As a huge politics nerd, election years have always been special for me. When I was younger, I remember staying up late on election night and printing out different maps showing who had won each state in previous elections to try to “predict” the next winner. Elections are very important and seem to get more stressful every four years. There are real consequences to elections that are felt well beyond finance, let alone the stock market. However, for this article, let’s focus on financial planning and zoom in on how the next president could affect the stock market and your personal investment strategy.

How could the next president impact the stock market?

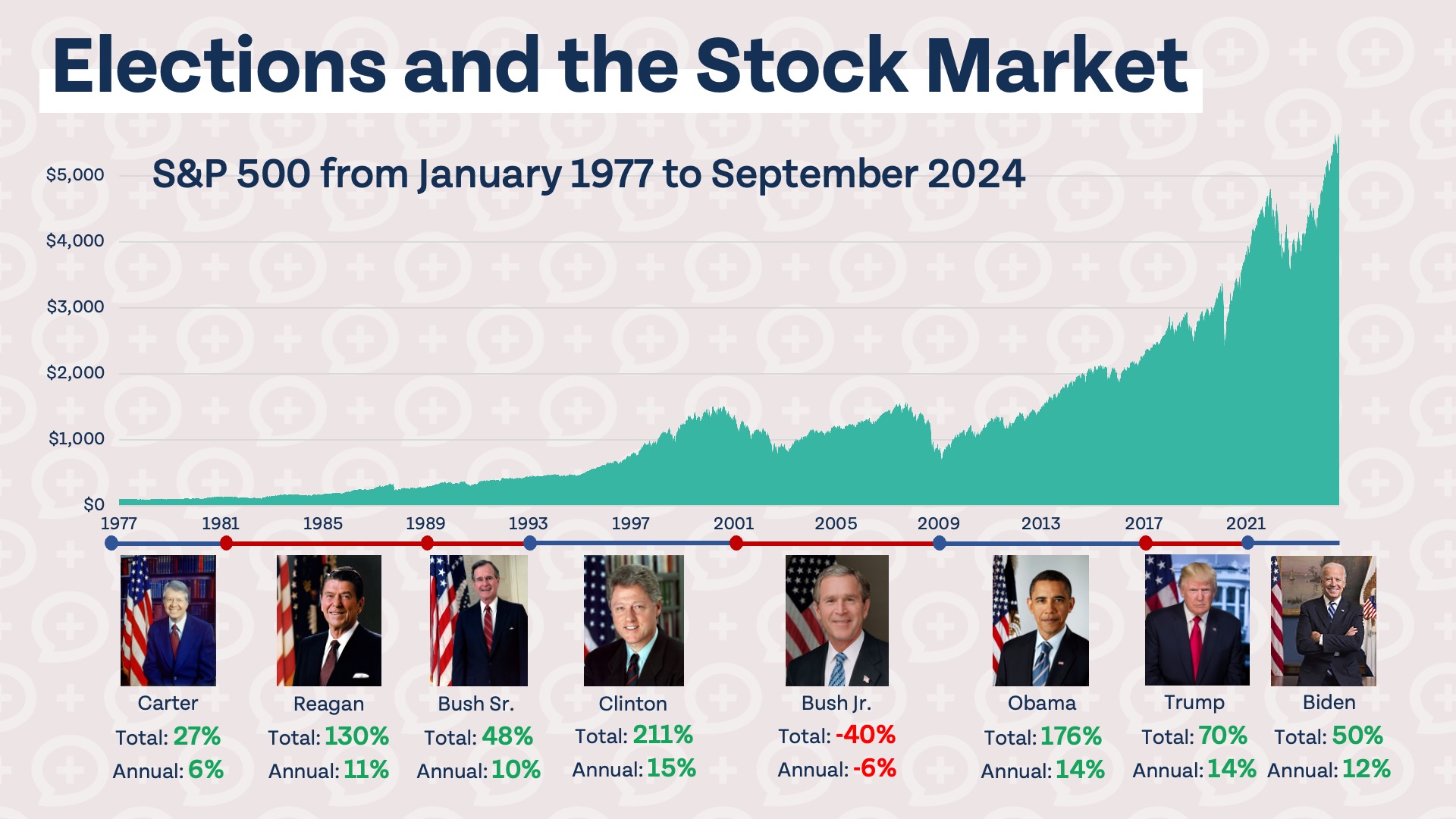

No matter who wins in November, we will have a different president on January 20th, 2025. This uncertainty can be scary, especially since the result feels, for the most part, out of your hands. We have two major political parties in the US and, most likely, the next president will be a Democrat or a Republican. Does the stock market perform better with either political party in the White House? Let’s take a look at the data.

As you can see, the stock market has performed pretty well no matter which political party holds the White House. George W. Bush didn’t have a great run, but investors who bought and held stocks during that time period are still experiencing good returns today. Outside of that one outlier, the stock market performs pretty well over time no matter which party is in office.

I don’t want to understate the importance of elections, but as far as stock market investors are concerned, history indicates that the election in November will have little impact on the performance of the stock market over the long-term. Still, markets can become volatile leading up to elections and even if you know on paper the president shouldn’t affect stock market returns, it can be tempting to make changes to your portfolio to reduce risk.

Should you change your portfolio before the election?

If you are really nervous about a certain candidate winning in November, making changes to your portfolio in advance of the election might seem like a good idea. Moving to safer assets such as cash or bonds could reduce the volatility in your portfolio. However, it is generally a bad idea to adjust your portfolio allocation for one short-term event. If your plan was actually good in the first place, it should continue to be good, carrying you through short-term volatility. Historically, the data shows that whoever wins in November does not have a strong impact on how the stock market will perform over that president’s term, so shifting your allocation because your preferred candidate may not win could lead to a significant loss of long-term returns, potentially changing your possible retirement date, withdrawal amount, or ability to achieve personal financial goals.

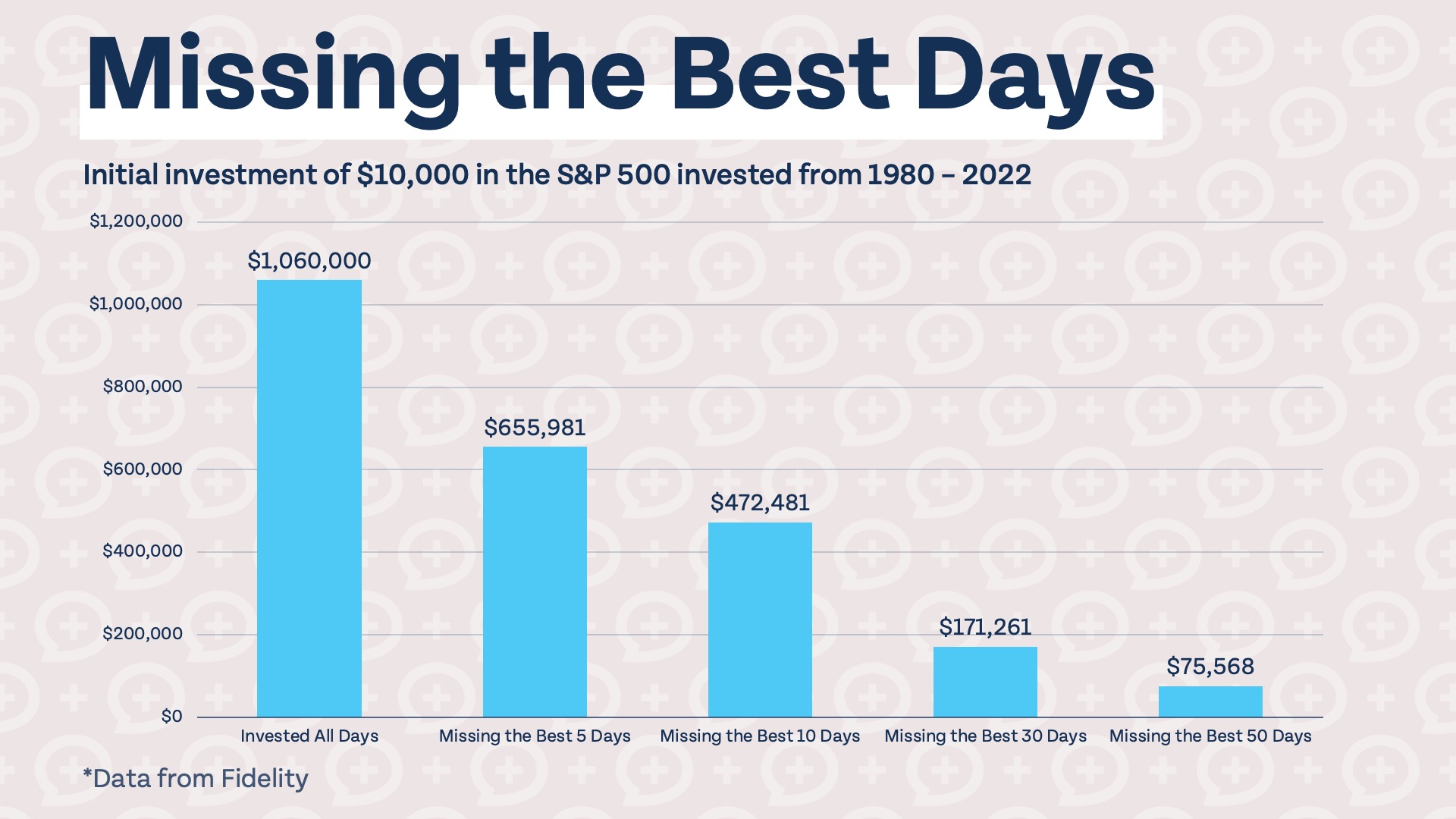

Don’t take my word for it – just look at the data. The following chart shows what missing just a handful of days in the stock market could cost you in the long-run. We have no idea when the best days in the market will occur, and they can often occur following periods of volatility. Removing your money from the market for any length of time could cost you big-time if you miss some periods of great returns.

Your long-term investing strategy should be appropriate for your risk tolerance and financial goals. There may be a bigger conversation to be had if your portfolio doesn’t match your tolerance for risk or personal financial goals, but shifting your allocation based on who may win the election in November could be a very bad idea. If nothing else, crunch your numbers, be honest about your financial goals, and do not take this decision lightly!

Focus on what you can control

Nobody likes feeling like they don’t have control over events that could greatly impact their lives, personal or financial. There are always going to be events and people out of our control that affect our lives. The key to feeling better about what you can’t control is to focus on what you can control.

There is so much about your finances that you have control over. You may not be able to control the direction of the stock market (even the president has very little control over that), but you do have control over what you choose to spend money on, how much you invest for retirement, and your own financial goals.

If you feel like you don’t have control of your finances, our Financial Order of Operations is a great place for anyone to start. Whether you are maxing out all of your retirement accounts and wondering if you are on-track to retire or are still struggling with high-interest credit card debt, the Financial Order of Operations can help you develop a plan of attack for getting your finances under control. We hope this is the start, a roadmap, for getting a great financial plan in place that will help you weather the short-term storms with more confidence!

Here are the nine steps of the Financial Order of Operations:

- Cover your insurance deductibles

- Get your employer match

- Pay off high-interest debt

- Build a full emergency fund

- Max-out your Roth IRA and HSA

- Max-out your employer retirement plan

- Hyper-accumulation

- Pre-pay future expenses

- Pay off low-interest debt

Have any questions about how these nine steps work and how to tell which step you are on? We created an ultimate guide to the Financial Order of Operations to help answer your questions. For those that want to take the FOO to the next level with video lessons, homework, private live streams, and access to our exclusive Facebook group, check out the Financial Order of Operations course.