Annuities are generally safe investments. You pay the insurance company a sum of money and then the insurance company makes payments to you for a certain length of time, starting immediately or at some time in the future. Annuities are as safe as the company issuing them; if you purchase an annuity from a financially stable insurance company, your annuity will be safer than an annuity issued by an insurance company that has made poor financial decisions.

The appeal of annuities

In times of market volatility, safer investments such as annuities become more attractive. Annuities come without the fear of losing money in the stock market and offer guaranteed returns. Those guaranteed returns don’t come without a hefty price; annuities can be complex, fees can erode a large portion of your potential gains, and many annuities include surrender charges to discourage purchasers from changing their mind about the investment. For investors who are extremely risk averse, annuities may seem worth the trade-offs, especially when the market is experiencing turbulence.

Fixed vs. variable annuities

There are two basic types of annuities, fixed annuities and variable annuities. Fixed annuities are normally relatively simple. Fees are typically embedded in the stated return or guaranteed income amount. There are two major types of fixed annuities, immediate fixed annuities and deferred fixed annuities. Immediate annuities allow you to immediately convert a lump sum of cash into an income stream, while the income with deferred annuities is, well, deferred. The earnings of both deferred and fixed annuities are not taxed until you receive them.

Variable annuities are a bit more complex. Many variable annuities are often pitched as investment products; they may offer a taste of investing in the stock market with none of the risk. Returns of these equity-indexed annuities typically don’t go below 0%, but are also normally capped with a participation rate (more on that later). The fee structure of variable annuities can also be confusing. They often come with insurance charges, investment management fees, surrender charges (fixed annuities normally have surrender charges as well), rider fees, and flat contract fees.

Risks of annuities

Annuities currently offer a low return on investment, and inflation is also low. When purchasing an annuity, there is a risk of the rate of inflation increasing while the return of your annuity stays the same. If the return of an annuity is lower than the rate of inflation, the annuity is essentially costing you money, as your dollars would become worth less and less over time.

Annuity surrender charges limit your ability to change your mind if you want to move your money somewhere else. With other investments, you’re normally free to leave whenever you want, although there may be tax consequences for doing so. If you need to cash out an annuity early due to an emergency or for other reasons, you may owe a surrender charge which can be quite substantial.

Can annuities beat indexes?

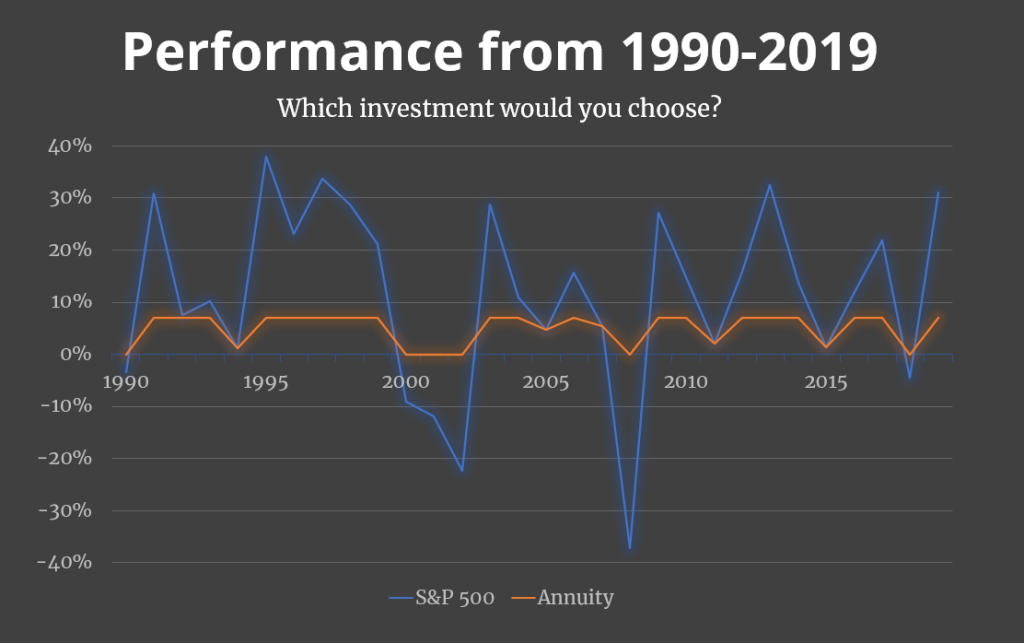

Fixed annuities currently yield around 2% to 4%; historically, the S&P 500 has returned about 10% per year on average. It’s a little more difficult to compare equity-indexed annuities to index funds since the terms and fees of the annuity will vary. Let’s see how an equity-based annuity capped at 7% (the cap is usually between 3% to 7%) with a 100% participation rate (the participation rate is normally less than 100%) and no fees stacks up to the S&P 500. Below is the performance of the described annuity and the S&P 500 over the last 30 years.

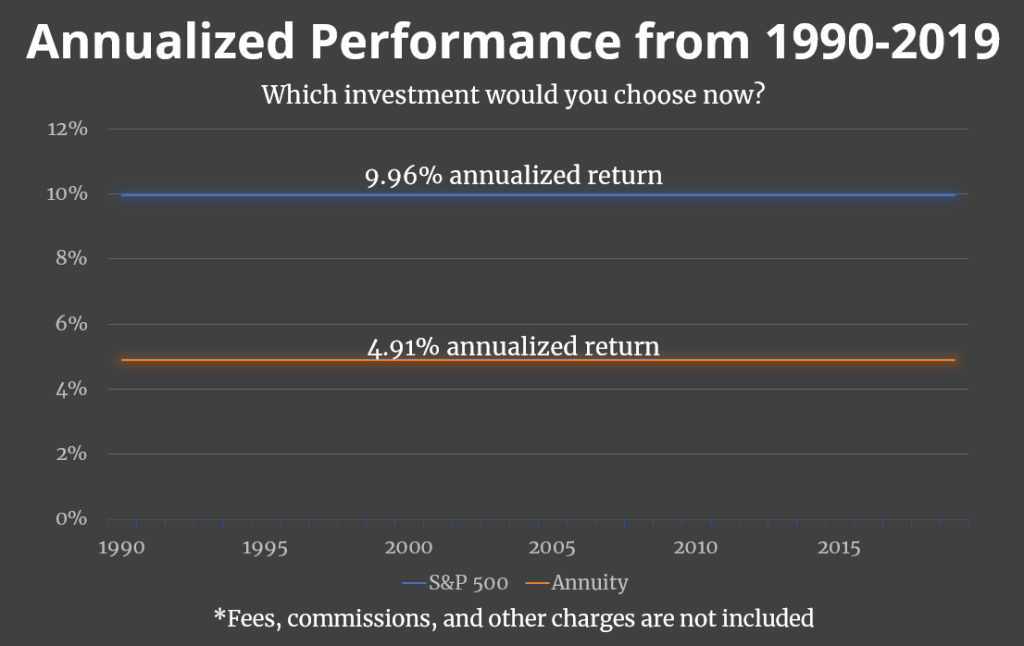

The chart above isn’t really clear, which is why equity-indexed annuities can be attractive. They outperform indexes during downturns by not losing value, but when the market is doing well they don’t capture as much of the upside. The annuity looks like a much smoother ride; the peaks aren’t as high, but the valleys aren’t nearly as low. Let’s flatten the graph by looking at the annualized performance over the last 30 years.

Using the annualized return, the picture suddenly becomes much clearer. Annuities may be safer from year-to-year and fluctuate less than indexes, but over the long-term you may be sacrificing a great deal of performance for that safety. In this example, we very generously assumed the annuity had a high cap, high participation rate, and no fees. In reality, the performance of many equity-indexed annuities would look much worse than the hypothetical annuity in the example above.

Annuities may seem attractive because they eliminate the risk of losing money in the stock market, but taking risk in the market is often associated with higher returns. Over the short-term, indexes can experience wild swings in value. In bull markets, it is common for indexes to experience gains of 20% or more in a given year, and in a bear market it is not uncommon for losses of 20% or greater in a single year. Annuities will never have gains or losses that extreme, but when we look at the long-term performance of annuities they under-perform broad market indexes.

Our latest show, “The Harsh Truth About Annuities,” includes everything you need to know about annuities. Our show will help you understand the differences in different types of annuities, different fees associated with annuities, and signs you may be making a bad investment. Watch it now on YouTube below.