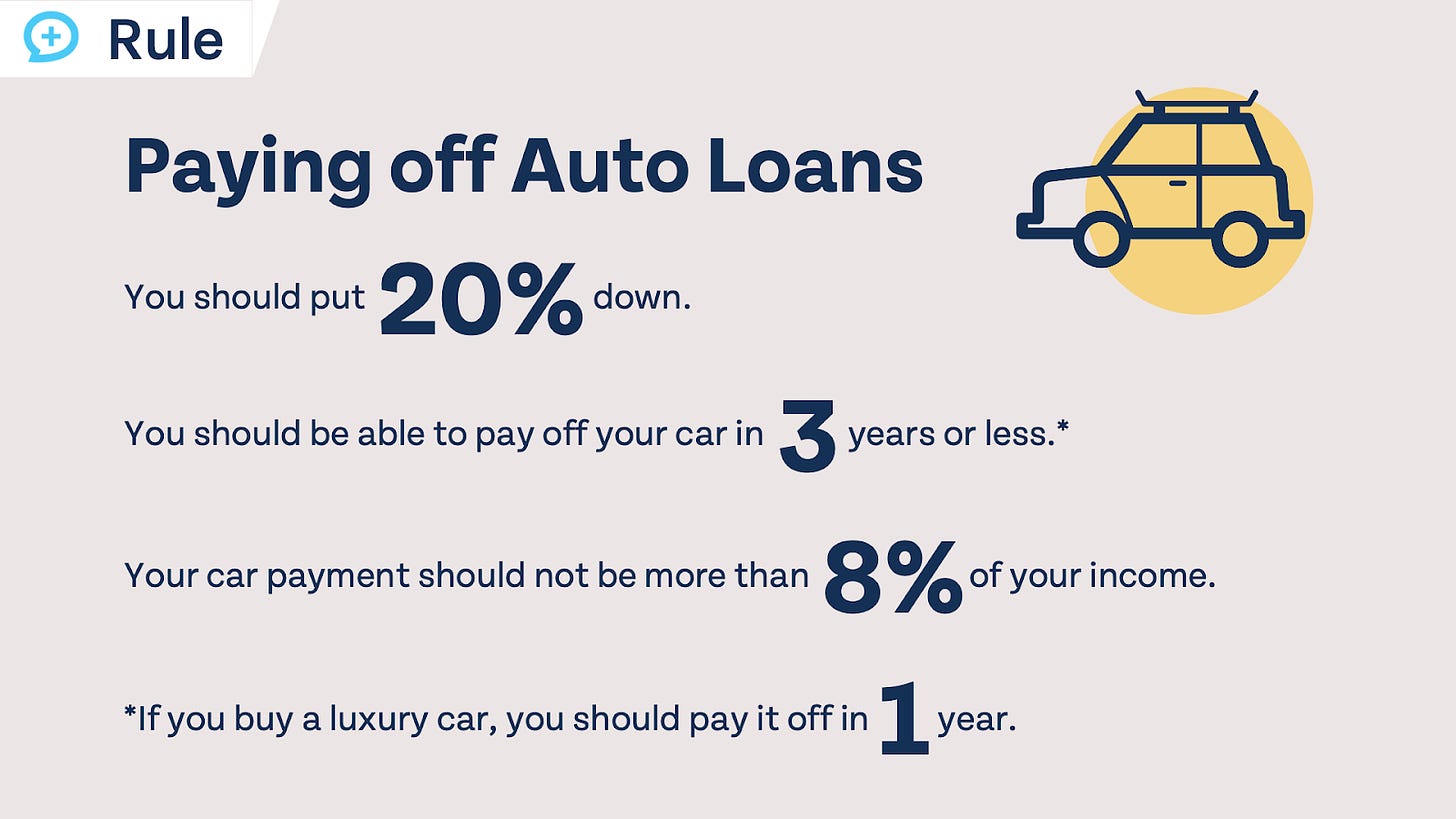

Our 20/3/8 rule includes putting at least 20% down on any car you buy, paying it off in 3 years or less, and keeping your total car payment(s) to 8% of your gross income or less.

Know someone who’s in the market for a new car? Send them this article!

The 20/3/8 rule may seem rigid, but it is flexible – you can put as much down as you wish. If 20/3/8 doesn’t work for you, you could try other variations like 30/3/8, 40/3/8, or 20/4/10. However, it’s very important to pay off your car in 3 years or less. Many cars lose around 20% of their value in the first year alone, and 15% per year more until the 4-5 year mark. If you stretch out your car loan, you could easily end up underwater on your vehicle (owing more than it is worth). Unforeseen events like accidents could also cause you to end up owing tens of thousands of dollars on an asset that is now worth next to nothing.

Not all cars depreciate at the same rate, and luxury vehicles tend to depreciate much faster due to the higher initial cost. If you are buying a luxury vehicle, which includes manufacturers like BMW, Mercedes, Tesla, and more, you should pay for your vehicle same as cash, meaning in less than a year. We’d also like for you to be at Step 8 of the Financial Order of Operations before purchasing a luxury car.

It’s essential to keep the sum of your monthly car payments to no more than 8% of your gross income. This ensures you have room left to spend on housing, other debt, investing, and living expenses. The average monthly payment for a new car is $716, which means the average American with a new car loan is spending 16% of their income on their car loan. With the average loan term for new cars at nearly 6 years, it’s not hard to see why many Americans have trouble saving for the future.

How much car can you afford?

Copy link to this section: How much car can you afford?

Copied the URL to your clipboard!

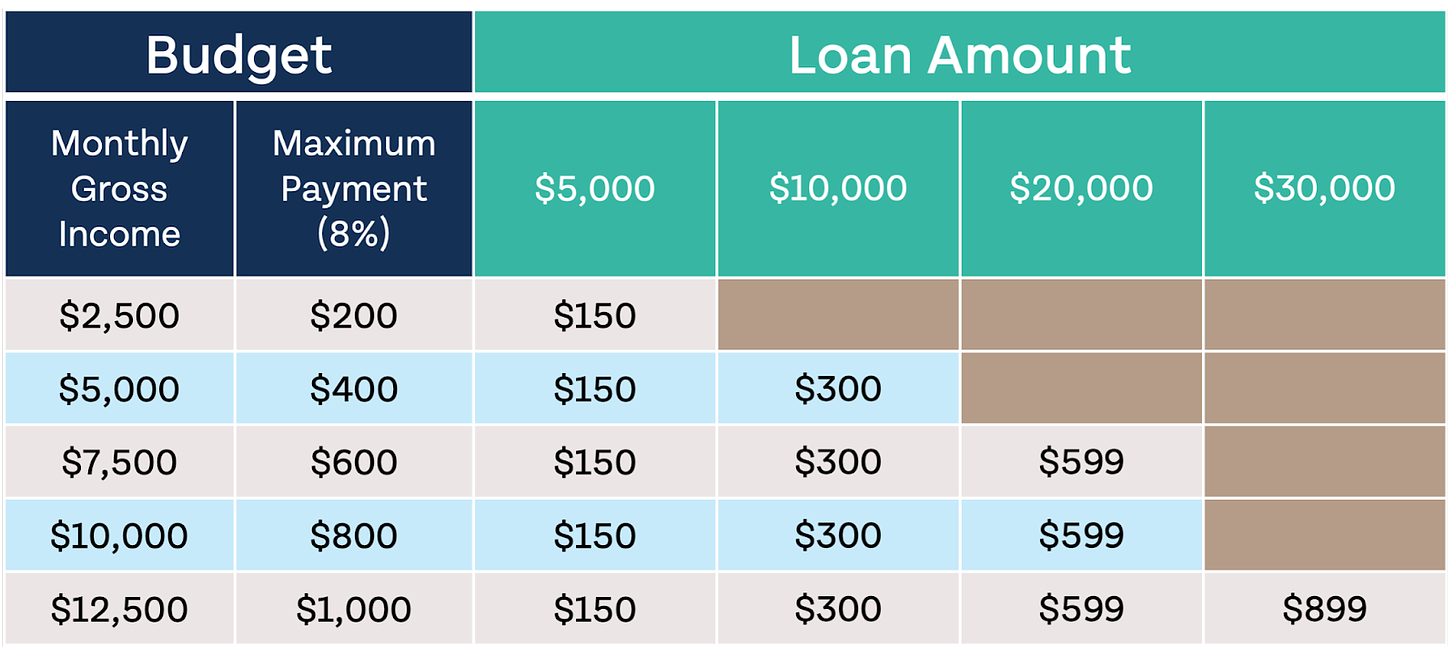

Now that you know our car buying guidelines, what does that look like for you specifically? The table below shows how much car loan you can afford at different incomes. If your monthly household income is $7,500 ($90,000 per year), you would be able to take on a car loan of $20,000 (with a purchase price of $25,000) while staying within our guidelines. However, you could put down $10,000 and buy a $30,000 car; or maybe you want a $40,000 car, in which case you would put down $20,000.

This table assumes your loan is paid off over 36 months and your interest rate is 5%. If you don’t see your income on the table above, don’t worry! We created a car affordability calculator where you can see exactly how much car you can afford using our Money Guy guidelines.

How do you buy a car in 2025?

Copy link to this section: How do you buy a car in 2025?

Copied the URL to your clipboard!

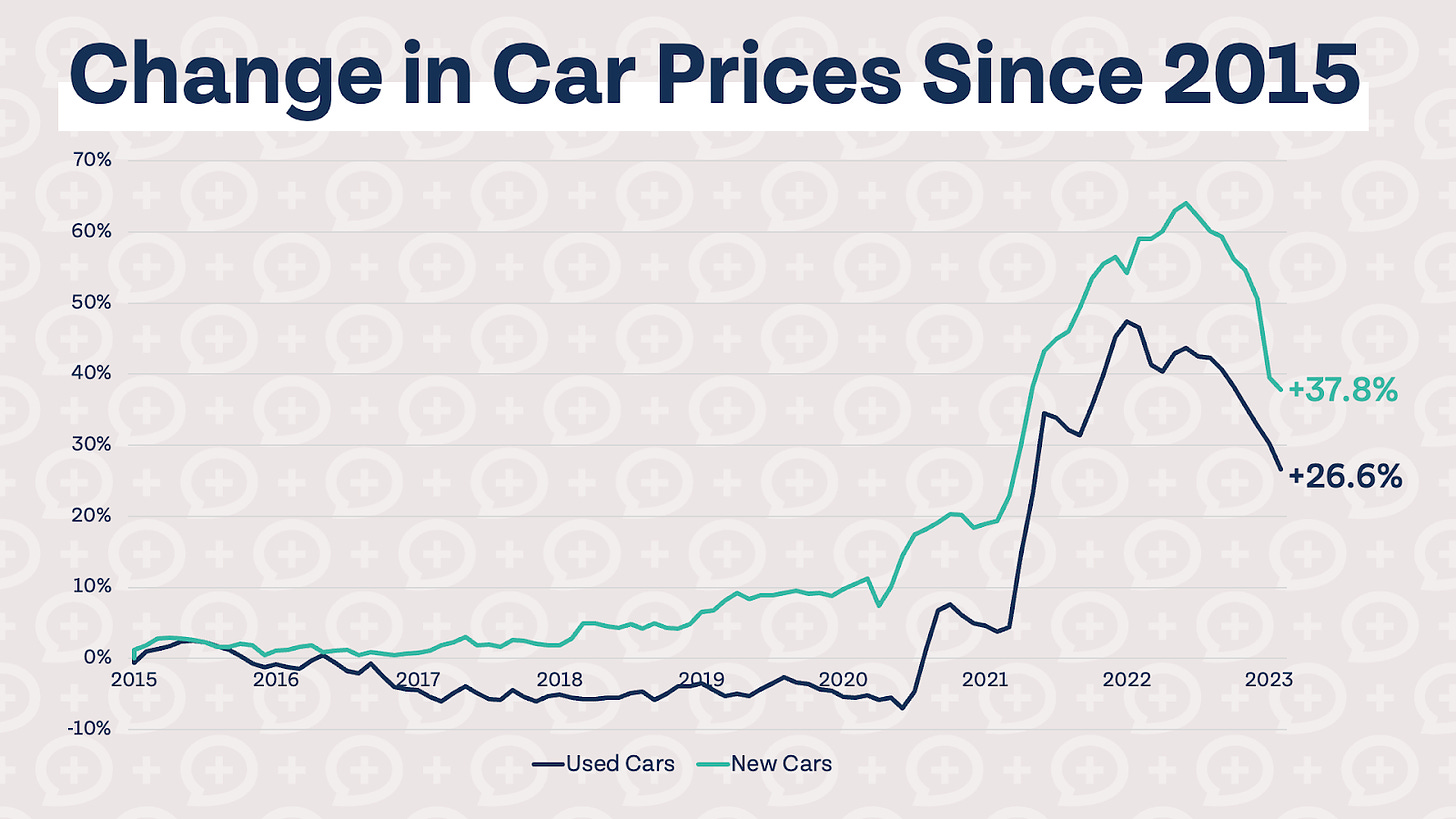

It’s no secret that car prices have skyrocketed over the last few years. The Federal Reserve has been tracking car prices since the 1950s, and we have never before seen a spike in prices like we did during the pandemic. The following chart shows the change in car prices since 2015, using data from the Federal Reserve.

If you have been waiting to buy a car, you probably feel pretty good right now! Prices for both used and new cars have dropped significantly from their pandemic peaks. While car prices are still much higher than they were before the pandemic, it is now much easier to buy a car and there is actually room for negotiation at the dealership again. Car prices still could come down even more, but it is a much better time to buy a car now than it was in recent years.

Buying a car is a huge financial decision, often second only to buying a house. If you make a bad car buying decision, it could impact your finances for years or even decades. Investing for retirement is exponentially more important than driving an expensive, nice car. No matter what stage of your financial life you find yourself in, you should always be investing more than you are spending on a car.

Needless to say, we really want to help you get this one right. That’s why we created our brand new Car Buying Checklist and additional online resources including a car affordability calculator. Take advantage of these resources to find a car that meets your needs and fits within your budget!