Last Updated

May 15, 2025

Read Time

Share

401(k) plans are one of the most popular retirement savings vehicles in America and can help you build a tremendous amount of tax-advantaged wealth. Not all 401(k) plans are created equal, so it’s important to understand the intricacies of your plan to know how much you should contribute, when employer contributions will be yours to keep, different contribution types, 401(k) pitfalls, and more.

Key Takeaways

Copy link to this section: Key Takeaways

Copied the URL to your clipboard!

- The history of 401(k) plans and why they were created

- Why you should invest in your 401(k)

- How much your 401(k) can grow

- Average 401(k) balance of Americans by age

How did your 401(k) compare to your peers’ in 2023? Check back May 2024 for this year’s updated survey.

What is a 401(k)?

Copy link to this section: What is a 401(k)?

Copied the URL to your clipboard!

The 401(k) was created by The Revenue Act of 1978 that allowed employees to choose to receive a portion of their income as deferred compensation. It wasn’t until later in 1981 that major companies adopted 401(k) plans, and the rest is history. By the end of the very next year, 1982, about half of all large employers in the country offered 401(k) plans to their employees. Today, about two out of every three workers have access to 401(k) plans, while only 15% of private workers have a pension (pensions were the more popular retirement plan before 401(k)s were introduced).

Want to see how much every dollar invested in your 401(k) could become by age 65? Check out our Money Guy Wealth Multiplier tool.

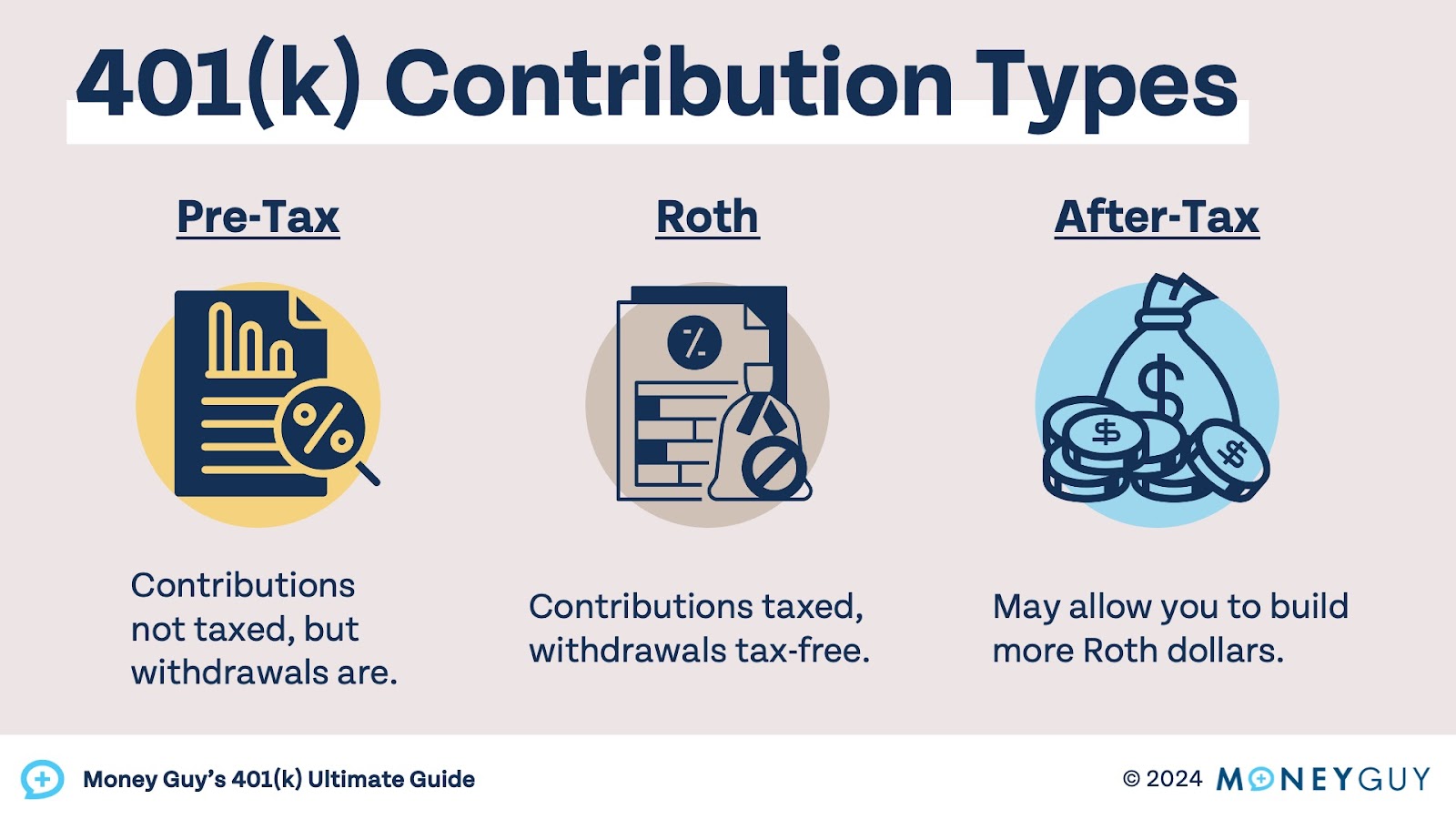

Within a 401(k) plan, employees may have the option of making pre-tax contributions or Roth contributions. Pre-tax contributions are not taxed initially, but upon distribution in retirement. Roth contributions are taxed initially, but growth is tax-free and qualified distributions are tax-free in retirement. Not all employers offer a Roth option, but about 89% of employers that sponsor a 401(k) plan now allow Roth contributions. Employer contributions usually go into the pre-tax side of your 401(k), but new legislation allows employees to choose for those contributions to go into the Roth portion of their 401(k). However, the employee is responsible for the tax if employer contributions are elected into the Roth portion of their 401(k).

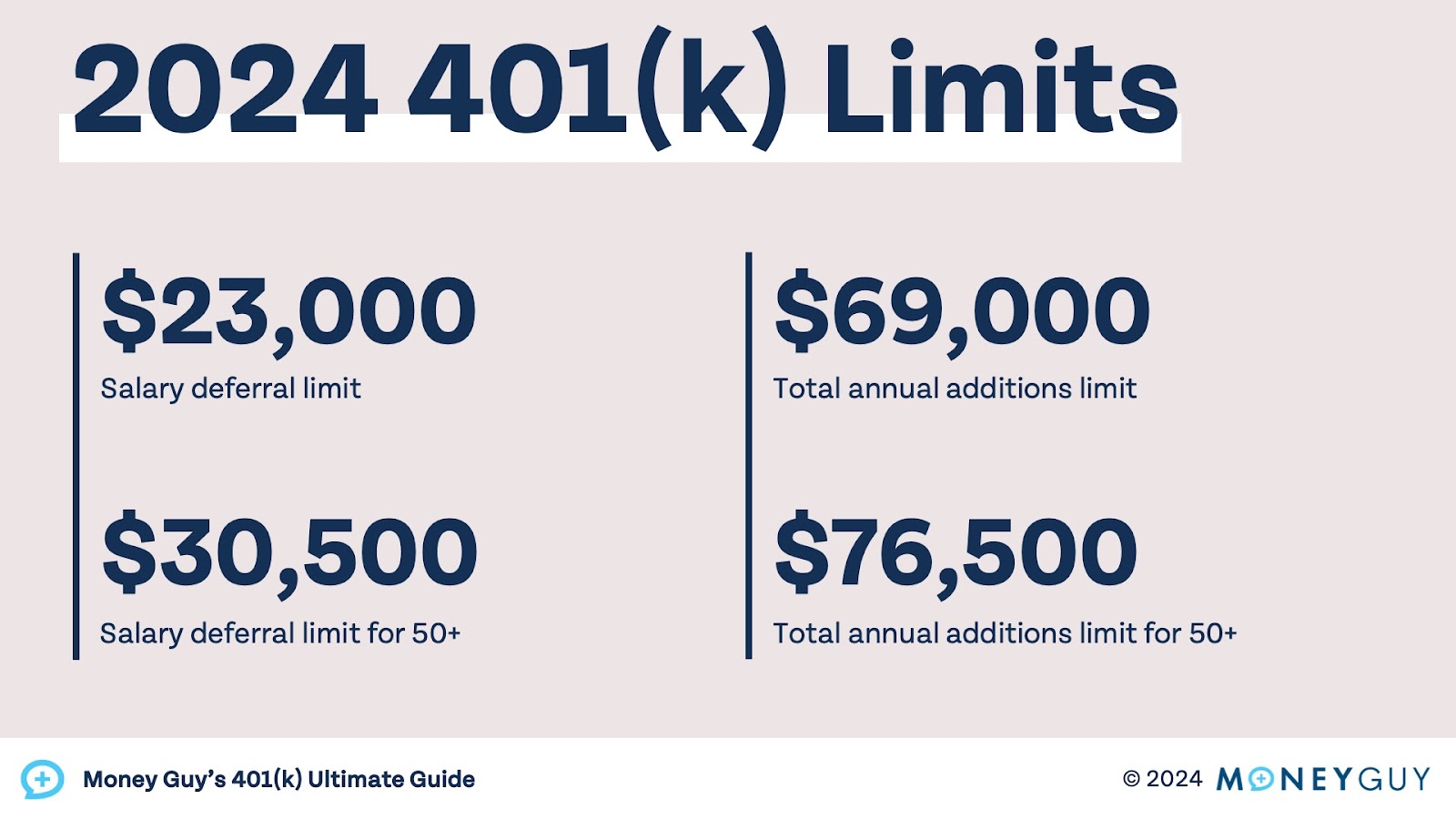

Share image

Those who are self-employed may still be able to utilize a 401(k) to save for retirement. Solo 401(k) plans are for business owners with no employees. Users of solo 401(k)s may make Roth or pre-tax contributions just like with a regular 401(k). The contribution limits of 401(k) and solo 401(k) plans are the same; the employee contribution is limited to $23,000 in 2024 (with an additional $7,500 allowed for those 50 and older).

The combined employee and employer limit, known as the annual additions limit, is currently $69,000. Since those with a solo 401(k) are both employee and employer, they may be able to utilize the entire $69,000 limit if they have the income to do so. Traditional employees may also be able to contribute up to the annual additions limit of $69,000 to their 401(k) if their employer allows after-tax contributions (which may be used to make what are called mega backdoor Roth contributions).

Share image

401(k) plans are the most popular employer-sponsored retirement plan, but they are not the only plans. Instead of a 401(k), you may have a 403(b) plan, 457 plan, SIMPLE IRA, SEP IRA, TSP, or a different type of plan. Many of these different types of plans are offered to non-profit or government employees. These plans work similarly to 401(k) plans, but may have different contribution limits, investment options, and rules depending on the plan. Employers may also offer stock ownership plans, such as ESPPs or ESOPs.

What do I invest in in my 401(k)?

Copy link to this section: What do I invest in in my 401(k)?

Copied the URL to your clipboard!

Your 401(k) plan custodian is selected by your employer, and investment options are set by the custodian. A 401(k) typically only offers 8 to 12 investment options, so your choices may be limited and the options available may have high fees and expenses. If you are unhappy with the choices available in your 401(k), try talking with your boss or HR to see if they can make a change. If you work for a smaller employer, you may have better luck than if you work for a large employer.

Look for low-cost index funds in your 401(k), in particular target date index funds. Target date index funds are a “set it and forget it” investment option that automatically changes as you age. This means you don’t need to worry about adjusting your portfolio manually as you get closer to retirement. If target date index funds are not offered in your 401(k), consider other low-cost index funds if they are available. Some 401(k)s that don’t have great options may have neither available, in which case you’ll be looking for the best of the worst.

Why 401(k) plans are so awesome?

Copy link to this section: Why 401(k) plans are so awesome?

Copied the URL to your clipboard!

Why do we love 401(k)s so much? For many investors, they are the single largest retirement account they have. The contribution limit is much larger than IRAs and HSAs, and many Americans only save for retirement in their 401(k). The data shows that 80% of millionaires invested in their company’s 401(k) plan.

Share image

Even if the vast majority of millionaires invest in 401(k)s, that doesn’t necessarily mean they are a great investment. If 80% of millionaires jumped off a bridge would you follow them?

Millionaires aren’t investing in 401(k)s for no reason. They are one of the best ways to legally hide money from the government. If you contribute to a pre-tax 401(k), your contributions are not taxed and your account grows entirely tax-free. If you contribute to a Roth 401(k), your contributions are taxed, but your account grows entirely tax-free and qualified distributions are entirely tax-free. The higher contribution limits of 401(k) plans make them one of the best ways to build tax-advantaged wealth. It’s no wonder why so many millionaires invest in them.

How much can your 401(k) grow?

Copy link to this section: How much can your 401(k) grow?

Copied the URL to your clipboard!

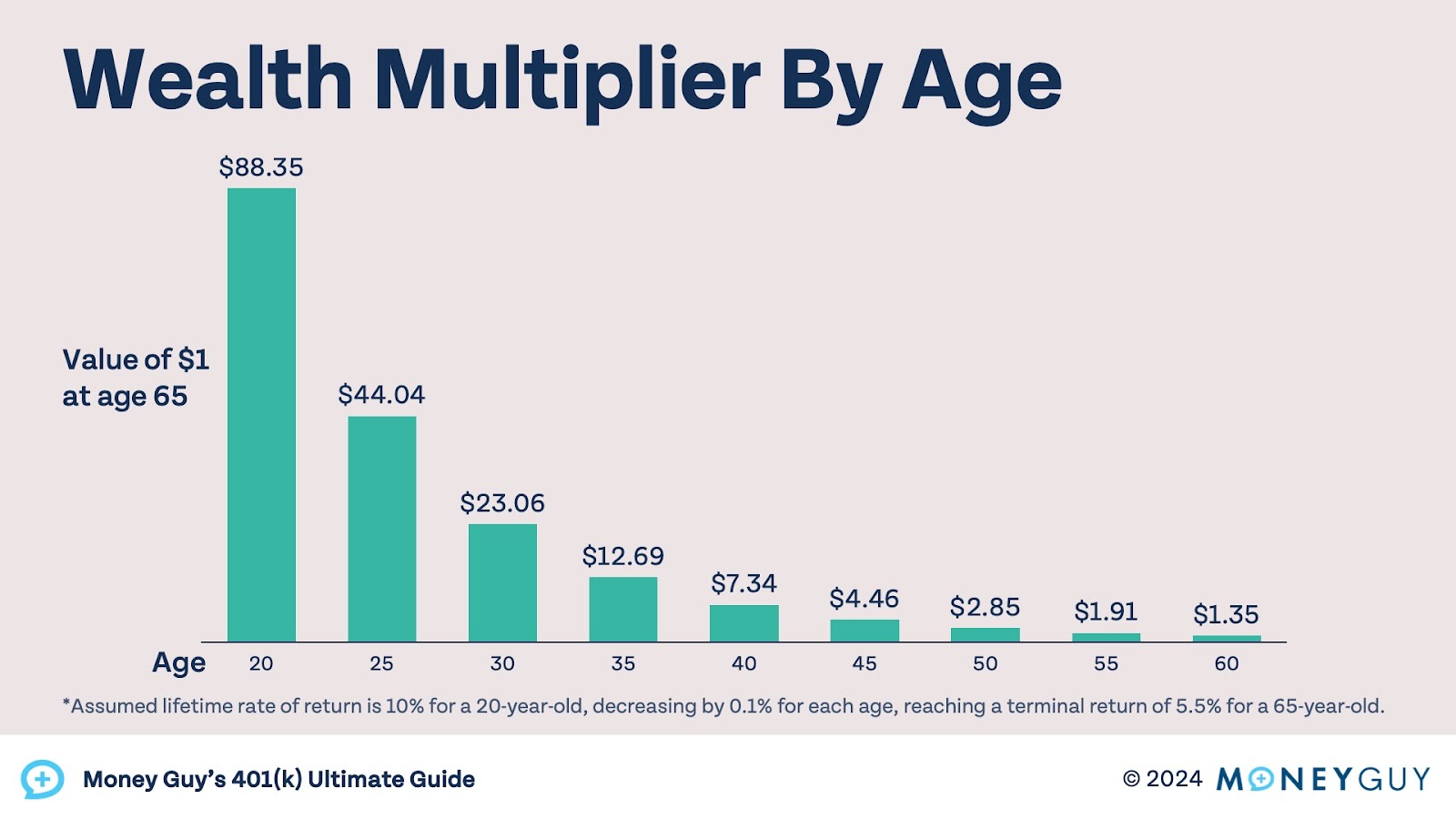

Every dollar you invest in your 401(k) while you’re working can grow substantially by the time you retire. The chart below shows what every single dollar you invest in your 401(k) could turn into by 65, using our assumed rates of return. At age 20, your Wealth Multiplier is 88.35. That means if you invest $1,000 in your 401(k), it could turn into $88,350 at age 65! If you are able to invest $10,000 at age 20, that amount could turn into $883,500 by age 65, assuming an annualized return of 10%. Use our interactive Wealth Multiplier tool to see what your dollars could turn into by age 65, based on your age and how much you currently have invested.

Share image

Our Wealth Multiplier assumes an annualized return of 10% per year, every single year. Over the last 50 years the S&P 500, an index tracking the 500 largest companies in the US, has annualized a little over 11%. But it’s not as simple as earning 10% or 11% every single year you invest. There are high peaks and deep valleys. The S&P 500 may go up 29% one year, go down 18% the next year, and go up 26% the year after (sound familiar? That’s what the S&P 500 has done the last three years, 2021, 2022, and 2023).

What if we told you the peaks and valleys of the stock market are actually a good thing for investors buying into the market every single month, which are most people with a 401(k) plan? We have the data to prove it.

The S&P 500 went down $2 from October of 2007 to April of 2013. Over a period of nearly six years, the stock market was “flat.” But it wasn’t really flat! The drops and volatility in the market allowed consistent investors to buy into the market at lower and lower prices. Someone who invested everything when the index was at $1,565 would have little to show 5 ½ years later when the index was at $1,563. However, someone investing $500 per month over this time period would have annualized 11.9% even though the market had not gone up.

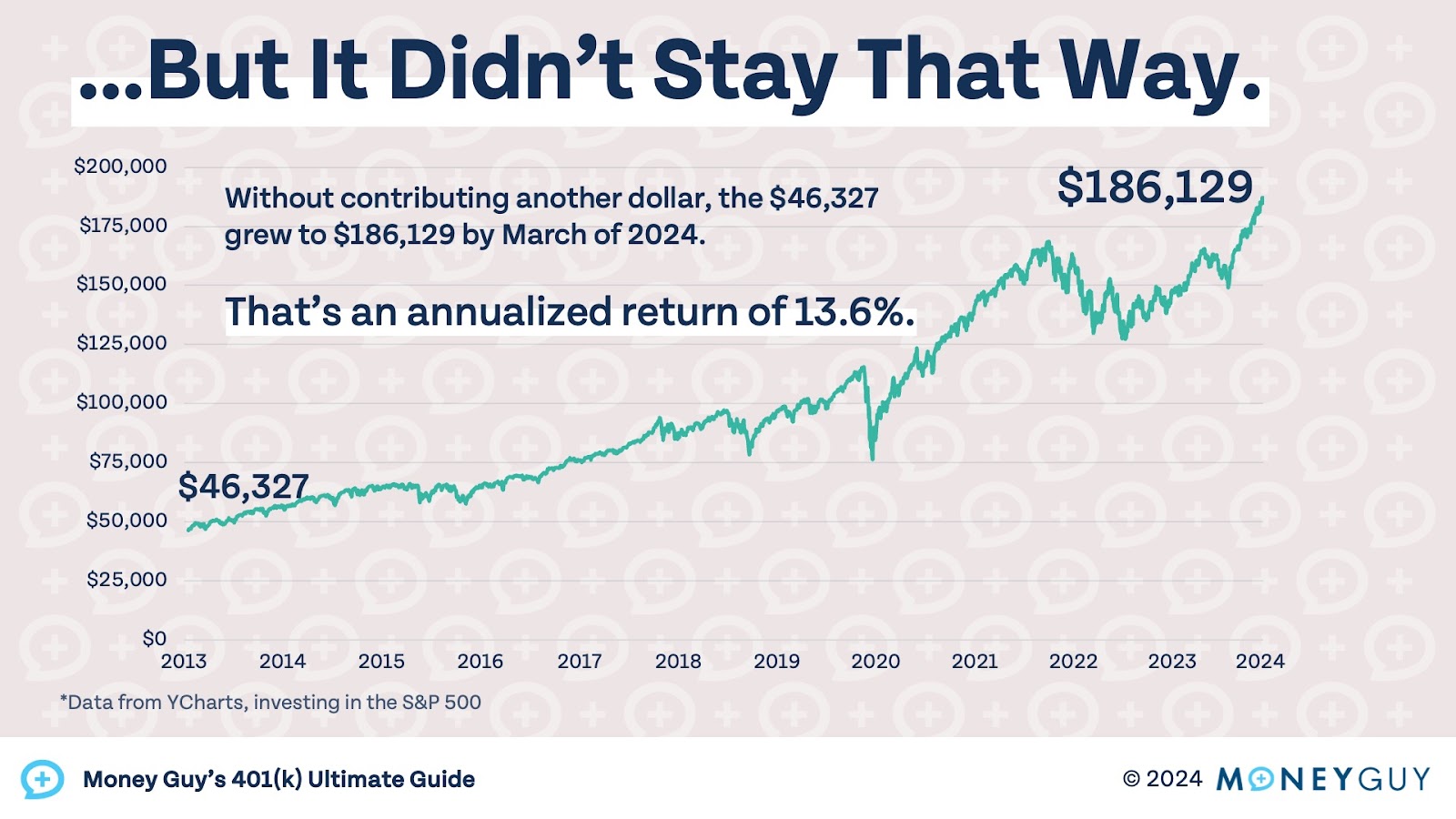

Share image

There will always be periods where the market is down or flat, and it may even last for years. Periods of volatility or poor market returns are often followed by great years for the stock market, which is what we saw after 2013. If the investor never contributed another dollar to their 401(k), it would be worth $186,129 in March of 2024, an annualized return over this period of 13.6%. In total they contributed just $33,000, and their investment has grown exponentially to nearly $200,000.

Share image

If they are able to let their 401(k) grow for another 25 years (which would equal 42 years combined with the 17 that have already passed, or about the typical working career), their 401(k) would be worth $1,366,220 at an annualized rate of 8%. Remember, they only contributed $33,000 total for 5 ½ years. Imagine what your money can do for you if you keep contributing!

Favorite 401(k) Resources

Copy link to this section: Favorite 401(k) Resources

Copied the URL to your clipboard!

- Premium product: Money Guy Net Worth Tool – Know exactly where you are and where you are going.

- Free download: Wealth Multiplier by Age

- Free download: How Much Should You Save?

- Video: Don’t make this huge 401(k) mistake

- Article: Average 401(k) balances by age. Check back in May 2024 for the latest on this popular annual Money Guy exclusive.

- Article: The IRS Just Changed the Rules About 401(k)s (What You Need to Know) – September 2023

- Related product: Roth IRA Guide

401(k) By Age

Copy link to this section: 401(k) By Age

Copied the URL to your clipboard!

How do you stack up to Americans your age? Knowing exactly what other savers your age have in their 401(k) can help you determine how far ahead (or behind) you are when compared to your peers.

Share image

401(k) By Age | Early Career (20s)

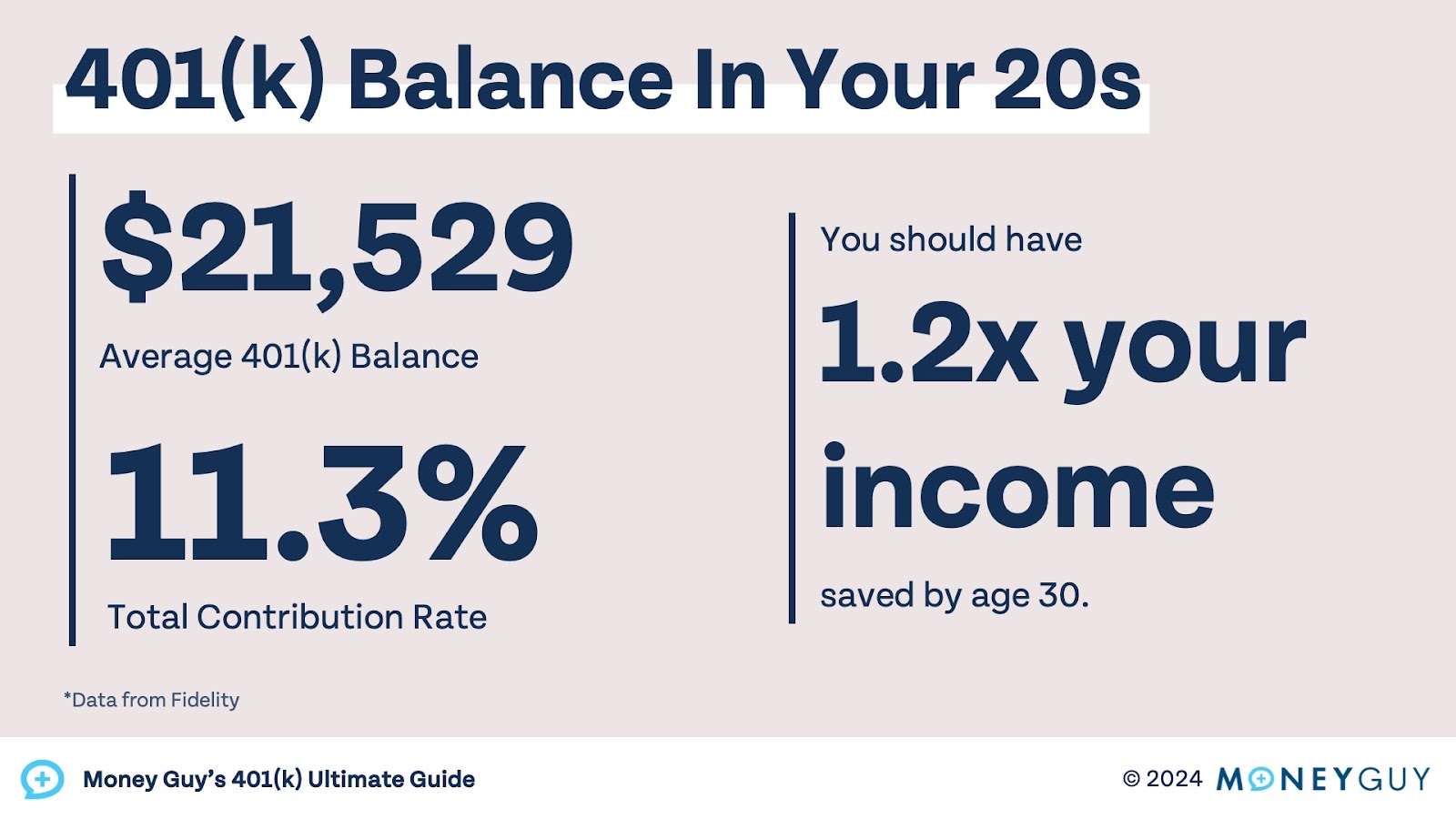

You may not be contributing much to your 401(k) in your 20s or right when you start your career – and that’s okay! Aim to get your full employer match after funding your highest deductible (Step One of the Financial Order of Operations). Start planning for your retirement now and take advantage of your employer match.

The average 401(k) balance for those in their 20s is $21,529, average contribution rate is 11.3%, and you should aim to have about 1.2x your income saved by age 30.

Share image

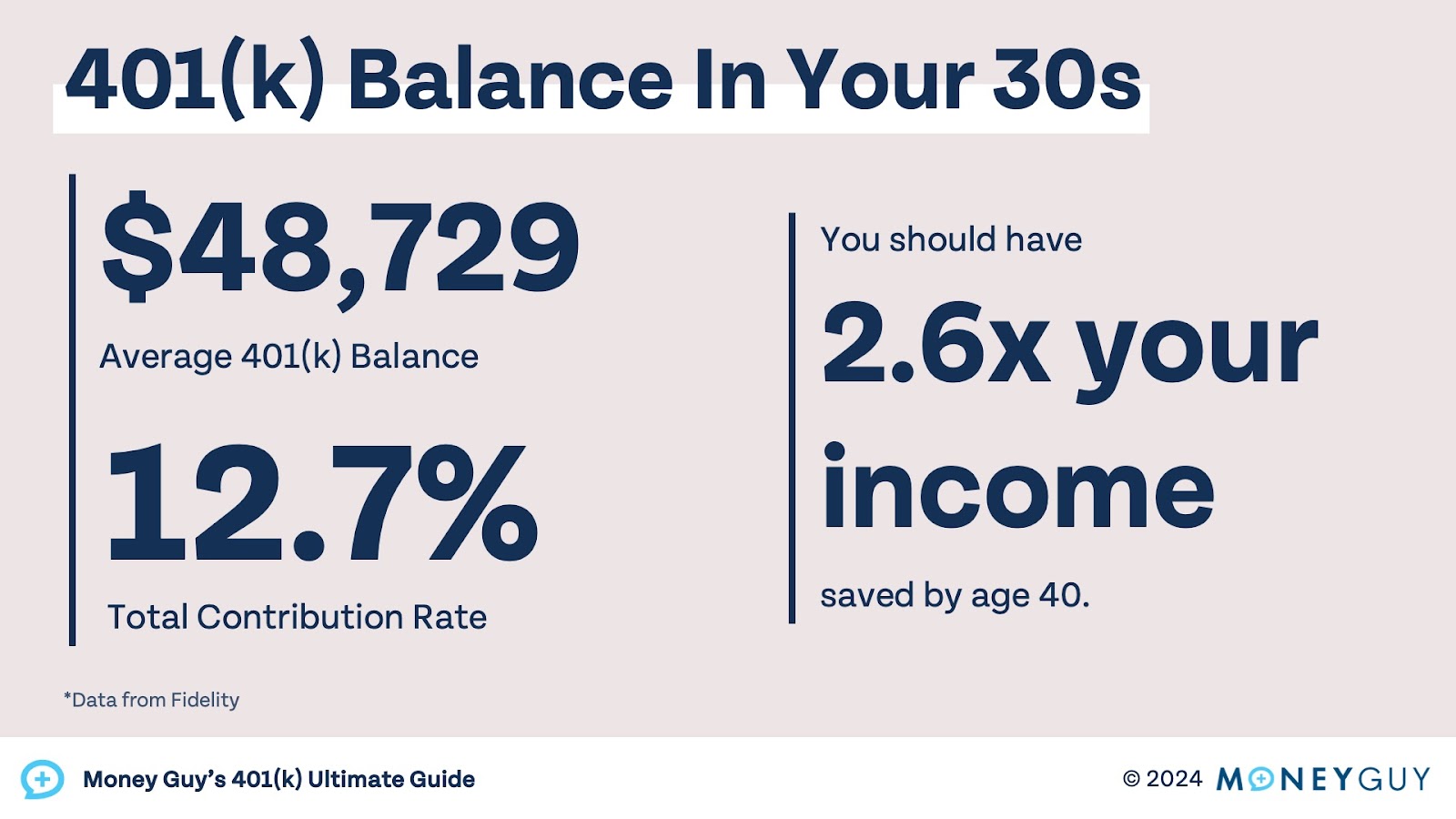

401(k) By Age | Messy Middle (30s)

When you reach the Messy Middle, you need to have a plan so that every dollar gets maximized. Both time and money are scarce in your 30s. Aim to invest 25% of your gross income by the time you reach your 30s. You will also likely be contributing more than the match to your 401(k).

The average 401(k) balance for those in their 30s is $48,729, average contribution rate is 12.7%, and you should aim to have about 2.6x your income saved by age 40.

Share image

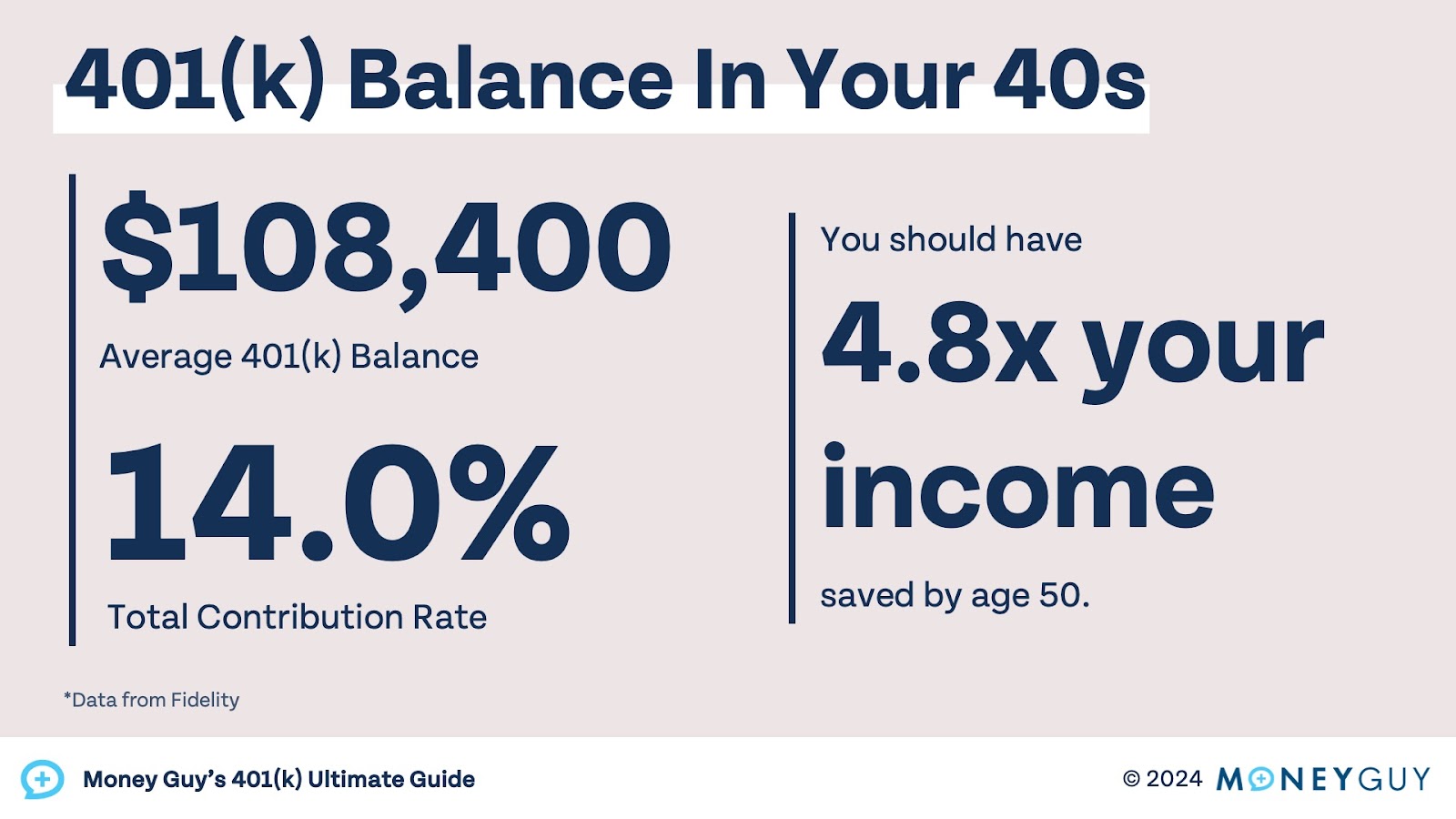

401(k) By Age | Mid-Career (40s)

If you’ve been working for a couple decades in a job that offers a 401(k), your account is likely close to reaching a critical mass. If you are behind in retirement savings, there is still time to catch up. If you start investing from $0 at age 40, you can reach financial independence by age 69 by saving 25% of your income (assuming a 6% annual real rate of return and 80% income replacement ratio).

The average 401(k) balance for those in their 40s is $108,400, average contribution rate is 14.0%, and you should aim to have about 4.8x your income saved by age 50.

Share image

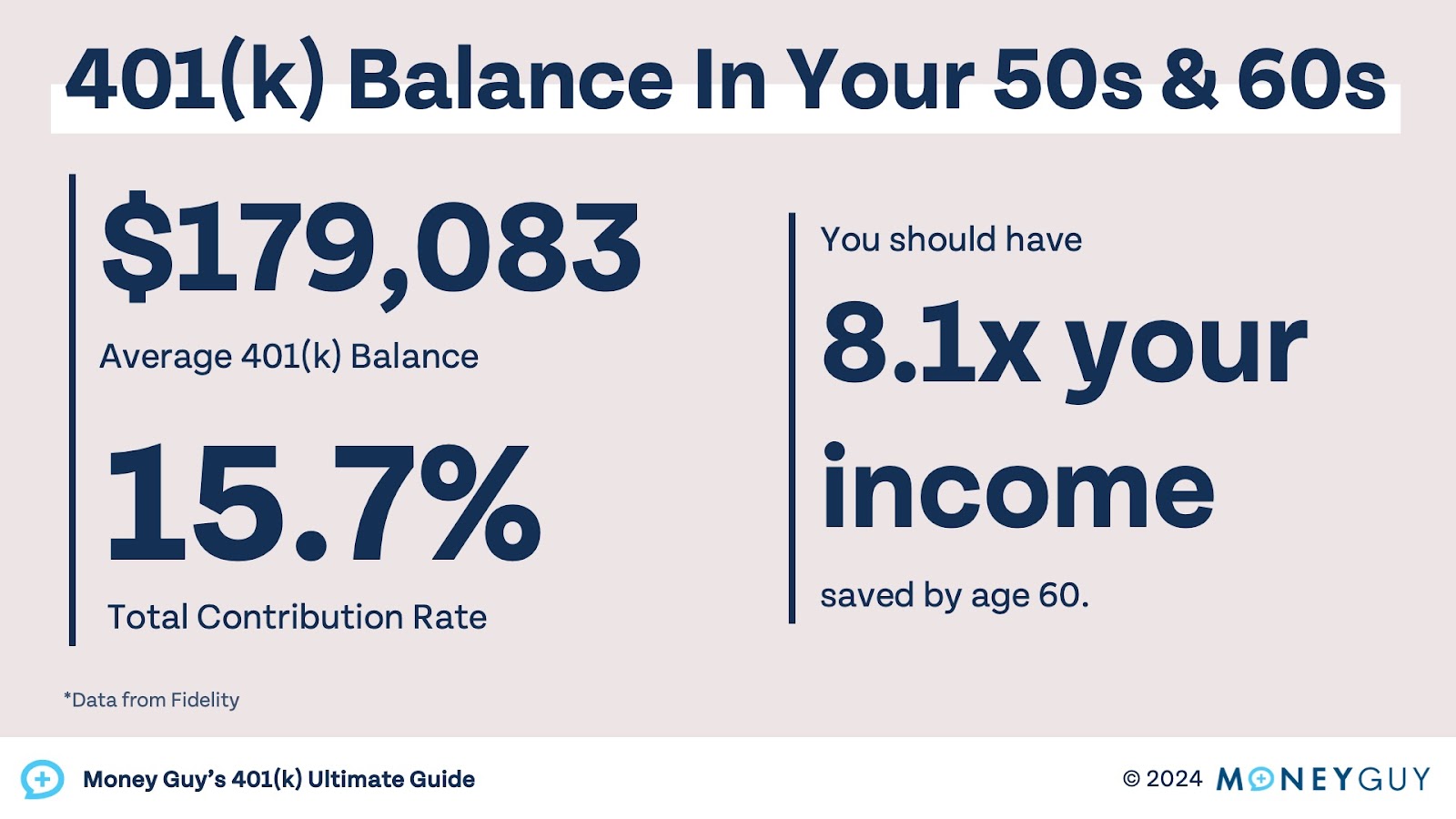

401(k) By Age | Nearing Retirement (50s & 60s)

Crossing 50 is an exciting time to be contributing to a 401(k) – you finally get to make catch-up contributions! As you get closer to retirement, you should be dialing in your retirement plan and make sure you are doing what you need to with your retirement accounts. Do you have the ability to convert some money to Roth before retirement? How about contributing more right before retirement?

The average 401(k) balance for those in their 50s and 60s is $179,083, average contribution rate is 15.7%, and you should aim to have about 8.1x your income saved by age 60.

Share image

Impact and Evolution of the 401(k)

Copy link to this section: Impact and Evolution of the 401(k)

Copied the URL to your clipboard!

Over 20% of Americans don’t even know what a 401(k) is, and those that do likely don’t know how to make the most of their 401(k). It’s safe to say the 401(k) has come a long way, from a blip on the radar in 1978, gradually overtaking pensions as the most popular retirement plan in America, and now being featured in a song by international rap sensation Kendrick Lamar.

There’s no doubt the 401(k) will continue to grow and evolve in the future. Whether it’s by new legislation, annual inflation adjustments, or other changes, we will keep you up-to-date with all 401(k)-related changes.

401(k) Fees

Copy link to this section: 401(k) Fees

Copied the URL to your clipboard!

The fees and expenses 401(k) owners are responsible for vary wildly from plan-to-plan. Asset-weighted expense ratios of 401(k) plans, which weigh large plans more heavily, are just 0.36%. However, expense ratios for smaller 401(k) plans average around 1.60%. If you are in a smaller 401(k) plan with high expenses, don’t be afraid to advocate for change at your company. Your boss may not even know just how bad the plan is. Large custodians like Fidelity, Charles Schwab, and Vanguard may have better options for you and your employer.

401(k) Loans

Copy link to this section: 401(k) Loans

Copied the URL to your clipboard!

401(k) loans are generally available to active participants of a plan and may allow the employee to withdraw up to $50,000 or 50% of the account balance, whichever is less. Borrowing money from yourself instead of a bank may seem like an attractive idea, but taking a loan from your 401(k) can be damaging to your financial life. Loans must be paid back, with interest, and some plans do not allow participants to make new contributions with an active loan. Borrowing from yourself now could really negatively impact your retirement savings, not only by losing out on potential growth but by making it difficult or impossible to keep contributing normally.

401(k) Taxes

Copy link to this section: 401(k) Taxes

Copied the URL to your clipboard!

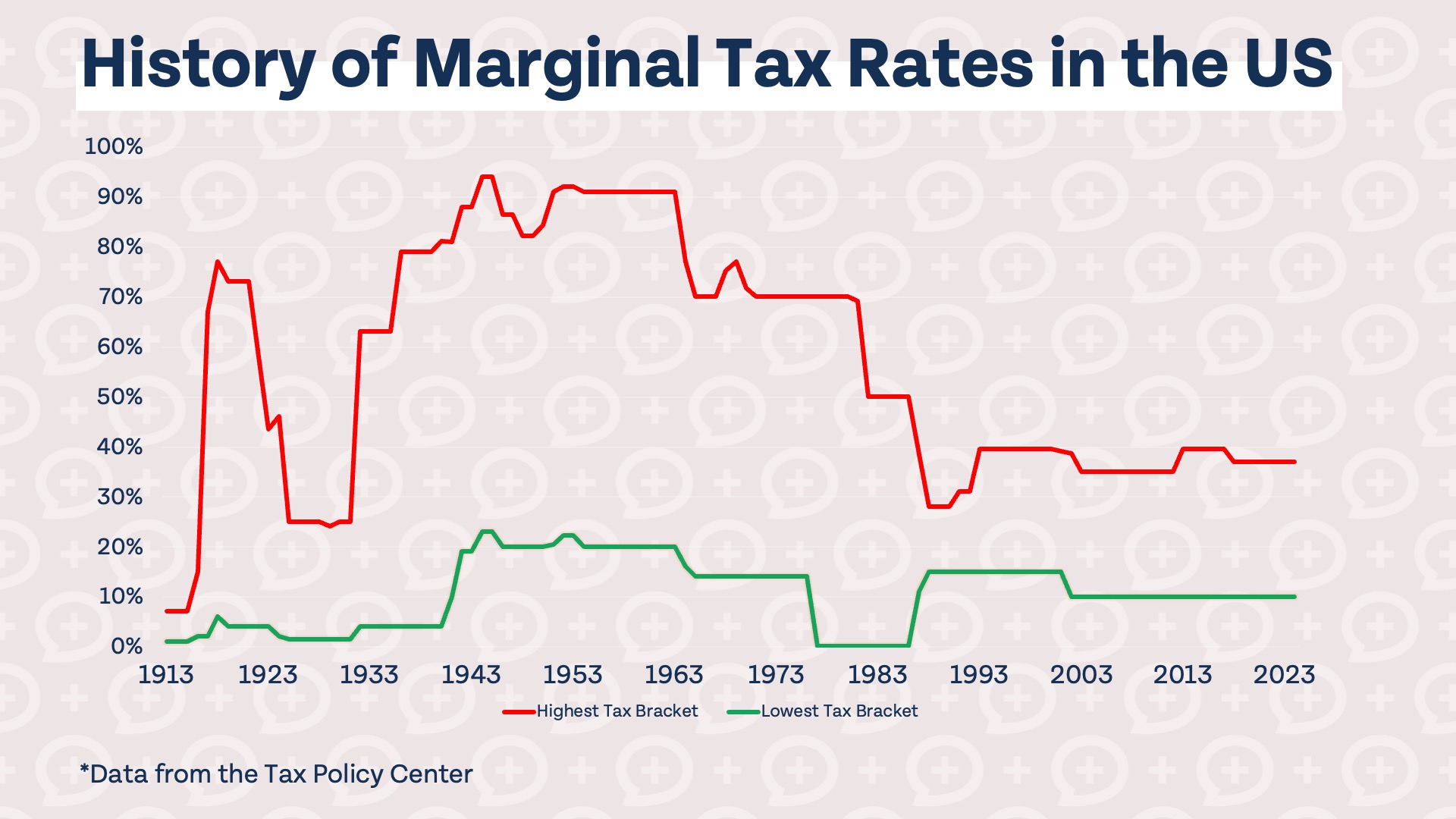

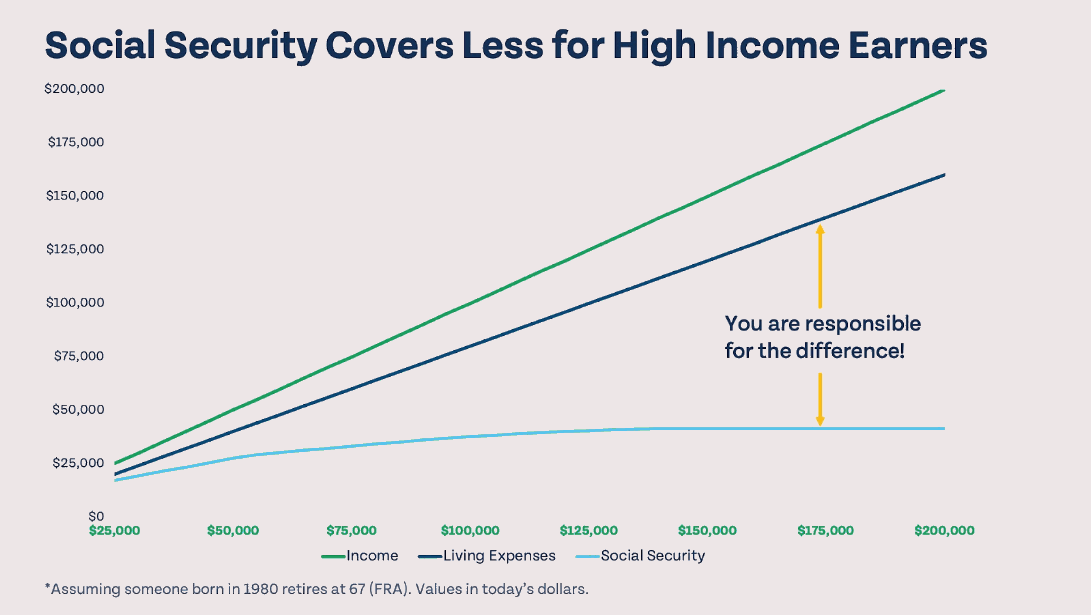

While 401(k) accounts are tax-advantaged retirement savings vehicles, they are not tax-free, and in some cases taxes can be significant in retirement. If you contribute to your 401(k) on a pre-tax basis, which means your contributions are not taxed now but will be at the time of withdrawal, your account could become a ticking tax bomb the larger it gets. Many 401(k) participants choose to contribute to a Roth 401(k) or convert a pre-tax 401(k) to Roth to avoid this tax pickle. It does not always make sense to contribute to Roth, so consider your current tax rate and tax rate in retirement before deciding on the best course of action.

401(k) Neglect

Copy link to this section: 401(k) Neglect

Copied the URL to your clipboard!

In some cases 401(k)s can be a “set it and forget it” retirement account, but you always should keep up-to-date with your account balance and any changes to your plan. Make sure your asset allocation properly reflects your financial goals and risk tolerance. If you are a young person with your first 401(k), it may not make sense to be allocated entirely to risk-off assets such as bonds. If you are about to retire, it probably isn’t a good idea to invest everything in small cap US stocks. Index target date retirement funds are a great option for hands-off participants that don’t want to manually choose investments in their 401(k).

401(k) Matching

Copy link to this section: 401(k) Matching

Copied the URL to your clipboard!

92% of employers with a 401(k) plan offer a match to their employees, and every employee that is able to should take full advantage of their employer match. It’s Step 2 of our Financial Order of Operations for a reason – any employer match is essentially free money from your employer and offers a tremendous rate of return on your initial contribution. If you don’t get a 401(k) match, that’s okay! They are still a great place to save for retirement in a tax-advantaged manner.

401(k) Maxing

Copy link to this section: 401(k) Maxing

Copied the URL to your clipboard!

Americans with a 401(k) would need to contribute $23,000 in 2024 to maximize their account, or $30,500 if they are 50 or older. That’s not to mention they may be contributing to a Roth IRA or HSA before trying to maximize their 401(k). It’s safe to say that someone will need to have a high income and margin to invest a significant amount for retirement to be able to maximize their 401(k). For those that are able to maximize their account and are looking to save even more for retirement, some employers offer after-tax 401(k) contributions which will allow you to build what are called mega backdoor Roth assets.

Rolling over a 401(k)

Copy link to this section: Rolling over a 401(k)

Copied the URL to your clipboard!

If you’re a Financial Mutant, one of the first things you’re looking forward to when starting a new job may be rolling over your old 401(k) to your new one…but should you really rollover your old 401(k)? Although it’s tempting to consolidate your accounts and have one less 401(k) to worry about, it may not make sense to roll it over. If your old 401(k) had better investment options, it could be worth leaving it alone, at least until you have a better option to roll it over to.

If you do want to roll over your old 401(k), it is essentially to ensure your last contribution has gone into the plan so you aren’t missing out on any money. If your employer offers profit-sharing contributions, closing your account before those go in, which can happen the following year, could cause you to lose out on employer contributions.

401(k) Vesting Schedules

Copy link to this section: 401(k) Vesting Schedules

Copied the URL to your clipboard!

Every dollar you contribute to your 401(k) is yours to keep forever, no matter when you leave your employer. However, employer contributions could come with strings attached. Employer contributions often have vesting schedules, which means the funds are not actually yours until you have been employed for a certain length of time. Some employers offer immediate vesting, where everything is always yours to keep, others offer cliff vesting, where your employer contributions go from 0% to 100% vested after a certain period of time, and some offer graded vesting, where employer contributions gradually become more vested the longer you remain with the company.

Glossary of 401(k) terms

Copy link to this section: Glossary of 401(k) terms

Copied the URL to your clipboard!

Plan Administrator

The plan administrator is typically a third-party manager chosen by your employer to ensure the smooth operation of your plan. Plan administrators are usually not affiliated or associated with your company, but your company can change plan administrators if the service and options available to employees are not up to their standards.

After-tax contributions

Distinctly different from Roth contributions, employers that allow after-tax contributions may allow employees to contribute up to the annual additions limit and use what is commonly referred to as a mega backdoor Roth to build even more tax-advantaged retirement assets.

401(k) allocation

The allocation of your 401(k) is the mix of investments held in your account. If you like to keep things simple, you may only have a target date index fund, which is one investment that contains the diversity of an entire portfolio and automatically changes as you get older and closer to retirement.

401(k) beneficiary

Nobody likes to think about death, but naming the beneficiary on your 401(k) is extremely important. Whoever you name as beneficiary will receive your 401(k) assets if you pass away. Check your beneficiary whenever you go through major life changes and at set intervals, such as every year. If you are in a situation where you don’t update your beneficiary after, say, a divorce, your ex-spouse could end up with your 401(k) when you pass away.

Catch-up contribution

401(k) catch-up contributions are only allowed for those 50 and older and are intended to help those getting older save more for retirement and catch up if they are behind. Since the standard 401(k) limit is so high, not everyone will have the capacity to take advantage of catch-up contributions, but they can be a great boost for those with a high income who haven’t been saving for retirement like they should have.

Expense ratio

All funds have what are called an expense ratio, which is a percentage of assets that the fund charges as a fee each year. Very few funds have no expenses, as there are always some costs to operating investment funds, but many investment funds are very low-cost. Always consider cost when evaluating investment options, as a high expense ratio directly takes away from your potential rate of return in the investment.

Hardship withdrawal

Hardship withdrawals are available to participants experiencing financial hardship in limited circumstances. Unlike a 401(k) loan, these distributions are not expected to be repaid, but an individual can pay the funds back within 60 days to avoid penalties on the distribution.

Profit-sharing plan

Your employer may operate a profit-sharing plan within your 401(k) where company profits are shared with employees. There are rules and regulations that specify how much your employer must contribute and who receives a contribution.

Qualified distribution

A qualified distribution from a 401(k) plan is any normal distribution from the plan taken after the allowed age that does not incur penalty.

Top heavy 401(k) plan

A 401(k) plan may be deemed top heavy if key employees own 60% or more of the total assets in the plan. If a plan is found to be top heavy, the employer must contribute up to 3% of compensation to all non-key employees still employed on the last day of the plan year.

Conclusion

Copy link to this section: Conclusion

Copied the URL to your clipboard!

401(k) plans are one of the most popular retirement plans available for good reason. If you start investing at a younger age, your money has tremendous potential to grow significantly by retirement. Understanding exactly how your plan works can help your dollars stretch even further, ensuring you leave no money on the table.